Limited Liability Partnership (LLP) has come to be a desired shape of organization amongst entrepreneurs because it includes the advantages of each partnership firm and agency right into a single form of organization.

The idea of the Limited Liability Partnership (LLP) was added in India in 2008. An LLP has the traits of each partnership corporation and agency. The Limited Liability Partnership Act, 2008 regulates the LLP in India. Minimum two partners are required to comprise an LLP. However, there may be no higher restriction at the most wide variety of partners of an LLP.

Among the partners, there need to be not less than designated partners who shall be individuals, and at least one in every of them need to be resident in India. The rights and responsibilities of designated partners are ruled with the aid of using the LLP agreement. They are without delay accountable for the compliance of all of the provisions of the LLP Act, 2008 and provisions certain with inside the LLP agreement.

If you need to begin your enterprise with a Limited Liability Partnership, you then definitely have to get it registered below the Limited legal responsibility Partnership Act, 2008.

|

FORM NAME |

PURPOSE OF THE FORM |

|

RUN – LLP (Reserve Unique Name-Limited Liability Partnership |

Form for reserving a name for the LLP |

|

FiLLiP |

Form for incorporation of LLP |

|

Form 5 |

Notice for change of name |

|

Form 17 |

Application and statement for the conversion of a firm into LLP |

|

Form 18 |

Application and Statement for conversion of a private company/unlisted public company into LLP |

LLP Registration Process

Step 1: Obtain Digital Signature Certificate (DSC)

Before beginning the procedure of registration, you have to follow the digital signature of the designated partners of the proposed LLP. This is due to the fact all of the documents for LLP are filed online and are required to be digitally signed. So, the designated partners have to attain their digital signature certificate from authorities diagnosed certifying agencies. The price of acquiring DSC varies relying upon the certifying agency.

STEP 2: Incorporation of LLP Using Fillip Form

-

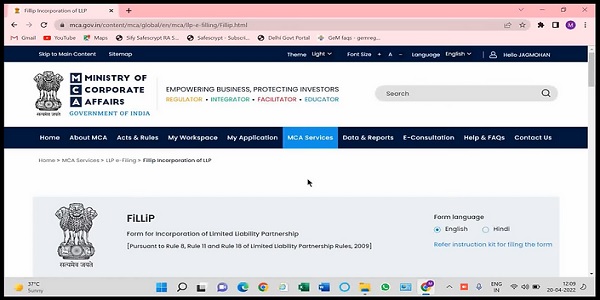

The form used for incorporation is Fillip (Form for incorporation of Limited Liability Partnership) which will be filed with the Registrar who has jurisdiction over the kingdom wherein the registered workplace of the LLP is located. The form might be an integrated form.

-

Fees as according to Annexure ‘A’ will be paid.

-

This form additionally offers for applying for allotment of DPIN, if a person who’s to be appointed as a designated partner does now no longer have a DPIN or DIN.

-

The application for allotment will be allowed to be made with the aid of using people best.

-

The application for reservation can be made via Fillip too.

-

If the name gets approved, then the approved name will be filed as the proposed name of the LLP.

1. Login to MCA Portal:- Log in to your account on MCA Portal

How to login in LLP V3 portal on MCA?

-

Firstly the user needs to go to the “Sign in/Sign Up” link on the top right corner of the MCA portal, using the existing login id of MCA, you are not required to create a new login for the LLP portal. Users can use existing login id.

-

While logging in kindly pick the LLP login choice in place of company login.

-

In order to register in an LLP with the Ministry of Corporate Affairs, step one is to reserve a name for the proposed LLP.

-

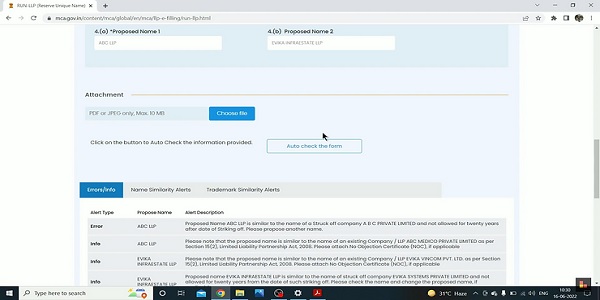

In order to reserve name, RUN-LLP needs to be filled out on MCA in conjunction with 2 proposed names of the LLP and NoC, if any required with the aid of using paying a charge of Rs.200/-

-

Once the call has been approved with the aid of using MCA, the name is legitimate for a duration of three months inside which e-Form Fillip desires to be filed in conjunction with documents as can be required, for incorporating the LLP. The price of submitting e-Form Fillip relies upon the contribution of the LLP.

-

LLP-RUN (Limited Liability Partnership-Reserve Unique Name) is filed for the reservation of the name of the proposed LLP which will be processed with the aid of using the Central Registration Centre below Non-STP. But earlier than quoting the name withinside the form, it’s recommended that you use the free name search facility on the MCA Portal.

-

It usually takes 10-12 running days after the LLP name is approved. However, the approvals are a problem to authorities processing time.

