Due to lack of compliance, people start their business as Sole Proprietors, as the business grows, it does not fit the limitations of Sole Proprietorship. With growth, it is aiming to meet with the business world, but the drawbacks of a Sole Proprietorship do not meet its growth; thus, it goes for Conversion into a Private Limited Company.

A Sole Proprietorship cannot get all benefits of operation as it grows. Conversion of a Proprietorship into a Private Limited Company provides many benefits, but it also brings along the diffusion of power and loss of independence. Therefore, the decision must be taken after careful consideration of all the factors involved and t o see if it genuinely brings about the privileges intended.

Conditions

Procedure of Conversion

There are no such provisions given in the Companies act 2013 for conversion or takeover of Sole proprietorship into a Private Limited Company. A proprietorship Firm is not governed by any law. You can follow the Procedure as stated below for converting a Sole Proprietorship business into a Private Limited Company.

> The Proprietor must complete the Slump Sale formalities.

> The owner has to inform all the Authorities where it has been registered and has to surrender all the Registration Certificates.

> Apply for the Incorporation of the Company to MCA.

> After incorporating a Private Limited Company, The Board of Directors of the Company is required to take Board Approval for taking up the Sole Proprietorship.

> Takeover Agreement/ Sale Agreement is required to be executed between Sole Proprietorship and Company to transfer all its Assets and Liabilities.

> The debt of Sole Proprietorship cannot be transferred, so the owner can either settle all the debts or it can take the Consent of Creditors to transfer the Sole Proprietorship to another Company and no new bill is to be raised in the name of Sole Proprietorship.

> Transfer of Sole Proprietorship to Company attracts Capital Gain Tax in the hands of the Owner of Sole Proprietorship for transfer of assets. There is a certain provision under Section 47(xiv) in the Income Tax Act to avail the benefit of Tax Exemption on the transfer of assets from Sole Proprietor to Company.

> The takeover is then done by submitting the Takeover Agreement/Sale agreement and other documents like the company’s PAN and COI. These documents are submitted to the Registrar within 30 days of the completion of the sale. By completing this process of the takeover, all the Assets and Liabilities concerning the Sole Proprietorship become the Assets and Liabilities of the Company.

> After the conversion, 50% of the Total Voting Rights will be held by the Sole Proprietor for a minimum period of 5 years from the date of Incorporation of the Company.

> Similarly, there will not be any monetary consideration between a Sole Proprietorship and a Private Limited Company as it is a mere conversion, not a sale.

> The Company cannot work with the bank account of Sole Proprietorship. So, it has to close all the Accounts in the name of Sole Proprietorship and a new Bank Account shall be opened in the name of the Company.

> Finally, the Proprietorship will then be needed to shut down officially. Use of any Licenses or Tax Registrations by the Proprietorship can then be discontinued or they can be surrendered to the authorities.

DOCUMENTS REQUIRED FOR CONVERSION

1. Documents required to Incorporate a Private Limited Company

2. PAN Card copy of Proprietorship Firm.

3. Approval by passing Board Resolution

4. Takeover/ Sale Agreement

Prirequisites

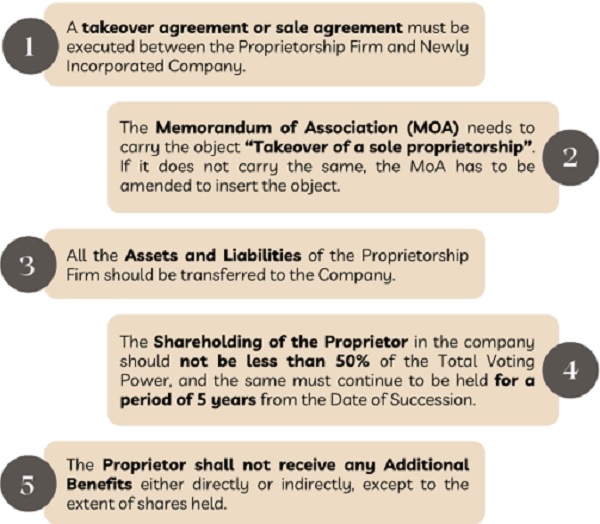

The procedure is to first form a Private Limited Company and then takeover the Sole Proprietorship through a Memorandum of Association (MoA) and transfer all Assets and Liabilities to the company. So, the following requirements must be taken care of before applying for a Certificate of Incorporation.

