Going Concern Assessment:

[Ind AS – 1 and 10]

The Financial statements are normally prepared on the assumption that an entity is a going concern and will continue in operation for the foreseeable future.

In assessing whether the going concern assumption is appropriate, management considers all available information about the future, which is at least, but is not limited to, twelve months from the end of the reporting period.

Considerations:

1. Management of the entity should assess the impact of COVID-19 and the measures taken on its ability to continue as a going concern.

2. The impact of COVID- 19 after the reporting date should also be considered and if, management after the reporting date either intends to liquidate the entity or to cease trading, or has no realistic alternative but to do so, the financial statements should not be prepared on going concern basis.

3. Necessary disclosures as per Ind AS 1 shall also be made, such as material uncertainties that might cast significant doubt upon an entity’s ability to continue as a going concern.

In this context let us also consider the aspects of relevant SA i.e.SA 570 – Going concern.

Auditor’s role:

SA 570 – Going concern:

COVID-19 is resulting in significant operational disruption and presents an existential threat for many businesses. Entities and audit teams need to consider the implications on the assessment of going concern and viability in the financial report and whether these circumstances will result in prolonged operational disruption which will significantly erode the financial position of the entity or otherwise result in failure.

This is critically important for the going concern assessment. Auditors will need to consider whether the threat to liquidity as a result of supply/demand disruption presents a material uncertainty to the going concern status for the 12 months look forward period.

SA 570(Revised) also requires auditors to consider events that may cast significant doubt on the entity’s ability to continue as a going concern beyond the period of management’s assessment.

Audit teams should robustly assess the going concern and viability risks relating to COVID-19 threat in compliance with SA 570(Revised). This includes evaluating whether there is adequate support for the assumptions underlying management’s assessment and the consistency of these assumptions across the entity’s business activities.

Presentation of Financial Statements:

[Ind AS – 1]

Aspect 1:

Breach of loan covenants (including classification of liabilities into current and non-current):

Consideration:

Due to COVID-19 there may be instances of breach of loan covenants which may trigger the liability becoming due for payment and liability becoming current.

However, as per paragraph 74 of Ind AS 1, such a liability shall not be classified as current, if the lender agreed, after the reporting period and before the approval of the financial statements for issue, not to demand payment as a consequence of the breach.

Aspect 2:

Sources of estimation uncertainty under Ind AS 1:

Paragraph 125 of Ind AS 1, requires an entity to disclose information about the assumptions it makes about the future, and other major sources of estimation of uncertainty at the end of the reporting period, that have a significant risk of resulting in a material adjustment to the carrying amounts of assets and liabilities within the next financial year.

Consideration:

COVID-19 may have created many uncertainties about the likely future scenarios which may affect the estimations of amounts recognised in the balance sheet as of reporting date. Entities shall be guided by the prescriptions in paragraphs 125 to 133 of Ind AS 1.

Aspect 3:

Comparative information:

Ind AS 1 requires presentation of minimum comparative information.

Framework for the preparation and presentation of financial statements under Ind AS considers comparability as an important qualitative characteristic of financial statements. The Framework requires that users must be able to compare the financial statements of an entity through time in order to identify trends in its financial position and performance and also compare it with financial statements of other entities.

Consideration:

COVID-19 may have affected the financial performance and financial position of entities. Therefore, preparers may consider making adequate disclosures and explanatory notes regarding the impact of COVID-19 on its financial position, performance and cash flows.

Summary – Bird’s eye view:

| Aspect | Ind AS requirement | Management Action (due to COVID) |

| 1. | Breach of loan covenants (including classification of liabilities into current and non-current) | Due to COVID-19 there may be instances of breach of loan covenants which may trigger the liability becoming due for payment and liability becoming current. |

| 2. | Sources of estimation uncertainty under Ind AS 1 | COVID-19 may have created many uncertainties about the likely future scenarios which may affect the estimations of amounts recognised in the balance sheet as of reporting date. Entities shall be guided by the prescriptions in paragraphs 125 to 133 of Ind AS 1. |

| 3. | Comparative information | Preparers may consider making adequate disclosures and explanatory notes regarding the impact of COVID-19 on its financial position, performance and cash flows. |

Post Balance Events:

[Ind AS – 10]

COVID-19 outbreak incidence surfaced in December 2019 and the condition has continued to evolve throughout after 31 December 2019.

