Legal Updates- IMPACT OF COVID 19

Income tax

1. The due date of TDS/TCS Return for Q4 (FY 2019-20) has been extended from 15.05.2020/31.05.2020 to 30.06.2020.

2. CBDT has clarified that for the purpose of TDS on Salary for FY 2020-21, employer is required to obtain a declaration from each employee about opting of scheme of taxation (with deductions OR without deduction) and deduct TDS for whole year basis such declaration.

3. CBDT has further extended the applicability of reporting under Clause 30C and clause 44 of the Tax Audit Report and the same shall be kept in abeyance till 31 -Mar-2021.

4. The order under section 119 of the IT Act,1961 for lower deduction of TDS/TCS u/s 195/197/206C(9) states that Forms filed for FY 2019-2020 shall also be valid for the first quarter of FY 2020-21 except for application for New /different TANs.

Clarification regarding short deduction of TDS/TCS due to increase in rates of surcharge by Finance (No.2) Act, 2019.

It is clarified a person responsible for deduction/collection of tax under any provision of the Income-tax Act shall be considered to be an assessee in default if the person fails to fulfill any of the conditions as laid down below, Further, if the deductor/collector has deducted/collected shortfall of tax after 5th of July, 2019 from the transaction(s) made subsequently after the said date, interest, if any, for delay in deduction/collection of such tax shall not be levied.

Due Dates for Payments/Returns,Forms Relaxation

| Nature of Compliance | Tax period |

Without interest /late fees |

With interest @9% but without late fees | Consequences Post 30-Jun-2020 |

| TDS deposit | Mar-20 | 30-Apr-20 | 30-Jun-20 | With Interest @12%/ 18% and late fees |

| Apr-20 | 7-May-20 | 30-Jun-20 | ||

| May-20 | 7-Jun-20 | 30-Jun-20 | ||

| TCS deposit | Mar-20 | 07-Apr-20 | 30-Jun-20 | With Interest @12%/ 18% and late fees |

| Apr-20 | 7-May-20 | 30-Jun-20 | ||

| May-20 | 7-Jun-20 | 30-Jun-20 | ||

| Advance tax (First in stalment for FY 2020-21) |

FY 2020-21 | 15-Jun-20 | 30-Jun-20 | With Interest @ 1% p.m. or for part of month |

Due Dates for Payments/ Returns, Forms Relaxation

| Nature of Compliance | Period | Due Date |

| Income tax return | FY 2018-19 | 30-Jun-20 |

| Investment for rebate in income tax return (Deductions, Sec. 54 Exemptions | FY 2019-20 | 30-Jun-20 |

| Vivad se Vishwas Scheme | For any Assessment year where appeal is pending at any forum as on Jan 31, 2020.

|

30-Jun-20 |

| Linking of Aadhar with PAN | NA | 30-Jun-20 |

| Issue of notices, orders, filling of appeals, furnishing of return, statements, applications and reports and any other document and Benami Laws | Between March 20, 2020 to June 29, 2020 | 30-Jun-20 |

| Form G/ H Order u/s 119 dated April 3, 2020 | FY 2020-21 | 30-Jun-20 |

GOODS AND SERVICE TAX (GST)

GST

1. CBIC has clarified that application of refund can be filed till 30.06.2020 where the period of two years is expiring between 20.03.2020 to 29.06.2020.

2. CBIC has clarified that application for Letter of Undertaking (LUT) for export without tax payment can be filed till 30.06.2020 for F.Y. 2020-21. CBIC has clarified that where the taxes have been paid in relation to any supply which got returned/cancelled subsequently, taxpayer can raise a refund claim in Form GST RFD-01 if no subsequent output liability exist for adjustment of Credit Note.

3. Form GST PMT-09 is now available on GST Portal which can be used to transfer cash ledger balances from one tax head to another tax head.

4. Composition Taxable Person to file CMP-08 for Q4 (2019-20) by 07.07.2020 instead of 18.04.2020 and file GSTR-4 for FY 2019-20 by 15.07.2020 instead 30.04.2020.

