Concept of Beneficial Owner and Significant Owner {Section 89 & 90 of Companies Act, 2013}

“Assessing beneficial ownership isn’t like looking for a needle in a haystack?

Yes, it’s like looking for a needle in a pile of other needles and if you are the beneficial owner then you’ll be getting all the perks related to that position.

“Not everyone wants to be identified as the beneficial owner, many criminals will deliberately use the opacity of corporate vehicles to hide their identity, hence financial action task force (FATF), an international body established in 1989 by more than 35 countries to sets standards for combating money laundering, terror financing by issuing guidelines for implementing risk-based approach towards handling customers.”

> Meaning of Ownership

‘Ownership’ is a bundle of rights attached to the property.

> Types of Ownership

Ownership is categorized into 4 different kinds:

| Legal Owner | Registered Owner | Beneficial Owner | Significant Beneficial Owner |

| Who holds legal title to the property. | Whose name is entered in the register of members of the company as the holder of shares. | Natural person who enjoys the benefit or interest on shares (equity or preference; whether convertible or not except debentures) but he is not the actual owner i.e. name is not registered in the register of member of the company |

|

“But generally, legal and beneficial owner are same”

> Direct V/S Indirect Ownership

- Direct ownership is directly holding shares in the target company

- Indirect ownership is holding shares in a holding company, which in turns directly holding shares in target company.

EXAMPLE:

1. Mr. A directly holds 30 % in ABC Ltd

So he is the actual owner.

2. Mr. Z holds 100 % in XYZ Ltd. and XYZ Ltd. holds 70 % in ABC Ltd.

Mr. Z is indirect holder of shares of ABC Ltd. with 70% holding.

3. Mr. A hold 1 % in XYZ Ltd. and XYZ Ltd. holds 100 % in PQR Ltd. and in return PQR Ltd. also holds 99 % in XYZ ltd.

Here, subsidiary company can’t hold shares in its holding company. However, there is some exemptions u/s 19 of the Companies Act where a subsidiary can hold shares in its Holding Company.

> Concept of Registered Owner

Means a person whose name is entered in the register of members of company as the holder of shares, but who doesn’t hold beneficial interest in such shares.

“He is not the actual owner of shares, only his name is entered in ROM nor entitled to dividend or bonus shares”

“He is having voting rights, right to vote on poll, entitled to sign proxy form and counted for quorum”.

EXAMPLE:

Mr. A holds shares in ABC Ltd. and name of Mr. B is entered in ROM as registered member.

Mr. B is registered owner and Mr. A is actual owner

> Concept of Beneficial Owner

“A natural person who by virtue of express contract or arrangement oral or written ultimately owns or on whose behalf transaction is being conducted, i.e. a person who exercise ultimate control” over a legal person”.

Control: – Control means right to appoint majority of directors or right to control the management

“Who enjoys the benefits of being shareholder in a company through another person and with any % shareholding he can be beneficial owner”.

“A natural person, who acting alone or together with one or more judicial person and having controlled ownership interest or exercise control through other means”.

Controlled Ownership Interest means: – Entitled to receive income of estate without title, custody, or control over the property or the ownership/ entitlement of more than 25 % of shares or profits of the company.

Control means: – Right to appoint majority of the directors or control the management or poilicy decisions including shareholding and management rights

“One who is not having an apparent legal title, but enjoys the ownership of property”.

Beneficial Owner is defined under section 89 (10) of the companies act, 2013 which means the interest on shares directly or indirectly through contract or arrangement, alone or together with one or more persons to exercise or cause to be exercised any rights attached with such shares or receive or participate in dividend on such shares.

EXAMPLE:

1. Mr. X buys 100 shares in ABC limited via brokerage house, though shares are recorded under the broker’s name but Mr. X is beneficial owner.

2. In a case of WOS Company, holding company is holding 100 % shareholding in WOS in the name of a nominee, to maintain the minimum number of members in the company i.e. 2 for private and 7 for public.

(In this case, the company is beneficial owner and nominees are registered owner)

> Why the concept of Beneficial Owner emerged?