According to Ind AS 10, events occurring after the reporting period are categorised into two viz.

- Adjusting events i.e. those require adjustments to the amounts recognised in its financial statements for the reporting period; and

- Non-adjusting events i.e. those do not require adjustments to the amounts recognised in its financial statements for the reporting period.

In certain cases, Management judgement may be required to categorise the events into one of the above categories.

Considerations:

1. Entities must disclose significant recognition and measurement uncertainties that might have been created by the outbreak of the COVID -19 in measuring various assets and liabilities.

2. They should also disclose how they have dealt with the impact of COVID -19 on the financial position and financial performance of the entity.

In this context let us also consider the aspects of relevant SA i.e.SA 560 – “Events Occurring Between the Date of the Financial Statements and the Date of the Auditor’s Report”

Auditor’s role:

SA -560:

Events Occurring Between the Date of the Financial Statements and the Date of the Auditor’s Report:

Entities must disclose significant recognition and measurement uncertainties that might have been created by the outbreak of the COVID -19 in measuring various assets and liabilities. They should also disclose how they have dealt with the impact of COVID -19 on the financial position and financial performance of the entity.

The Responsibilities of the auditor for the subsequent events i.e. events between the date of financial statements and the date of auditor’s report are discussed in SA 560.

Provisions, Contingent Liabilities and Contingent Assets:

[Ind AS-37]

Aspect 1:

Onerous Contracts (including Executory Contracts):

Onerous contracts are those contracts for which the unavoidable costs of meeting the obligations under the contract exceed the economic benefits expected to be received under it.

Unavoidable costs under a contract are the least net cost of exiting from the contract, which is the lower of the cost of fulfilling it and any compensation or penalties arising from failure to fulfil it.

Considerations:

As a result of COVID -19, some contracts may become onerous for reasons such as increase in cost of material/labour, etc.;

Management should consider whether any of its contracts have become onerous. The same should be accounted for as per Ind AS 37.

Ind AS 37 also requires assets dedicated to a contract to be tested for impairment before a liability for an onerous contract is recognised.

Additionally, there could be losses from imposition of penalty due to delay in supply of goods, which may need to be considered under the guidance of Ind AS 1115.

If the management is unable to assess whether some of the executory contracts are onerous due to inadequacy of information, the same should be disclosed. Management should disclose that it has assessed whether executory contracts are onerous due to the adverse impact of COVID -19. If, the management is unable to assess whether some of the executory contracts have become onerous due to inadequacy of information, the same should be disclosed.

Aspect 2:

Contingent Assets – Insurance Claims:

Considerations:

Entities may have insurance policies that cover loss of profits due to business disruptions due to events like COVID-19. Entities claims on insurance companies can be recognised in accordance with Ind AS 37 only if the recovery is virtually certain i.e. the insurance entities have accepted the claims and the insurance entity will meet its obligations.

Aspect 3:

Recognition of Provisions:

Ind AS 37 requires a provision to be recognised only:

Condition (a)

Where an entity has a present obligation.

Condition (b)

It is probable that an outflow of resources is required to settle the obligation; and

Condition (c)

A reliable estimate can be made.

Considerations:

Due to COVID-19, there is a need for exercising judgement in making provisions for losses and claims. A provision may be accounted for only to the extent that there is a present obligation for which the outflow of economic benefits is probable and can be reliably estimated.

Caution:

Ind AS 37 does not permit provisions for future operating costs or future business recovery costs. However, Ind AS 37 requires that an entity should disclose the nature of the obligation and the expected timing of the outflow of economic benefits.