Benefits

of A Pvt. Ltd Company

> Capital Expansion

> Limited Liability

> Perpetual Existence

> Separate Legal Entity

> Easy Share Transfer

> Tax Benefits

> Highly Qualified & Capable Employees

> More Genuine (trusted by investors)

KEY POINTS

- The Proprietorship must be closed within three months of the incorporation of the Private Limited Company.

- The Assets of Proprietorship can be converted into Capital of the company, via making of Resolutions and further Contracts/Agreements. Any debt owing to any creditors (including fines/penalties) will have to be settled before the transfer of such assets.

- All bank accounts used for the Sole Proprietorship need to be closed, and a new Bank Account under the Private Limited Company needs to be opened.

- The Proprietorship will then be needed to shut down officially. Use of any Licenses or Tax Registrations by the Proprietorship can then be discontinued or they can be surrendered to the Authorities. That is the government should be informed of the closing.

- Debts of a Sole Proprietorship are actually debts of an Individual Owner and are not transferable to a New Owner. If the business has outstanding debts prior to the transfer, discuss with the creditor whether the New Owner may assume the debt before agreeing to the sale or transfer.

Income Tax Act

Proprietorship Firm into Company

EXEMPTION UNDER THE INCOME TAX ACT: CONVERSION OF SOLE PROPRIETORSHIP INTO COMPANY [SECTION 47(xiv)]

Conversion of a sole proprietorship into a private limited company entails a “transfer” within the meaning of the Income Tax Act, 1961. The Assets of the sole proprietorship concern are transferred to the newly formed company, which makes the sole proprietor liable to pay tax for any capital gains calculated on such transfer. However, there is a provision under section 47(xiv) of the Income Tax Act, which lays down certain conditions for exemption from any capital gains.

The conditions are:

a) All the assets and liabilities of the sole proprietorship relating to the business immediately before the succession become the assets and liabilities of the company;

b) The shareholding of the sole proprietor in the company is not less than 50% of the total voting rights in the company and such shareholding continues for a period of 5 years from the date of the succession; and

c) The sole proprietor does not receive any consideration or benefit, directly or indirectly, in any form or manner, other than by way of allotment of shares in the company;

WITHDRAWAL OF EXEMPTION [ SECTION 47A (3)]

The above exemption shall be withdrawn in the following case:

If any of the conditions laid down above are not complied with (say the sole proprietor sells his share in two years instead of holding on to the shareholding for five years), the amount of profits or gains arising from the transfer of such assets not charged earlier by virtue of these conditions shall be deemed to be the profits and gains chargeable to the tax of the successor company for the previous year in which the requirements are not complied with.

PROVISIONS RELATING TO CARRY FORWARD AND SET OFF OF ACCUMULATED LOSS AND UNABSORBED DEPRECIATION ALLOWANCE IN CASE OF SUCCESSION [SECTION 72A(6)]

Where there a proprietary concern is succeeded by a company, the accumulated loss and the unabsorbed depreciation of the proprietary concern shall be deemed to be the loss or allowance for depreciation of the successor company for the purpose of the previous year in which business reorganization was affected and other provisions of this Act relating to set off and carry forward of loss and allowance for depreciation shall apply accordingly.

As per Sec. 2(42C) of the Income Tax Act, 1961, “slump sale”, means the transfer of one or more undertakings as a result of the sale for a lump sum consideration without values being assigned to the individual assets and liabilities in such sale.

GST Act

What is the meaning of the term “Transfer as a Going Concern” under GST?