5. The tax-payers whosoever furnished Form GSTR-3B to save themselves from late fees and interest. For them the requirement to furnish Form GST CMP-08 and GSTR-1 for financial year 2019-20 has been waived off through notification 12/2020 dated March 23, 2020.

| S. No. | Return / Form | Period | Due Date | Revises Due Date | Remarks |

| 1 | GSTR3B (Turnover more than 5 Cr.) | Feb, Mar, Apr

Month |

20th of next month | 24th Jun 2020 | CBIC Notification no.32/2020 dt. 03.04.2020 – Late fee waived only if filed before this date |

| CBIC Notification no. 31/2020 dt. 03.04.2020 – Interest payable will be @NIL for first 15 days from original due date and @9% thereafter (this rate will be applicable only if filed before this date) | |||||

| 2 | GSTR3B (Turnover more than 1.5 Cr. but upto 5 Cr.) | Feb, Mar Month | 20th of next

month |

29th Jun 2020 | CBIC Notification no. 32/2020 dt. 03.04.2020 for late fees & CBIC Notification no.31/2020 dt. 03.04.2020 for interest Both Interest and Late fee waived only if filed before this date. |

| Apr Month | 20th of next

month |

30th Jun 2020 | |||

| 3 | GSTR3B (Turnover upto1.50 Cr.) | Feb Month | 20th of next month | 30th Jun 2020 | |

| Mar Month | 20th of next month | 3rd Jul 2020 | |||

| Apr Month | 20th of next month | 6th Jul 2020 | |||

| 4 | GSTR1 – Monthly Filings | Mar, Apr, May Month | 11th of next month | 30th Jun 2020 | CBIC Notification no. 33/2020 dt. 03.04.2020 Late fee waived only if filed before this date. |

| 5 | GSTR1 – Quarterly filings | quarter ended qtr. | 30th Apr 2020 | 30th Jun 2020 |

GST

| Sr No. | RETURN/FORM | Period | Due Date | Revised Due Date | Remarks |

| 1 | GSTR3B (Turnover more than 5 Cr.) |

May Month | 20th Jun 2020 | 27th Jun 2020 | CBIC Notification No.36/2020 dt. 03.04.2020 |

| 2 | GSTR3B (Turnover upto 5 Cr.) | May Month | 20th Jun 2020 | 12th Jul 2020 | |

| 3 | Form 9 and Form 9C | 2018-19 | 31st Mar 2020 | 30th Jun 2020 | CBIC Notification no. 15/2020 |

| 4 | Exemptions from issuing e-invoicing and capturing QR code for the the following :

Services by way of admission to exhibition of cinematograph films in multiplex screens |

01st Apr 2020 | 01st Oct 2020

|

CBIC notification 13/2020 and 14/2020

|

CORPORATE LAWS

RELAXATION UNDER VARIOUS PROVISIONS OF COMPANIES ACT,2013

RELAXATION UNDER VARIOUS PROVISIONS OF COMPANIES ACT,2013

PERIOD/DAYS OF EXTENSION FOR NAMES RESERVED AND RESUBMISSION OF FORMS

| Names reserved for 20 days for new company incorporation. SPICe+ Part B needs to be filed within 20 days of name reservation. |

|

| Names reserved for 60 days for change of name of company. INC-24 needs to be filed within 60 days of name reservation |

|

| Extension of RSUB validity of companies. |

|

| Names reserved for 90 days for new LLP incorporation/change of name. FiLLiP/Form 5 needs to be filed within 90 days of name reservation. |

|

| RSUB validity extension for LLPs. |

|

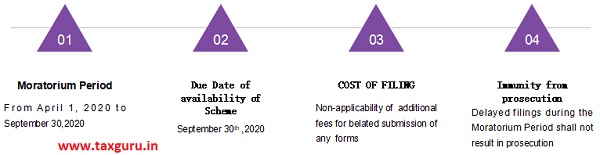

COMPANIES FRESH START SCHEME/LLPS SETTLEMENT 2020

ABOUT THE SCHEME

To enable the companies to make good any filing related defaults irrespective of the duration of the default and make a fresh start as a fully compliance entity. This Scheme incentivize compliance and reduce compliance burden during the unprecedented public health situation caused by COVID-19. The motive of both the schemes is a one-time waiver of additional filing fees for belated filings by the companies or LLPs with the Registrar of Companies.

Non -applicability of scheme

Other laws

ESI CONTRIBUTION

|

PF Contribution

Month: Mar,Apr,May,2020 Employer Contribution 12% + Employee 12% to be paid fully by government if the establishment employs less than 100 persons and 90% of such employees are drawing wages less than Rs.15000 |

| FTP Amendments

The existing FTP 2015-20, which is valid up to March 31, 2020, is extended up to March 31 2021. Various other changes are also made — extending the date of exemption by one year and extending validity of DFIA and EPCG authorizations for import purposes |

EPF CONTRIBUTION

Month: Mar’20 Due Date: 15.04.2020 Extended Due Date : 15-05-2020 |