Case Law Details

Distinct Realty Private Limited Vs DCIT (ITAT Indore)

ITAT Indore held that deduction of cost of land with expenses for exploitation on land duly allowable from the sale consideration before charging tax on the same.

Facts- A search u/s. 132 was carried out on the “Chugh Group” of Indore wherein two documents were seized by authorities. These documents revealed details of a sale transaction of land done by the assessee. The parties to the documents, namely (i) Distinct Realty Private Limited [seller of land], (ii) KMM Real Estate and Constructions Private Limited [purchaser of land], and (iii) Shri Ram, Shri Laxman, Shri Munna, these persons were the original owners of land, and (iv) Shri Vikram Agnihotri, the attorney holder of RLM.

The assessee had agreed/consented to sell land to KMM for a consideration of Rs. 1,28,50,000/-; that KMM shall pay the entire consideration to assessee only and not to RLM; that the consideration shall have two components, namely Rs. 99,20,000/- towards the cost of land and Rs. 29,30,000/- towards surrender of a right.

AO found that the assessee had filed a return of income without declaring the receipt of Rs. 1,28,50,000/- and, therefore, the receipt of Rs. 1,28,50,000/- had escaped assessment.

The assessee claimed the cost of land with expenses for exploitation on land and other in the hands of assessee as Rs. 99,20,000/-. However, AO didn’t believed the cost of land at Rs. 99,20,000/-. CIT(A) noted that the assessee did not file any evidence to prove the cost of Rs. 99,20,000/-. Accordingly, he confirmed the addition made by AO. Being aggrieved, the present appeal is filed.

Conclusion- Held that both of the lower authorities have made a concurrent finding that the assessee has not filed any evidence to prove the cost of Rs. 99,20,000/-. We are also aware that if the land is sold for Rs. 1,28,50,000/-the department cannot tax entire sum of Rs. 1,28,50,000/- as income of assessee; the department has to allow deduction of actual cost incurred by assessee since the impugned land actually belonged to RLM once upon a time and the assessee purchased from RLM and therefore certainly incurred cost whatever amount may be. Therefore, it is most appropriate in the situation to remand this case back to the file of AO who will decide the issue afresh.

FULL TEXT OF THE ORDER OF ITAT INDORE

1. Feeling aggrieved by appeal-order dated 16.01.2023 passed by learned Commissioner of Income-tax (Appeal), National Faceless Appeal Centre, Delhi [“CIT(A)”], which in turn arises out of assessment-order dated 23.12.2016 passed by learned Dy. CIT, Circle 2(1), Indore, [“AO”] u/s 147 read with section 143(3) of Income-tax Act, 1961 [“the Act”] for Assessment-Year [“AY”] 2011-12, the assessee has filed this appeal on following grounds:

“That the Ld. CIT(A) erred in confirming the addition of Rs. 99,20,000/without considering the facts and also without considering that legal rights in the property can be extinguished by an agreement to sell as per Section 2(47) of the Income-tax Act which defines the word ‘transfer’ in relation to capital assets. The company has offered income on the basis of agreement (i.e. MOU) in A.Y. 2010-11. The income double taxed in A.Y.2011-12 is against law of natural justice.

WITHOUT PREJUDICE TO THE ABOVE:

1. The Ld. CIT(A) erred, not to determine, the income which has been offered in the assessment year 2010-11 on the basis of surrender of rights of purchase, as tri party MOU agreement dt. 18.03.2010 and taxed it in A.Y. 2011-12, amounts to double taxation that too after reopening the assessment u/s 148 without examining legal position and without appreciating facts.

2. That the Ld. CIT(A) erred to discard the additional evidence produced, confirming death of three owner of land as per the rule 46A of Income– tax Act, while the rule 46A does fetter the right of assessees to produce evidences but it does not restrain the CIT(A)’s power u/s 254(4) or 250(5).”

