Case Law Details

T.V.S. Motor Company Limited Vs Commissioner of Central Excise (CESTAT Chennai)

M/S. TVS Motor Company (Petitioner) had appealed against the Tribunal’s Final Order No. 652 of 2012 dated June 13, 2012. The Petitioner had appealed in the Supreme Court against the order dated June 13, 2012, and the Court vide order 2015 (37) S.T.R. J177 (S.C.) disposed of the matter. The Petitioner then again appealed in the Tribunal vide Service Tax Appeal No. 41077 of 2013 and considering the connection between the two appeals, the Tribunal had passed a common Final Order Nos. 42277-42278 / 2021.

In this case, the Petitioner received Technical Consultancy Services and Project Consultancy Services from various service providers who were not having their offices in India. As per Section 68(2) of the Finance Act, 1994, read with Rule 2(1) (D) (IV) of the Service Tax Rules, 1994, if the service provider does not have an office in India and his usual place of residence is in a country other than India, then the service receiver who has his business establishment in India is liable to pay Service Tax on behalf of the service provider. The Petitioner thus paid Service Tax on the value of service charges under reverse charge mechanism though they were the service recipients. While paying the Service Tax, they did not include the tax deducted at source (TDS) for determining the taxable value.

The Petitioner, to substantiate, the case raised three issues to the Tribunal. Firstly, whether the Petitioner is liable to pay Service Tax under reverse charge mechanism in terms of Section 66 of the Finance Act, 1994 read with 2(1) (D) (IV) of the Service Tax Rules, 1994, before its very introduction. Secondly, whether the Petitioner is liable to pay Service Tax on the TDS portion deducted while paying the consideration to the service provider.

The Honorable Tribunal took cognizance of both the issues and opined that, the first issue is settled by the decision of the Hon’ble High Court of Bombay in the case of Indian National Ship-owners Association v. Union of India [2008 (12) TMI 41 – BOMBAY HIGH COURT, dated March 23, 2009]. The Honorable High Court held that the liability to pay Service Tax under reverse charge mechanism would arise only after the introduction of Section 66A of the Finance Act with effect from April 18, 2006. The said decision was upheld by the Hon’ble Supreme Court in Union of India v. Indian National Ship-owners Association [2009 (12) TMI 850 – SC ORDER].

In the second issue, the Tribunal held that TDS is deposited to the Government out of a statutory liability and the amount so deducted cannot be taken as consideration for services rendered.

Further, the amount of tax deducted depends upon the rate in force and it wholly depends upon the law prevailing in the direct tax regime.

The Honorable Tribunal relied on the decision in the case of M/s. Hindustan Oil Exploration Co. Ltd. v. Commissioner of GST & Central Excise [2019 (2) TMI 1248 – CESTAT CHENNAI] in which it was categorically stated that when the TDS amount has been borne by the assessee and only the consideration for the services as agreed upon by the parties has been paid to the service provider, the TDS amount cannot be included in the taxable value for determining the Service Tax liability, thus the demand for the entire period (March, 2004 to September, 2007 and October, 2006 to September, 2007) cannot sustain and requires to be set aside – the issue was also decided in favour of the Petitioner.

FULL TEXT OF THE CESTAT CHENNAI ORDER

The appeal in Service Tax Appeal No. 219 of 2009 was originally disposed of by this Tribunal vide Final Order No. 652 of 2012 dated 13.06.2012. By the said order, the Tribunal had held as under:

“22. In the light of the aforesaid discussions it is ordered:-

(1) That there shall not be levy of service tax on the engineering consultancy services availed from foreign consultant abroad prior to 18.04.2006.

(2) There shall be levy of service tax at the applicable rate for the period 19.04.2006 to 30.09.2007 on the gross amount of consideration inclusive of income tax deducted at source involved in availing engineering consultancy service availed under Section 66A of the Act.

(3) Adjudication order gets modified by the extent indicated in (1) and (2) above.

(4) Cum tax benefit if any admissible shall be granted in accordance with law.

(4) There shall not be any penalty under Section 78 of Finance Act, 1994.”

(Emphasis applied)

1.2 Against such order, the appellant preferred appeal before the Hon’ble Supreme Court and vide judgement reported in 2015 (37) S.T.R. J177 (S.C.), the Hon’ble Supreme Court remanded the matter:

“2. In response to the above notice, the respondent has appeared.

3. Learned Counsel for the appellant has no objection if the matter is remanded to the Customs, Excise and Service Tax Appellate Tribunal for fresh hearing and disposal of the appeal being Appeal No. ST/219/2009. We order accordingly.

4. Appeal is disposed of as above. No costs.”

(Emphasis applied)

2. The issue in Service Tax Appeal No. 41077 of 2013 is connected to the issue in Service Tax Appeal No. 219 of 2009. Hence, both the appeals are heard together and are disposed of by this common Order.

