Implementation Guide to Standard on Auditing (SA) 230, Audit Documentation (Revised 2018)

The Institute of Chartered Accountants of India

(Set up by an Act of Parliament)

New Delhi

Foreword

Standards on Auditing are critical in ensuring and enhancing quality in audits of financial statements. It is therefore necessary that the auditors properly understand and implement these Standards in their audit engagements.

The Implementation Guides to Standards on Auditing are important resource for auditors to understand the requirements of these Standards and also help them in their appropriate implementation. These Guides also provide solutions to various practical problems faced by auditors in implementing Standards on Auditing in real life audit situations.

Audit documentation is an essential element of audit quality and has always been a critical component of an audit process as it evidences the work done by the auditor. I am happy that the Auditing and Assurance Standards Board has brought out this revised edition of the Implementation Guide to SA 230, “Audit Documentation” whose first edition was issued in 2013. The Implementation Guide has been written in an easy to understand language in the form of frequently asked questions (FAQs) on this Standard and responses to those FAQs.

I wish to compliment CA. Shyam Lal Agarwal, Chairman, Auditing and Assurance Standards Board (AASB) for bringing out this Implementation Guide for the benefit of members. I am sure that the members and other interested readers would find this Implementation Guide useful in discharge of their professional responsibilities.

December 03, 2018

New Delhi

CA. Naveen N.D. Gupta

President, ICAI

Preface

Standards on Auditing issued by the Institute of Chartered Accountants of India lay down the fundamental principles of audit to be followed by auditors while conducting audits of financial statements. It is essential that auditors understand and implement these Standards appropriately in their audit engagements. Implementation Guides to Standards on Auditing are issued by the Auditing and Assurance Standards Board (AASB) of ICAI to assist auditors in practical implementation of these Standards. Till date, AASB has brought out a number of Implementation Guides.

Standard on Auditing (SA) 230, “Audit Documentation” is an important standard which lays down the basic principles of audit documentation. These principles need to be kept in mind by auditors while complying with requirements of SA 230 and specific documentation requirements of other Standards on Auditing. In 2013, AASB had issued the “Implementation Guide to SA 230, Audit Documentation” to provide practical implementation guidance on this Standard. It gives me immense pleasure to place in hands of the members, this Revised Implementation Guide to SA 230, “Audit Documentation” brought out by AASB.

The Implementation Guide explains the requirements of the Standard in a ‘Question and Answer’ format It also contains checklists of documentation requirements.

I am extremely grateful to CA. Vimal Chopra, Jaipur, CA. Bhupendra Mantri, Jaipur and CA. Vishnu Dutt Mantri, Jaipur, who despite their pressing professional and other preoccupations developed this Implementation Guide. I also wish to thank CA. Deepa Agarwal and CA. Lalit Kumar for their valuable inputs in finalising this Guide.

I wish to express my sincere thanks to CA. Naveen N.D. Gupta, Honourable President, ICAI and Honourable Vice-President, ICAI for their guidance and support to the activities of the Board.

I wish to also place on record, the appreciation of Vice- Chairman of the Board, all Members of the Board and the Council for their suggestions, support and guidance in finalising this Implementation Guide as well as other pronouncements of the Board. I also wish to thank CA. Megha Saxena, Secretary, other officers and staff of the Board for their efforts and hard work.

I am confident that the Implementation Guide would be well received by the members and other interested readers.

December 3, 2018

Jaipur

CA. Shyam Lal Agarwal

Chairman,

Auditing and Assurance Standards Board

Contents

Foreword

Preface

Chapter 1: Summary of the Standard

Chapter 2: Introduction

Chapter 3: FAQs on SA 230

Chapter 4: Checklist

Appendix: Illustrative Working Paper Format

Chapter 1

Summary of the Standard

Chapter 2

Chapter 2

Introduction

Concept of Documentation

2.1 Audit, according to Spicer and Pegler, “may be said to be such an examination of the books, accounts and vouchers of a business as will enable the auditor to satisfy that the Balance Sheet is properly drawn up, so as to give a true and fair view of the state of affairs of the business and the Profit or Loss for the financial period, according to the best of his information and the explanations given to him and as shown by the books, and if not, in what respect he is not satisfied.”

2.2 Though the above definition addresses various aspects of an audit, one of the most important and relevant issues arising out of this definition is that the auditor needs to “satisfy himself that the financial statements are properly drawn up…”, “… according to best of his information and explanations given to him …”, “…and if not, “in what respect the auditor is not satisfied”.