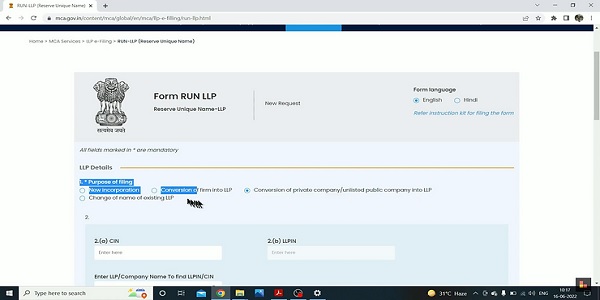

Steps to file RUN-LLP for Name Reservation for LLP Registration

1. Login to MCA: Log in to your account on MCA Portal with valid username and password

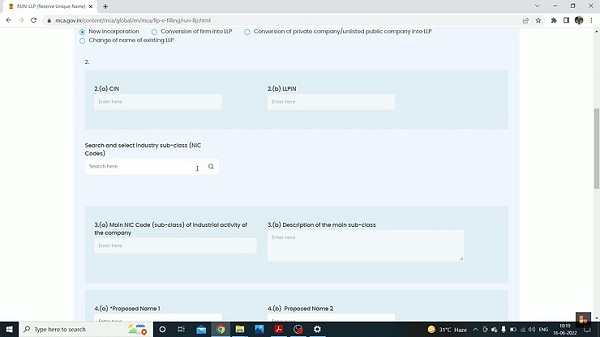

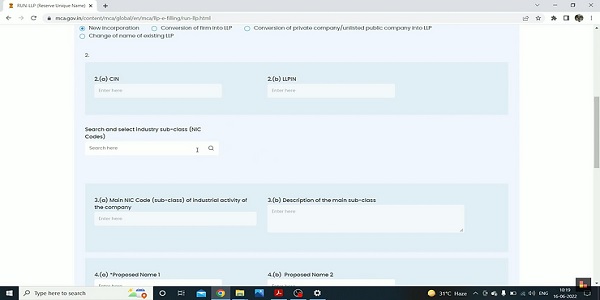

4. Enter LLPIN: Enter LLPIN i.e. Limited Liability Partnership Identification Number in case you are applying for the change of name for an existing LLP. (If you’re making use of a brand new Incorporation , you could pass that).

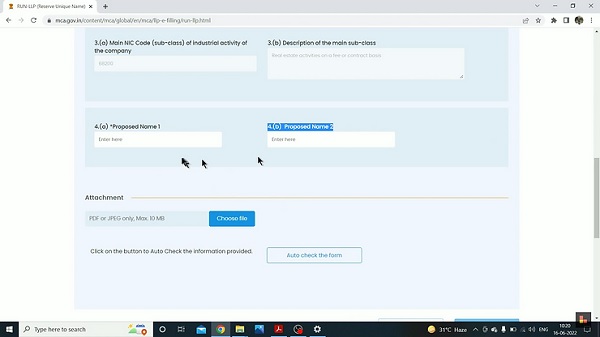

5.NIC code is associated with business activities of your LLP. Click on search and pick the perfect code.

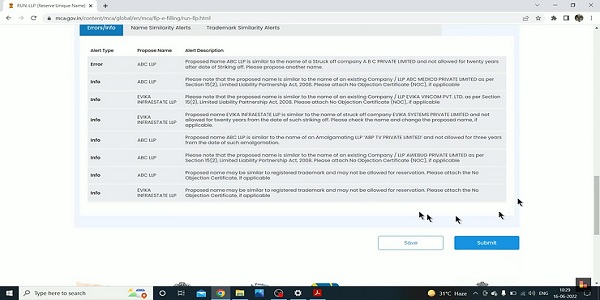

7.Primary Check for Proposed Name – Invalid: The system does a number one test for the names entered and shows a message whether or not it’s far legitimate or invalid.

10. Payment : The next display is the fee display on which a charge of Rs.200 is payable. Once the fee is made, the applicant can put up the request. There isn’t any choice to make a fee with the Pay Later choice.

11. SRN generated: On a success submission, an SRN and a Challan could be generated. The applicant can use the SRN to track the the status of name approval on MCA

12. Acknowledgment Letter: MCA could send the acknowledgment letter for approval or rejection of the proposed name to the registered e-mail ID of the MCA account from which the applicant had submitted the request

13. File for Incorporation within 3 months: The applicant has a duration of three months to FILE for incorporation of the LLP from the date of acknowledgment letter obtained on email.

-

The System will offer the listing carefully resembling names of existing companies/LLPs primarily based on search criteria. This will assist you in deciding on names now no longer just like already existing names. The registrar will approve the name best if the name isn’t unwanted withinside the opinion of the Central Government and does now no longer resemble any existing partnership corporation or an LLP or a body corporate or a trademark.

-

But You do not ought to fill a separate name for call approval, it may be executed with the Fillip form.

-

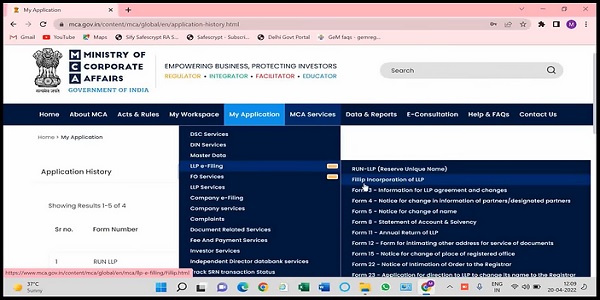

After efficient login, customers are capable of filling LLP incorporation form by using the usage of choice My Application-MCA Services –LLP e submitting– Use incorporation choice Fillip incorporation of LLP.