3.1 Brief facts are that the appellants are engaged in the manufacture of motor vehicles and IC engines. During the period from March 2004 to September 2007, appellants received Technical Consultancy Services and Project Consultancy Services from various service providers who were not having their offices in India. As per Section 68(2) of the Finance Act, 1994, read with Rule 2(1)(d)(iv) of the Service Tax Rules, 1994, if the service provider does not have an office in India and his usual place of residence is in a country other than India, then the service receiver who has his business establishment in India is liable to pay Service Tax on behalf of the service provider. The appellants thus paid Service Tax on the value of service charges under reverse charge mechanism though they were the service recipients. While paying the Service Tax, they did not include the tax deducted at source (TDS) for determining the taxable value.

3.2 The Department was of the view that the TDS portion has also to be included in the taxable value for discharging Service Tax. Show Cause Notice No. 10/2007 dated 19.11.2007 was issued proposing to demand the differential Service Tax along with interest and also for imposing penalty. After due process of law, the Original Authority vide Order-in-Original No. 01/2009 dated 05.01.2009, confirmed the demand along with interest and imposed penalty under Section 78 of the Finance Act, 1994. Hence, the appeal in Service Tax Appeal No. 219 of 2009.

4. The Tribunal vide Final Order No. 652 of 2012 dated 13.06.2012 confirmed the demand in respect of TDS amount and remanded to the Original Authority for the limited purpose of verifying and allowing the claim of cum-tax benefit, if any. The matter was taken up by the Original Authority vide de novo Order-in-Original No. 03/2013 dated 30.01.2013 and the Original Authority held that the appellant is not entitled to the benefit of cum-tax. Aggrieved by such order and the confirmation of demand in this regard, the appellant has filed the appeal in Service Tax Appeal No. 41077 of 2013.

5. When the matter was taken up for hearing, Shri R. Sai Prashanth, Learned Counsel, appeared on behalf of the appellants and Ms. K. Komathi, Learned Authorized Representative, appeared on behalf of the Department.

6. The period involved, the details of the impugned orders, Show Cause Notice and the demands in these two appeals are given in the table below:

| Appeal No. | ST/219/2009 | ST/41077/2013 |

| Period | March 2004 to September 2007 |

October 2006 to September 2007 |

| Impugned Order-in-Original |

01/2009 dated 05.01.2009 | 03/2013 dated

30.01.2013 |

| Show Cause Notice | 10/2007 dated 19.11.2007 | |

| Demand | Rs.1,65,53,563/- | Rs.50,50,404/- |

| Penalty imposed | Rs.1,65,53,563/- | – |

7. The two main issues that arise for our consideration in these appeals are:

(1) whether the appellants are liable to pay Service Tax under reverse charge mechanism in terms of Section 66 of the Finance Act, 1994 read with 2(1)(d)(iv) of the Service Tax Rules, 1994, before the introduction of Section 66A of the Finance Act; and

(2) whether the appellants are liable to pay Service Tax on the TDS portion deducted while paying the consideration to the service provider.

7.1 The first issue as to whether the appellants are liable to pay Service Tax under reverse charge mechanism before the introduction of Section 66A in the Finance Act, 1994 is settled by the decision of the Hon’ble High Court of Bombay in the case of M/s. Indian National Shipowners Association v. Union of India reported in 2009 (13) S.T.R. 235 (Bom.). The Hon’ble High Court held that the liability to pay Service Tax under reverse charge mechanism would arise only after the introduction of Section 66A with effect from 18.04.2006 to the Finance Act, 1994. The said decision was upheld by the Hon’ble Supreme Court as reported in 2010 (17) S.T.R. J57 (S.C.).

7.2 Respectfully following the same, we have no hesitation to hold that the demand of Service Tax till 18.04.2006 cannot sustain and requires to be set aside, which we hereby do.

8. The second issue is as to whether Service Tax is leviable on the amount of TDS borne by the appellant while grossing up of the consideration payable to the service provider.

9.1.1 Learned Counsel for the appellant adverted to the Advisory Agreement entered between the appellant-company and the foreign service provider. As per the terms of the agreement, the consideration payable was agreed as net of all duties and taxes applicable and payable. Therefore, in terms of the agreement, the consideration agreed will be paid by the appellant to the service provider and any amount of tax payable in India shall be borne by the appellant. As per Section 195 of the Income Tax Act, 1961, the appellant is liable to deduct income tax thereon (TDS) at the stipulated rate on the aforesaid payments. Since as per the agreements, the appellant had to bear all taxes including TDS, the amount of consideration agreed as per the agreement was grossed up and the TDS which is to be borne by the appellant was worked out in terms of Section 195A of the Income Tax Act. He submitted an illustration of the said calculation, as given below:

| Particulars | Amount (in Rs.) |

| Amount of consideration as per the agreement for which invoice is raised by the service provider (A) | 100 |

| Applicable TDS rate (B) | 10% |

| Grossed up amount for the purpose of TDS [C=A*100/(100-B)] (computation in terms of Section 195A) | 111 |

| TDS on grossed up amount (C*10%) | 11 |

9.1.2 That from the above illustration, it is clear that the grossing up of the amount of consideration to Rs.111 is only for the purpose of the Income Tax Act and the consideration for Service Tax purposes continues to remain Rs.100. TDS being a statutory liability was borne by the appellant and never charged to the foreign service provider.

