Ms. Jaya Sharma-Singhania and Ms. Shonette Gilroy Misquitta

Several instances of falsification of books of accounts were noticed under the Companies Act, 1956. To overcome this menace, several measures have been provided under the Companies Act, 2013. One such measure is the insertion of section 130 and 131 read with section 447, 448 in the New Act. Section 130 read with section 131 are newly inserted provisions that prohibits the company from suo-moto opening its accounts or revising its financial statements. The procedure for the same has been provided in the Act.

♦ HISTORICAL ELICITS:

In the past, there have been many instances, where companies and directors falsified the books of accounts and financial statements.

Reebok:

Reebok India has been accused by SFIO for falsifying its books of accounts to the tune of INR 1,400 crores by inflating its sales by INR 655 crores during the period 2007 to 2011. Top executives were involved in this, in order to get sales-linked incentives and bonuses.

Satyam:

In case of Satyam, the books of accounts were manipulated by showing nearly INR 71.36 billion fake billings and cash. In this case, even the auditors were alleged to be hand in gloves with the management to cover up the fraud and were accused of providing a misleading audit report.

♦ RE-OPENING OF ACCOUNTS ON COURT’S OR TRIBUNAL’S ORDERS.

There are similar provisions in the UK Companies Act, 2006 for defective accounts in Chapter 11. But the provisions are materially different from each other. However, the rationale behind the provisions appears to the same.

There is a bar on reopening its books of accounts. The act states that; “A company shall not re-open its books of account and not recast its financial statements” Thus, the company cannot suo-moto, reopen the books of accounts or recast its financial statements. Thus, books of accounts and the financial statement cannot be changed unless it is done as per the provisions of the Companies Act, 2013.

Right to make an application for reopening the financial statement and boards report:

The following authorities have the right to reopen the financial statements:

- Central Government;

- The Income-tax authorities;

- SEBI;

- Any other statutory regulatory body;

- Any person concerned.

The section states any other statutory body which means that any authority can may apply for reopening the financial statement. It does not specifies that the authority should have certain control over the company. Therefore, apart from the three authorities mentioned above the other authorities can be Reserve Bank of India, Provident Fund Regulatory Authority.

The section also states any person concerned. The term ‘person concerned’ is not specified under the act. Person Concerned can include any person who is allied with the company whether as debenture holder, shareholder, creditor, banker, lender, etc. Such person should be able to show some interest in the company and have a reason why he makes the application and how the accounts of the company not properly kept affects him. By using the term person concerned the legislature wanted to provide relief to all the stakeholders who may take the decision based on the accounts.

♦ PROCEDURE FOR RE-OPENING THE BOOKS OF ACCOUNTS:

A specific procedure under section 130 has not been provided under section 130 and the same has been provided in the NCLT Rules. The procedure for reopening the books of accounts is as follows:

| Sr.No. | Procedure for reopening the books of accounts |

| 1) | Issue Notice of Board Meeting and circulate to all the director of the company. Make sure that section 173 (3) of the Companies Act, 2013 & Secretarial Standard (SS-1) are complied with:

The Agenda of the Meeting should contain the following particulars:- – To consider In- Principal approval for revision of financial statement or Board Report of the Company – To authorise Practising Company Secretary in practice/ Practising Chartered Accountant/ Practising Cost Accountant to enter appearance |

| 2) | The company shall pass a board resolution for the aforementioned transactions. |

| 3) | A petition or application under section 130(1) for obtaining the order of reopening the books of accounts and recasting of financial statements shall be filed to the Tribunal in Form No. NCLT 1 of the NCLT Rules within fourteen days from the date of the decision taken by the Board. |

| 4) | The mandatory attachments to the form NCLT 1 is as follows:

|

| 5) | The company shall fourteen days before the date of hearing advertise the petition in form NCLT-3A, one in vernacular newspaper in the principal vernacular language of the district in which the registered office of the Company is situated and atleast once in English language in an English newspaper circulating in that district. |

| 6) | Every advertisement shall state the following:

|

| 7) | Upon hearing the petition or any adjourned hearing, the Tribunal may pass such an order as its thinks fit. |

| 8) | After receiving the Order from NCLT, a certified copy of the order of the Tribunal shall be filed with the Registrar of Companies within thirty days of the date of receipt of the certified copy e-form INC-28. |

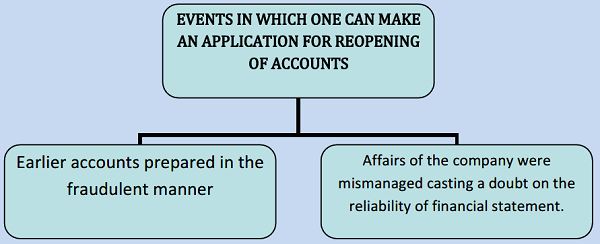

♦ EVENTS IN WHICH ONE CAN APPLY FOR REOPENING THE FINANCIAL STATEMENTS:

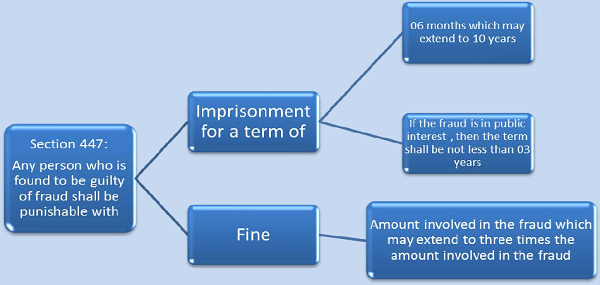

For understanding the term accounts prepared in the fraudulent manner we must first interpret the definition of fraud provided in section 447 read with section 448.