“The companies are independent corporate personality often misused for corporate illicit activities;

like money laundering, benami transactions, the Formation of shell companies, tax evasion, corruptions, having complex ownership by holding shares with different names & other illegal activities and;

Due to which company hide the real owners behind the transaction, and the properties held in benami transactions are liable for confiscation by the government”.

So to avoid the misuse of corporate vehicle, the Financial Action Task Force (FATF) designs and promote various policies to combat the financial crime.

Subsequently, to bring transparency, an onerous provision has been rolled out by MCA in regards to the concept of registered owner, beneficial owner & significant beneficial owner under section 89 and 90 of companies act, 2013 and this becomes an obligation on the company to collect the information from the respective persons and reporting the same to the registrar”.

“Under the beneficiary ownership rules, the company must maintain written records to identify and verify beneficial owners.”

> Detailed analysis of Section 89 of Companies Act, 2013

Section 89 of the Companies Act, 2013 read with rule 9 of Companies (Management and Administration) Rules, 2014 provides for the declaration to be filed by “Registered Owner” as well as “Beneficial Owner” and requires company to record such information in the registers, also this section doesn’t focus on quantum of shares.

- Declaration by Registered owner → is mandatorily required to give declaration under section 89(1) of the act to the company in Form MGT-4 within 30 days from the date of entry of his name in ROM explaining the details of ownership of registered as well as the beneficial owner;

If any change in the beneficial interest, registered owner to file declaration in Form MGT-4 within 30 days from such change.

- Declaration by Beneficial owner → is mandatorily required to give declaration under section 89(2) of the act to the company in Form MGT-5 within 30 days after acquiring beneficial interest in shares disclosing their interest.

If any change in the beneficial interest, beneficial owner to file declaration in Form MGT-5 within 30 days from such change.

- Filings by Reporting Company → is mandatorily required to give declaration under section 89(6) of the act in Form MGT-6 to registrar of companies within 30 days after the receipt of declaration from registered as well as beneficial owner.

“If no declaration was given by beneficial owner or registered owner to company, then as per section 89 (8) of the act no rights is available to beneficial owner or his representatives to any of his shares, but the company can’t refuse to pay dividend to members i.e.registered owners”.

> Contravention of Section 89 of Companies Act, 2013

| S.NO | Particulars | Penalty |

| 1. | Failure to provide declaration by RO or BO | Rs. 50,000 and if default continues Rs. 1,000 per day |

| 2. | Failure to provide declaration by company to registrar | Rs. 5000 and if default continues Rs. 1,000 per day |

> Crux of Section 89 of Companies Act, 2013

| E-Form | Purpose of Form | Time Period | By Whom | To Whom |

| FORM MGT-4 | Declaration of ownership | within 30 days | Registered owner | Company |

| FORM MGT-4 | Change of Beneficial Interest | within 30 days | Registered owner | Company |

| FORM MGT-5 | Declaration of ownership | within 30 days | Beneficial owner | Company |

| FORM MGT-5 | Change of Beneficial Interest | within 30 days | Beneficial owner | Company |

| FORM MGT-6 | Return of declaration provided by RO and BO by company to registrar | After the receipt of declaration from RO and BO | Company | Registrar |

> Case Studies in Respect to Section 89

Q.1 In case the beneficial holder and registered holder are two different people, then who is entitled to receive dividend/bonus shares?

The right to receive dividend/bonus shares lies with the ultimate beneficial owner, but company can also not restrict the rights for registered shareholder.

Q.2 Mr. A is registered holder of shares of PQR Ltd, whose beneficial owner is M/S XYZ Ltd. partnership firm.

The right to give declaration by both Mr. A as well as M/S XYZ Ltd. in MGT-4 and MGT-5 and subsequently by PQR Ltd. in MGT-6

Q.3 Mr. A is registered owner of 500 shares of PQR Ltd, whose beneficial owner is M/S XYZ Ltd. partnership firm, again Mr. B is registered owner of 1000 shares of PQR Ltd, whose beneficial owner is M/S XYZ Ltd. partnership firm. Mr. A transfers 500 shares to Mr. B

Since the beneficial owner remain the same, so no declaration is required to be made, SH-4 is sufficient to show the change.

