The Employees’ Provident Fund Organisation (EPFO) has developed a Standard Operating Procedure (SOP) for conducting inspections of establishments in a transparent and accountable manner. This document outlines the purpose of inspections, the scope, and the three-step inspection process. The goal is to promote self-compliance, protect worker’s rights, and ensure effective social security for employees through better compliance.

Key points from the document:

Purpose:

- The purpose of the SOP is to formalize the mechanism of inspections conducted in EPFO in a transparent and accountable manner.

- It aims to promote fairness and ease of compliance for employers while protecting workers’ social security rights.

- The SOP aligns with the EPF & MP Act, 1952, and the ILO Labour Inspection Convention, 1947 (No. 81), which emphasize the need for inspections in workplaces.

Scope:

- The SOP aims to standardize the process of periodic desk review of establishments within EPFO’s jurisdiction.

- It identifies likely defaulting establishments and establishes a priority matrix for selecting establishments for physical inspection.

- The focus is on establishments mandatorily covered under Section 1(3) of the EPF & MP Act, 1952.

Procedure:

- The inspection process consists of three steps: Nudge & Watch, E-verification, and Physical Inspection.

- Nudge & Watch involves identifying likely defaulters and nudging them through various means to remit the dues.

- E-verification is initiated for continued defaulters, requesting them to declare and remit dues or declare closure.

- Physical Inspection is carried out for establishments that have not complied despite the previous steps.

Method of Identification:

- Establishments are identified using various parameters, including non-filing of Employee Contribution Return (ECR), variations in ECR, intelligence from periodic desk review, complaints, data analytics, and inputs from other agencies.

- The use of both ECR-based and non-ECR parameters allows a comprehensive approach to identify defaulting establishments.

Roles and Responsibilities:

- The SOP outlines the roles and responsibilities of officers involved in the inspection process, including those at the field office, zonal office, and central office levels.

- A committee is responsible for reviewing and updating the Priority Matrix, which is used to prioritize defaulting establishments for inspection.

Monitoring Mechanism:

- The SOP emphasizes a robust monitoring mechanism to ensure effective implementation of the inspection scheme.

- Regular reviews are conducted at different levels, including field offices, zonal offices, and the central office, to track the progress and status of inspections.

Modifications/Amendments:

- The document specifies the authorities that have the power to modify or amend the SOP, annexures, and priority matrix if necessary.

- This provision allows the SOP to adapt to changing circumstances and requirements over time.

Conclusion:

- The conclusion emphasizes the significance of social security administration and inspection systems in the evolving labor conditions globally.

- The SOP aims to encourage self-compliance, enhance transparency, and effectively detect defaults through a systematic and technology-driven approach.

Overall, the SOP is a comprehensive and well-structured document that outlines the process of inspecting establishments to ensure compliance with social security regulations. By incorporating data-driven approaches and leveraging technology, the EPFO aims to achieve better results in promoting compliance, protecting workers’ rights, and improving the overall effectiveness of the inspection process.

Standard Operating Procedure For Inspection of Establishments

Employees’ Provident Fund Organisation

Bhavishya Nidhi Bhawan,

14, Bhikaji Cama Place,

New Delhi – 110066

Page Contents

- 1. Purpose

- 2. Introduction

- 3. Scope

- 4. Periodic Desk Review of Establishments

- 5. Procedure

- 6. Method of identification of defaulting Establishment:

- 7. Roles and responsibilities

- 8. Monitoring mechanism

- 9. Modifications/Amendments in SOP

- 10. Power to remove difficulties

- 11. Conclusion

- Annexure A – The Role, Responsibility & Report for Periodic Desk Review

- Annexure B – Nudging: Process of Encouraging Self Compliance

- Annexure C- Inspection Report Format (Illustrative)

- Annexure D- Format for e-SCN and list of documents

- Annexure D- Format for e-SCN and list of documents

- Annexure E – Terms/Acronyms/ Abbreviations

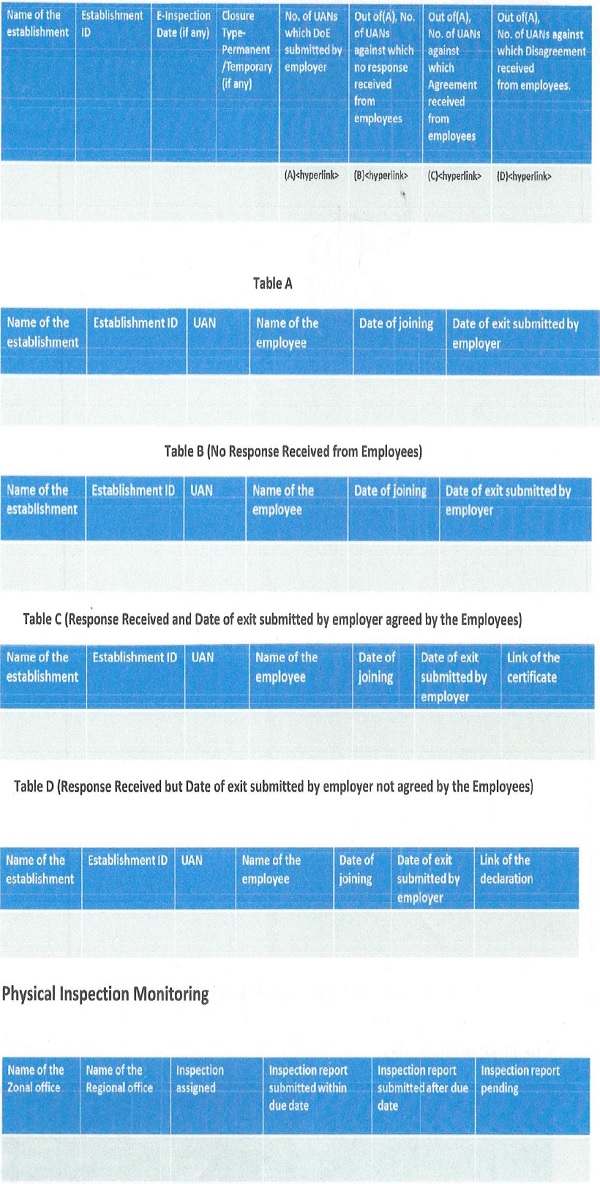

- Annexure F – Dashboards for Monitoring and Reporting E-Verification Monitoring

- Annexure G- Roles and Responsibilities

1. Purpose

1.1 The purpose of this document is to formalize the mechanism of inspections conducted in EPFO in accordance with the mandate given vide circular No. MIS-2(4)CAIU/Web Portal/2014-15/ dated 26/06/2014 through a transparent and accountable system based on data and evidence.