Summary – Bird’s eye view:

| Aspect | Ind AS requirement | Management Action (due to COVID) |

| 1. | Onerous contracts | See detailed discussion above |

| 2. | Insurance claims | Entities may have insurance policies that cover loss of profits due to business disruptions due to events like COVID-19. Entities claims on insurance companies can be recognised in accordance with Ind AS 37 only if the recovery is virtually certain i.e. the insurance entities have accepted the claims and the insurance entity will meet its obligations. |

| 3. | Recognition of provision | Due to COVID-19, there is a need for exercising judgement in making provisions for losses and claims. |

Measurement of Inventory:

[Ind AS-2]

Aspect 1:

As per Ind AS 2, it might be necessary to write down inventories to net realisable value due to:

Considerations:

Entities should assess:

The significance of any write-downs and whether they require disclosure in accordance with Ind AS 2 as well as paragraph 98 (a) of Ind AS 1.

Aspect 2:

Ind AS 2 provides that the allocation of fixed production overheads to the costs of conversion is based on the normal production capacity.

The amount of fixed overhead allocated to each unit of production is not increased as a consequence of low production or idle plant. Unallocated overheads are recognised as an expense in the period in which they are incurred.

Considerations:

It is unlikely that the normal production capacity is to be reviewed for allocating fixed production overheads for the year 2019-2020, because of adverse impact on the utilisation of the production capacity due to the impact of coronavirus on the overall economy or the segment (s) in which the entity is operating.

Summary – Bird’s eye view:

| Aspect | Ind AS requirement | Management Action (due to COVID) |

| 1. | It might be necessary to write down inventories to net realisable value | The significance of any write-downs and whether they require disclosure. |

| 2. | Allocation of fixed production overheads to the costs of conversion is based on the normal production capacity. | It is unlikely that the normal production capacity is to be reviewed for allocating fixed production overheads for the year 2019-2020. |

In this context, let us also lay down the aspects of relevant SA – SA 501 (Audit Evidence).

Auditors role:

Valuation of Inventory on a date other than date of Financial Statements

i.e. 31st March 2020

[SA 501 (Audit Evidence) – Specific Considerations for Selected Items]

Due to government-imposed shutdowns or due to unavailability of the client personnel, it may not be practicable for most of the business entities to conduct physical verification of inventory as on the date of the financial statements i.e. 31st March, 2020.

The auditor must plan procedures depending on the underlying circumstances wherein the inventory count date could be advanced prior to the year- end or deferred to a date after the year-end.

The auditor would need to comply with the procedures given in Paragraphs 5 and 7 read with Paragraphs A9 to A14 of SA 501.

Property Plant and Equipment (PPE):

[Ind AS – 16]

Ind AS 16 requires that useful life and residual life of PPE needs revision in annual basis.

Due to COVID-19, PPE can remain under-utilised or not utilised for a period of time. It may be noted that the standards require depreciation charge even if the PPE remains idle. Further, COVID-19 impact may have affected the expected useful life and residual life of PPE.

Consideration:

The management may review the residual value and the useful life of an asset due to COVID 19 and, if expectations differ from previous estimates, it is appropriate to account for the change(s) as an accounting estimate in accordance with Ind AS 8.

Borrowing Costs:

[Ind AS – 23]

Ind AS 23 requires that the capitalisation of interest is suspended when development of an asset is suspended.

Consideration:

The management may consider this aspect while evaluating the impact of COVID-19.

Impairment of Non-Financial Assets:

[Ind AS-36]

Aspect 1:

Ind AS 36 requires an entity to assess, at the end of each reporting period, whether there is any indication that non-financial assets may be impaired.

The impairment test has to be carried out only if there are such indications. If any such indication exists, the entity shall estimate the recoverable amount of the asset.

Considerations:

The management needs to consider whether:

Contraction in economic activity due to the outbreak of COVID 19 is considered to be an impairment indicator at the reporting date, which results in an impairment assessment.

Aspect 2:

An entity needs to estimate the recoverable amount of the asset for impairment testing.

Recoverable amount is the higher of the fair value less costs of disposal and the value in use. In cases where the recoverable amount is estimated based on value in use, the considerations on accounting estimates apply.