> Concept of Significant Beneficial Owner

Identification of SBO is based on direct or indirect holding of any right or entitlement in the reporting entity. Every Individual (resident or non-resident) is determined as a significant beneficial owner:

Who acting alone or together or through one or more individual or trust or possess one or more “right or entitlement” in reporting company by way of holding indirectly or together with direct holding not less than 10% of shares/voting rights/distributable divided or right to exercise control or significant influence.

“Direct Right or Entitlement: – an Individual holding shares in the reporting company in his name or acquire beneficial interest in shares of reporting company and has made declaration u/s 89 is considered as holding right or entitlement directly.

“Indirect Right or Entitlement: – an individual holding shares in the reporting company through body corporate, HUF, partnership entity, trust or pooled investment vehicle, then that individual must holds majority stake in the body corporate or holding majority stake in the holding reporting company.

As per amended Rule 2A of SBO rules, SBO is an individual who holds:

1. Shares or Profit (equity, CCPS, CCD and GDRs’; in case of non-convertible PS, and failed to pay dividend for 2 years are counted in shares)

- Ultimate beneficial interest indirectly or together with direct holding, not less than 10 % of shares or entitlement of not less than 10 % of profits or 10 % interest in trust.

- (the name of SBO is not entered in ROM of company)

2. Voting Rights

- Ultimate beneficial interest indirectly or together with direct holding of not less than 10 % of voting rights

3. Dividend and Control

- Has right to participate in not less than 10 % of total distributable dividends or any distribution in a FY

- Right to exercise or actually exercise significant influence or control over.

- Other distribution means interest declared on CCD’s

DIRECT HOLDING

For the purpose of direct holding, the person must hold shares in his own name i.e. name must be mentioned in the register of members (in such case he is not SBO) or holds or acquire beneficial interest in shares of reporting company and declaration made in reporting company.

INDIRECT HOLDING

For the purpose of indirect holding, the member may hold the shares on behalf of body corporate, HUF, partnership firm, trust, or through pooled investment fund.

“If an individual doesn’t hold any indirect right or entitlement, then he is not considered as significant beneficial owner, so to be significant beneficial owner, he must have indirect holding”.

- Body Corporate Member

Where member of reporting company is a body corporate or an individual is holding shares indirectly on behalf of body corporate, then to be an SBO, he must be natural person and hold majority stake (more than ½ of shares or voting rights or right to participate in dividend) in the body corporate or the ultimate holding of body corporate.

- HUF Member

Where member of reporting company is HUF, then SBO must be karta of HUF

- Partnership Entity Member

Where the member of reporting company is partnership firm, then SBO is either partner or who holds majority stake in the body corporate which is partner of partnership entity or in its ultimate holding company.

- Trust Member

Where member of reporting company is trust (acting through trustee), then SBO must be trustee if it’s charitable trust, beneficiary in case of specific trust or the author of trust in case of revocable trust.

- Pooled Investment Vehicle

Where member of reporting company is pooled investment vehicle or any entity controlled by pooled investment vehicle, and that individual is general partner or investment manager or CEO of that pooled investment vehicle where investment manager is body corporate or partnership entity.

- Meaning of Person Acting Together

- If any individual is acting through any person or trust; or

- He is acting in such a manner with a common intent or purpose of exercising rights or entitlement; or

- Exercising control or significant influence over a reporting company via an agreement formal or informal.

- Meaning of Significant Influence

Significant influence implies power to participate in the financial and operating decisions of the reporting company, but it only focuses on power of participation not the control or joint control over policies.

EXAMPLES:

1. Mr. A is holding 60 % shares in XYZ Ltd. and his name is entered in ROM, whether SBO rules are applicable to Mr.A?

No, SBO rules are not applicable, as Mr. A is the registered owner of the XYZ Ltd.

2. Mr.A is holding 80 % shares in XYZ Ltd., which holds 80 % in PQR Ltd. whether SBO declaration is required for PQR Ltd.?

Yes, SBO rules are applicable because Mr. A holds indirect holding of 80% in PQR Ltd. So Mr. A is SBO of PQR Ltd.

3. A holds 51% in ABC Ltd. and ABC Ltd. holds 51 % in PQR Ltd. and PQR Ltd. holds 20% in MNT Ltd., So whether Mr. A is required to give declaration to ABC Ltd. and MNT Ltd.?