2. Brief facts culled out from assessment-order are such that a search u/s 132 was carried on “Chugh Group” of Indore wherein two documents were seized by authorities. These documents revealed details of a sale-transaction of land done by assessee. Let us familiarize ourselves with the parties to the documents, namely (i) Distinct Realty Private Limited [seller of land and also “assessee” in this appeal], (ii) KMM Real Estate and Constructions Private Limited, purchaser of land [“KMM”], (iii) Shri Ram, Shri Laxman, Shri Munna, three persons who were the original owners of land [“RLM”], and (iv) Shri Vikram Agnihotri, the attorney holder of RLM [“Vikram”]. The 1st document is a tri-party MOU dated 18.03.2010 executed among (i) assessee, (ii) KMM and (iii) Vikram, precisely mentioning that the assessee had agreed/consented to sell a land to KMM for a consideration of Rs. 1,28,50,000/-; that KMM shall pay entire consideration to assessee only and not to RLM; that the consideration shall have two components, namely Rs. 99,20,000/- towards cost of land and Rs. 29,30,000/- towards surrender of right (Clause No. 1.1, 1.4 and 1.7 of MOU). The 2nd document is again a tri-party Agreement dated 20.07.2010 executed among (i) RLM, (ii) assessee and (iii) KMM, mentioning that a MOU dated 18.03.2010 was executed; that the assessee has received full consideration from KMM; and that RLM has executed a sale-deed dated 24.06.2010 in favour of KMM as per instruction of assessee (Clause No. 2, 3 and 4 of Agreement). On the basis of corroborative contents of these two documents seized during search, the AO arrived at a conclusion that the assessee had sold the subject land on 24.06.2010 (date of sale-deed) for Rs. 1,28,50,000/- to KMM. Since the date 24.06.2010 was falling in Previous Year 2010-11 relevant to AY 2011-12, the AO verified case-records of assessee pertaining to AY 2011-12. On verification, the AO found that the assessee had filed return of income declaring income of Rs. 2,77,320/- from business but without declaring the receipt of Rs. 1,28,50,000/- and, therefore, the receipt of Rs. 1,28,50,000/- had escaped assessment. Accordingly, the AO after taking approval from JCIT, issued notice u/s 148 dated 02.11.2015 and conducted proceedings u/s 147. During proceeding, the assessee filed a reply dated 15.06.2016, re-produced by AO at Page No. 3 of assessment-order. In this reply, the assessee filed a copy of purchase-agreement dated 07.02.2008 (or 04.02.2008) as an evidence to show that the subject land was purchased in the year 2007-08 from RLM. The assessee submitted that the cost of land with expenses for exploitation on land and others in the hands of assessee was Rs. 99,20,000/- upto AY 2010-11. The assessee also submitted that as per MOU dated 18.03.2010, the assessee’s share, namely the surrender value of right over and above the cost was fixed at Rs. 29,30,000/- and the assessee had already offered it in Previous Year 2009-10, AY 2010-11 on the basis of MOU dated 18.03.2010. However, the AO held that the MOU dated 18.03.2010 was in future tense and the sale-deed was actually executed on 24.06.2010 (which is also mentioned in tri-party Agreement dated 20.07.2010), thus the transaction of sale was actually done on 24.06.2010. Accordingly, the AO insisted that the issue actually related to previous-year 2010-11, AY 2011-12 (Para No. 1 / Page No. 4 of assessment-order). The AO also accepted the assessee’s version that the receipt of Rs. 29,30,000/- had been shown in the return of income of AY 2010-11 (Para No. 2 / Page No. 4 of assessment-order). But with regard to the cost of land, on perusal of Clause No. 2 of the aforesaid purchase-agreement dated 07.02.2008, the AO found that the assessee is stated to have purchased land for Rs. 62,00,000/- and paid a sum of Rs. 12,00,000/- (partly through cheque and partly in cash) by 26.12.2007 and remaining 50,00,000/- was to be paid by 31.12.2008. But the assessee could not file any supporting document to prove the payment of Rs. 62,00,000/- to RLM. Due to this reason, the AO did not believe the cost of land at Rs. 99,20,000/-, so also did not believe that the component of Rs. 99,20,000/- (forming part of consideration of Rs. 1,28,50,000/-) was towards cost of land. Accordingly, the AO again show-caused the assessee vide notice dated 08.11.2016. In response, the assessee filed reply dated 17.11.2017 which is re-produced by AO on Page no. 7 of assessment-order. In this reply, the assessee re-iterated that the assessee sold only right in land vide MOU dated 18.03.2010 and out of total consideration of Rs. 1,28,50,000/-, the assessee’s share was only Rs. 29,30,000/- which the assessee had rightly offered in AY 2010-11 on the basis of MOU. The assessee further submitted that two parties, namely Ram and Munna (out of RLM) had expired. However, the AO was not satisfied with reply of assessee, who noted that the assessee did not file any proof of death of Ram and Munna, further the assessee did not produce even the surviving owner Laxman. Then, the AO deputed inspector to the addresses of RLM but could not find any satisfactory reply from their legal heirs/relatives. Therefore, the AO noted his dis-satisfaction with regard to the identity of RLM. Furthermore, the assessee also filed bank statement which the AO found incomplete or not substantiating the claim of assessee. Finally, the AO was not satisfied with assessee’s version with regard to Rs. 99,20,000/- and therefore made addition by concluding thus:

“As per the agreement dated 10.07.2010, sale-deed was executed in AY 2011-12 and hence in absence of verification of claim of assessee that Rs. 99,20,000/- has been received for cost of land which was paid by it to three persons Shri Ram, Shri laxman and Shri Munna in F.Y. 2007-08, Rs. 99,20,000/- is being added to total income of assessee as amount received from KMM Real Estate Private Limited as per MOU dated 18.03.2010. The transaction was completed in F.Y. 2010-11 and therefore this amount is to be taxed in A.Y. 2011-12. Rs. 29,30,000/- as mentioned in MOU has already been offered by assessee in A.Y. 2010-11. Thus, no addition is being made for this amount in this A.Y.”

3. Aggrieved by action of AO, the assessee carried matter in first-appeal. During first-appeal, the assessee submitted that all three original owners, RLM, had expired and in support the assessee filed death-certificates which are accepted by CIT(A) in Para No. 2 of appeal-order. But then CIT(A) noted that the assessee did not file any evidence to prove the cost of Rs. 99,20,000/-. Accordingly, he confirmed the addition made by AO by concluding thus:

“The assessee, having failed to produce any documentary evidence in support of its contention that the amount of Rs. 99,20,000/-was the cost of land paid by it to the three dead persons, Sri Ram, Sri Lakshman and Mr. Munna in the FY 2007-08, is liable to LTCG tax on the amount of Rs. 99,20,000/- in the FY 2011-12. In the absence of copies of bank statements evidencing the payment of Rs. 99,20,000/- to the so called ‘original owners’ of the land, the contention of the assessee raised in ground nos. 1 & 2 are not acceptable. Therefore, the assessment of LTCG of Rs. 99,20,000/- in the hands of the assessee for the AY 2011-12 is confirmed.”

4. Still aggrieved by order of CIT(A), the assessee has come in next appeal before us.

5. We have heard the learned Representatives of both sides at length and also perused the material held on record including the orders of lower authorities.

6. At the outset we would like to record that the veracity of the two documents seized during search, which are the very basis of addition by department, namely MOU dated 18.03.2010 and Agreement dated 20.07.2010, are not disputed by assessee. Hence, those two documents are very much authentic and acceptable to assessee without any dispute. It is also a fact that the assessee himself received/collected entire sum of Rs. 1,28,50,000/- from KMM; the original owners RLM did not receive/collect any amount from KMM. Thus, as far as the receipt side is concerned, there is no dispute. Now, the dispute between assessee and department is with regard to the taxation of Rs. 99,20,000/- which is a component of the sum of Rs. 1,28,50,000/-. The issue of Rs. 99,20,000/- has become complicated and it appears that it is the assessee who is responsible for this. Firstly, the purchase-agreement dated 07.02.2008, even if taken as true, specifies purchase-consideration of Rs. 62,00,000/- only to be paid by assessee to RLM. Then, in such a situation, how the assessee is claiming the cost of land at Rs. 99,20,000/-. Although the assessee is a company and maintaining statutory books of account but not providing the documentary evidences to authorities and simply making claims after claims in different voices and that is why the authorities are moving around the circle. In fact, we are also getting confused and considerable time had to be applied in drafting order. Let us discuss the different claims made by assessee qua the cost of land at Rs. 99,20,000/-:

(i) In reply dated 15.06.2016, re-produced by AO on Page No. 3 of assessment-order, the assessee made following claim before AO:

“4) Cost of land with expenses for exploitation on land and others in the hands of assessee company is Rs. 99,20,000/- upto A.Y. 2010-11”

(ii) In a separate sheet titled “Statement of Facts” filed by assessee to CIT(A) as Annexure to Form No. 35, the assessee claimed:

“2…… The working of income offered in assessment-year 2010-11 is as under:-

|

Agreed consideration of land for surrender of all its rights of assessee company as per MOU dated 18/03/2010 |

Rs. 1,28,50,000 |

| Less: Cost of consideration and expenses (As per MOU) in the hands of assessee company | Rs. 99,20,000 |

| Net Income in the hands of assessee company offered in AY 2010-11 | Rs. 29,30,000 |

