The (Prohibition of Benami Property Transactions) Act, 1988

INTRODUCTION:

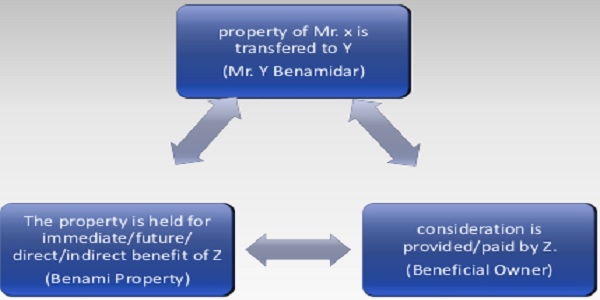

“Benami” means “no name” or “without name” Benami properties are those that are held by an owner through proxies. The property is purchased in the name of or held in the name of a person who has neither paid for it nor actually enjoys it. It may even be held in the name of a non-existent person. Such front person is known as ‘Benamidar’. This name is only an alias for the actual owner, the ‘Beneficial Owner’. Thus, the Benami property transaction is where the ‘Beneficial Owner’ buys the property in the name of a Benamidar but seeks to enjoy it himself.

Thus, a ‘Beneficial Owner’ is a person (whether his identity is known or not) for whose benefit the benami property is held by a Benamidar. Sometimes the Benamidar does not know or cannot disclose the identity of the real owner. He may have only taken money and placed some signatures. Even in these conditions, the property will be benami

IMPORTANT DEFINATIONS:

1. BENAMI PROPERTY, means any property which is the subject matter of a benami transaction and also includes the proceeds from such property.

2. PROPERTY, Means assets of any kind, whether

(a) Movable, or Immovable, Tangible, or Intangible, Corporeal (Having a physical material existence – Furniture and fixtures) or Incorporeal (Having a conceptual existence but no physical existence-Copyrights and patents)

(b) It includes any right or interest or legal documents or instruments evidencing title to or interest in the property and

(c) It also includes the converted form of any property where such property is capable of conversion.

(d) Therefore, all forms of assets come under the definition of property, bringing into its scope real estate, shares, vehicles, fixed deposits, bank deposits, bank lockers and private lockers etc.

3. BENAMIDAR, means An actual person or a fictitious person: a) In whose name the Benami property is transferred or held; and b) includes a person who lends his name.

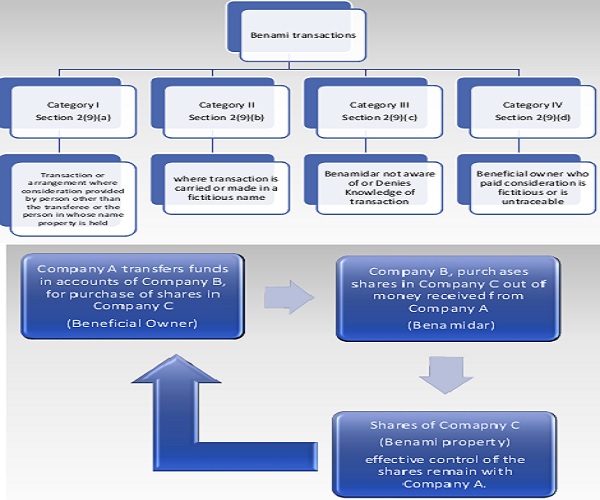

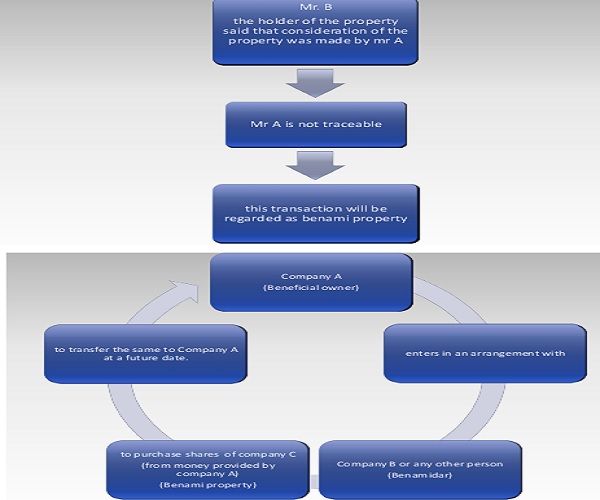

4. BENAMI TRANSACTION, means—

- a transaction or an arrangement—(a) where a property is transferred to, or is held by, a person, and the consideration for such property has been provided, or paid by, another person; and (b) the property is held for the immediate or future benefit, direct or indirect, of the person who has provided the consideration, except when the property is held by—