Considerations:

The management needs to consider whether:

Assumptions used for impairment testing and to determine the recoverable amounts before the outbreak of COVID 19 requires any change.

The assumptions used to determine discount rate to measure the recoverable amount require any adjustments.

The forecasts or budgets for future cash flows prepared by management should be updated to reflect the impact of COVID 19.

Market assumptions used to determine fair value for recoverable amounts needs reconsideration. Reasonable assumptions are taken in estimating the value-in-use and fair value less costs of disposal and ensure that the impairment loss, if any, is estimated reliably.

Aspect 3:

For indefinite useful life intangible asset or an intangible asset not yet available for use and goodwill, Ind AS 36 requires an annual impairment testing.

There could be an indicator that impairment testing of goodwill and indefinite useful life intangible assets are tested as of reporting date even if the entity follows other annual testing cycle as per Ind AS 36.

The standard requires that goodwill being tested for impairment at a level that reflects the way an entity manages its operations and with which the goodwill would naturally be associated.

Considerations:

The management needs to consider whether:

Due to COVID-19, there might be significant changes with an adverse effect in operations of a cash generating unit to which goodwill is allocated and therefore requiring additional focus and attention while testing of impairment of goodwill as at March 31, 2020.

Aspect 4:

Disclosure requirements:

The disclosure requirements in Ind AS 36 are extensive.

Considerations:

The management needs to consider whether:

Depending on specific facts and circumstances, entities need to consider providing detailed disclosures on the assumptions and sensitivities considered for effects of the COVID-19.

Summary – Bird’s eye view:

| Aspect | Ind AS requirement | Management Action (due to COVID) |

| 1. | An entity to assess, at the end of each reporting period, whether there is any indication that non-financial assets may be impaired. | Does contraction in economic activity due to the outbreak of COVID 19 is considered to be an impairment indicator at the reporting date, which results in an impairment assessment? |

| 2. | An entity needs to estimate the recoverable amount of the asset for impairment testing. | See details in Aspect 2 above. |

| 3 | Goodwill allocation | Due to COVID-19, there might be significant changes with an adverse effect in operations of a cash generating unit to which goodwill is allocated and therefore requiring additional focus and attention while testing of impairment of goodwill as at March 31, 2020 |

| 4 | Disclosure requirement | Depending on specific facts and circumstances, entities need to consider providing detailed disclosures on the assumptions and sensitivities considered for effects of the COVID-19. |

Impairment Losses on Financial Instruments:

[Ind AS-109]

Aspect 1:

Financial Instruments within the scope of Ind AS 109 are subject to impairment loss recognition and measurement based on an approach called Expected Credit Loss (ECL).

ECL approach is expected to consider forward looking information and it is measured based on probability weighted amount that is determined by evaluating a range of possible outcomes.

The widespread contraction in economic activity across the globe due to the rapid spread of COVID-19 is likely to have an impact on the quantification of ECL and classification of financial assets into 3 buckets for recognition and measurement of impairment losses.

Considerations:

In this context, following are important factors to be considered by the preparers.

Measurement of ECL:

Sub -aspect (a):

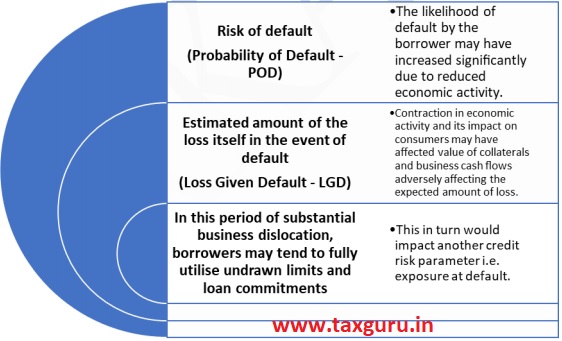

Adverse impact on the business of borrowers or debtors may impact the following credit risk parameters:

Sub -aspect (b):

ECL requirement of Ind AS 109, the measurement of ECL is expected to consider current as well as forecasted macro-economic conditions and more than one scenario.