1.2 It aims to promote fairness and ease of compliance for employers while effectively protecting worker’s social security rights keeping in view EPFO’s priorities and the provisions of ILO C-81.

1.3 The section 13 of the EPF & MP Act, 1952, (hereinafter referred to as “the Act”) provides for inspections of establishments which can be conducted by officers of the organization notified as Inspectors by appropriate Government in the Official Gazette.

1.4 India ratified ILO’s Labour Inspection Convention, 1947 (No. 81) in 1949. As per article 12 of this convention:

i. An inspector shall be empowered to enter freely and without previous notice at any workplace liable to inspection.

ii. An inspector shall notify the employer or his representative of their presence on the occasion of an inspection visit.

1.5 This Standard Operating Procedure (SOP) for inspection in EPFO aims to streamline the inspections by making them more systematic, based on a technology enabled methodology of identification which is transparent and objectively determined. Moreover, it also aims to promote self-compliance by Periodic Desk Reviews and to layout a well-defined priority structure of the establishments to be selected for physical inspection, considering the limited human resources for conducting large number of physical inspections every month.

2. Introduction

2.1 The conditions under which Social Security administration/compliance and inspection systems operate have changed dramatically over the last few decades. This change is mainly necessitated by the technological, economic, and political developments and the ramifications of globalization. The technology based social security compliance strategies, aim to better respond to the demands of evolving labour markets and to ensure implementation of good governance measures.

2.2 Inspection of establishments is necessary to address and rectify the issue of poor compliance with the law. Inspections ensure that monitoring mechanisms are in place and defaulting establishments undergo timely verification to meet their compliance obligations. It is to enforce protective legislation and promote labour welfare and ease of living.

3. Scope

3.1 The scope of the SOP for inspection is to standardize the process of periodic review of establishments, to identify likely defaulting establishments, to create a seamless process of inspection, thus enhancing the coverage and ensuring effective social security for employees through better compliance.

3.2 The broad scope is as follows: –

i. To standardize the process of periodic Desk Review of establishments.

ii. To identify likely defaulting establishment.

iii. To nudge the establishments to regularize their compliance.

iv. To establish the parameters through which defaulting establishments will be identified for physical inspection.

v. To prioritize and select the number of establishments for physical inspection on a month to month basis as per the available human resources.

vi. To identify cases for initiating proceedings for determination of dues under section 7A of the Act as per guidelines issued by Head Office from time to time.

3.3 The companies which are automatically allotted PF code by MCA portal but are not yet required to comply would be identified and dealt separately. The focus would be on the establishments mandatorily covered under Section 1(3) of the Act.

4. Periodic Desk Review of Establishments

4.1 Each field office shall undertake a Desk Review of all the establishments (which are not marked as “closed”) within their jurisdiction, at least once in a year.

4.2 Each Dealing Assistant entrusted with this task will review at least 10 establishments every week and submit the review report through e-office to the concerned Section Supervisor who, after recording his observations, will submit it to the Circle Officer. The role and responsibility matrix for periodic desk review is detailed in Annexure A.

4.3 While the above exercise will form the precursor of default management, it will also feed into the intelligence for “nudge and watch” as well as physical inspection in a systemic manner as explained in following para.

5. Procedure

5.1 There would be three step procedures for inspection which are as following:

i. Step1: Nudge & watch

ii. Step2: E-verification

iii. Step3: Physical Inspection

5.2 Stepl: Nudge and Watch

i. In step1, likely defaulters would be identified through parameters such as non-filing of ECR, variations in ECR, intelligence from periodic desk review and other sources etc. This information is received from an IT tool and all such establishments will be nudged by touch points such as e-mails, SMS and Pop Up in Employer Portal to remit the dues followed by weekly SMS and Email Reminders. The establishments that file ECR and remit the dues will be out of defaulter’s list for that wage month.

ii. The IT tool will continue to nudge till the end of second month of default also. However, every such ‘nudge and watch’ will also be recorded in establishment master and will form a part of the e-file during Periodic Desk Review. The process flow for ‘nudge and watch’ is detailed in Annexure B.

5.3 Step2: e-Verification

i. The ‘nudge and watch’ in step 1 will continue till the end of 3rd month. At the same time, if default is continued, at the start of third month, e-Verification system will be automatically deployed in the Employer Login, requesting the employer to declare and remit Dues or declare Closure (Temporary or Permanent), as the case may be, within 30 days.

ii. In case of closure of the establishment, date of exit of employees shall be marked by employer in the portal in accordance with para 36(2)(b) of the EPF Scheme 1952.Thereafter, a confirmation would be taken from employee using a system-based mechanism about his exit date. In case dispute is raised by employee within due date (i.e. within e-Verification period of 30 days), the establishment would be added in list for next step of physical inspection, otherwise establishment would be marked closed. If response is received after due date (i.e. after end of e-Verification period), then response would be recorded in complaint portal for further action.

iii. The establishment, which responds to the notice of the e-Verification either declaring closure details without any dispute from employees on date of exit or declaring and remitting dues would be out of defaulters list for that wage month. Remaining establishments will be added to the pool of establishment to be selected for physical inspection in step 3.

5.4 Step 3: Physical Inspection

i. At the start of the 4thMonth, an e-SCN for inspection u/s 13 of the Act will be deployed in employer login to the identified establishments as per priority matrix. Employer will upload the required documents within 7 days. The remaining defaulters which have not come into the priority list will remain in the pool of establishment to be selected for physical inspection till it sets right the default for which it was selected or a physical inspection is done.

ii. The authority competent to assign inspection on Shram Suvidha Portal (SSP) of Ministry of Labour & Employment (designated as ‘Regional Head’ on SSP) will mark unavailability of Inspectors. List of establishments from para 5.4(i) would now be visible to Field office on the Unified Portal. In case, an inspector becomes unavailable after the system based selection of inspection, Regional Head may assign such inspection to another inspector and update the same in Unified Portal. For larger quantum of likely default, Regional Head may depute a squad of Inspectors and record the same in Unified Portal. On the basis of this list of establishments and deputed official as per system, Regional Head will assign inspection for the establishment through Shram Suvidha Portal without sharing the date of inspection with establishment.

iii. After assignment of inspection, it shall be completed within five working days and spot inspection report shall be uploaded on Unified Portal immediately on completion of inspection. Copy of e-SCN, response of employer along with uploaded documents and spot inspection report with inputs from Inspector will be included in inspection report.

iv. The Inspection report will be uploaded on SSP as well as unified portal within stipulated time as per SSP norms. An illustrative format of inspection report to be filled online is given in Annexure C.

v. The inspection report as submitted on SSP shall be exported as a pdf file from unified portal by inspecting official and submitted in e-office to circle officer. The corresponding-receipt number of e-office would be recorded in Unified Portal.