2.3 An auditor, during the course of his audit may come across various materials in the form of deeds, agreements, contracts, invoices, vouchers, etc. which are the supporting materials to evidence the happening of an event/transaction. These are the basis for him to satisfy (or to not satisfy) himself in material aspects as to whether the financial statements give a true and fair view of the state of the affairs of the business and of the profit and loss for that period.

2.4 A document is any material which provides evidence of work performed, action taken or the happening of an event. It may be in paper or electronic form. Examples of documents include work papers, copy or abstract of signed agreements, videos, pictures, spreadsheets, transcripts, correspondences, data in electronic form containing the records in systemic manner etc.

2.5 Oxford dictionary defines documentation “as material that provides official information or evidence or that serves as a record; the process of classifying and annotating texts, photographs, etc”.

2.6 SA 230, “Audit Documentation”defines audit documentation as “The record of audit procedures performed, relevant audit evidence obtained, and conclusions the auditor reached (terms such as “working papers”or “work papers”are also sometimes used”.

2.7 Hence “document”in the context of audit refers more to that which is required to be maintained by an auditor to record his findings during the course of the audit.

Why is Documentation Important?

2.8 Documentation is considered the backbone of an audit. The work that the auditor performs, the explanations given to the auditor, the conclusions arrived at, are all evidenced by documentation. Poor documentation may depict poor performance in an audit. The auditor may have executed appropriate audit procedures, however, if there is no documentation to prove, it may put question on the work done, in case any material misstatement is reported. Improper and incomplete documentation, at times, may put the auditor in embarrassing situations.

2.9 Documentation is essential because:

- It supports the auditor’s asis for a conclusion about achieving the auditor’s objectives.

- Provides evidence that audit was planned and performed.

- It assists supervision and review.

- It results in better conceptual clarity, clarity of thought and expression.

- It facilitates better understanding and helps avoid

- It supports and evidences compliance with standards, applicable legal & regulatory requirements.

Form and Content of Documentation

2.10 The form and content of audit documentation should be designed to meet the circumstances as necessary of the particular audit. It should satisfy the requirements of the governing standards and substantiate the conclusions arrived at by the auditor.

2.11 The form and content of documentation depends on various factors such as:

- Size, nature and type of entity.

- Risk assessment.

- Materiality.

- Sampling methods, etc.

2.12 Documents are segregated into those forming part of the Permanent Audit File and Current Audit File. Permanent audit file contains those documents, the use of which is not restricted to one time period, and extends to subsequent audits also. e.g. Engagement letter, Communication with previous auditor, Memorandum of Association, Articles of Association, Organization structure, List of directors/partners/trustees/bankers/ lawyers, etc. On the other hand, a current audit file contains those documents relevant for that time period of audit.

2.13 Documentation includes the following:

- Understanding the entity.

- Time and cost constraints.

- Audit programme.

- Risk assessment.

- Team discussion.

- Working papers pertaining to significant areas.

- Review points.

- Communication with those charged with governance.

- Basis for conclusions.

- Reporting & completion.

- Quality/Engagement quality control review.

2.14 In general, a working paper may contain the following:

- Risk and controls relevant to the area.

- Assertions to be tested and satisfied.

- Substantive and analytical procedures performed.

- Persons performing/reviewing the work.

- Dates on which the work was performed/reviewed.

- Extent of review.

- Documents prepared by client.

- Nature, type and size of the entity.

2.15 Audit documentation may be lesser in case of less complex entities and small entities as compared to large and complex entities.

Chapter 3

FAQs on SA 230

Q1. What is the scope of SA 230?

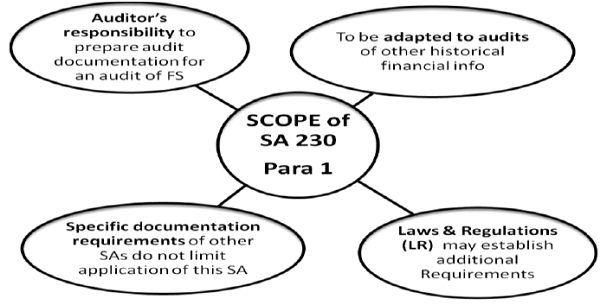

SA 230 deals with the auditor’s responsibility to prepare audit documentation for an audit of financial statements. It is to be adapted as necessary in the circumstances when applied to audits of other historical financial information. The specific documentation requirements of other SAs do not limit the application of SA 230. Laws or regulations may establish additional documentation requirements.

Q2. What is the nature and purpose of audit documentation?

