Companies Act, 2013 | Companies (Registration of Charges) Second Amendment Rules, 2022.

Ministry of Corporate Affairs (MCA) known as MCA21 is an online portal for all the company related information accessible to various stakeholders and general public. MCA is concerned with administration of the Companies and the LLP’s on V2 version. With a view to enhance and upgrade the present version of the portal from Version 2 to Version 3, MCA has recently implemented V3 portal services for Companies, post rolling out the V3 services for LLP’s in the month of March.

There are certain forms, which were rolled out in this behalf on V3 Portal, which included charge related forms E-forms CHG-1, CHG-4, CHG-6, CHG-8, CHG-9.

The Ministry of Corporate Affairs (MCA) has on August 29, 2022, notified Companies (Registration of Charges) Second Amendment Rules, 2022, in addition to Rule 12 of the Companies (Registration of Charges) Rules, 2014, in exercise of the powers conferred by sections pertaining to registration of charges read with sub-sections (1) and (2) of section 469 of the Companies Act, 2013.

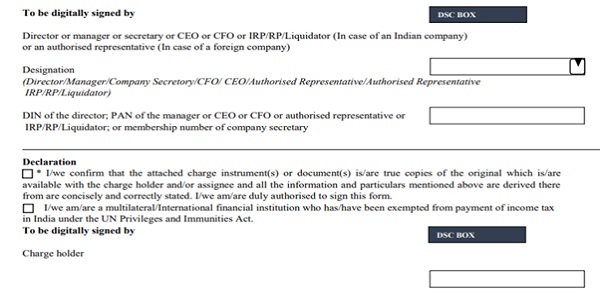

The said amendment by the MCA with respect to Registration of Charges Rules, is that the given e-form CHG-1, CHG-4, CHG-8 and CHG-9 shall be signed by the following persons, as the case may be which is to be filed with Registrar of

- Insolvency resolution professional or

- Resolution professional or

- Liquidator for companies

For detailed overview, below attached is the snapshot of the amendment which has been made in the charge related forms on V3 Portal.

Bibliography: MCA notifies rule for signing of Form CHG-1, CHG-4, CHG-8 & CHG-9 by IRP or liquidator

Authors

|

|

|

Krupa Dodia is a commerce graduate and aspiring company secretary who is currently undergoing her long-term training as a junior associate with Jaya Sharma and Associates. She believes in the quote, “Develop a passion for learning. If you do, you will never cease to grow”. She is willing to understand and process the complexities of various laws like corporate and securities law. |

Saloni Adhia is commerce graduate also pursuing LLB and aspiring company Secretary who is currently undergoing her long -term training as a junior associate with Jaya Sharma and Associates. She believes in that the more you read more new things you will learn. |