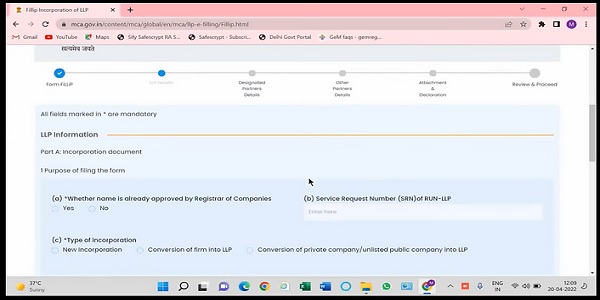

- After clicking on the “Fillip Incorporation of LLP”, you will get to see the form.

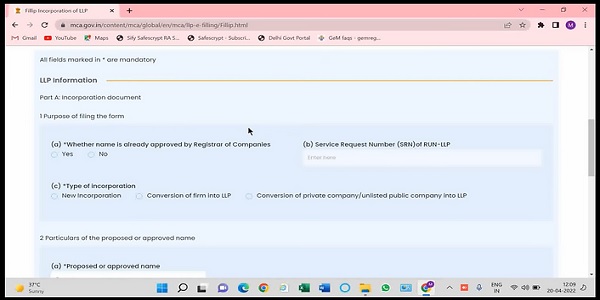

- You can see the form in the above picture, scroll down and you will get the fields which are required to be filled.

-

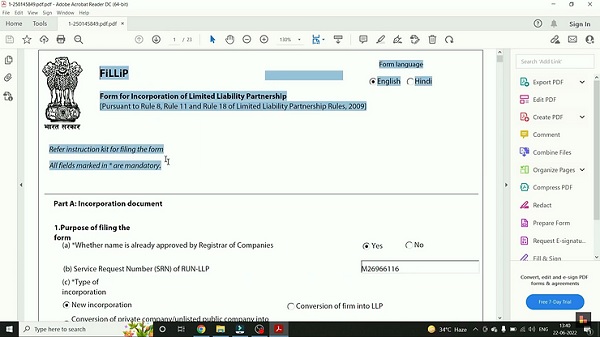

The screenshot of the form is stating Purpose of filling the form.

-

A point over there is asking for the Name of the LLP. Here if you have filled the RUN form for the name approval and it’s been approved by the authority then click on yes, if you haven’t done so go for No.

-

In case of yes there is point B asking for then SRN no. of the name approved.

-

C Point is talking about the “Type of Incorporation”, if its new incorporation click on “new” otherwise you can go for conversion respectively.

-

After filling the details of purpose you will get fields in regards to the name of the LLP approved.

-

Here in above picture A is for Name of the LLP, and B is asking if you have used any short forms of the name or the abbreviations , in that case you will have to type the full name, and if you haven’t used any abbreviation then type NIL.

-

In the C section , you will state the language used other than English (if any).

-

D is asking for the trademark registration of the LLP Name.(it’s not mandatory, if you have one you can fill in the details for the same).

-

As you can see in the picture, below there is B point which states the NOC , if the LLP name is already registered under trademark act by another person and you are still wanting to use that, you will have to ask the trademark holder for a no objection certificate.

-

Point E talking is asking for the attachment of consent or board of resolution from LLP and company respectively, as proof of no objection in case of registered trademark.

-

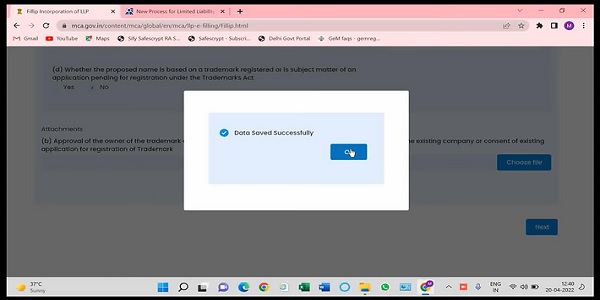

Once check if everything is filled appropriately click on save and continue.

-

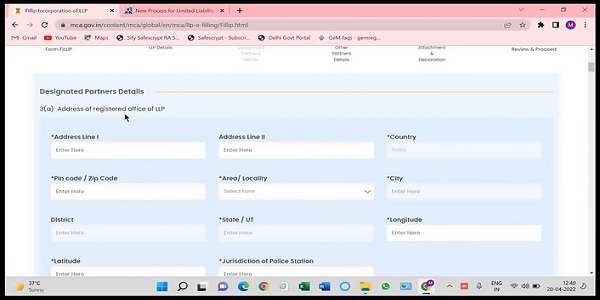

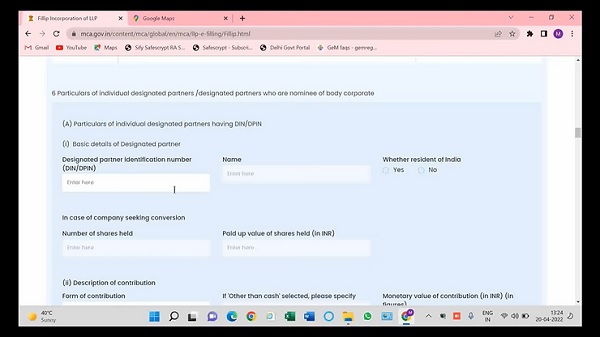

After the completion of the last page you will get another page, asking for the details related to designated partners.