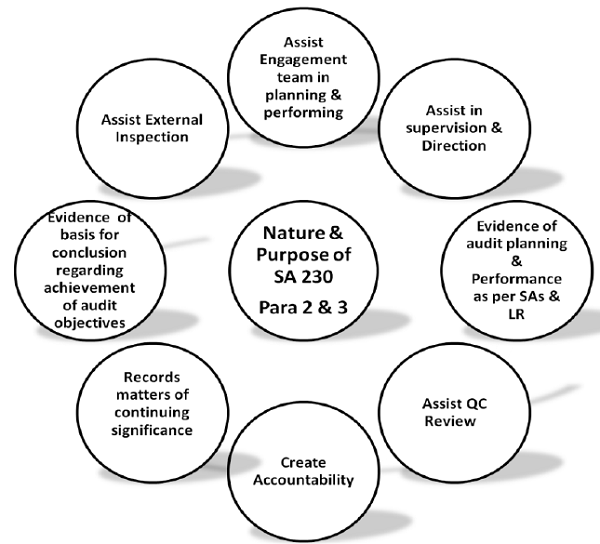

A2. Audit documentation that meets the requirements of this SA and the specific documentation requirements of other relevant SAs provides:

(a) Evidence of the auditor’s basis for a conclusion about the achievement of the overall objectives of the auditor; and

(b) Evidence that the audit was planned and performed in accordance with SAs and applicable legal and regulatory requirements.

A table has been given stating the specific documentation requirements under various SAs. Refer response to FAQ No. 37.

Q3. What are the purposes which may be served by audit documentation?

A3. Audit documentation serves a number of purposes, including the following:

- Assisting the engagement team to plan and perform the audit.

- Assisting members of the engagement team responsible for supervision to direct and supervise the audit work, and to discharge their review responsibilities in accordance with SA 220.

- Enabling the engagement team to be accountable for its work.

- Retaining a record of matters of continuing significance to future audits.

- Enabling the conduct of quality control reviews and inspections in accordance with SQC 1.

- Enabling the conduct of external inspections in accordance with applicable legal, regulatory or other requirements.

Q4. What is the objective of the auditor under SA 230?

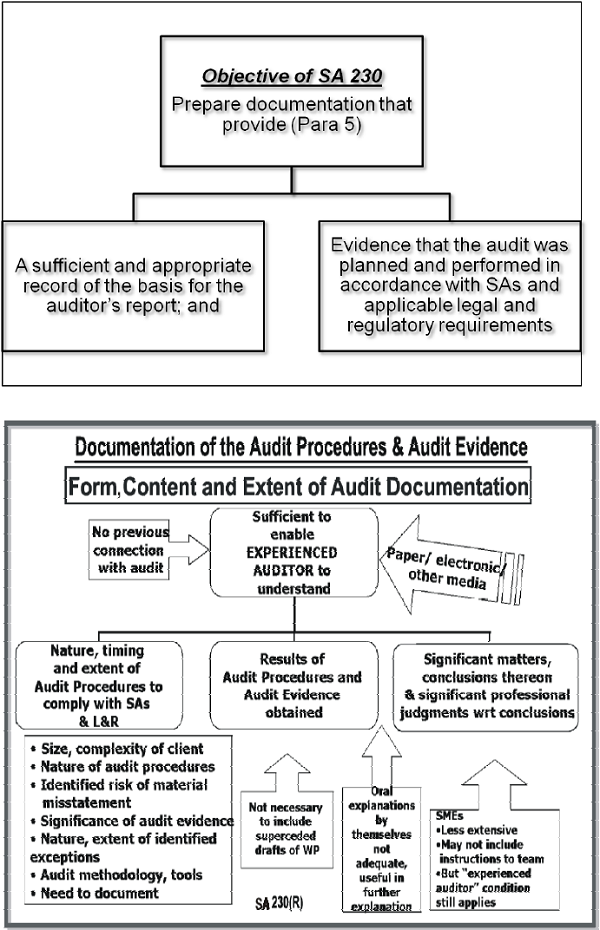

A4. The objective of the auditor is to prepare documentation that provides:

- A sufficient and appropriate record of the basis for the auditor’s report; and

- Evidence that the audit was planned and performed in accordance with SAs and applicable legal and regulatory requirements.

Q5. What do you mean by audit documentation?

A5. The record of audit procedures performed, relevant audit evidence obtained, and conclusions the auditor reached (terms such as “working papersor “workpapes” are also sometimes used). It may be noted, that the documents provided by client’ which are used to do audit should be part of audit documentation and checking notes should be attached by auditors on such documents.

Q6. What do you mean by audit file?

A6. One or more files, in physical or electronic form, arranged containing the records that comprise the audit documentation for a specific engagement.