5.5 Inspection Report and the follow up action:

i. The inspection report will also be visible to the employer through employer login on Unified Portal. The establishment would be intimated through an email along with copy of inspection report in attachment that it can access inspection report on employer login of Unified Portal also and has been given 15 days’ time to comply with the findings of the inspection report. In case the establishment complies with the inspection report and remits dues, system will verify it in Unified Portal and in case of full compliance, the case will be closed. The establishment will have the option to submit response to the report in Unified Portal login.

ii. In addition to action as per Inspection report, in case of non-production of records by the establishment, the report of inspecting official will be sent to circle officer through e-office for processing of filing prosecution against the establishment under section 14 of the Act.

iii. Response of the employer against the notification of inspection report will be recorded in unified portal along with e-receipt number. There may be six scenarios as listed below for the response of the Establishment to the Inspection Report and corresponding action will be taken as given in the following table:

1. Fully agree and remit dues

2. Fully agree but doesn’t remit dues

3. Partly agree and remit agreed dues

4. Disagrees

5. Doesn’t respond at all

6. Does not provide documents for verification during physical inspection

Response of Establishment and action by office after Physical inspection

|

Establishment’s Response to the calculated dues as per the Inspection Report after physical inspection |

|||

| Scenario & Action | Fully agrees and remit dues (scenario 1) | Fully/Partly agrees and does not remit full dues (scenario 2 & 3) | Disagrees/No response

(scenario 4,5,6) |

| Action for Establishment | Establishment complies and remits dues within 15 days and submits response to the report with payment details in Unified Portal | Establishment agrees/remits the undisputed part of dues and submits response in unified portal and uploads its comments along with supporting documents (if any) for the disputed part. |

Establishment submits response (with disagreement) to the report in Unified Portal and uploads its comments along with supporting documents (if any) or no response |

| System check | System will verify payment in Unified Portal. |

System will verify part payment(if any) in Unified Portal, and for the disputed/unpaid part of dues, Inspection report with documents submitted by the establishment would be sent to e-proceedings portal for determination of dues/applicability dispute (as the case may be) in accordance with section 7A of the Act. |

The inspection report with details of dues would be automatically sent to e-proceedings. portal for determination of dues/applicability dispute (as the case may be) in accordance with section 7A of the Act. |

| Field office | In case of full compliance, the case will be closed.

If full dues are not remitted, proceedings u/s 7A/7Q/14/14B of the Act and/or proceedings u/p26B of the EPF Scheme (as the case may be) shall be initiated. |

Proceeding u/s 7A/7Q/14/14B of the Act for disputed part of inspection report or proceedings u/p 26B of the EPF Scheme (as the case may be) shall be initiated. | Proceeding u/s 7A/7Q/14/14B of the Act as per the inspection report and/or proceedings u/p 26B of the EPF Scheme (as the case may be) shall be initiated. |

6. Method of identification of defaulting Establishment:

6.1 The parameters for identification and prioritization of defaulting establishments for physical inspection will be as per the inspection scheme of EPFO. However, since defaulting establishments are much larger in numbers within those parameters, a Priority Matrix’ will be decided on the basis of a mathematical formula by committee of CAIU, HO. Among other indicators as may be included in such formula, priority may be given to bigger defaulters keeping in view quantum of default in terms of remittances and number of employees. The number of physical inspections will be decided considering the available human resources at field offices.

6.2 The committee for “Priority matrix” shall consist of following officers:

i. ACC (CAIU, HO)

ii. Senior most ACC, ZO

iii. Concerned RPFC-I, CAIU, HO

Concerned RPFC-II of CAIU, HO shall be the convener of the meetings held by the said committee.

The “Priority Matrix” will be dynamic in nature and to be reviewed every six months by the said committee. The review report along with recommendations will be submitted by the committee to ACC (HQ), CAIU for approval, if any change is proposed. The decision of ACC (HQ) will be under intimation to CPFC.

6.3 There would be two types of parameters :

A. ECR based parameters:

ii. period (months) of default and quantum of probable default (number of active UANs),

iii. number and/or percentage of UANs for which No return or contribution (without NCP) received

iv. number and/or percentage of UANs for which incomplete return or part contribution received (eg. only employees share deposited)

v. variation in membership

iv. variation in contribution amount

vi. compliance starting status after date of registration(New coverages)

B. Non-ECR parameters such as:

i. Complaints against establishment,

ii. Inputs from other agencies (ESIC, GST, Income tax etc.),

iii. Inputs from data-analytics, suspected fraudulent establishments flagged by FIA

iv. Inputs from wage analysis

v. VIP references.

vi. Establishments reported for closure

6.4 The format of E-Show Cause Notice (E-SCN) along with list of documents required for different causes of inspection is given in Annexure D.

6.5 The Terms/Acronyms/Abbreviations are given in Annexure E.

7. Roles and responsibilities

Roles and responsibilities are given in Annexure G.

8. Monitoring mechanism

8.1 The periodic desk review of establishments has to be monitored at the level of Officer in Charge of the field office on a weekly basis and reviewed by Zonal office on fortnightly basis. Further, CAIU, HO would review the progress on monthly basis in this regard.

8.2 Periodic reports from Field offices and online portal on progress/status of inspections would be displayed in dashboards of ZO and CAIU, HO.

8.3 Review of Priority Matrix every six months by the standing committee

8.4 The Design of various Dashboards for Monitoring and Reporting are given in Annexure F.

9. Modifications/Amendments in SOP

9.1 The CPFC may modify or amend this SOP.

9.2 The ACC (HQ), CAIU, HO may modify or amend any annexure of this SOP.

9.3 The ACC(HQ), CAIU, HO may modify or amend the Priority Matrix on the recommendation of the standing committee constituted for review.

9.4 The ACC, CAIU, HO may modify or amend Software Requirement Specifications for this SOP along with format of inspection report.