-

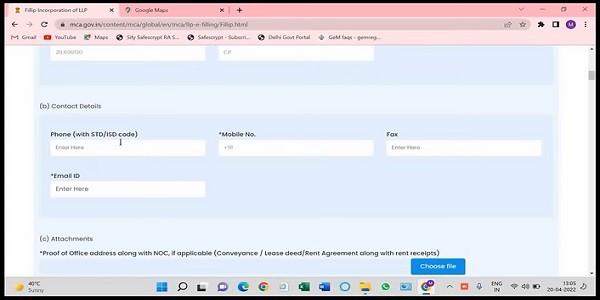

You have to fill in the registered office address in the details.

-

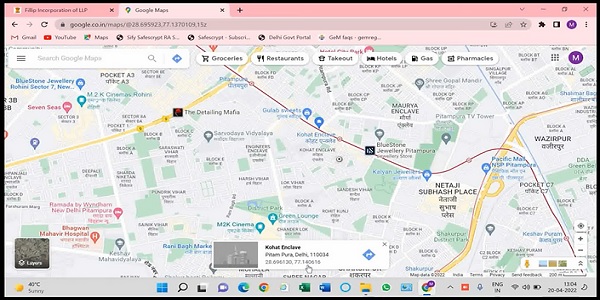

Everything is easy to understand, you will witness two new fields which is latitude and longitude, but it’s easy to search on google maps.

-

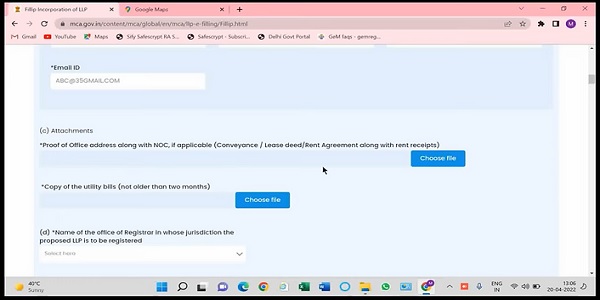

Contact details of the registered office, email ID and phone number is mandatory

-

For Point C,

-

You will have to attach a rent agreement of the premises where you plan to start your business. If no rent agreement has been signed. You can attach a NOC from the owner of the premise stating that the new company can start its business in the stated premise.

-

You will have to attach an electricity bill or gas bill not older than 2 months.

-

Next you have to select the registrar office name of the area your office is registered.

-

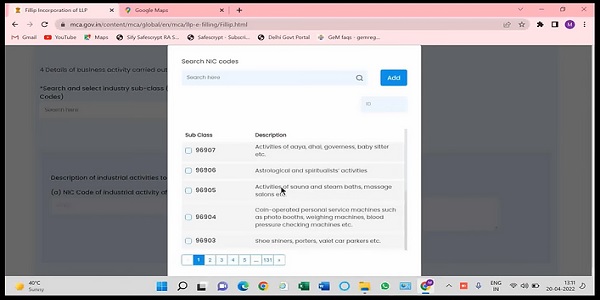

The 4th point is related to business activity you will be carrying in LLP.

-

In the you have to select the code matching your business activity, for this you will have to search.

-

You can search by typing the type of business and it can be more than one.

-

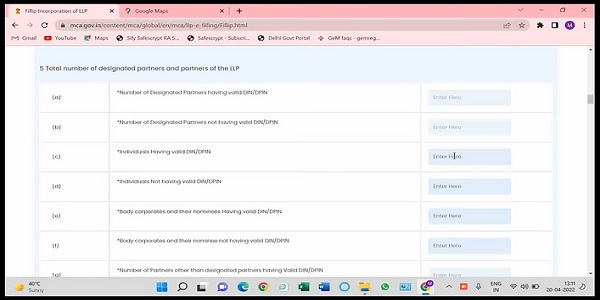

In Section 5,

1. You will have to enter the business structure of your LLP.

2. An LLP can have two types of partners

1) Designated Partners 2) Partners

1. Partner is a normal time period used to symbolize partners in case of General Partnerships even as Designated Partner is a time period utilized in case of Limited Liability Partnerships.

2. The responsibilities, rights and liabilities of a partner are commonly laid down in a partnership deed in which as in case of a designated partner; his responsibilities, rights and liabilities are referred to withinside the LLP Agreement.

3. The legal responsibility of a partner to a third party is limitless and extends to his private assets while the legal responsibility of a designated partner is best as much as the capital added by them or as supplied withinside the LLP Agreement.

4. The Designated Partners are totally accountable for the control and the execution of all of the acts and matters required to be performed with the aid of using the LLP together with compliance of the provisions along with submitting of files/returns/statements as required with the aid of using the LLP Act. On the contrary, partners in a LLP aren’t accountable for this kind of acts and are best required to make a contribution withinside the LLP.