Q7. What do you mean by experienced auditor?

A7. An individual (whether internal or external to the firm) who has practical audit experience, and a reasonable understanding of:

- Audit processes;

- SAs and applicable legal and regulatory requirements;

- The business environment in which the entity operates; and

- Auditing and financial reporting issues relevant to the entity’s

Q8. What would be the form, content and extent of Audit Documentation?

A8. The auditor shall prepare audit documentation that is sufficient to enable an experienced auditor, to understand:

- The nature, timing, and extent of the audit procedures performed to comply with the SAs and applicable legal and regulatory requirements;

- The results of the audit procedures performed, and the audit evidence obtained; and

- Significant matters arising during the audit, the conclusions reached thereon, and significant professional judgments made in reaching those conclusions.

Q9. What are influential factors for the form, content and extent of audit documentation?

A9. The form, content and extent of audit documentation depend on factors such as:

- The size and complexity of the entity.

- The nature of the audit procedures to be performed.

- The identified risks of material misstatement.

- The significance of the audit evidence obtained.

- The nature and extent of exceptions revealed.

- The need to document a conclusion or the basis for a conclusion not readily determinable from the documentation of the work performed or audit evidence obtained.

- The audit methodology and tools used.

Q10. How should the audit documentation be recorded?

A10. Audit documentation may be recorded on paper or on electronic or other media.

Q11. What are the examples of the audit documentation?

A11. Examples of audit documentation include the following:

- Engagement letter.

- Audit programmes defined, with details of work carried out and results filled, including planning memorandum.

- Analyses of various account balances through comparatives and corroborative.

- Issues memoranda.

- Summaries of significant matters.

- Letters of confirmation and representation.

- Checklists.

- Correspondence (including e-mail) concerning significant matters.

- Abstracts or copies of the entity s records/contracts/ agreements.

Audit documentation, however, is not a substitute for the entity’s accounting records and vice versa.

Q12. Whether Minutes Book, Records, Bills, Vouchers, Fixed Assets Register, legal books etc. are to be obtained by auditor as audit documentation? What would the auditor not include in the audit documentation?

A12. No, such records are to be kept and maintained by the management / owner of the entity. Auditor may take abstract of some accounts, records, contracts etc as he may find relevant as per his judgement. Further, the auditor also need not include in audit documentation:

- Superseded drafts of working papers and financial statements;

- Notes that reflect incompleteness;

- Preliminary thinking;

- Previous copies of documents corrected for typographical or other errors; and

- Duplicates of documents.

Oral explanations by the auditor, on their own, do not represent adequate support for the work auditor performed or conclusions the auditor reached, but may be used to explain or clarify information contained in the audit documentation.

Q13. Whether confirmation of all parties account balances should be obtained by the management and copy of all should be recorded by the auditor as audit documentation, if not, then to what extent and in which manner the confirmation(direct/third party/obtained by management/ verification from records) is relevant for the audit documentation required to be recorded?

A13. No, the SAs do not prescribe that the confirmation of all account balances are required to be obtained. As it may also not be feasible considering the time and cost involved and to complete the audit in time. It is the auditor’s judgment to rely on the running account balances, statements, transactions with the parties and behaviour of the account. In the cases when the auditor has reason to believe that the account balances with the respective parties are material and may have material differences, he should ask for the confirmations of the balances from the respective parties/entities to reduce the risk of material misstatement at low level. The confirmations, if available in other cases also will further support the auditor’s opinion.

As required by SA 330 and SA 505, the auditor should obtain more persuasive audit evidence to respond to the auditor’s assessment of higher risk. In such situation external confirmation is more reliable as an audit evidence. Hence when there is higher risk involved the auditor should reduce the risk by obtaining the external confirmation.

Q14. The requirements of the laws and regulations for compliances of the disclosure are given in illustrative formats and contents of the respective laws and regulations. The auditor is required to document all matters of non-compliances in material aspects. Whether the additional documentation is required?

A14. The Companies Act, 2013 has given the formats for financial statements in Schedule III, with the manner of disclosure and items required to be disclosed. For high quality of reporting it is always desired that the disclosure should be more appropriate. The requirements are meant to add value to the users of the financial statements. The auditor should therefore document to support the opinion where there is any material departure from the requirement and which may also materially influence the decision of the user.

Further, in those cases where no specific requirement of the format or disclosure is given, the auditor may agree to the financial reporting framework being followed by the entity and disclosing those items which are pertinent to the said framework and the applicable requirement under that audit. In such case the auditor should specify the same in the engagement letter issued to the auditee. As in case of non-corporate entities, the disclosure as required under the Companies Act, 2013 is not applicable.