- a Karta, or a member of a Hindu undivided family, as the case may be, and the property is held for his benefit or benefit of other members in the family and the consideration for such property has been provided or paid out of the known sources of the Hindu undivided family;

- a person standing in a fiduciary capacity for the benefit of another person towards whom he stands in such capacity and includes a trustee, executor, partner, director of a company, a depository or a participant as an agent of a depository under the Depositories Act, 1996 (22 of 1996) and any other person as may be notified by the Central Government for this purpose;

- any person being an individual in the name of his spouse or in the name of any child of such individual and the consideration for such property has been provided or paid out of the known sources of the individual;

- any person in the name of his brother or sister or lineal ascendant or descendant, where the names of brother or sister or lineal ascendant or descendent and the individual appear as joint-owners in any document, and the consideration for such property has been provided or paid out of the known sources of the individual; or

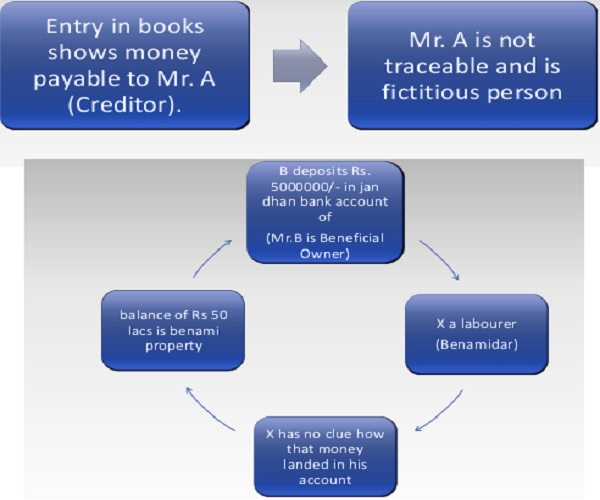

- a transaction or an arrangement in respect of a property carried out or made in a fictitious name; or

- a transaction or an arrangement in respect of a property where the owner of the property is not aware of, or, denies knowledge of, such ownership;

- a transaction or an arrangement in respect of a property where the person providing the consideration is not traceable or is fictitious.

Explanation.—For the removal of doubts, it is hereby declared that benami transaction shall not include any transaction involving the allowing of possession of any property to be taken or retained in part performance of a contract referred to in section 53A of the Transfer of Property Act, 1882 (4 of 1882), if, under any law for the time being in force,—

- consideration for such property has been provided by the person to whom possession of property has been allowed but the person who has granted possession thereof continues to hold ownership of such property;

- stamp duty on such transaction or arrangement has been paid; and

- the contract has been registered;

MOTIVE BEHIND ENTERING BENAMI PROPERTY TRANSACTION:

As the name indicates Benami property means a property without a name. In such kind of a transaction, the person who pays for the property does not buy it under his/her own name and motive behind such a transactions of this nature is to evade payment of tax. Any asset movable or immovable, any security, legal document, gold etc which are held or transferred in any other name are covered under Benami property.

WHAT IF THE BENAMI PROPERTY IS RE-TRANSERRED BY THE BENAMIDAR:

Re-transfer of the property by the Benamidar to the Beneficial owner or any other person acting on his behalf is prohibited and such re-transfer shall be deemed to be null and void.

Illustration: If A, the Beneficial Owner purchases a property in the name of Benamidar B. To avoid confiscation, Benamidar B re-transfers the Benami property either to A, the Beneficial Owner or to P, a person acting on behalf of the Beneficial Owner. Both these transactions are null and void.

OFFCENCES AND PROSECUTION:

The, offences under The Prohibition of Benaml Property Transactions Act, 1988 are non-cognizable.