5. The volume of legal responsibility at the partners and the designated for consequences imposed for any contravention of the provisions will be ruled with the aid of using the Partnership Deed and the LLP Agreement respectively.

-

The rows have been also bifurcated between those partners who have a DPIN vs those who don’t have one.

-

Every person who needs to be appointed as a designated partner of a current Limited Liability Partnership has to follow for a DPIN (Designated Partner Identification Number) in Form DIR-3, as according to Rule 10(1)(a) of the Limited Liability Partnership Rules, 2009.

-

Designated Partner Identification Number (DPIN) is a registration required for any character who needs to be appointed as a Designated Partners of a Limited Liability Partnership (LLP).

-

All Designated Partners in an LLP are required to have a Designated Partner Identification Number (DPIN) or Director Identification Number (DIN).

-

DIN/DPIN are very vital documents that a designated partner needs to have if he’s being part of the LLP. Availing of those documents is obligatory for all legal functions in an LLP.

-

An LLP is needed to have at the least 2 certain partners.

-

The name of designated partners needs to be as according to pan database, because the identical could be reflecting withinside the MCA master data.

-

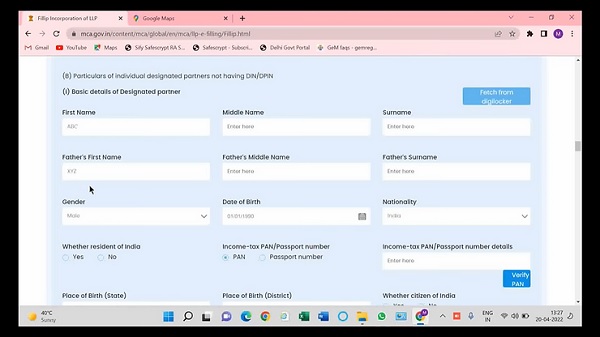

The above screenshot is related to details that have to be filled in for Designated partners that don’t have a valid DIN/DPIN.

-

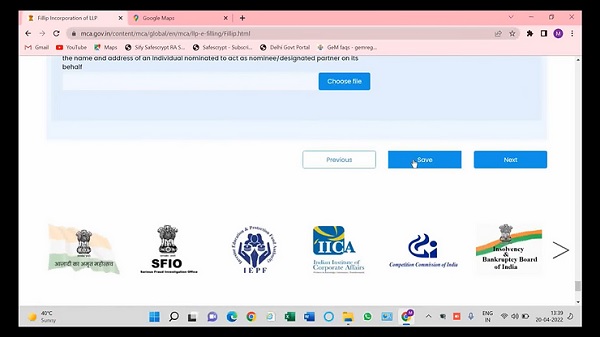

Click on save and next.

-

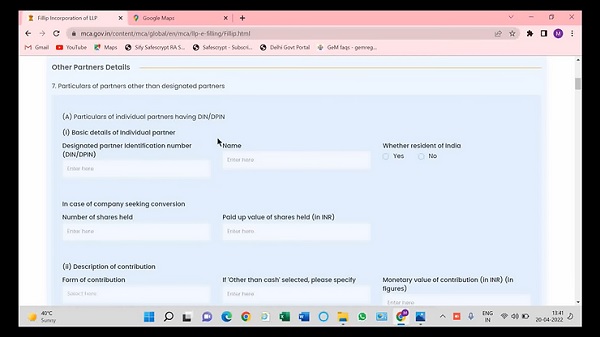

The 7th point is asking for the details of the partners who are not designated partners. Please fill in the details as filled in for the designated partners and proceed.

-

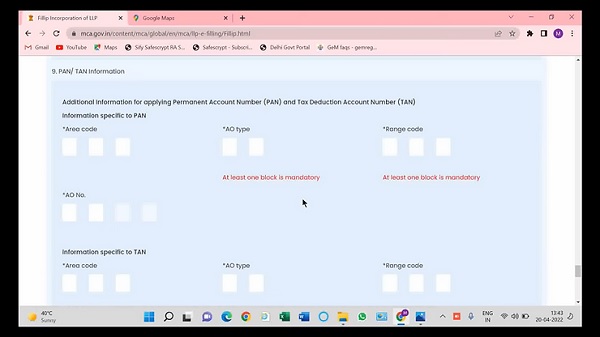

Once you are done with the partners details, you will see the details to be filled related to PAN and TAN.