Q15. What would be the audit documentation in case of Smaller / Less Complex Entity?

A15. The audit documentation for the audit of a smaller/less Complex entity is less extensive than that for the audit of a larger entity. In certain cases it may materially vary as

there may be few documentation in some small/less complex entity. Here there may be more personal communication and formally there may only be the representation letter as audit documentation.

When preparing audit documentation, the auditor of a smaller entity may also find it helpful and efficient to record various aspects of the audit together in a single document.

Examples of matters that may be documented together in the audit of a smaller entity include understanding of the entity and its internal control, the overall audit strategy and audit plan, materiality, determined in accordance with SA 320, ‘Materiality in Planning and Performing an Audit’, assessed risks, significant matters noted during the audit, and conclusions reached.

Application and Other Explanatory Material given in the standards on auditing also mention the lesser documentation and deals with considerations specific to Smaller entities, the brief of which is explained as below (for details the auditor may refer the relevant standard):

- SA 260(Revised), “Communication with Those Charged with Governance”, which explains that in some smaller entities, however, one person may be charged with governance, for example, the owner-manager where there are no other owners, or a sole trustee.

Also, in some cases, the appropriate person(s) with whom to communicate may not be clearly identifiable from the applicable legal framework or other engagement circumstances, for example, entities where the governance structure is not formally defined, such as some family-owned entities, some not-for-profit organizations, and some government entities. In such cases, the auditor may need to discuss and agree with the engaging party (Auditee) the relevant person(s) with whom to communicate.

- SA 265, “Communicating Deficiencies in Internal Control to Those Charged with Governance and Management”, explains that smaller entities may find that certain types of control activities are not necessary because of controls applied by management. For example, management’s sole authority for granting credit to customers and approving significant purchases can provide effective control over important account balances and transactions, lessening or removing the need for more detailed control activities.

- SA 240, “The Auditor’s FResponsibilities relating to Fraud in an Audit of Financial Statements’,which states that in case of small entity where a single owner manages the entity and no one else has governance In these cases, there is ordinarily no action on the part of the auditor because there is no oversight separate from the management.

- SA 300, “Planning an Audit of Financial Statements’, which explains that in audits of small entities, the entire audit may be conducted by a very small audit Many audits of small entities involve the engagement partner (who may be a sole practitioner) working with one engagement team member (or without any engagement team members). With a smaller team, co-ordination of, and communication between, team members are easier. Establishing the overall audit strategy for the audit of a small entity need not be a complex or time-consuming exercise; it varies according to the size of the entity, the complexity of the audit, and the size of the engagement team. For example, a brief memorandum prepared at the completion of the previous audit, based on a review of the working papers and highlighting issues identified in the audit just completed, updated in the current period based on discussions with the owner-manager, can serve as the documented audit strategy for the current audit engagement if it covers the matters noted in paragraph 7 of SA 300.

- SA 315, “Identifying and Assessing the Risks of Material Misstatement Through Understanding the Entity and Its Environment”, which explains that Many small audits are carried out entirely by the engagement partner (who may be a sole practitioner). In such situations, it is the engagement partner who, having personally conducted the planning of the audit, would be responsible for considering the susceptibility of he ent y s financial statements to material misstatement due to fraud or error. Further, smaller entities may not have interim or monthly financial information that can be used for purposes of analytical procedures. In these circumstances, the auditor may be able to perform very limited procedures.

- SA 320, “Materiality in Planning and Performing an Audit”, which explains that when aent y’s profit before tax from continuing operations is consistently nominal, as might be the case for an owner-managed business where the owner takes much of the profit before tax in the form of remuneration, a benchmark such as profit before remuneration and tax may be more relevant for audit documentation.

- SA 330, “The Auditor’s Respo ses to Assessed Risks”, explains that in the case of small entities, there may not be many control activities that could be identified by the auditor, or the extent to which their existence or operation have been documented by the entity may be limited.

- SA 540, “Auditing Accounting Estimates, Including Fair Value Accounting Estimates, and Related Disclosures”, explains that obtaining understanding of estimates for smaller entities is often less complex as their business activities are often limited and transactions are less complex. Further, often a single person, for example the owner-manager, identifies the need to make an accounting estimate and the auditor may focus inquiries accordingly.

- SA 570(Revised), “Going Concern”, explains that in many cases, the management of smaller entities may not have prepared a detailed assessment of the entity’s ability to continue as a going concern, but nstead may rely on in-depth knowledge of the business and anticipated future prospects. Nevertheless, in accordance with the requirements of this SA, the auditor needs to evaluate management’s assessment of the e tity’s abiity to continue as a going concern.