Mr. A is required to give declaration to MNT Ltd.

Mr. A is not required to give decalartion to ABC Ltd. because its holding reporting company, and is exempted under SBO rules (As ABC Ltd. is holding 51% in PQR Ltd, so its deemed that PQR is subsidiary company)

4. X holds 10 % shareholding in PQR ltd. and XYZ Ltd. holds 5% shareholding in PQR Ltd. and also Mr. X holds 60 % shareholding in XYZ Ltd. Do Mr. X required to give SBO declaration?

Yes, Mr. X will be SBO of PQR Ltd.

Direct Holding: 10%

Indirect Holding: 5% (as he holds majority stakes in XYZ Ltd.)

Total D + ID = 15%

5. A holds 0% in reporting company T ltd, S ltd. holds 30% stake in T ltd. H ltd. holds 60% shares in S ltd. Mr. A holds 70 % shares in H ltd

Here, Mr. A will be SBO of S Ltd.

Indirect Holding: 60% (as he holds majority stakes in H Ltd.)

Further, S Ltd. will be Holding Reporting Company for T Ltd. and exempted from SBO Rules However, T Ltd. will file Form BEN-2 with RoC.

> Why the concept of Significant Beneficial Owner Emerged?

The issue of misuse of multi-layered corporate entities have grabbed the attention of various policymakers and regulators, so the concept of the significant beneficial owner was incorporated to catch those individuals (natural person) who hold significant beneficial interest or who have significant influence or control over the company “beyond the threshold limits.

“After various deliberations and playing the game of hide and seek, MCA vide its notification provides SBO rules Companies (Significant Beneficial Owner) Amendment Rules, 2019 notified dated 08.02.2019, the intension of amending the rules is still to remove the parda and unmask the real owners of companies, as various layers of investment are involved and it’s tough to find out the real owners. So, to remove the parda, MCA notified the amended rules.”

15th February, 2018 – Draft Companies (Beneficial Interest and Significant Beneficial Interest) Rules, 2018

13th June, 2018 – Companies (Beneficial Interest and Significant Beneficial Interest) Rules, 2018 “Final Rules” and enforced section 90

08th February, 2019 –Companies (Significant Beneficial Owner) Amendment Rules, 2019

> Benefits of disclosing SBO?

- Ongoing Screening

- Maintain existing records

- Improve client experience

> What is SBO I’d?

When company files Form BEN-2, the SBO I’d gets generated automatically and the same will be sent on the email id of SBO entered in form. It’s a 10 digit number.

In case SBO is same in more than one company, then at the time of filing BEN-2 for second company put the SBO id generated for the earlier company.

> Detailed Analysis of Section 90 of Companies Act, 2013

“The ultimate intent of section 90 is to identify the natural persons who hold beneficial interest in company or exercise significant beneficial interest or control over the company.”

This new section has introduced the concept of significant beneficial owner and filing of such declarations by such SBO.

Applicability of SBO

Provision of SBO is applicable for resident as well as non-resident and all companies:-

- Listed public

- Unlisted public

- Private

- Small Companies

Non-applicability of SBO

The rules of SBO is not applicable, is shares of reporting company are held by:

- IEPF authority

- Its Holding reporting company but the details to be reported in Form BEN-2

“Exemption is provided to holding reporting company, not only holding company”.

- CG/SG or any entity governed by CG/SG or partially by CG or SG

- Mutual funds/ Alternate investment funds

- Real estate investment funds/ Infrastructure investment funds

- Investment vehicle regulated by RBI

Identification of SBO

- SBO is a natural person and identify the reporting company for which SBO needs to be ascertained.

- Ascertain direct holding in reporting company

- Ascertain indirect holding in reporting company (through body corporate, LLP, partnership, trust. HUF, PIV)

- There should be indirect holding or together with direct holding of at least 10% of shares/voting rights/dividend/control, as only direct holding can’t be considered as SBO

- If any relative or partner with common understanding is also holding shares in reporting company, ascertain the shareholding.

- Hold majority stake in body corporate

- If an individual is holding less than 10%, but if such individual together with other individual holds more than 10%, then he is SBO.