Transfer of a going concern means the transfer of a running business that is capable of being carried on by the purchaser as an independent business but shall not cover the transfer of activity comprising a service. Such sale of the business as a whole will comprise the comprehensive sale of immovable property, goods, and transfer of unexecuted orders, employees, goodwill, etc.

How can treat “Sale of business as a going concern in GST”?

Entry No. 4 of Schedule II of the GST Act, defines activities to be treated as a supply of goods or a supply of services.

|

S. No. |

Illustration | Whether supply of goods or services |

| 4. | Transfer of Business Assets | |

| (c) Where any person ceases to be a taxable person, any goods forming part of the assets of any business carried on by him shall be deemed to be supplied by him in the course or furtherance of his business immediately before he ceases to be a taxable person, unless: –

(i) The business is transferred as a going concern to another person; or (ii) The business is carried on by a personal representative who is deemed to be a taxable person. |

Supply of goods |

The above-mentioned provision is reconciled and summarized in the below table: –

|

S. No. |

Situation | Levy of Taxation |

| 1. | Business is transferred as a going concern by the taxable person to another person (i.e., sale, merger, demerger, amalgamation, transfer of the business) with the specific provisions for transfer of liabilities. | Transfer of goods will not be considered as supply of goods, Transfer shall be allowed to transfer the input tax credit which remains unutilized in terms of Section 18(3) of the CGST Act, 2017 read with rule 41 of the CGST Rules, 2017. The transferee shall be considered a taxable person under the CGST Act, 2017. |

As per Entry No. 2 of Notification No. 12/2017–Central Tax (Rate) dated 28th June 2017, services by way of transfer of a going concern as a whole or an independent part thereof is exempted from GST.

Hence, in order to avail of the above exemption, the following conditions shall be satisfied –

- The transfer of business shall be the transfer of a going concern.

- The business which is being transferred shall be transferred as a whole or independent part.

Where there is a change in the constitution of a registered person on account of the sale, merger, demerger, amalgamation, lease, or transfer of the business with the specific provisions for transfer of liabilities, the said registered person shall be allowed to transfer the ITC (Input Tax Credit) which remains unutilized in his electronic credit ledger to such sold, merged, demerged, amalgamated, leased or transferred business in such manner as may be prescribed.

Now let us analyze what is meant by the word going concern. “The enterprise is normally viewed as a going concern, that is, as continuing in operation for the foreseeable future. If any enterprise is having the intention to continue the business it could be said to be a going concern. It is not necessary that all the assets and liabilities shall be transferred, it is sufficient if only those assets which are essential to continue the business are transferred, but what is being transferred should be capable of being considered as a whole or an independent part.

If the exemption is claimed, whether ITC is required to be reversed?

If any person is transferring the business as a going concern, then the same will be treated as an exempted supply in terms of the above-discussed notification. Further, as per sec. 17 read with rule 42 of CGST Rules, 2017, in case any registered person is having any exempted supplies, then ITC pertaining to such exempted supplies shall be reversed proportionately.

DISCLAIMER- All content provided on this blog is for informational purposes only. The owner of this blog makes no representations as to the accuracy or completeness of any information on this site or found by following any ink on this site. The owner will not be liable for any errors or omissions in this information nor for the availability of this information. The owner will not be liable for any losses, injuries, or damages from the display or use of this information.

The agreement of take over deed of sole proprotor to pvt ltd company between husband having 99.46% shares and wife having .56% shares . is the agreement attracts Stump Duty or not

Hello Sahil ,

Your Article is very valuable as regards to the conversion of prop into pvt ltd company. I am working on the assignment in which a company takeover the proprietorship business. Please Share your personal contact no / Email . Also

share any Takeover/ Sale Agreement, if possible.

Hello Shishir Gupta, I apologize for replying lately. You can contact me on [email protected].

Dear Sahil

Your Article is very good.

I am working on the assignment in which a company takeover the proprietorship business.

Please Share Takeover/ Sale Agreement, if possible.