Considerations:

Entities may need to develop one or more scenarios considering the potential impact of COVID-19.

Sub -aspect (c):

Appendix A of Ind AS 109 states that a financial asset is credit-impaired when one or more events that have a detrimental impact on the estimated future cash flow of the financial asset have occurred.

Evidence that a financial asset is credit-impaired include observable data about various events, for example, the lender(s) of the borrower, for economic or contractual reasons relating to the borrower’s financial difficulty, having granted to the borrower a concession(s) that the lender(s) would not otherwise consider.

Sub -aspect (d):

Entities may also need to consider the impact of any Prudential Regulatory actions to sustain the economy such as loan repayment holidays, reduction in interest rates etc.

Aspect 2:

Disclosure aspects – Ind AS-107:

In respect of Ind AS 107, entities may need to disclose the impact of COVID-19 on various credit related aspects such as methods, assumptions and information used in estimating ECL, policies and procedures for valuing collaterals etc.

If the entity is unable to assess the impact of COVID-19 in estimating the impairment loss due to the inadequacy of information, the same should be disclosed appropriately.

Summary – Bird’s eye view:

| Aspect | Ind AS requirement | Management Action (due to COVID) |

| 1. | ECL Approach | Review of POD; LGD etc. Entities may also need to consider the impact of any Prudential Regulatory actions to sustain the economy such as loan repayment holidays, reduction in interest rates etc. Entities may need to develop one or more scenarios considering the potential impact of COVID-19. |

| 2. | Disclosures | Entities may need to disclose the impact of COVID-19 on various credit related aspects such as methods, assumptions and information used in estimating ECL, policies and procedures for valuing collaterals etc. If the entity is unable to assess the impact of COVID-19 in estimating the impairment loss due to the inadequacy of information, the same should be disclosed appropriately. |

Hedge Accounting:

[Ind AS-109]

Ind AS 109 has elaborate requirements on the application of hedge accounting, which is an accounting choice for the entities.

The requirements, among others, include the qualifying criteria for hedge accounting, how to assess hedge effectiveness and accounting for its impact in the financial statements.

Fair Value Measurements:

[Ind AS-113]

Various Ind AS’s such as Ind AS 109, Ind AS 16, etc. prescribe when to measure an asset or liability at fair value and how to recognise the resultant fair value gains and losses i.e. in Profit or Loss section or Other Comprehensive Income section of Statement of Profit and Loss.

Ind AS 113, lays down certain fundamental principles in respect of Fair value, its definition and how to determine it.

Aspect 1:

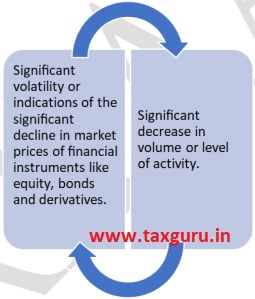

Ind AS 113 recognises the fact that there are different ways in which fair value is determined.

It can be based on observable market price (quoted price in an active market – Level 1) or application of valuation techniques (Level 2 and Level 3) as of the reporting date.

The current financial and capital market environment across the globe has got affected by the rapid spread of COVID-19 and may have developed the following features:

Considerations:

The above features may need adequate management consideration and professional judgment to determine whether the quoted prices are based on transactions in an orderly market.

It may not be always appropriate to conclude that all transactions in such a market are not orderly. Preparers should be guided by the application guidance in Ind AS 113 that indicates circumstances in which the transaction is not considered an orderly transaction.

Aspect 2:

Valuation Techniques:

Considerations:

Preparers using valuation techniques may have to consider the impact of COVID-19 on various assumptions including discount rates, credit-spread/counter-party credit risk etc.

Summary – Bird’s eye view:

| Aspect | Ind AS requirement | Management Action (due to COVID) |

| 1. | Fair value determination – transactions are based in an orderly market | Adequate management consideration and professional judgment to determine whether the quoted prices are based on transactions in an orderly market. |

| 2. | Valuation Techniques | Preparers using valuation techniques may have to consider the impact of COVID-19 on various assumptions including discount rates, credit-spread/counter-party credit risk etc. |

Leases:

[Ind AS-116]

Aspect 1:

Modification of lease:

Due to COVID-19, there may be changes in the terms of lease arrangements or lessor may give some concession to the lessee with respect to lease payments, rent free holidays etc.