Further, continued support by owner-managers is often important to smaller ent ties’ ability to continue as a going concern. Where a small entity is largely financed by a loan from the owner-manager, it may be important that these funds are not withdrawn. For example, the continuance of a small entity in financial difficulty may be dependent on the owner-manager subordinating a loan to the entity in favour of banks or other creditors, or the owner-manager supporting a loan for the entity by providing a guarantee with his or her personal assets as collateral. In such circumstances, the auditor may obtain appropriate documentary evidence of the subordination of the owner-manager’s loan or of the guaranteeWhere an entity is dependent on additional support from the owner-manager, the auditor may evaluate the owner-manager’s abilty to meet the o blgation under he support arrangement. In addition, the auditor may request written confirmation of the terms and conditions attaching to such support and the owner-manager’s intention or understanding.

Further, in the case of an audit where the engagement partner performs all the audit work, the documentation will not include matters that might have to be documented solely to inform or instruct members of an engagement team, or to provide evidence of review by other members of the team (for example, there will be no matters to document relating to team discussions or supervision).

Q16. If the auditor complies with SA 230, will the result be sufficient and appropriate audit documentation?

A16. In principle, compliance with the requirements of this SA will result in the audit documentation being sufficient and appropriate in the circumstances. Other SAs contain specific documentation requirements that are intended to clarify the application of this SA in the particular circumstances of those SAs.

Q17. Do the specific documentation requirements of other SAs limit the application of SA 230?

A17. No, the specific documentation requirements of other SAs do not limit the application of this SA.

Q18. What will be the consequence, if there is no audit documentation requirement in any SA?

A18. The absence of a documentation requirement in any particular SA is not intended to suggest that there is no documentation that needs to be prepared as a result of complying with that SA. Documentation appropriate to the circumstance needs to be maintained.

Q19. Is it necessary for the auditor to document separately (as in a checklist, for example) compliance with matters for which compliance is demonstrated by documents included within the audit file?

A19. No, audit documentation provides evidence that the audit complies with SAs. However, it is neither necessary nor practicable for the auditor to document every matter considered, or professional judgment made, in an audit. Further, it is unnecessary for the auditor to document separately (as in a checklist, for example) compliance with matters for which compliance is demonstrated by documents included within the audit file. For example:

- The existence of an adequately documented audit plan demonstrates that the auditor has planned the audit.

- The existence of a signed engagement letter in the audit file demonstrates that the auditor has agreed the terms of the audit engagement with management, or where appropriate, those charged with governance.

- An uditors report containing an appropriately qualified opinion demonstrates that the auditor has complied with the requirement to express a qualified opinion under the circumstances specified in the SAs.

- In relation to requirements that apply generally throughout the audit, there may be a number of ways in which compliance with them may be demonstrated within the audit file:

- For example, there may be no single way in which the ditor’s professnal skepticism

documented. But the audit documentation may nevertheless provide evidence othe auditor’ exercise of professional skepticism in accordance with SAs. Such evidence may include specific procedures performed to corroborate management’s responses to the auditor’s inquiries. - Similarly, that the engagement partner has taken responsibility for the direction, supervision and performance of the audit in compliance with the SAs may be evidenced in a number of ways within the audit documentation. This may include documentation of the engagement partner s timely involvement in aspects of the audit, such as participation in the team discussion required by SA 315.

- For example, there may be no single way in which the ditor’s professnal skepticism

Q20. What are the examples of significant matters?

A20. Judging the significance of a matter requires an objective analysis of the facts and circumstances. Examples of significant matters include:

- Matters that give rise to significant risks. As defined in SA 315, significant risks mean an identified and assessed risk of material misstatement that, in the auditor’s judgentrequires special audit consideration.

- Results of audit procedures indicating (a) that the financial statements could be materially misstated, or (b) a need to revse the auditor’s previous assessment of the risks of mater al misstatement and the auditor’s responses to those risks.

- Circumstances that cause the auditor significant difficulty in applying necessary audit procedures.

- Findings that could result in a modification to the audit opinion or the inclusion of an Emphasis of Matter paragraph in the auditor’s report.

Q21. What are the important factors in determining the form, content and extent of audit documentation of significant matters?

A21. An important factor in determining the form, content and extent of audit documentation of significant matters is the extent of professional judgment exercised in performing the work and evaluating the results. Documentation of the professional judgments made, where significant, serves to explain the audito s conclusions and to reinforce the quality of the judgment. Such matters are of particular interest to those responsible for reviewing audit documentation, including those carrying out subsequent audits, when reviewing matters of continuing significance (for example, when performing a retrospective review of accounting estimates).