10. Power to remove difficulties

If any difficulty arises in giving effect to this SOP, Central Provident Fund Commissioner (CPFC) may issue such instruction or clarification as appear to be necessary or expedient for the removal of the difficulty.

11. Conclusion

It is noteworthy that under the evolving labour conditions globally, social security administration and inspection systems have gained a newfound significance. In this context, EPFO aims to formulate and conduct its inspection scheme with a larger objective of incentivizing establishments to be compliant with the Act and maximizing clarity of operations. This SOP clearly defines parameters, procedures, and process flow to inspect the establishments, thus ensuring transparency as well as optimum utilization of available human resources and increasing ease of compliance for employers and protection of workers’ rights. This SOP, thus, promotes self-compliance enabling a paradigm shift from enforcer to enabler, while at the same time establishes a robust mechanism to detect defaults in time and ensure inspections in a systematic and transparent manner.

Annexure A – The Role, Responsibility & Report for Periodic Desk Review

| SN | Role | Responsibilities |

| 1 | Officer In Charge | Define and regulate the workload in such a manner that the concerned office reviews all the establishments within its jurisdiction once in a financial year.

Monitor the progress of Desk review and ensure the compliance of defaulting establishments. |

| 2 | Circle Officer | To take necessary action for discrepancies found in review and recommend cases fit for physical inspection through CAIU Portal |

| 3 | Enforcement Officer | To refer review report while conducting physical inspection |

| 4 | Section Supervisor | To check and put his observation and submit to Circle Officer |

| 5 | Entrusted Officials | To collect relevant information about establishments and prepare review report and submit to Section Supervisor for further action |

| 6 | IS division | To make necessary changes in Unified Portal to enable this functionality in the login of SSA, SS and Officers in various roles |

Report of Periodic Desk Review of establishments

|

A. System generated report |

|||

| Parameter | Status | Details | |

| Frequency of Contribution | No Contribution for more than one wage months in last N months | Y/N | No. of months without Contribution |

| No contribution in last M months or since coverage | No. of months without

Contribution |

||

| Amount of Contribution | Variations in contribution as compared to last ECR (more than x %) | Y/N | % of variation |

| Pending contribution in any account in ECR (eg Account I , II, X, XXI) for Employee share or Employer share or admin charges

(despite not being exempted. for that |

Y/N | No. of months | |

| No contribution in ECR with only min admin charges of Rs 75 in Account II | Y/N | No. of months for which such ECR received | |

| Membership | variations in membership as compared to last ECR (more than x %) | Y/N | % of variation |

| No. of Active UAN’s for whom ECR not filed for last three wage months for which ECR is filed by establishment for other UANs | No. of UANs | UAN wise details | |

| Form 5A Submitted | Y/N | ||

| DSC updated | Y/N | ||

| Contact Details | Mobile | Y/N | |

| Y/N | |||

| Geo tagging | Y/N | ||

| KYC pending | Aadhaar | No. of

UANs |

UAN wise details |

| Bank | No. of

UANs |

UAN wise details | |

| Mobile | No. of

UANs |

UAN wise details | |

| PAN | No. of

UANs |

||

| Details of last inspection | Date of inspection: Auto filled (if available in system) | Compliance status (Complied/7A proceedings/Prosecution) | |

–

| B. To be entered manually | |

| Compliance status on last inspection | |

| Pending 7A/14B enquiry | |

| Pending compliance related complaints | |

| Pending Current demands | |

| Pending Arrear demands | |

| If the establishment is under NCLT for liquidation or closure | |

| Others | |

Annexure B – Nudging: Process of Encouraging Self Compliance

1. Pop Up with the message such as given below will be displayed on the Employer portal after Due Date is over. Weekly SMS and Email reminders will be sent to the employers to nudge them toward compliant behavior. This will happen from the due date up to 3 months. SMS format with auto populated details of establishment code, name and default will be as following:

| Table 1: format of SMS alerts in step 1 | ||

| SN | Scenario | Sample SMS |

| 1. | No ECR Filed for the wage month (Out of establishments who have filed at least one ECR during the last N months) | “DEAR EMPLOYER, YOUR ESTABLISHMENT DL/CPM/1234567, M/S ABCD PVT LTD, HAS FAILED TO REMIT DUES FOR WAGE MONTH JANUARY 2022, PLEASE MAKE THE ECR PAYMENTS AT THE EARLIEST TO AVOID FURTHER PENAL DAMAGES AND INTEREST. PLEASE IGNORE IF ALREADY PAID – EPFO |

| 2. | Live/Linked UANs with No ECR/NCP | “DEAR EMPLOYER, YOUR ESTABLISHMENT DL/CPM/1234567, M/S ABCD PVT LTD, HAS NEITHER FILED ECR NOR MARKED DATE OF EXIT FOR N EMPLOYEES. IT IS REQUESTED TO FILE CORRECT ECR FOR ALL EMPLOYEES AND TIMELY MARK DOE OF ALL EXITED EMPLOYEES.”-EPFO |

| 3. | Fall in membership in excess of x% or N members | “DEAR EMPLOYER, IT HAS BEEN NOTICED THAT THERE IS A SUDDEN FALL IN MEMBERSHIP IN YOUR ESTABLISHMENT DL/CPM/1234567, M/S ABCD PVT LTD, IT IS REQUESTED TO FILE CORRECT ECR FOR ALL EMPLOYEES OR SUBMIT CLARIFICATION FOR THE SAME WITHIN 30 DAYS.”-EPFO |

| 4. | Fall in contributions in excess of x% or M rupees | “DEAR EMPLOYER, IT HAS BEEN NOTICED THAT THERE IS A SUDDEN FALL IN CONTRIBUTION IN YOUR ESTABLISHMENT DL/CPM/1234567, M/S ABCD PVT LTD, IT IS REQUESTED TO FILE CORRECT ECR FOR ALL EMPLOYEES OR SUBMIT CLARIFICATION FOR THE SAME WITHIN 30 DAYS. “-EPFO |

| 5. | No compliance from Date of Registration | “DEAR EMPLOYER, YOUR ESTABLISHMENT DL/CPM/1234567, M/S ABCD PI77′ LTD, HAS FAILED TO REMIT DUES SINCE COVERAGE, PLEASE MAKE THE ECR PAYMENTS AT THE EARLIEST TO AVOID further PENAL DAMAGES AND INTEREST. PLEASE IGNORE IF ALREADY PAID – EPFO |

| 6. | Live/Linked UANs with part contribution (eg. only Employees share) | “DEAR EMPLOYER, YOUR ESTABLISHMENT DL/CPM/1234567, M/S ABCD PVT LTD, HAS FAILED TO CORRECTLY PAY BOTH EMPLOYEES SHARE AND EMPLOYERS SHARE IN ECR FOR N EMPLOYEES. IT IS REQUESTED TO FILE CORRECT ECR FOR ALL EMPLOYEES WITH REMAINING SHARE OF CONTRIBUTION IMMEDIATELY. “-EPFO |

| 7. | For non ECR parameters | For such parameters, there would be physical inspection and details of such discrepancy eg complaint or input from wage analysis would be provided in e-SCN. |