- “Initially, we will check the holding (for individual indirect holding + direct holding and for other members of reporting company- direct holding), further we need to check the majority shareholding held by individual in members of reporting company”

Responsibility of SBO

Every individual who is beneficial owner mandatorily required to give SBO declaration to the reporting company under section 90 (1) of the act in Form BEN-1 within 30 days from the date of acquisition or any change thereon, if he holds 10% as per Companies (Significant Beneficial Owners) Rules, 2018 or right or actual exercise of control or significant influence.

“Significant Influence: control of at least 20% of total voting power or business decisions”

If an individual is having significant beneficial interest in more than 1 company, he needs to give declaration in all the companies simultaneously.

Responsibility of Reporting Company

First Step:

On the receipt of declaration in Form BEN-1, reporting company shall undertake the following things:

- File a return in Form BEN-2 within ROC within 30 days from the date of receipt of declaration

- If reporting company is subsidiary company, then details of holding company shall also be filed in Form BEN-1

- Enter the details of BEN-1 in registers also in BEN-3

Suspected SBO:

Reporting companies are taking various steps to find out the individuals who are significant beneficial owner, hence as per section 90 (5) of the act, the reporting company is seeking information (whether member or not) in Form BEN-4 by way of notice, whom the company knows or reasons to believe-

- To be SBO of the company

- To be having knowledge of identity of SBO

- Have been SBO at any time during the 3 years immediately preceding the date on which notice is issued.

Responsibility of reporting company to file the return of SBO

Reporting company shall file a return to registrar of companies in Form BEN-2 within 30 days from the date of receipt of declaration.

Register of SBO

Every company to maintain register of SBO under section 90 (3) of the act in BEN-3 which shall be kept open for inspection during the business hours on payment of such fees not exceeding Rs. 50 for each inspection.

Application to Tribunal

If the company has not received Form BEN-1 or the reporting company is not satisfied with the reason of non-submission of Form BEN-1, then reporting company can apply to the tribunal within 15 days of expiry of period specified in notice.

The tribunal after providing ROOBH within 60 days from the date of appeal order directing to:

- Restricting the right to transfer interest on shares

- Suspend the right to receive dividend/voting rights on shares

- If any person is aggrieved by the order of tribunal, he may make an application to the tribunal for lifting of restrictions within 1 year.

> Contravention of Section 90 of Companies Act, 2013

| S.NO | Particulars | Penalty |

| 1. | Failure to provide return to ROC or to maintain registers by company | Rs. 10, 00, 000 which may extend to Rs. 50, 00, 000 and if the failure continues Rs. 1,000 per day |

| 2. | Wilfully furnish false or incorrect information, which he was aware of | Liable for section 447 |

> Crux of Section 90

| E-Form | Purpose of Form | Time Period | By Whom | To Whom |

| Form BEN-4 | Notice for extraction of informaton | Company | Individual | |

| Form BEN-1 | Declaration by Individual | within 30 days after the receipt of notice | Disclosure of interest by SBO | Company |

| Form BEN-2 | Declaration by Company | within 30 days | Return filled by Company | Registrar |

| BEN-3 | Registers of SBO | Company to maintain registers of SBO | ||

| Form BEN-4 | Notice for extraction of informaton | Company | Individual |

> Process of ROC filings

- Form BEN-2 (Return to the registrar in respect to the declaration under section 90)

- Check the number of member holding direct or indirect holding

- Name/address/PAN/passport/email id of member

- Date of acquiring SBO and date of entry in the register of member

- Details of holding company having SBO and details of SBO

- Before filing the form, first check the purpose of form: Declaration of SBO, change of SBO or the declaration of holding reporting company

- Attaching the declaration received by company in BEN-1 with the Form BEN-2

Fees for Filing Form BEN-2 to ROC

Fees for the form depends on share capital and if company not having share capital, then fees of Rs. 200/- and additional fees depends on period of delays

> CFSS Scheme

The Ministry of corporate affairs issued a scheme known as Companies Fresh Start Scheme 2020 (CFSS-2020), this scheme provides immunity to stakeholders who was unable to file the forms to ROC.

CFSS scheme-2020 shall remain enforce from 1st April, 2020 to 30th September, 2020.

So under this scheme, company can file is belated forms without any additional fees.

“So, company now hereby can file BEN-2 within 30th September, 2020 without additional fees”.