Q22. Give examples of circumstances in which, it is appropriate to prepare audit documentation relating to the use of professional judgment?

A22. Some examples of circumstances in which, it is appropriate to prepare audit documentation relating to the use of professional judgment include, where the matters and judgments are significant:

- The rationale for the auditor’s conclusion when a requirement provides that the auditor ‘shall cons der’ certain information or factors, and that consideration is significant in the context of the particular engagement.

- The asis for the uditor s conclusion on the reasonableness of areas of subjective judgments (for example, the reasonableness of significant accounting estimates).

- The basis for he aditor s conclusions about the authenticity of a document when further investigation (such as making appropriate use of an expert or of confirmation procedures) is undertaken in response to conditions identified during the audit that caused the auditor to believe that the document may not be

The auditor may consider it helpful to prepare and retain as part of the audit documentation a summary (sometimes known as a completion memorandum) that describes the significant matters identified during the audit and how they were addressed, or that includes cross-references to other relevant supporting audit documentation that provides such information. Such a summary may facilitate effective and efficient reviews and inspections of the audit documentation, particularly for large and complex audits. Further, the preparation of such a summary may assist the auditor’s consideration of the significant matters. It may also help the auditor to consider whether, in light of the audit procedures performed and conclusions reached, there is any individual relevant SA objective that the auditor cannot achieve that would prevent the auditor from achieving the overall objectives of the auditor. It is however to be noted that the audit documentation for use of the professional judgment will be materially lesser in case of audit of small entities and where the engagement partner himself is dealing with the audit of such entities in all respect.

Q23. What should the auditor record in documenting the nature, timing and extent of audit procedures performed?

A23. The auditor should record:

- The identifying characteristics of the specific items or matters tested;

- Who performed the audit work and the date such work was completed; and

- Who reviewed the audit work performed and the date and extent of such review.

SA 220 requires the auditor to review the audit work performed through review of the audit documentation. The requirement to document who reviewed the audit work performed does not imply a need for each specific working paper to include evidence of review. The requirement, however, means documenting what audit work was reviewed, who reviewed such work, and when it was reviewed.

Q24. What purposes do recording the identifying characteristics serve?

A24. Recording the identifying characteristics serves a number of purposes. For example, it enables the engagement team to be accountable for its work and facilitates the investigation of exceptions or inconsistencies. Identifying characteristics will vary with the nature of the audit procedure and the item or matter tested. For example:

- For a detailed test of entity-generated purchase orders, the auditor may identify the documents selected for testing by their dates and unique purchase order numbers.

- For a procedure requiring selection or review of all items over a specific amount from a given population, the auditor may record the scope of the procedure and identify the population (for example, all journal entries over a specified amount from the journal register).

- For a procedure requiring systematic sampling from a population of documents, the auditor may identify the documents selected by recording their source, the starting point and the sampling interval (for example, a systematic sample of shipping reports selected from the shipping log for the period April 1 to September 30, starting with report number 12345 and selecting every 125th report).

- For a procedure requiring inquiries of specific entity personnel, the auditor may record the dates of the inquiries and the names and job designations of the entity personnel.

- For an observation procedure, the auditor may record the process or matter being observed, the relevant individuals, their respective responsibilities, and where and when the observation was carried out.

Q25. What all should the auditor document for communication/discussion with management?

A25. The auditor shall document discussions of significant matters with management, those charged with governance, and others, including the nature of the significant matters discussed and when and with whom the discussions took place. The documentation is not limited to records prepared by the auditor but may include other appropriate records such as minutes of meetings prepared by the entity’s personnel and agreed by the aud tor. Others with whom the auditor may discuss significant matters may include other personnel within the entity, and external parties, such as persons providing professional advice to the entity. The auditor should specifically deal with key audit matters documentation as specified in SA 701 and other audit conclusion and reporting standards.

Q26. What should the auditor document if the auditor identified information that is inconsistent with the auditor’s final conclus on regarding a significant matter?

A26. The auditor shall document how the auditor addressed the inconsistency. The requirement to document how the auditor addressed inconsistencies in information does not imply that the auditor needs to retain documentation that is incorrect or superseded.

Q27. What will the auditor do when it is necessary to depart from a relevant requirement in a SA?