Considerations:

Such revised terms or concessions shall be considered while accounting for leases, which may lead to the application of accounting relating to the modification of leases.

Caution:

However, anticipated revisions should not be taken into account.

Aspect 2:

Variable lease payments:

Considerations:

Variable lease payments may be significantly impacted, especially those linked to revenues from the use of underlying asses due to contracted business activity.

Aspect 3:

Discount Rate:

Considerations:

Discount rate used to determine the present value of new lease liabilities may need to incorporate any risk associated with COVID-19.

Aspect 4:

Compensation:

Considerations:

If any compensation is given/declared by the Government to the lessor for providing concession to the lessee, it should be considered whether the same needs to be accounted for as lease modification as per Ind AS 116 or whether assistance received from Government is to be accounted as government grants under Ind AS 20.

Aspect 5:

Onerous contract – Ind AS 37 application:

Considerations:

Entities will need to determine whether as a result of COVID -19, any lease arrangement has become onerous.

Summary – Bird’s eye view:

| Aspect | Ind AS requirement | Management Action (due to COVID) |

| 1. | Revised terms or concessions to lessee | Revised terms or concessions shall be considered while accounting for leases, which may lead to the application of accounting relating to the modification of leases.. |

| 2. | Variable lease payments | Variable lease payments may be significantly impacted, especially those linked to revenues from the use of underlying asses due to contracted business activity. |

| 3. | Discount rate | Discount rate used to determine the present value of new lease liabilities may need to incorporate any risk associated with COVID-19. |

| 4. | Compensation: | If any compensation is given/declared by the Government to the lessor for providing concession to the lessee, it should be considered whether the same needs to be accounted for as lease modification as per Ind AS 116 or whether assistance received from Government is to be accounted as government grants under Ind AS 20. |

| 5. | Onerous contract – Ind AS 37 application | Entities will need to determine whether as a result of COVID -19, any lease arrangement has become onerous. |

Revenue:

[Ind AS-115]

Aspect 1:

Variable consideration:

Due to COVID-19, there could be likely increase in sales returns, decrease in volume discounts, higher price discounts etc.

Considerations:

Under Ind AS 115, these factors need to be considered in estimating the amount of revenue to recognised, i.e., measurement of variable consideration.

Aspect 2:

Disclosures:

Ind AS 115 also requires disclosure of information that allows users to understand the nature, amount, timing and uncertainty of cash flows arising from revenue.

Considerations:

Entities may have to consider disclosure about the impact of COVID-19 on entities revenue.

Summary – Bird’s eye view:

| Aspect | Ind AS requirement | Management Action (due to COVID) |

| 1. | Variable consideration | Due to COVID-19, there could be likely increase in sales returns, decrease in volume discounts, higher price discounts etc. These factors need to be considered in estimating the amount of revenue to recognised, i.e., measurement of variable consideration. |

| 2. | Disclosures | Entities may have to consider disclosure about the impact of COVID-19 on entities revenue. |

Income Taxes:

[Ind AS – 12]

COVID-19 could affect future profits and/or may also reduce the amount of deferred tax liabilities and/or create additional deductible temporary differences due to various factors (e.g., asset impairment).

Considerations:

1. Entities with deferred tax assets should reassess forecasted profits and the recoverability of deferred tax assets in accordance with Ind AS 12, considering the additional uncertainty arising from the COVID-19 and the steps being taken by the management to control it.

2. Management might also consider whether the impact of the COVID-19 affects its plans to distribute profits from subsidiaries and whether it needs to reconsider the recognition of any deferred tax liability in connection with undistributed profits.

3. Management should disclose any significant judgements and estimates made in assessing the recoverability of deferred tax assets, in accordance with Ind AS 1.