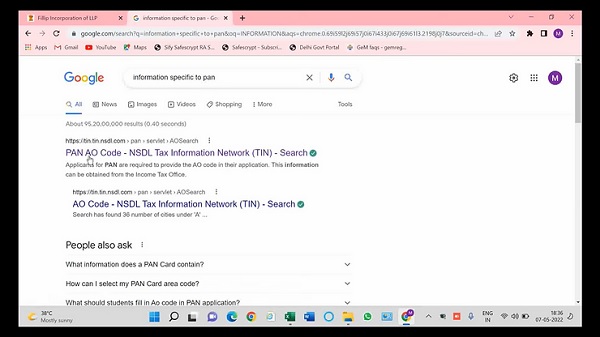

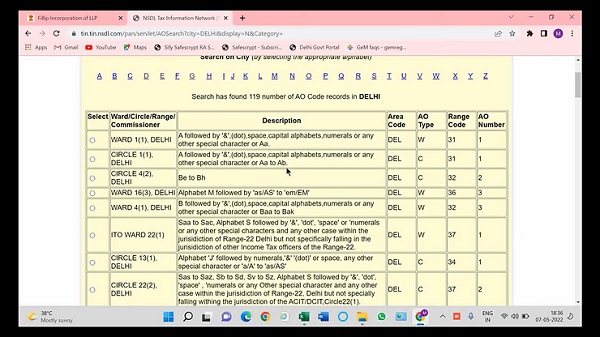

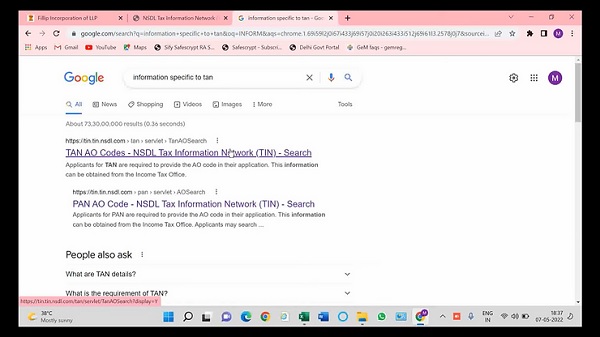

- IN case of PAN , to search Area code you will have to google search “Information on specific PAN”.

-

Click on the first link.

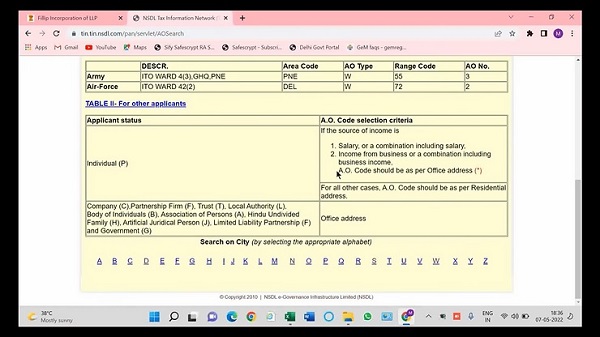

-

Choose your city of office.

-

Now you will have to choose the particular area of the city where you want to register your office.

-

Once the PAN is done we will go to the TAN details.

-

Same procedure to be followed like PAN.

-

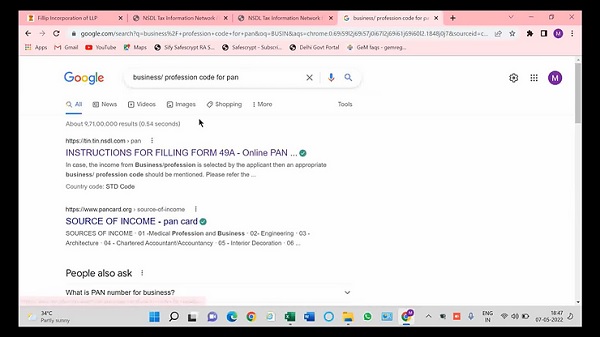

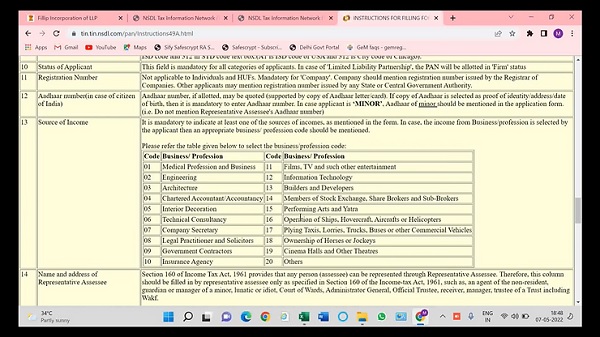

Now you will have to select the source of income from the options, in 90% of cases the same would be “Income from business/profession”.

-

The relevant business codes have been mentioned in the screenshot below. Please select the appropriate one.

-

Check the details filled appropriately, and click on save and next.

-

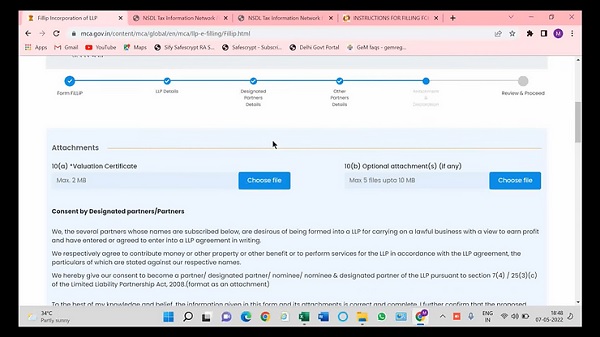

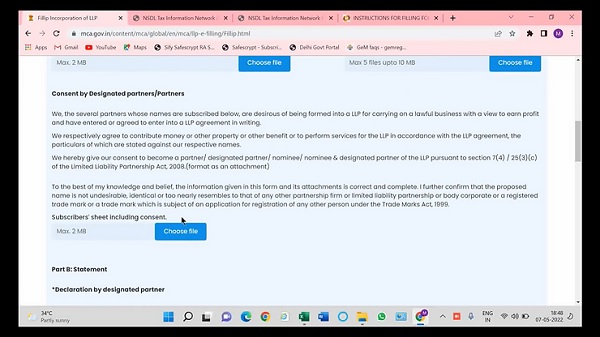

In the next page they are asking for the valuation certificate, which is of no use for LLP incorporation ( used in conversion case).