(iii) In a Written-Submission filed to us in Paper-Book, following claims are made:

Page No. 2 of Paper-Book:

“3. That the party of the first part i.e. Distinct Realty Pvt. Ltd. could have paid with interest to parties of third part Mr. Rama, Mr. Munna and Mr. Laxman Amount Rs. 99,20,000/- shown as advance in the books, as the sale-deed was not executed/registered in the name of assessee company, till A.Y. 2010-11”

Page No. 6 of Paper-Book:

“That the section 2(47) of Income-tax Act, which defines the word “transfer” in relation to capital assets. The assets can be capitalized on execution/registered of sale deed but here the assessee company offered the income on the basis of MOU (for surrender of rights on land) dated 18/03/2010, as such the sale deed was not registered in the name of assessee company, showing continuously advance to owner of land since A.Y. 2008-09, it’s not capitalized in the books of account of the assessee company.”

(iv) The CIT(A) has understood assessee’s case as if the assessee had paid Rs. 99,20,000/- to the original owners RLM in the FY 2007-08 itself:

Para No. 2 / Page No. 2 of appeal-order:

“2………. It is also contended in the “Statement of facts” that the cost of land of Rs. 99,20,000/- was paid by the assessee to the “original land owners” in the FY 2007-08 itself and hence the assessee is not liable to LTCG tax on this amount. This contention of the assessee has been verified by me and the result of verification is recorded below:

……”

Thereafter, the CIT(A) has proceeded to adjudicate on the basis that the assessee paid Rs. 99,20,000/- to the original owners in the FY 2007-08 itself.

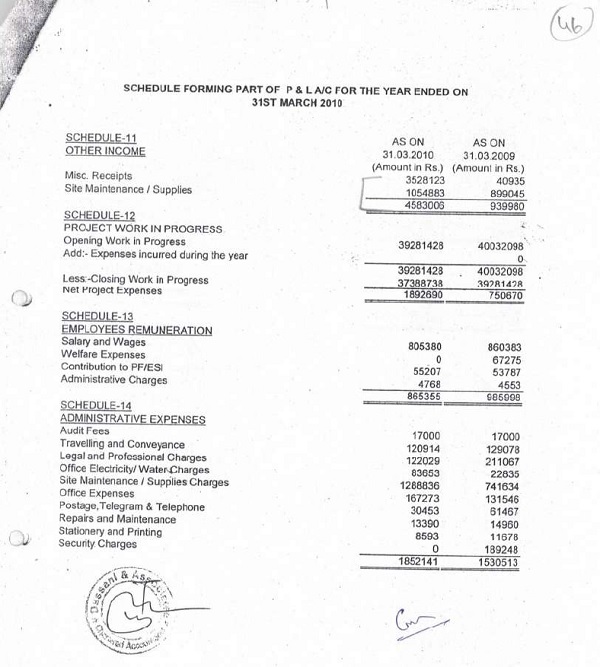

7. Thus, the assessee claimed “Cost of land with expenses for exploitation on land and others” before AO. Then, it claimed “Cost of consideration and expenses (As per MOU)” in the Statement of Facts filed to CIT(A) and the CIT(A) has gained an understanding that the assessee paid Rs. 99,20,000/- to original owners in the year 2007-08 itself and accordingly proceeded for adjudication of first-appeal. Now, before us, it is stated that “the assessee has shown the amount of Rs. 99,20,000/- as advance in books of account and not capitalized because the registration was pending”. Thus, the assessee is not making its position clear. When the assessee is a statutory body incorporated under Companies Act and maintaining statutory books of account, why it is not proving the “expenses on exploitation and others” incurred by it or the cost incurred by it being shown as “advance” in accounts? We fail to understand the approach of assessee. The matter does not stop here. Interestingly, we find that the assessee had claimed before AO that it had declared the receipt of Rs. 29,20,000/- in AY 2010-11 and the AO has accepted this version of assessee too but the authenticity of this claim is also doubtful. The assessee has filed a copy of the audited accounts in Paper-Book. On Page No. 46, the assessee has filed “Schedule-11-Other Income” of financial year 2009-10, AY 2010-11, duly signed and sealed by M/s & Associates, Chartered Accountants and auditors, this sheet is scanned and reproduced below:

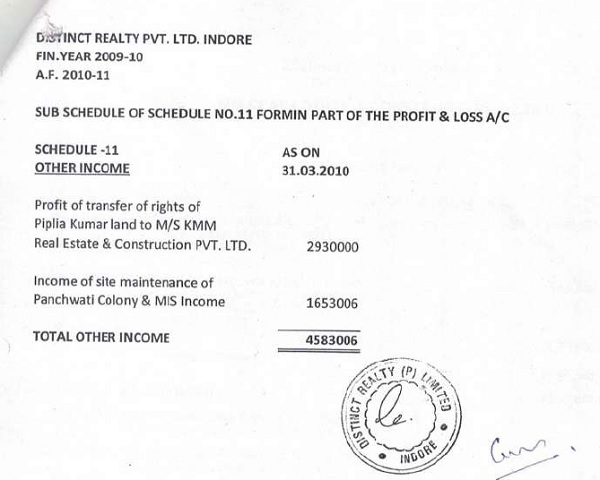

Another sheet titled as “Sub-schedule of Schedule No. 11 forming part of the Profit & Loss A/c” signed and sealed by assessee and not by auditors is placed at Page No. 33 of Paper-Book, the same is also scanned and reproduced below:

Another sheet titled as “Sub-schedule of Schedule No. 11 forming part of the Profit & Loss A/c” signed and sealed by assessee and not by auditors is placed at Page No. 33 of Paper-Book, the same is also scanned and reproduced below:

On perusal and comparison of two sheets, one can easily discern a total mis-match. While in the first-sheet which is audited by auditors, the breakup of receipt of Rs. 45,83,006/- shown in P&L A/c was “Misc. Receipts of Rs. 35,28,123 (+) Site maintenance/supplies of Rs. 10,54,883/-”, in the second-sheet which is signed only by assessee and not by auditors, it has changed to “Profit of transfer of rights of Piplia Kumar Land to M/s KMM Real Estate & Construction Pvt. Ltd. – Rs. 29,30,000/- (+) Income of site maintenance of Panchwati Colony & MIS income – Rs. 16,53,006/-”. We fail to understand how can it be so? It certainly requires a probe. It seems that the AO has accepted assessee’s version that the receipt of Rs. 29,30,000/-had been declared in P&L A/c of financial year 2009-10 related to AY 201011 because of this new sheet. One may empathically say that when the AO has accepted the assessee’s version, how the ITAT can raise a question on same? But it is an accepted law that the ITAT is the last fact-finding authority and we have a sacred duty to give a correct finding. Further, the observation made by us is very much relevant for proper adjudication of the controversy in hand and unless we report the same, the AO would not be able to decide the assessee’s case when the issue goes back to him.

8. Having said so, we now come back to the final disposal of controversy before us. We find that both of the lower authorities have made a concurrent finding that the assessee has not filed any evidence to prove the cost of Rs. 99,20,000/-. We are also aware that if the land is sold for Rs. 1,28,50,000/-the department cannot tax entire sum of Rs. 1,28,50,000/- as income of assessee; the department has to allow deduction of actual cost incurred by assessee since the impugned land actually belonged to RLM once upon a time and the assessee purchased from RLM and therefore certainly incurred cost whatever amount may be. Therefore, it is necessary to ascertain the correct cost incurred by assessee and give deduction to assessee. At the same time, we also note that it’s assessee onus to prove conclusively the amount of cost incurred. We also find that all three original owners, namely RLM from whom the land was purchased, have already expired and their death certificates are filed in the Paper-Book. We feel that the legal heirs/relatives of RLM have not co-operated the department in earlier proceeding and it would be unreasonable to expect any assistance from them at this stage for the transactions done by deceased RLM. However, as mentioned earlier, we note that the assessee is a company and maintaining books of accounts in terms of statutory provisions of Companies Act as well as Income-tax Act. Therefore, the assessee is having complete documents and information from which it can easily file documentary evidences to AO to prove cost without any difficulty. Therefore, it is most appropriate in the situation to remand this case back to the file of AO who will decide the issue afresh. Needless to mention that the AO would give adequate opportunities to assessee and the assessee shall avail those opportunities; in the event of any failure by assessee without just cause, the AO shall be free to take a decision as the situation warrants. We direct the assessee to submit all documentary evidences including production of audited balance-sheets of past years, books of accounts and accounting entries therein, as may be required by AO, to prove its claims. The assessee shall make clear submissions with documentary evidences so that there remains no ambiguity on the factual aspects and the litigation does not multiply again. The AO shall also take a decision afresh without being influenced by his earlier order.

9. Resultantly, this appeal of assessee is allowed for statistical purpose in terms indicated above.

Order pronounced in the open court on 07.08.2023.