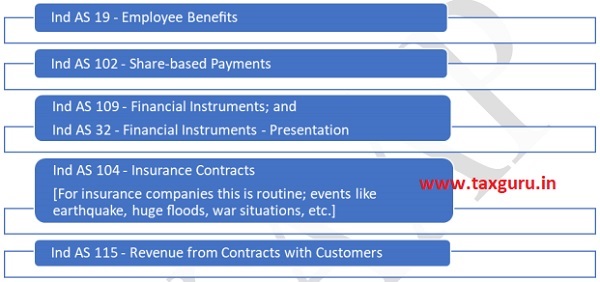

Modifications or Termination of Contracts or Arrangements:

[Relevant Ind AS]

It may also be noted that the entities may modify or terminate certain contracts which may be within the scope of other Ind ASs.

Entities are advised to consider the specific requirements of these standards and guidance note to account for these modifications or terminations.

Consolidated Financial Statements (CFS):

[Ind AS – 110]

Ind AS 110 prescribes that the financial statements of parent and subsidiaries used in the preparation of the consolidated financial statements are usually drawn upto the same date. It may be noted that in any case, the difference between the reporting dates should not be more than three months.

In this context let us also consider the aspects of relevant SA i.e.SA 600 – Using the Work of Another Auditor.

Auditor’s role:

Audit of Consolidated Financial Statements

where Components/component auditors are located in severely affected places:

[SA 600 – Using the Work of Another Auditor]

If the financial information/ financial statements of the components are unavailable, for the year ended March 31, 2020, the maximum difference between the reporting dates cannot exceed the above limits.

The Roles and Responsibilities of the Auditor with regards to Consolidated Financial Statements are as follows:

Paragraph 49 of Guidance Note on Audit of Consolidated Financial Statements, issued by ICAI states as under:

“In a case where the parent’s auditor is not the auditor of all the components included in the consolidated financial statements, the auditor of the consolidated financial statements should consider the requirements of SA 600.”

Interim Financial Reporting:

[Ind AS – 34]

Note:

This Ind AS may be applicable to a limited set of entities.

Aspect 1:

Tax Rate:

The recognition and measurement guidance applicable to annual financial statements equally applies to interim financial statements.

Consideration:

There are typically no recognition or measurement exceptions for interim reporting, although management might have to consider whether the impact of the COVID-19 is a discrete event for the purposes of calculating the expected effective tax rate.

Aspect 2:

Use of estimates:

Ind AS 34, states that there might be greater use of estimates in interim financial statements, but it requires that the information is reliable and that all relevant information is disclosed. Ind AS 34 Interim financial information usually updates the information in the annual financial statements. However, Ind AS 34 requires that an entity shall include in its interim financial report an explanation of events and transactions that are significant to an understanding of the changes in financial position and performance of the entity since the end of the last annual reporting period.

Consideration:

This implies that additional disclosure should be given to reflect the financial impact of the COVID-19 and the measures taken to contain it. This disclosure should be entity specific and should reflect each entity’s circumstances. Where significant, the disclosures required by paragraph 15B in Ind AS 34 should be included.

Aspect 3:

Disclosures:

Consideration:

The preparers may consider making suitable disclosures in the Management Discussion and Analysis section of the Annual Report about the effect of Coronavirus (COVID-19) on the overall risks to the businesses in which the entity is engaged.

Summary – Bird’s eye view:

| Aspect | Ind AS requirement | Management Action (due to COVID) |

| 1. | Tax rate | Management might have to consider whether the impact of the COVID-19 is a discrete event for the purposes of calculating the expected effective tax rate. |

| 2. | Use of estimates | Additional disclosure should be given to reflect the financial impact of the COVID-19 and the measures taken to contain it. This disclosure should be entity specific and should reflect each entity’s circumstances. Where significant, the disclosures required by paragraph 15B in Ind AS 34 should be included. |

| 3. | Disclosures | Preparers may consider making suitable disclosures in the ‘Management Discussion and Analysis section’ of the Annual Report about the effect of Coronavirus (COVID-19) on the overall risks to the businesses in which the entity is engaged. |

Important FAQ’s – Impact of COVID on Financial Statements (prepared as per Ind AS)

FAQ 1:

Accounting of impact of significant changes in foreign exchange rates:

[Ind AS-21]

How will one account for exceptional losses on account of significant changes in forex rates due to COVID-19?