(a) Punishment for entering Into benam! transaction prior to 01.11.2016:

Both Benamidar as well as Beneficlal owner are liable to face imprisonment for a term which may extend to three years or with fine or with both

(b) Punishment for entering Into benami transaction after 01.11.2016:

Both Benamidar as well as Beneficlal owner are liable to face imprisonment for a term from one to seven years and with fine upto 25% of the FMV.

EXAMPLE REGARDING BENAMI PROPERTY TRANSACTION:

1. If a businessman, A, purchase a flat in the name of B, his driver and the source of income is not disclosed by Mr. A then the flat becomes the Benami property and the Mr. B becomes the Benamidar. Hence Benamidar is the person whose name is appeared on the paper i.e. the person on whose name the Benami property is bought, held or transferred.

It is clear that benamidar, Mr. B is held liable for seven years imprisonment, fine upto 25% of FMV of the property and/or confiscation of property if he fails to explain the source of income for purchasing such a flat. Now if Mr. B revealed that the actual owner was Mr. A then the same punishment is applicable on Mr. A without any compensation.

2. A buys a house in the name of his sister-in-law Mrs. B. Payment has been made by A and he and his family start to live in that house. Even if B is a rich lady, the transaction is Benami. B is the Benamidar and A is the beneficial Owner.

3. Fixed Deposits kept in the name of fictitious persons is a Benami Property.

4. Cash kept by Mr. A in bank locker in the name of his employee/relative who denies knowledge, is a Benami Property

5. P wants to take a liquor license from the government. He pays the money in the name of his employee Mr. K and the contract is awarded to Mr K, but Mr. P is deriving benefit from the liquor license. The transaction is benami transaction. Mr. K is the Benamidar, Mr. P is the Beneficial Owner and profits from such liquor business will be the Benami propert

Now there are certain myths in the mind of people regarding properties which are in the name of their wife, daughter or any other relative. Any property, be it in the name of your relatives or joint, if you are able to produce the source of income to the relevant authority, it cannot be called Benami Property. Hence if the source of income is disclosed then those properties are outside the purview of Benami Property.

Some transactions tend to fall under the definition of Benami Transactions, such as:

1. When a property is bought under a fictitious name. i.e. the Benamidar is an unreal person.

2. When the owner of the property denies being the owner of the property.

3. When the identity of the beneficial owner is unknown.

CASE STUDY REGARDING BENAMI PROPERTY:

In Bhim Singh v. Kan Singh, a case where the issue was whether contribution of money would render a property to be termed as Benami. The Supreme Court observed that ‘the question whether a transaction is a benami transaction or not, mainly depends upon the intention of the person who has contributed the purchase money.

The courts further said that the principle is recognized in section 82 of The Indian Trusts Act, 1882 which says that where a property is transferred to one person for some consideration paid by another person, and it appears that such person did not intend to provide benefit of such transaction to the transferee.

GUIDE TO DETERMINE THE NATURE OF THE TRANSACTION:

Following six circumstances which can be taken as a guide to determine the nature of the transaction.

1. The nature and possession of the property, after the purchase.

2. Motive, if any, for giving the transaction a Benami Colour.

3. The possession of the parties and the relationship, if any between the claimant and the alleged Benamidar.

4. The custody of the title deeds after the sale; and

5. The conduct of the parties concerned in dealing with the proper after the sale.

6. The source from which the purchase money came.

The above indicia are not exhaustive and their efficacy varies according to the facts of each case. Nevertheless, the source from where the purchase money came and the motive why the property was purchased Benami are by far the most important tests for determining whether the sale standing in the name of one person, is in reality for the benefit of another.

Conclusion: Understanding Benami property is essential to comprehend the legal implications of transactions involving proxy ownership. The act of evading taxes through such transactions carries significant penalties, including imprisonment and fines. By analyzing real-life examples, individuals can grasp the complexities and risks associated with Benami property transactions. Proper disclosure and adherence to regulations can help individuals stay compliant with the law and avoid legal consequences.

Well explained

well explained and with perfect examples. KUDOS !!!

Very Informative