2. At the start of 3rd month, e-Verification will be deployed in the Employer Login, and the system will auto populate a message in the Employer Login which will read as follows:

“YOUR ESTABLISHMENT DL/CPM/1234567, M/S ABCD PVT LTD, HAS FAILED TO REMIT DUES FOR WAGE MONTH JANUARY 2022. IF THE ESTABLISHMENT IS FUNCTIONAL, THIS ATTRACTS, APART FROM THE PENALTIES, INSPECTION OF YOUR ESTABLISHMENT. IN CASE THE REMITTANCES ARE PAID WITHIN 30 DAYS THE NEED FOR INSPECTION MAY GET OBVIATED. PLEASE MAKE THE PAYMENTS IMMEDIATELY.”-EPF0

The format of this SMS would also be changed for each scenario in a similar manner as given in table 1.1.

3. An illustrative list of documents that can be uploaded by the employer in support its declaration of closure is as follows-

i. Cancellation of the Registration of the Company by the Registrar of Companies.

ii. Order from Official Liquidator confirming closure.

iii. Order of the Resolution Professional under the Insolvency and Bankruptcy Code, confirming closure.

iv. Any other such document confirming closure, as issued by the Competent Authority of the concerned Government Department.

v. Cancellation of Electricity connection

vi. Cancellation of Labour License/Trade License

vii. Cancellation of Sales Tax/GST Number

viii. Income Tax Return for the three financial years since year of declared closure

ix. Form 26AS for the three financial years since year of declared closure

x. Up to date Bank statement since last contributing month

xi. ESIC returns from last quarter since when last ECR submitted till date

4. Confirmation from ex-employees: A system based on the mechanism of confirming exit from employees using SMS or login based communications will be used to cross verify closure of establishment. Text of the Message to be sent to Exited Employees is as follows-

“Your employer has marked that you exited on <DD/MM/YYYY> and submitted closure of business. Do you agree with your Date of Exit? If Yes, kindly reply “DOE Y”.If No, kindly Upload Proof by clicking<Link to Member Login> for further action.”

These employees are informed through SMS/Email/Member Login at day end of updating DOE and input taken through them is actionable by Field Office.

Annexure C- Inspection Report Format (Illustrative)

| Shram Shuvidha Portal Ministry of Labour and Employment Establishment Profile Part A – Basic Particulars |

||||||||||

| Inspection ID generated by SSP:(Auto- Populated) Date & Time of inspection: LIN: (Auto- Populated) |

||||||||||

| EPF No. (Auto- Populated) | ESIC No. (if available) |

PAN* | Bank Account(s)* | |||||||

| Name of the establishment: | Auto-populated(editable) | |||||||||

| E-mail (s) | Auto-populated(editable) | |||||||||

| Mobile No. | Auto-populated(editable) | |||||||||

| Present Address Line1: | Auto-populated(editable) | |||||||||

| Present Address Line2: | Auto-populated(editable) | |||||||||

| City/Village: | Auto-populated(editable) | |||||||||

| Pin Code: | Auto-populated(editable) | |||||||||

| State: | Auto-populated (editable) | |||||||||

| District: | Auto-populated(editable) | |||||||||

| Police Station | Auto-populated(editable) | |||||||||

| Geo-tagging of establishment’s location*: | To Be Done by inspecting official/employer | |||||||||

| Photo of the establishment* | <upload option> | |||||||||

| Details of Branches/Parent company of Establishment* | ||||||||||

| Nature of Activity/work (link with NIC Code/SSP Industry Classification)* | ||||||||||

| Details of employer/ his representative present during inspection :Auto-populated from Unified portal as submitted by Employer (editable)* | ||||||||||

| Name | ||||||||||

| Designation | ||||||||||

| Email I.D. | ||||||||||

| Mobile No | ||||||||||

| Present Address | Check box: Same as in LIN ( ), if not, please provide below: | |||||||||

| Present Address Line1: | ||||||||||

| Present Address Line2: | ||||||||||

| City/Village: | ||||||||||

| Pin Code: | ||||||||||

| State: | ||||||||||

| District: | ||||||||||

|

||||||||||

Part B

Documents verified/collected during Inspection*

| Registers produced and checked (to be hyperlinked to records uploaded by employer) | Period From – To |

Remarks |

| Register of Employee Form A– (Yes/No); | DDMMYYY- DDMMYYY | |

| Register of wages Form B — (Yes/No); | DDMMYYY- DDMMYYY | |

| Attendance Register Form D — (Yes/No); | DDMMYYY- DDMMYYY | |

| Details of Appointment/ Relieving& Past Employment (Form 5/1O& 11) | DDMMYYY- DDMMYYY | |

| Register of Contractors– (Yes/No); | DDMMYYY- DDMMYYY | |

| International Worker Return– (Yes/No); | DDMMYYY- DDMMYYY | |

| Trial Balance– (Yes/No); | DDMMYYY- DDMMYYY | |

| Balance sheet and Annexure– (Yes/No); | DDMMYYY- DDMMYYY | |

| Tax Returns of establishment for specified period | DDMMYYY- DDMMYYY | |

| Form 24Q, Form 26 Q and Form 26 AS of establishment– (Yes/No); | DDMMYYY- DDMMYYY | |

| Bank statement– (Yes/No); | DDMMYYY- DDMMYYY | |

| Form 5A and Details of authorised signatory/DSC (if not already submitted) | DDMMYYY- DDMMYYY | |

| Others–(Please Specify) | DDMMYYY- DDMMYYY |

Note: Mandatory list of documents will be as per table given in Annexure D- Format for e-SCN and list of documents