Response:

Till any further guidance is issued by ICAI, the entire amount of forex losses will have to be routed through P&L A/c.

FAQ 2:

[Impact of Ind AS 10 on FS for the year ending 31st March, 2020 and 31st December, 2019]

What will be the impact of Ind AS 10 while preparing FS as at March 31, 2020 and December 31, 2019?

Response:

COVID -19 originated in the province of Wuhan in China in December 2019, thus the condition of COVID was pretty much in existence on both the above-mentioned days.

Therefore, one needs to evaluate the further evidence available post balance sheet date that relates to conditions existing on the balance sheet date. Accordingly, the entity shall apply Ind AS 10.

FAQ 3:

[Application of Impairment losses on Financial Assets – Ind AS 36 + Application of Impairment losses on Non-Financial Assets – Ind AS 109]

How would one account for / classify impairment due to Financial Losses and Impairment due to change in Credit Rating?

Response:

For Financial Assets:

Entity needs to disclose according to the impact on the business model of the Company.

For Non-Financial Assets:

Entity needs to access the impact at the CGU Level.

Note:

In both the cases, whatever assumptions or impacts have been taken into account, it needs to be disclosed.

FAQ 4:

[Physical count on 31st March, 2020 for Inventory and PPE]

How would you conduct physical verification of Inventory or PPE as at March 31, 2020 since there is a lockdown?

Response:

You would have to conduct the physical stock take as on the next best available date whenever the lockdown ceases to continue.

Let’s say the lockdown ceases to continue on April 30, 2020; thus, in the ideal scenario one would take a stock take say on May 1, 2020 and then perform roll backward procedures to arrive at the physical stock as at March 31, 2020.

Also, this should be comprehensively documented in CARO.

Note:

Please also refer the discussion on the relevant SA discussed above under Ind AS 2.

FAQ 5:

[Losses due to COVID – Impact of Ind AS 10]

Whether the losses due to COVID can be deferred in the wake of deferment announced by RBI or other regulatory authorities?

Response:

No Losses due to COVID under any circumstances, can be deferred by any period of time.

One needs to take adequate impact of the losses due to COVID. [Refer FAQ 2]

FAQ 6:

[Bank confirmations/Debtor’s confirmations]

How should we obtain bank confirmations/ debtors confirmations for our audit during COVID?

Will mail communications be acceptable rather than going to the bank/ vendor?

Response:

Initially communications over the electronic mode should be acceptable.

But one needs to assess based on the materiality, once the lockdown is over – independent confirmations should still be obtained.

FAQ 7:

[Voluntary contributions made by GOI towards PF – Ind AS 20]

What should be the accounting treatment of Voluntary Contributions made by GOI towards PF during the lockdown period?

Response:

As per Ind AS 20, the same should be treated as a Government Grant and measured accordingly.

FAQ 8:

[Impact on NBFC’s – RBI Guidelines]

How does the COVID and RBIs deferral payment policy impact the accounts of NBFCs?

Response:

For the period of 3 months which have been granted as a relief, while calculating NPA’s that period must be excluded.

Note:

Please refer the revised RBI guidelines.

FAQ 9:

[Purchase of asset – Ind AS 16/38]

How should one account for assets purchased during the COVID period?

Response:

As per the Companies Act, 2013 if the asset is ready for use before the lockdown and all costs have been incurred to bring it to its present condition and location; then we must start charging depreciation even though the asset has not been actually put to use.

FAQ 10:

[Payment to contractual employees – Ind AS 19]

How should we account for Provisions for contractual employees even though they have not worked for us but as per the Government regulations we have to make payment to them?

Response:

The same needs to be accounted for and expensed off in the P&L as per Ind AS 19.