> Compliance for Professionals

- Auditor while auditing a company, check if any body corporate shareholder

- If yes, check status of BEN-1; if not received then serve notice

- If notice sent and reply not received within 30 days, check whether company has taken action in tribunal

- Auditor to give qualification mark, if he is unsatisfied

- Director who are officer in default, need to check whether any SBO or not, any holding subsidiary or associate company.

> Case studies in respect to section 90:

1. If a company says H Ltd. incorporated under companies act, 1956 and P ltd. holds 99.9% in H Ltd and P Ltd. is strike off, how H Ltd. can file BEN-2?

If P Ltd. is already striking off then it can’t hold shares in H Ltd. anymore, so now provisions of section 56 of companies act, 2013 applies.

2. A Ltd holds 99.99% in Z Ltd. and P & Q holds 10% and 30% respectively in A Ltd. Does Z Ltd. required to file BEN-2 after receiving declarations in BEN-1 from P & Q?

No, P & Q (together) does not holds majority stakes in A Ltd.

Trustees of Trust will be SBO in B Ltd.

“If member of reporting company is body corporate and if that individual holds majority stake, then required to file BEN-1”.

“Individual shareholders are not required to give BEN-1, but if the company has only individual shareholders, then this provision is out of purview as per SBO Rules, 2019”.

“Date of receipt of declaration is the date mentioned in Form BEN-1”.

“If no natural person is identified, then the senior managerial person is considered as SBO”.

4. Mr. A beneficiary holds Rs. 55000/- equity in XYZ Ltd. (capital structure – equity Rs. 2,00,000/- , CCPS – Rs. 3,00,000/- and CCD – Rs. 1,00,000) and XYZ Ltd. holds 50 % equity in PQR Ltd. Whether Mr. A required to gove SBO declaration in PQR Ltd.?

55,000/2,00,000 + 3,00,000 + 1,00,000 * 100 = 9.17%

Mr. A is not SBO in PQR as he does not holds majority stakes in XYZ Ltd.

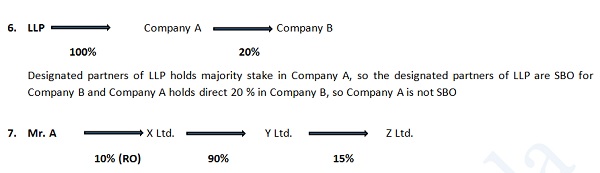

Whether Mr. A is required to give declaration with Y Ltd.

Though there is holding subsidiary relationship, Mr. A will not file declaration as SBO to Y Ltd. because Y Ltd. is holding reporting company and is exempted under SBO rules.

A. Whether Mr. A is SBO in X Ltd.?

No, he is registered owner

B. Whether Mr. A is SBO in Y Ltd.?

No, Mr. A is not SBO in Y Ltd. as he does not hold majority stake in X Ltd.

C. Whether Mr. A is SBO in Z Ltd.?

No, Mr. A is not SBO in Y Ltd. as he does not hold majority stake in X Ltd.

Please Note:

Every individual, who subsequently becomes a significant beneficial owner, or where his significant beneficial ownership undergoes any change shall file a declaration in Form No. BEN-1 to the reporting company, within thirty days of acquiring such significant beneficial ownership or any change therein.

Disclaimer:

The content of this article are for the information purpose only and is based on the relevant laws and facts. The information given in this document has been made on the basis of the provisions stated in the Companies (Amendment) Act, 2017 and Companies Act, 2013. It is based on the analysis and interpretation of applicable laws as on date. The information in this document is for general informational purposes only and is not a legal advice or a legal opinion. You should seek the advice of legal counsel of your choice before acting upon any of the information in this document. Under no circumstances whatsoever, we are not responsible for any loss, claim, liability, damage(s) resulting from the use, omission or inability to use the information provided in the document. This is not any kind of advertisement or solicitation of work by professional.

For any further queries and suggestions you can contact me on the mail id csanchalchawla94@gmail.com and on mobile +91 9992356422.

Your suggestions and feedback are highly appreciated. Thanks!

Hi

Your Article given me very much clarity of the sec. 89 and 90. Thanks

Very well articulated

Well explain and drafted…keep it up.