Part C

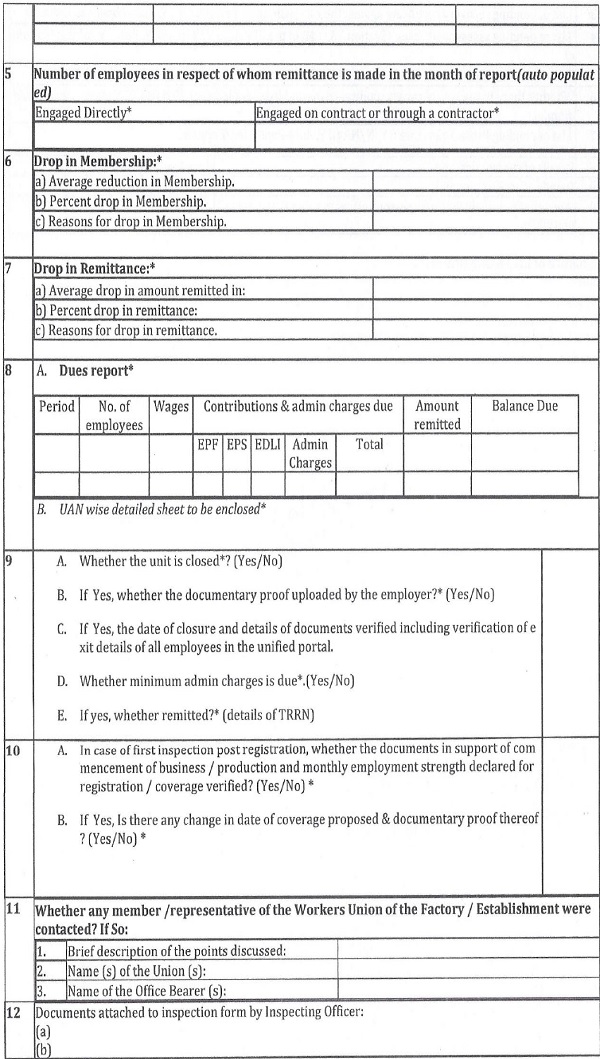

1. Purpose of inspection – (Auto populated from e-SCN) (further details can be added by Inspecting Official):

IL Compliance Status in latest ECR auto populated

| Last Contributory Wage Month (LCWM) | Auto-Populated |

| UANs in LCWM | Auto-Populated |

| Amount remitted in LCWM | Auto-Populated |

| Default Period | Auto-Populated |

| Probable UANs in Default | Auto-Populated |

| Probable Amount in Default | Auto-Populated |

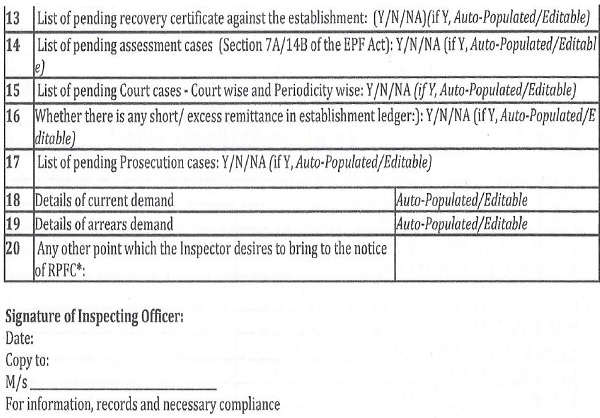

IV. Inspection

Signature of Inspecting Officer:

Date:

Copy to:

M/s___________________________

For information, records and necessary compliance

Annexure D- Format for e-SCN and list of documents

Annexure D- Format for e-SCN and list of documents

e- Show Cause Notice

Whereas M/s<Establishment Name> (Auto Populated)(hereinafter referred to as “Establishment” is an establishment covered under the provisions of the Employees’ Provident Fund and Miscellaneous Provisions Act, 1952(herein referred to as the Act). The particulars of the establishment are as under:

EPF Code no (Auto Populated)

LIN (Auto Populated)

Coverage under Section : (Auto Populated)

Date of Coverage (Auto Populated)

Registered Address (Auto Populated)

Email id (Auto Populated)

Telephone no. (Auto Populated)

Last Contributory Wage Month (LCWM): (Auto Populated)

Number of UANs in LCWM: (Auto Populated)

Amount Remitted in LCWM: (Auto Populated)

And whereas the inspection of the establishment has been necessitated due to the reasons as below-

(Trigger(s) of Inspection to be selected by the system based on purpose of inspection which would be dynamic)

1. No ECR Filed for the given wage month

2. Live/Linked UANs with No ECR/NCP or part ECR

3. Variation in membership

4. Variation in contributions

5. No compliance from Date of Registration

6. Complaints/ Intelligence/Closure/ VIP References/Others

- If Trigger is “No ECR Filed for the Wage Month” then the following will also be displayed-

And whereas as per the Last Contributory Wage Month MMM-YYYY(Auto Populated) the number of Contributory UANs were___ (Auto Populated) & Amount of Remittance made was_________ (Auto Populated). The number of defaulting months during the period _____________ (Auto Populated) is _________ (Auto Populated). The tentative dues in default accordingly payable by the establishment are____________ rupees. (Auto calculated – number of defaulting months given period * Amount of remittance in Last Contributory Wage Month). The account wise dues are as below

| A/c 1 | A/c II | A/c X | A/c XXI | Total |

- If Trigger is “Live/Linked UANs with No ECR/NCP or part compliance” then the following will also be displayed

And whereas as per available information, the wage month wise number of UANs in default and corresponding amount in default during the given period is shown in the table below.

| Wage Month | Number of UANs in default | Amount in Default |

| MMM-YYYY | <Live UANs with No ECR/NCP> | <Last Contributory Amount in these UANs> |

| MMM-YYYY | <Live UANs with No ECR/NCP> | <Last Contributory Amount in these UANs> |

| TOTAL | <Total UANs in Default> | <Total Amount in Default> |

- If Trigger was “Variation in membership” or “Variation in contributions” then the following will also be displayed

And whereas as per the Last Contributory Wage Month Le__________ (Auto Populated) the number of Contributory UANs is__________ (Auto Populated) & Amount of Remittance made is _______ (Auto Populated). As per the Previous Contributory Wage Month i.e_______ (Auto Populated) the number of Contributory UANs were_______ (Auto Populated) & Amount of Remittance made was________ (Auto Populated). Such variation shows a probable default in remittance of dues for eligible employees.

