Case Law Details

Deputy Commissioner Anti-Evasion Vs Geetpriya Hotels And Resorts Pvt. Ltd. (Rajasthan High Court)

1. The present Sales Tax Revision Petition has been filed against the impugned order dated 27.09.2017 passed by the Appellate Authority and order dated 18.12.2019 passed by the Rajasthan Tax Board, Ajmer.

2. The contention of counsel for the petitioner-Revenue is that as assessee has applied with the State Excise Department for the liquor licence under the category of ‘Three Star & More’ hotel, estoppel is created and for the purposes of charging commercial tax, rate applicable on ‘Three Star & More’ category will be applicable as a result of which 5% tax was enhanced to 14% and different interest and consequently penalty will be applicable.

3. It is contended that learned Tribunal has not considered the application form by with the assessee with the State Excise Department.

4. Per contra learned counsel for the respondent-assessee has submitted that their hotel is not categorized under any star category by Ministry of Tourism which is the Competent Authority to give such categorization. He has further submitted that on account of pressure imposed by the State Excise Department he had deposited the differential duty under the category of ‘Three Star & More’ but with a protest application which has not been decided by the Department till date and still is alive.

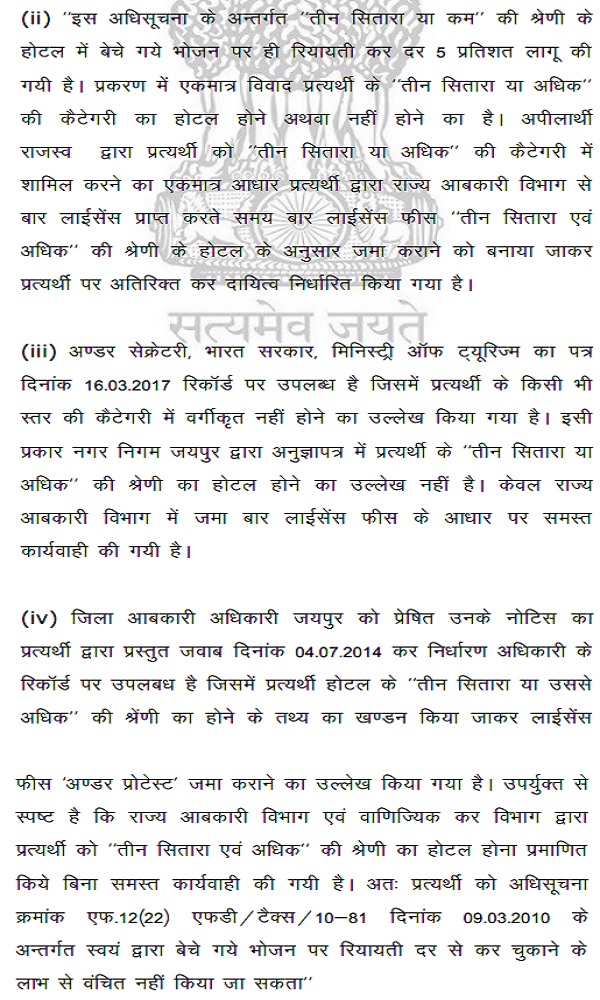

5. Keeping in consideration the finding of the Tax Board which reproduced as under:-

6. Further taking into consideration the fact that there is a concurrent finding of fact and there is no star category given/sanctioned by the Competent Authority i.e. Ministry of Tourism and application was filed with under a protest tag, we are of the opinion that the impugned orders passed by the Authorities below require no interference.

7. Hence, the present Sales Tax Revision Petition is dismissed.

Stay application also stands disposed of.