A27. The auditor should document how the alternative audit procedures performed achieve the aim of that requirement, and the reasons for the departure, if, in exceptional circumstances, the auditor judges it necessary to depart from a relevant requirement in a SA. The requirements of the SAs are designed to enable the auditor to achieve the objectives specified in the SAs, and thereby the overall objective of the auditor. Accordingly, other than in exceptional circumstances, the SAs call for compliance with each requirement that is relevant in the circumstances of the audit.

Q28. Under which situation is a documentation requirement not necessary?

A28. The documentation requirement applies only to requirements that are relevant in the circumstances. A requirement is not relevant only in the cases where:

- The entire SA is not relevant [for example, if an entity does not have an internal audit function, nothing in SA 610(Revised) is relevant]; or

- The requirement is conditional and the condition does not exist (for example, the requirement to modify the auditor’s opinion where there is an inability to obtain sufficient appropriate audit evidence, and there is no such inability).

Q29. What will be the audit documentation, if, in exceptional circumstances, the auditor performs new or additional audit procedures or draws new conclusions after the date of the auditor’s report?

A29. The auditor is required to document:

- The circumstances encountered;

- The new or additional audit procedures performed, audit evidence obtained, and conclusions reached, and their effect on the auditor’s report; and

- When and by whom the resulting changes to audit documentation were made and reviewed.

Q30. Give examples of exceptional circumstances – Matters arising after the Date of the Auditor’s Report?

A30. Examples of exceptional circumstances include facts which become known to the auditor after the date of the auditor’s report but which existed at that date and which, if known at that date, might have caused the financial statements to be amended or the auditor to modify the opinion in the auditor’s report. The resulting changes to the audit documentation are reviewed in accordance with the review responsibilities set out in SA 220, with the engagement partner taking final responsibility for the changes.

Q31. When should the auditor complete the administrative process of assembling the final audit file?

A31. The auditor should complete the administrative process of assembling the final audit file on a timely basis after the date of the auditor’s report. SQC 1 requires firms to establish policies and procedures for the timely completion

of the assembly of audit files. An appropriate time limit within which to complete the assembly of the final audit file

is ordinarily not more than 60 days after the date of the auditor’s report.

Q32. Whether the administrative process of completion of the assembly of the final audit file after the date of the auditor’s report construes as performance of new audit procedures or the drawing of new conclusions? If not, what are the changes permissible in the audit documentation during the final assembly process?

A32. No, the administrative process of completion of the assembly of the final audit file after the date of the auditXW’R report does not construe as performance of new audit procedures or the drawing of new conclusions. Changes may, however, be made to the audit documentation during the final assembly process if they are administrative in nature. Examples of such changes include:

- Deleting or discarding superseded documentation.

- Sorting, collating and cross referencing working

- Signing off on completion checklists relating to the file assembly process.

- Documenting audit evidence that the auditor has obtained, discussed, and agreed with the relevant members of the engagement team before the date of the auditor’s report.

Q33. What is the retention period for the audit documentation?

A33. The retention period for audit engagements, as per SQC 1, ordinarily is no shorter than seven years from the date of the auditor’s report, or, if later, the date of the group auditor’s report

Q34. What will be the audit documentation in the circumstances where the auditor finds it necessary to modify existing audit documentation or add new audit documentation after the assembly of the final audit file has been completed?

A34. The auditor shall, regardless of the nature of the modifications or additions, document:

- The specific reasons for making them; and

- When and by whom they were made and reviewed.

Q35. Give an example of a circumstance in which the auditor may find it necessary to modify existing audit documentation or add new audit documentation after file assembly has been completed.

A35. Example is the need to clarify existing audit documentation arising from comments received during monitoring inspections performed by internal or external parties.

Q36. Who is the owner of the audit documentation?

A36. Standard on Quality Control (SQC) 1, “Quality Control for Firms that Perform Audits and Reviews of Historical Financial Information, and Other Assurance and Related Services Engagements”, issued by the ICAI, provides that, unless otherwise specified by law or regulation, audit documentation is the property of the auditor. He may at his discretion, make portions of, or extracts from, audit documentation available to clients, provided such disclosure does not undermine the validity of the work performed, or, in the case of assurance engagements, the independence of the auditor or of his personnel.

A37. Provide the specific audit documentation requirements in other SAs?

A37. The specific audit documentation requirements in the respective SAs are given below. Since the standards on auditing are in alignment of the international standards on auditing prepared keeping in mind the requirements of the listed entities and public interest entities with a view to oversee the public interest, the specific documentation requirements have been given accordingly. The same may be adjusted (in case of small/ less complex entities as also briefed in the application material of the respective Standards) according to the requirements based on the size, nature, type of the entity being audited and complexities involved.

SA 220, Quality Control for an Audit of Financial Statements