- If Trigger was “No compliance from Date of Registration” then the following will also be displayed

And whereas your establishment has not filed returns and remitted contributions of your employees since date of coverage.The tentative dues in default accordingly payable by the

establishment in respect of <Employees declared at the time of Coverage> employees are___________

rupees. (Auto calculated – Number of months with no ECR since coverage * Number of Employees declared at the time of coverage * 3750 (considering average wage Rs 15000).

And whereas failing to deposit statutory dues as per following provisions of the Act is a punishable offense under section 14/14(A) of the Act:

i) Section 6 of the Act read with Para 30 and 38 of the Employees’ Provident Funds Scheme, 1952

ii) Section 6A read with Para 3 & 4 of the Employees’ Pension Scheme, 1995

iii) Section 6C of the Act read with Para 8 of the EDLI Scheme, 1976.

Therefore, you, being the employer within the meaning of section 2(e) of the EPF Act are hereby directed to Show Cause as to why prosecution under section 14/14(A) and/or proceedings u/s 7A of the Act may not be initiated against you and the establishment for the above contraventions.

You are also hereby directed to upload the following documents within 7 days-

<List of documents based on purpose(s) of inspection>

It may be noted that failure to submit or upload the requisite item wise information, records or submission of any false information will render yourself liable for legal action for breach of para 76 EPFS 1952, para 42 of EPS 1995 and para 29 of EDLI Scheme 1976 read with section 13 of the Act.

Regional/Assistant Provident Fund Commissioner

(This e-SCN would also reflect in the login of Field office along with the name of Inspector selected by system. Once inspection is assigned in SSP and assignment details are updated in CAIU Portal (or new option in unified portal), a copy of this e-SCN would reflect in the login of concerned Inspector who can download it as an authorisation letter for conducting physical inspection.)

Copy to:

Area EO <Name of EO> with direction to visit the establishment and submit inspection report as per prescribed format.

Regional/Assistant Provident Fund Commissioner

Table A: Illustrative list of documents that may be verified during inspection |

||||||

SN |

Name |

No ECR Filed

|

Live/ Linked

|

Variation in

|

Variation in

|

No compliance from date of Registration |

1 |

Register of Employee – Form A |

✓ |

✓ |

✓ |

✓ |

V |

2 |

Register of Wages – Form B |

✓ |

✓ |

✓ |

✓ |

V |

3 |

Attendance Register – Form D |

✓ |

✓ |

✓ |

V |

✓ |

4 |

Register of Contractors |

✓ |

✓ |

✓ |

✓ |

✓ |

5 |

Principal Employer details (if applicable) |

✓ |

✓ |

✓ |

✓ |

✓ |

6 |

Proof of Closure (if applicable) |

✓ |

✓ |

✓ |

✓ |

✓ |

7 |

International Worker Return (if applicable) |

V |

✓ |

|||

8 |

Trial Balance/Balance sheet/Books of P&L account as the case may be for specified period |

✓ |

✓ |

✓ |

✓ |

|

9 |

Tax Returns and Bank Statement of establishment for specified period |

✓ |

✓ |

✓ |

✓ |

✓ |

10 |

Form 24Q 26Q and 26AS of establishment for specified period assubmitted in IT returns-, |

✓ |

✓ |

✓ |

✓ |

✓ |

11 |

Details of Branches/Parent company of Establishment |

✓ |

✓ |

✓ |

✓ |

✓ |

12 |

Details of Appointment/ Relieving& Past Employment (Form 5/10& 11) |

✓ |

✓ |

✓ |

||

13 |

Employee KYC Details —Bank, Aadhaar, PAN, Mobile for non-enrolled employees |

–✓ |

✓ |

|||

14 |

Form 5A and Details of authorised signatory/DSC (if not already submitted) |

✓ |

✓ |

✓ |

✓ |

✓ |

15 |

Other relevant documents (if any) |

✓ |

✓ |

✓ |

✓ |

✓ |

Annexure E – Terms/Acronyms/ Abbreviations

| S. No. | Abbreviation | Full Form |

| 1. | ACC | Additional Central Provident Fund Commissioner |

| 2. | ACC(HQ) | Additional Central Provident Fund Commissioner (Head Quarter) |

| 3. | CAIU | Central Analysis and Intelligence Unit |

| 4. | ECR | Electronic Challan cum Return |

| 5. | E0 | Enforcement Officer |

| 6. | EPF & MP Act | Employees’ Provident Fund and Miscellaneous Provisions Act |

| 7. | EPFO | Employees’ Provident Fund Organization |

| 8. | e-SCN | Electronic Show Cause Notice |

| 9. | HO | Head Office |

| 0. | ILO | International Labour Organisation |

| 1. | IS Division | Information Services Division of EPFO |

| 2. | RO | Regional Office |

| 3. | RPFC | Regional Provident Fund Commissioner |

| 4. | SOP | Standard Operating Procedure |

| 5. | SSP | Shram Suvidha Portal |

Annexure F – Dashboards for Monitoring and Reporting E-Verification Monitoring

Annexure G- Roles and Responsibilities

|

SN |

ROLE | RESPONSIBILITES |

| 1 | EMPLOYER | i. File ECR and make payment by due date for all employees.

ii. Keep mobile number and email id updated in unified portal. iii. Timely update KYC and Date of Exit of all employees as perpara 36(2)(b) of EPF Scheme , before the fifteenth day of themonth following that in which the members left the service. iv. To declare the outstanding dues or closure (temporary or permanent as the case may be) in respond to e- verification notice within 30 days. v. To appoint a nodal officer from the establishment for inspection within 7 days of receiving e-ECN. vi. To provide required information and upload documents within 7 days of receiving e-ECN. vii. Provide required data, documents and statutoryrecords/registers ‘to the inspecting official during physical inspection. |

| 2 | INSPECTING OFFICIAL | i. Download e-SCN and submit in file/e-file for records.

ii. Examine office records including desk review report related to the establishment selected for physical inspection and prepare list of deficiencies found within 7 days of e-SCN. iii. Verify the documents uploaded by employer in response to e-SCN from original records. iv. Inspecting Official may ask the employer to provide documents, if not uploaded by employer and additional documents, if required. v. In case of contradiction in the statements of employer’s, worker and entries in the record, the inspecting officer will seize the relevant records. vi. Inspection report should always be prepared on the work-spot by the inspecting officer himself and copy of report would be provided to the employer’s representative, vii. The inspection should be carried out during the normal working hours as far as possible. viii. If any non-enrolled employees found, inspecting official should ix. get their UAN generated, validated, and linked with x. Submit spot inspection report in prescribed format in Unified portal along with supporting documents. xi. Export the report from Unified Portal and upload in SSP within 48 hours (or such time limit as prescribed by SSP) after inspection. |

| 3 | FIELD OFFICE | i. Update unavailability status of Inspectors in Unified Portal.