Section 448 – Punishment for false statement:

Section 448 says that, if in any return, report, certificate, financial statement, prospectus, statement or other document required by, or for, the purposes of any of the provisions of this 2013 Act or the rules made there under, any person makes a statement,

A. which is false in any material particulars, knowing it to be false; or

B. which omits any material fact, knowing it to be material, the, such person be liable under section 447.

Thus, every professional who gives / signs / attests / certifies a return, report, certificate, financial statement etc. under the 2013 Act will be punishable u/s.447 if the criteria stated in Section 448 are attracted.

♦ WHEN TO MAKE AN APPLICATION FOR REOPENING THE ACCOUNTS OF THE COMPANY:

The most important facet to note is that when can one apply for reopening the accounts. In case of reopening, as we all know that an application should to be made to the Tribunal. Therefore, the Limitation Act will apply for the same. The act does not prohibit the reopening at any stage. Thus even if the accounts are filed with the Registrar or approved by the shareholder; we can make an application for reopening the accounts.

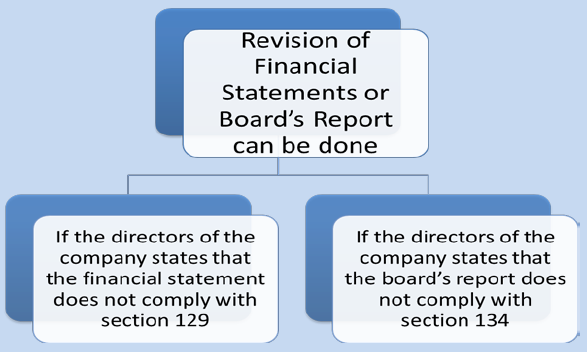

♦ VOLUNTARY REVISION OF FINANCIAL STATEMENTS OR BOARD’S REPORT:

Duration for which revision is permitted:

The revisions of financial statements and board’s report in respect of any of the 03 preceding financial year after obtaining approval of the tribunal on an application made by the company. The revised financial statements and board’s report shall not be prepared or filed more than once in a financial year.

Reporting of the revisions made by the company:

The detailed reason for revision of such financial statements and board’s report shall be disclosed in the Board’s report in the relevant financial year for which such revision is being made.

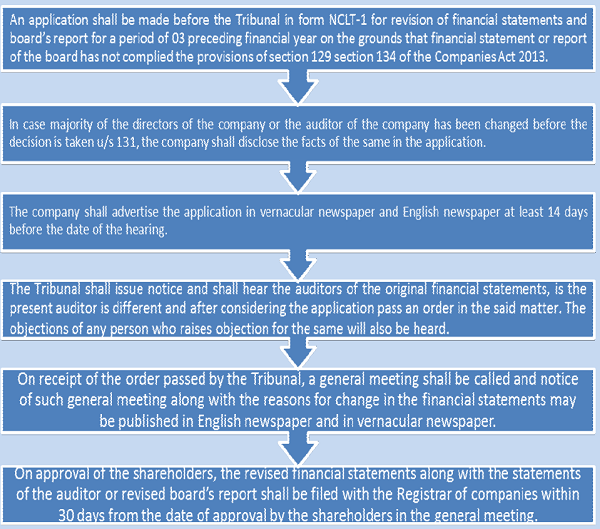

Procedure for voluntary revision of financial statement or board’s report:

♦ HOW DO WE HELP:

We as professionals ensure that all the compliances with respect to procedure to be followed while for making the revision in the financial statements and board’s report before the NCLT are complied with. We represent the company for the appearances before the NCLT/NCLAT related legalities from start to finish in a very professional manner. We also coordinate with the Registrar of Companies, Stock Exchanges and various corporate bodies in order to ensure that the procedure is followed as per the law and the process is done in a systematic manner and within the prescribed time.

♦ CONCLUSION:

We should hope that approved Rules and clarifications would throw light wherever non-compliance is indicated so as to true and fair view is not jeopardized. The company should strive not to enter into any non-compliance activity as the same would lead to heavy penalty because of fraud. This change is a welcome development. The Companies Act 2013 is intended to make it easier and cheaper to operate a company. Practical changes such as this are an example of that aim being put into practice.

♦ CONTRIBUTED BY:

Ms. Jaya Sharma-Singhania

Ms. Shonette Gilroy Misquitta

Jaya Sharma and Associates, Practising Company Secretary Firm, Mumbai.

♦ BIBLIOGRAPHY

- www.mondaq.com

- Companies Act, 2013

- Corporate Law Referencer

- Book on NCLT and NCLAT Law, Practice & Procedure

DISCLAIMER

The entire contents of this article have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided, I assume no responsibility therefore. Users of this information are expected to refer to the relevant existing provisions of applicable Laws. We assume no responsibility for the consequences of use of such information. in no event shall we shall be liable for any direct, indirect, special or incidental damage resulting from, arising out of or in connection with the use of the information. This is only a knowledge sharing initiative and author do not intend to solicit any business or profession.

specimen application u/s131is desirable

A VERY NICE ARTICLES,BUT THIS HAS NOT ADDRESSED THE ISSUE IF FINANCIAL STATEMENTS ONCE APPROVED BY THE BOARD AND SIGNED BY AUDITORS.BUT BEFORE CICULATION IT WAS FOUND A MISTAKE IN ACCOUNTS.HOW THE FINANANCIAL STATEMENTS CAN BE CHANGED? WHETHER IT WILL FALL UNDER SECTION 131OR NOT?

NICE ARTICLE

CS Manish Buchasia IP Manish Buchasia

Practising Company Secretaries

Insolvency and Bankruptcy Professional