-

You will have to scroll down and Attach the subscribers sheet.

-

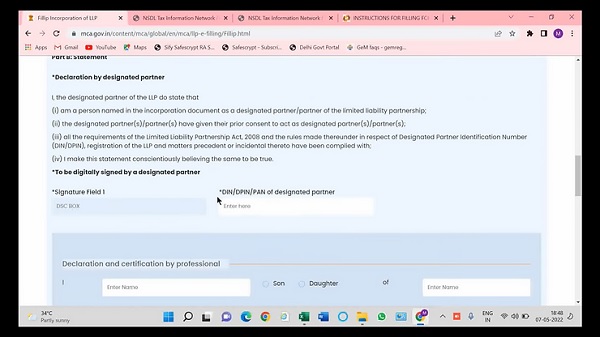

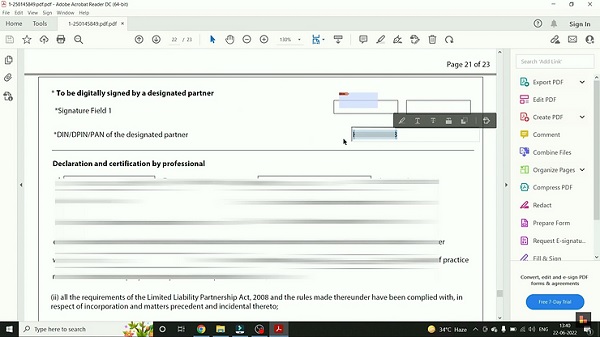

Once the incorporation forms are prepared, a pdf document of the same can be downloaded and the DSC has to be attached in that document not here. Also change it to PAN/DIN number.

-

Check the details filled.

-

And then click on save and next.

-

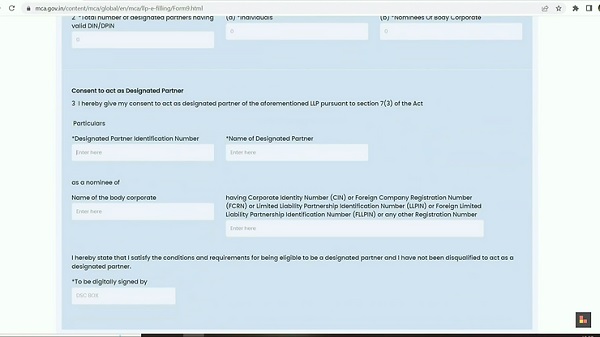

Now click on the Fill Form 9.

-

Form 9 is a fully Pre filled form.

-

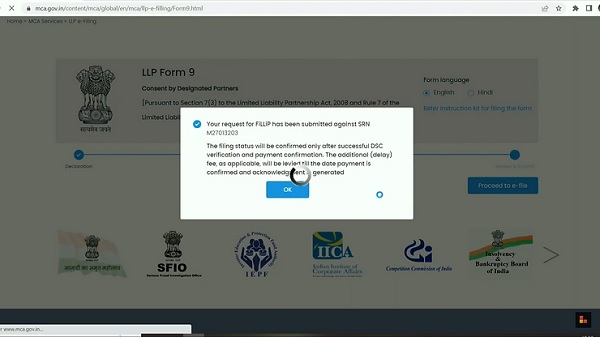

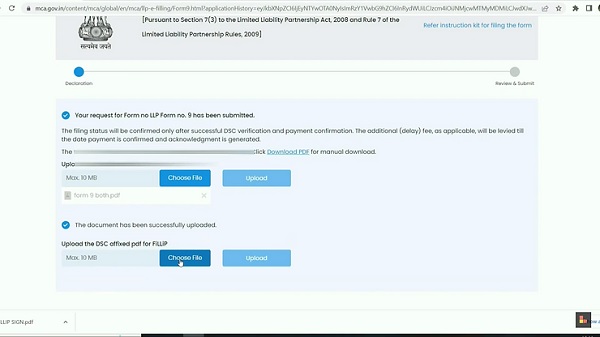

Click on save and continue, Next click on “Proceed to e-file”

-

After this your SRN Number will be generated and the 2 PDSs will be automatically downloaded.

-

Save those PDFs in the folder for future upload of DSC.

-

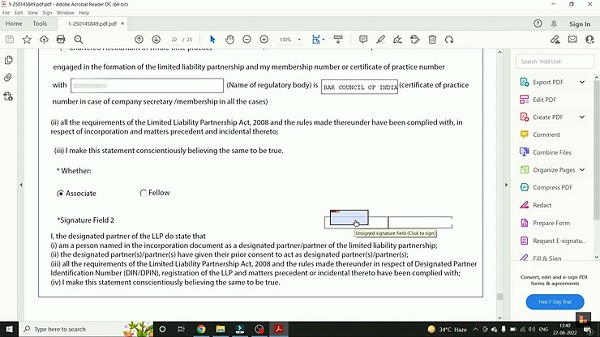

The above screenshot is a PDF of Fillip Form.