ii. In case, an inspector becomes unavailable after the system based selection of inspection, Regional Head may assign such inspection to another inspector and update the same in Unified Portal. iii. Assign inspection to the Inspector in Shram Suvidha Portal for the establishment as per e-SCN visible to Field Office in Unified Portal. iv. Monitor Inspection progress every week. v. Place all notices and inspection reports in the file/e-file of establishment. vi. Initiate e-proceedings in case on non-compliance/part vii. In case of violations by the inspecting official, entries shall be recorded in APAR. |

| 4 | ZONAL OFFICE | i. Monitor Inspection progress every month.

ii. Examine and approve complaint related cases for non-ECR database for Priority Matrix. iii. Review inspection reports related to VIP references and submit report about resolution of the matter to CAIU, HO. |

| 5 | CAIU, HEAD OFFICE | i. Will finalise and maintain the information for e-Register of the establishments with IS division.

ii. Collect data through liaison with enforcement agencies like ESIC, Income Tax, Central Excise and other State and Central iii. Generate list of establishments for first steps for nudging and e-verification. iv. Provide list to IS division for deployment in the back end in Unified portal for step 1 and step 2. v. Review Priority matrix every six months. vi. Generate list of establishments for physical inspection as per priority matrix every month. vii. Deploy e-SCN for identified establishment through Unified Portal as per availability of manpower resources every week. viii. Monitor progress and pendency of inspections. ix. Random Scrutiny of inspections for quality purpose. x. Regulate and control any specific inspection of any xi. To assist in advisory capacity in proper deployment of staff in field offices for anti-evasion measures. |

| 6. | IS Division | i. Develop software and required functionality to implement this SOP for inspection of establishments.

ii. Deploy the list of establishments in back end for step one and two and deploy e-SCN for physical inspection every week. iii. Prepare manuals for new functionalities and provide training modules. iv. Provide technical support and necessary enhancements in the Unified portal for smooth functioning. |

Annexure-I

Report of Periodic Desk Review of establishments

Establishment Code: ____________________________________

Establishment Name:____________________________________

Date of Coverage: Coverage Section:

|

Part-A(System generated report) |

|||

| Parameter | Status | Details | |

| Frequency of Contribution | No Contribution for more than one wage months in last 36 months | Y/N | <No. of months without Contribution> |

| Amount of Contribution | Variations in contribution as compared to last ECR (more than x%) | Y/N | <% of variation> |

| No contribution in ECR with only min admin charges of Rs 75 in Account II | Y/N | <No. of months for which such ECR received> | |

| Membership | Variations in membership as compared to last ECR (more than x%) | Y/N | <% of variation> |

| Form 5A Submitted | Y/N | ||

| DSC updated | Y/N | ||

| Contact Details | Mobile | Y/N | |

| Y/N | |||

| Geo tagging | Y/N | ||

| KYC pending | Aadhaar | No. of UANs | |

| Bank | No. of UANs | ||

| Mobile | No. of UANs | ||

| PAN | No. of UANs | ||

–

|

Part-B (To be entered manually) |

|

| Date of last inspection | |

| Compliance status of last inspection report | |

| Pending 7A/14B enquiry | |

| Pending compliance related complaints | |

| Pending Current demands | |

| Pending Arrear demands | |

| If the establishment is under NCLT for liquidation or closure | |

| Others (E.g. Intelligence Inputs as available on websites of GST, MCA, ESIC or other agencies and/or media reports, etc.) | |

*Note: The above format is only indicative. The Regional Offices may add relevant fields, as per requirement,for better capturing of available information and for strengthening the Periodic Desk Review mechanism.

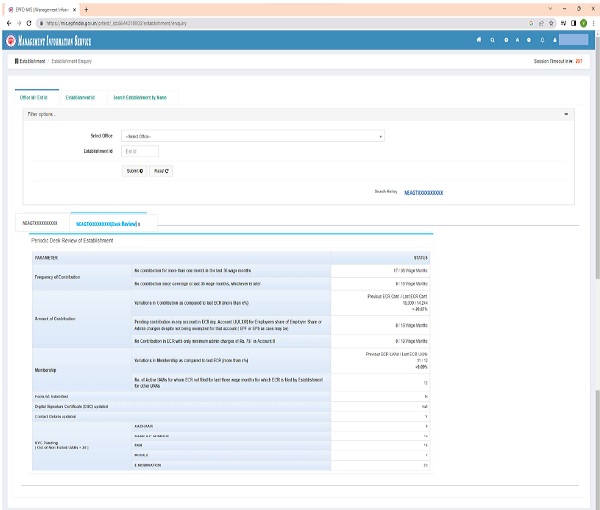

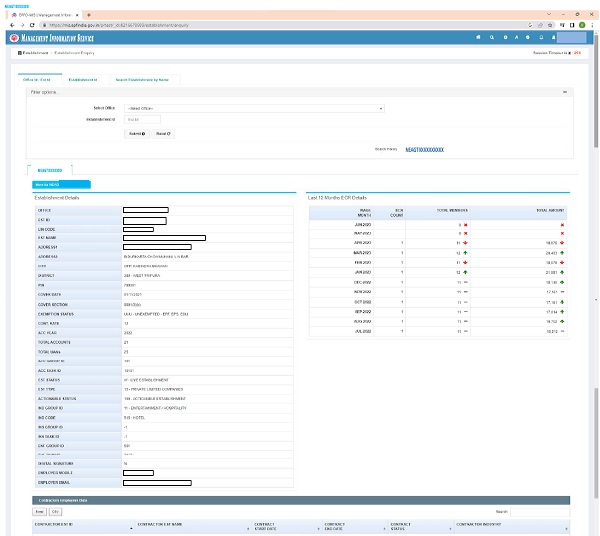

1. Log into MIS portal and select Establishment Enquiry.

2. Enter PF Code of estbalishment in the following screen.

3.Following screen will appear after searching establishment.

4.Then choose “More for <Establishment Code>” and then select “Desk Review Report”.

5. “Desk Review Report” will appear as follows: