CBIC imposes anti-dumping duty on alloy steel chisel/tool and hydraulic rock breaker in fully assembled condition, originating in or imported from China PR and Korea RP vide Notification No. 11/2024-Customs (ADD) | Dated: 27th June, 2024

The Central Board of Indirect Taxes and Customs (CBIC) has issued Notification No. 11/2024-Customs (ADD) on June 27, 2024, imposing definitive anti-dumping duty on alloy steel chisels/tools and hydraulic rock breakers in fully assembled condition originating from China PR and Korea RP. This action follows the findings of the designated authority, which concluded that these products were being exported to India at prices lower than their normal value, causing material injury to the domestic industry.

For hydraulic rock breakers originating from China PR, duties range from 26.95% to 162.50%, with Yantai Eddie Precision Machinery Co., Ltd facing the highest duty of 131.11%. Similarly, alloy steel chisels from China PR face duties ranging from 4.55% to 29.21%. For Korean products, duties are lower, with some producers like Soosan Heavy Industries Co., Ltd. facing no duty on certain items.

The duties are applicable for a five-year period unless amended earlier, and are calculated based on CIF value at the time of import. The notification aims to address the dumping issue and safeguard the interests of the domestic industry involved in construction, mining, and related sectors utilizing these tools.

MINISTRY OF FINANCE

(Department of Revenue)

Notification No. 11/2024-Customs (ADD) | Dated: 27th June, 2024

G.S.R. 349(E).—Whereas in the matter of ‘alloy steel chisel/ tool and hydraulic rock breaker in fully assembled condition’ (hereinafter referred to as the subject goods) falling under chapter headings 84314930 and 84314990 of the First Schedule to the Customs Tariff Act, 1975 (51 of 1975) (hereinafter referred to as the Customs Tariff Act), originating in, or exported from China PR and Korea RP (hereinafter referred to as the subject countries), and imported into India, the designated authority in its final findings vide notification number 6/8/2022-DGTR, dated the 28th March, 2024, published in the Gazette of India, Extraordinary, Part I, Section 1, dated the 28th March, 2024, has come to the conclusion that–

(i) the subject goods have been exported to India from subject countries below its normal value, thus resulting in dumping of the product;

(ii) the domestic industry has suffered material injury due to dumping of the subject goods;

(iii) the material injury has been caused by the dumped imports of the subject goods originating in or exported from the subject countries,

and has recommended imposition of definitive anti-dumping duty on the imports of subject goods, originating in, or exported from the subject countries and imported into India, in order to remove injury to the domestic industry.

Now, therefore, in exercise of the powers conferred by sub-sections (1) and (5) of section 9A of the Customs Tariff Act, read with rules 18 and 20 of the Customs Tariff (Identification, Assessment and Collection of Antidumping Duty on Dumped Articles and for Determination of Injury) Rules, 1995, the Central Government, after considering the aforesaid final findings of the designated authority, hereby imposes on the subject goods, the description of which is specified in column (3) of the Table below, falling under chapter heading of the First Schedule to the Customs Tariff Act as specified in the corresponding entry in column (2), originating in the countries as specified in the corresponding entry in column (4), exported from the countries as specified in the corresponding entry in column (5), produced by the producers as specified in the corresponding entry in column (6), and imported into India, an antidumping duty at a rate as specified in the corresponding entry in column (7) of the said Table, namely:-

TABLE

Sl.

|

Heading |

Description

|

Country

|

Country of

|

Producer |

Duty (%

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

1. |

84314930 and 84314990 |

Hydraulic Rock Breakers#1 |

China PR |

Any country including China PR |

Yantai Eddie Precision Machinery Co., Ltd |

131.11% |

2. |

-do- |

Alloy Steel Chisels #2 |

China PR |

Any country including China PR |

Yantai Eddie Precision Machinery Co., Ltd |

29.21 % |

3. |

-do- |

Hydraulic Rock Breakers#1 |

China PR |

Any country including China PR |

NINGBO YINZHOU GET MACHINERY LTD. |

26.95% |

4. |

-do- |

Alloy Steel Chisels #2 |

China PR |

Any country including China PR |

NINGBO YINZHOU GET MACHINERY LTD. |

4.55% |

5. |

-do- |

Hydraulic Rock Breakers#1 |

China PR |

Any country including China PR |

Any producer other than S.No. 1 to 4 above |

162.50 % |

6. |

-do- |

Hydraulic Rock Breakers#1 |

Any country other than subject countries |

China PR |

Any producer |

162.50 % |

7. |

-do- |

Alloy Steel Chisels #2 |

China PR |

Any country including China PR |

Any producer other than S. No. 1 to 4 above |

29.21 % |

8. |

-do- |

Alloy Steel Chisels #2 |

Any country other than subject countries |

China PR |

Any producer |

29.21 % |

9. |

-do- |

Hydraulic Rock Breakers#1 |

Korea RP |

Any country including Korea RP |

Soosan Heavy Industries Co., Ltd. |

NIL |

0. |

-do- |

Alloy Steel Chisels #2 |

Korea RP |

Any country including Korea RP |

Soosan Heavy Industries Co., Ltd. |

NIL |

1. |

-do- |

Hydraulic Rock Breakers#1 |

Korea RP |

Any country including Korea RP |

DAEMO Engineering Co. Ltd. |

9.43% |

12. |

-do- |

Alloy Steel Chisels #2 |

Korea RP |

Any country including KoreaRP |

DAEMO Engineering Co.Ltd. |

12.47% |

13. |

-do- |

Hydraulic Rock Breakers#1 |

Korea RP |

Any country including KoreaRP |

D and A Heavy Industries Co.,Ltd. |

Nil |

14. |

-do- |

Alloy Steel Chisels #2 |

Korea RP |

Any country including KoreaRP |

D and A Heavy Industries Co.,Ltd. |

12.47% |

15. |

-do- |

Hydraulic Rock Breakers#1 |

Korea RP |

Any country including KoreaRP |

Hyundai Everdigm Corporation |

11.91% |

16. |

-do- |

Alloy Steel Chisels #2 |

Korea RP |

Any country including KoreaRP |

Hyundai Everdigm Corporation |

12.47% |

17. |

-do- |

Hydraulic Rock Breakers#1 |

Korea RP |

Any country including KoreaRP |

FEEL INDUSTRIAL ENGINEERING CO. LTD. |

8.16% |

18. |

-do- |

Alloy Steel Chisels #2 |

Korea RP |

Any country including KoreaRP |

FEEL INDUSTRIAL ENGINEERING CO. LTD. |

12.47% |

19. |

-do- |

Hydraulic Rock Breakers#1 |

Korea RP |

Any country including KoreaRP |

HANSUNG SPECIAL MACHINERY CO., LTD |

52.77% |

20. |

-do- |

Alloy Steel Chisels #2 |

Korea RP |

Any country including KoreaRP |

HANSUNG SPECIAL MACHINERY CO., LTD |

Nil |

21. |

-do- |

Hydraulic Rock Breakers#1 |

Korea RP |

Any country including KoreaRP |

Any producer other than S. No. 9 to 20 above |

52.77% |

22. |

-do- |

Hydraulic Rock Breakers#1 |

Any country other than subject countries |

Korea RP |

Any producer |

52.77% |

23. |

-do- |

Alloy Steel Chisels #2 |

Korea RP |

Any country including KoreaRP |

Any producer other than S.No. 9 to 20 above |

12.47% |

24. |

-do- |

Alloy Steel Chisels #2 |

Any country other than subject countries |

Korea RP |

Any producer |

12.47% |

#1

For Hydraulic Rock Breakers:

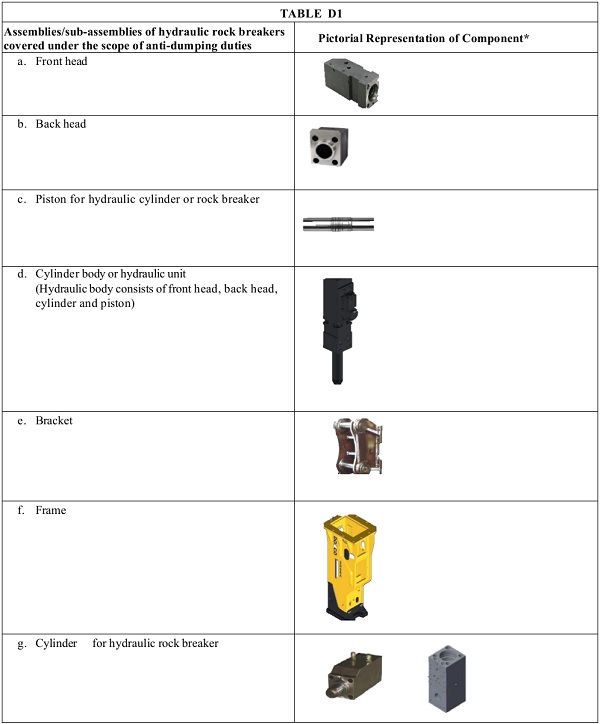

a. Hydraulic Rock Breakers are used in construction and mining industry along with Alloy Steel Chisels for carrying out demolition, excavation, mining, concrete and boulder breaking activities. Hydraulic Rock Breakers are imported and sold in fully assembled condition as well as in semi-knocked (SKD) condition and CKD (completely knocked down) condition, wherein different assemblies. sub-assemblies as mentioned in Table D1 below can be imported to form fully assembled hydraulic rock breakers.

b. The duties mentioned in column 7 of the Duty Table above for fully assembled Hydraulic Rock Breakers shall be applicable to imports of Hydraulic Rock Breakers and the Assemblies/Sub-assemblies mentioned in Table D1 only.

c. Where Alloy Steel Chisels are imported with Hydraulic Rock Breakers, anti-dumping duties applicable to Alloy Steel Chisels shall be applicable to such Alloy Steel Chisels. Anti-dumping duties for hydraulic rock breakers and its assemblies/sub-assemblies mentioned in Table D1, shall not be made applicable to alloy steel chisels or vice-versa. (Also refer point below)

d. The duties on hydraulic rock breakers shall be applicable only to the following assemblies/sub-assemblies and not to other parts and components of hydraulic rock breakers:

*The photos are for representative purposes only. The form of the actual assemblies/sub-assemblies may vary.

e. The recommended duties on assemblies/sub-assemblies shall be applicable on them irrespective of the fact that whether they are imported individually or along with other assemblies/sub-assemblies mentioned in Table D1

f. It is to be ensured that exporters do not attempt to evade the recommended duties by physically combining two or more assemblies/sub-assemblies together to establish that they are exporting a different assemblies/sub-assembly other than what has been covered in Table D1 Further, the description of the goods being cleared should be captured adequately in terms of value and unit of measurement.

g. The duties applicable to hydraulic rock breakers shall not be applicable to any other assemblies/sub-assemblies, part or component, or kits which have not been mentioned in Table D1 above.

#2

For Alloy Steel Chisels:

h. Alloy Steel Chisels are used along with hydraulic rock breakers. They come in various shape, size and the tip of the chisel varies according to the required end use.

i. Alloy Steel Chisels are also imported by the name of tool, wedge, toil, moil, teeth, tooth, working tool, chisel blunt, hydraulic hammer (tool), breaker tool etc. Where chisels are imported with rock breakers, anti-dumping duties applicable to chisels shall be applicable to such chisels. Antidumping duties applicable to alloy steel chisels shall not be made applicable to hydraulic rock breakers or its assemblies/sub-assemblies mentioned in Table D1 above. (Also refer point b above).

2. The anti-dumping duty imposed under this notification shall be effective for a period of five years (unless revoked, superseded or amended earlier) from the date of publication of this notification in the Official Gazette, and shall be payable in Indian currency.

Explanation. – For the purposes of this notification, –

(a) rate of exchange applicable for the purposes of calculation of such anti-dumping duty shall be the rate which is specified in the notification of the Government of India, in the Ministry of Finance (Department of Revenue), issued from time to time, in exercise of the powers conferred by section 14 of the Customs Act, 1962 (52 of 1962), and the relevant date for the determination of the rate of exchange shall be the date of presentation of the bill of entry under section 46 of the said Act.

(b) “CIF value” means the assessable value as determined under section 14 of the Customs Act, 1962 (52 of 1962).

[F. No. CBIC-190354/160/2023-TO(TRU-I)]

VIKRAM VIJAY WANERE, Under Secy