-

Scroll down and Fill the sections of PAN/ DIN no. of designated partners.

-

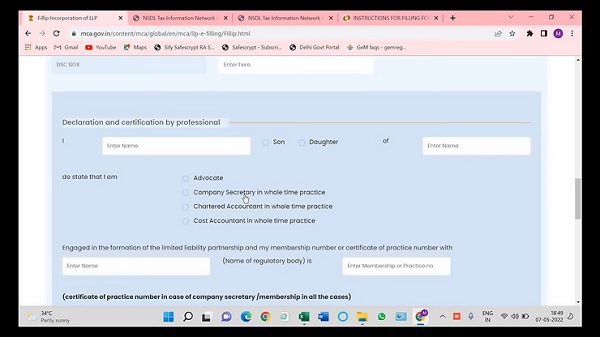

The blue box in the above picture is related to the DSC of certifying authority.

-

Sign and save both the files and Upload them.

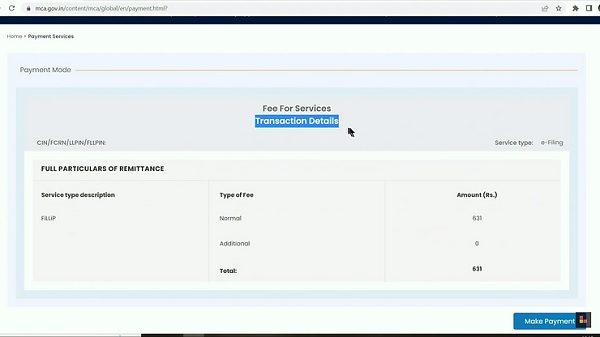

- Click on proceed for payment.

-

Click on make payment and fill in the basic details.

-

Once the payment is done. You will get the receipt.

-

-

You can download the receipt.

-

-

For the recheck you can login to the portal and check the status of Process.

STEP 3: LLP Agreement

- The LLP Agreement is a completely vital document that consists of the guidelines and obligations of the designated partners withinside the company.

- For this, Form 3 is filed at the MCA portal.

- It is obligatory to file within 30 days of LLP registration in any other case extra prices are charged for the delay.

- Once you get the agreement, it desires to be print on stamp paper.

- Stamp obligation is one-of-a-kind in each state that is calculated primarily based totally at the approved capital.

- You can check state wise prices of stamp obligation at the LLP Agreement here.

And that’s the whole procedure of LLP registration in India. With the assistance of the proper specialists at Register karo, the procedure may be finished hastily and perfectly. Ready to kick-begin your business?

Documents Required for LLP Registration

A. Documents of Partners

- PAN Card/ ID Proof of Partners – All the partners are required to provide their PAN at the time of registering LLP. PAN card acts as a primary ID proof.

- Address Proof of Partners – Partner can submit any one document out of Voter’s ID, Passport, Driver’s licence or Aadhar Card. Name and other details as per address proof and PAN card should be exactly the same. If the spelling of one’s own name or father’s name or date of birth is different in address proof and PAN card, it should be corrected before submitting to RoC.

- Residence Proof of Partners – Latest bank statement, telephone bill, mobile bill, electricity bill or gas bill should be submitted as residence proof. Such a bill or statement shouldn’t be more than 2-3 months old and must contain the name of the partner as mentioned in the PAN card.

- Photograph – Partners should also provide their passport size photograph, preferably on white background.

- Passport (in case of Foreign Nationals/ NRIs) – For becoming a partner in Indian LLP, foreign nationals and NRIs have to submit their passport compulsorily. Passport has to be notarized or apostilled by the relevant authorities in the country of such foreign nationals and NRI, else the Indian Embassy situated in that country can also sign the documents.

- Foreign nationals or NRIs have to submit proof of address also which will be a driving licence, bank statement, residence card or any government-issued identity proof containing the address.

- If the documents are in other than the English language, a notarized or apostilled translation copy will also be attached.

B. Documents of LLP

- Proof of Registered Office Address: Proof of registered office has to be submitted during registration or within 30 days of its incorporation.

- If the registered office is taken on rent, a rent agreement and a no-objection certificate from the landlord has to be submitted. No objection certificate will be the consent of the landlord to allow the LLP to use the place as a ‘registered office’.

- Besides, any one document out of utility bills like gas, electricity, or telephone bill must be submitted. The bill should contain the complete address of the premise and owner’s name and the document shouldn’t be older than 2 months.

- Digital Signature Certificate: One of the designated partners needs to opt for a digital signature certificate also since all documents and applications will be digitally signed by the authorized signatory.

Checklist for LLP Registration

- Minimum of two partners.

- DSC for all designated partners.

- DPIN for all designated partners.

- Name of the LLP, which is not similar to any existing LLP or trademark.

- Capital contribution by the partners of the LLP.

- LLP Agreement between the partners.

- Proof of registered office of the LLP.

If proposed partners do not have DPIN which is mandatory to associate DSC as business user role, how will they Sign Form FILIP ?