1. Introduction:

1.1 At times, the trade requests for Customs clearance facilities or for Customs supervision of loading/unloading of vessels, stuffing, de-stuffing of containers, examination of cargo etc. beyond normal working hours of Customs or on holidays. Sometimes requests are received for posting of officers to supervise activities like stuffing, de-stuffing of containers etc., at a factory or place beyond the Customs area. Normally, the trade is required to plan its activities requiring Customs supervision or presence during working hours on working days and within the Customs area. However, in certain cases, e.g. in case of perishable cargo, life saving drugs or other consignments required urgently which has landed at an airport after working hours or on holidays, the importer may require immediate clearance. Considering the difficulties of the trade, the services of Customs, after normal working hours or on holidays within the Customs area or at any time at a place beyond Customs area, are provided on payment of overtime fee.

1.2 The overtime fee (also referred as MOT fee) is collected in terms of Section 36 of the Customs Act, 1962 which allows unloading/loading of imported/export cargo from/on a vessel beyond working hours on a working day or on holidays only on payment of a prescribed fees and the Customs (Fees for Rendering Services by Customs Officers) Regulations, 1998 which prescribes the rates and the manner for collection of such fee.

2. Levy of overtime fee:

2.1 The overtime fee is levied for services rendered by the Customs officers to trade beyond normal working hours or on holidays. If the service is rendered at a place that is not their normal place of work or at a place beyond the Customs area, overtime is levied even during the normal working hours. The term ‘function’ means any function performed by the Customs officer under the Customs Act, 1962 and it includes:

(a) Examination of the goods and related functions,

(b) Loading and unloading of goods whether generally or specifically,

(c) Escorting goods from one Customs area to the other, and

(d) Any other Customs work authorised by the Commissioner of Customs.

2.2 The term ‘working hours’ means the duty hours prescribed by the jurisdictional Commissioner of Customs for normal Customs work. Where different working hours have been prescribed by the Commissioner of Customs for different items of Customs work or for different places within his jurisdiction, such working hours are to be considered as ‘working hours’ for the purpose of levy of overtime fee.

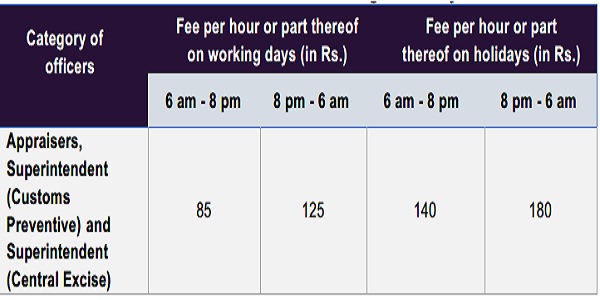

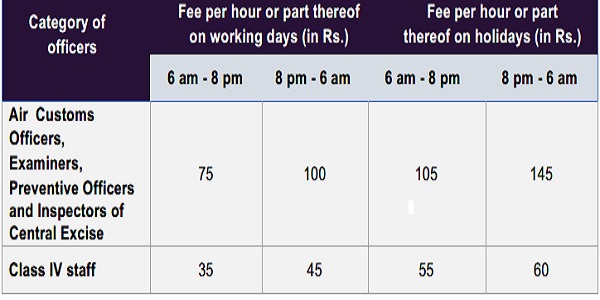

2.3 Present rates of overtime fee for rendering services by the Custom officers listed in Table 12.1:

Table 12.1: Present rates of overtime fee for rendering services by the Custom officers

2.4 Overtime fee is levied for a minimum of 3 hours in each case, except in cases of overtime postings immediately preceding or immediately following the working hours of the concerned cadre of officers. The period between the midnight and 6 am is treated as a block for calculation of overtime fee whether the services are required for the entire block or for a portion thereof. In regard to services provided by Customs officers during working hours at a place beyond Customs area, the overtime fee is charged for the entire block of working hours before lunch or after lunch, as the case may be, whether the request for the services of Customs officer is for the entire block or a portion thereof.

3. Procedure for posting of officers on overtime basis:

3.1 The party desirous of availing of the services of officers on overtime basis is required to make prior request for such posting. The Customs scrutinizes the application and ascertains the requirement of the job and calculates the overtime fee on the basis of rates prescribed in the said Regulations. A separate fee will be charged if either the Customs Broker, vessel, party (importer/exporter) changes. Once the party pays the overtime fee, the officers are posted to perform Customs work.

3.2 In case a Customs Broker handles more than one Bill of Entry/Shipping Bill of an importer/exporter, he need not pay separate set of fee for each such document. Similarly, if an exporter or importer has more than one activity to be supervised by Customs during the same block, he need not pay overtime fee for each activity separately.

3.3 In case a custodian requests for services of Customs officers beyond the normal working hour, the same is allowed on payment of merchant overtime fee.

4. Expansion of 24X7 Customs clearance and clarification of levy of MOT charge in CFS attached to 24X7 ports.

4.1 As a trade facilitation measure CBIC has amended the Customs (Fees for Rendering Services by Customs Officers) Regulations, 1998 and no fee shall be leviable in location where the working hours in respect of clearance of cargo in Customs Ports or Customs Airport has been prescribed as 24 hours on all day.

Source – Custom Duty Manual 2023