9.1.3 During the relevant period, as per Section 2(1)(d)(iv) of the Service Tax Rules, 1994, the appellant was liable to pay Service Tax on the aforesaid payments under reverse charge mechanism. In terms of Section 67 of the Finance Act, 1994, value for the purpose of Service Tax is the actual amount charged by the service provider. Accordingly, during the period March 2004 to September 2007, the appellant discharged Service Tax on the actual amount of consideration agreed upon and paid to the service provider.

9.2.1 It is stressed by the Learned Counsel for the appellant that the amount of consideration is grossed up by the appellant only for the purpose of payment of TDS and the TDS liability is fully borne by the appellant. It is very much clear from the Show Cause Notice itself that the TDS is borne by the appellant. That the demand of Service Tax on the TDS portion is without any legal basis. The issue is no longer res integra and has been settled in favour of the assessee by the Tribunal in the following decisions:

(i) M/s. Hindustan Oil Exploration Co. Ltd. v. Commr. of G.S.T. & C.E. [2019 (2) TMI 1248 – CESTAT Chennai];

(ii) M/s. Indian Additives Ltd. v. C.C.E. & S.T. [2018 (6) TMI 523 – CESTAT Chennai];

(iii) M/s. Magarpatta Township Development and Construction Co. Ltd. v. C.C.E. [2016 (3) TMI 811 – CESTAT Mumbai];

(iv) M/s. Garware Polyester Ltd. v. Commr. of Central Tax & Cus. [2017 (5) TMI 1142 – CESTAT Mumbai];

(v) M/s. Centre for High Technology v. C.S.T. [2018 (8) TMI 243 – CESTAT New Delhi]

9.2.2 He argued that the Department having accepted the fact that the TDS is borne by the appellant, cannot demand tax on such value when the same has not been passed on as consideration to the service provider.

9.2.3 The demand for the entire period covered in the Show Cause Notice is the differential tax after including the TDS amount in the taxable value. He therefore contended that even for the period after 18.04.2006, the appellant would not be liable to pay Service Tax as the demand is only on the TDS amount borne by the appellant.

9.3.1 Learned Counsel put forward arguments on the ground of limitation also. He submitted that the question as to whether an assessee was liable to pay Service Tax prior to introduction of Section 66A to the Finance Act, 1994 is an interpretational one and there were several litigations pending before various fora. Being an interpretational issue, the extended period of limitation is not invokable. Furthermore, that the appellant had discharged the Service Tax liability without including the TDS amount under the bona fide belief that the same is not includible in the taxable value since the TDS amount was borne by the appellant.

9.3.2 That it is merely alleged in the Show Cause Notice that the appellant failed to pay the differential Service Tax with an intention to evade payment of Service Tax. It is also alleged that the appellant suppressed the fact of deduction of TDS from the value of service charges. He stated that the deduction of TDS as well as payment of the same under the provisions of the Income tax Act is fully reflected in the accounts maintained by the appellant. The appellant has discharged Service Tax on the consideration that has been paid to the service provider. This being so, the allegation that the appellant has suppressed facts with an intention to evade payment of Service Tax is without any legal or factual basis.

9.3.3 He argued that the demand raised invoking the extended period of limitation cannot be sustained and the penalties may also be set aside.

10.1 Learned Authorized Representative appearing for the Department supported the findings in the impugned order. She adverted to Section 67 of the Finance Act, 1994, which reads as under:

“(1) Subject to the provisions of this Chapter, where service tax is chargeable on any taxable service with reference to its value, then such value shall, —

(i) in a case where the provision of service is for a consideration in money, be the gross amount charged by the service provider for such service provided or to be provided by him;….”

10.2 That from the above Section itself it is clear that Service Tax has to be paid on the gross amount charged. Since the appellants have grossed up the value along with TDS, the TDS amount has to be included in the taxable value for discharging their Service Tax liability. She argued that the demand raised is legal and proper.

11. Heard both sides.

12. The relevant part of the Advisory Agreement entered into between the parties (the appellant and the foreign service provider) reads as under:

“Section 2. Fixed Fee and Performance Fee

In consideration for the Services hereunder, Counterpart shall pay Advisor the following compensation:

2.1 Upon signature of this Agreement, the Counterpart will pay the Advisor a Fixed Fee of 15000 US dollors

2.2 The Counterpart shall also pay to Advisor a “Performance Fee” upon the earlier of (1) sale of rights to CERs or (2) issuance of CER’s resulting from the Project by the CDM Executive Board. At Advisor’s option, the Performance Fee shall either be paid:

(i) US Dollors, in an amount equal to 10% (ten Percent) of the sales price for rights to any CERs sold by Counterpart resulting from the Project, directly or indirectly. For purposes of calculation of the Performance Fee, CERs will be considered as having been “sold” if, in connection with the transaction involving such CERs (i) revenues are generated; (ii) debts are offset or renegotiated; (ii) funds do not have to be invested; or (iv) Counterpart (or a successor or assignee thereof) in other way benefits from such CERs being recognized as existing and/or tradable), or

(ii) In CER’s (or rights to CER’s) equal to 10% (ten percent) of the number of CER’s issued or expected to be issued by the CDM Executive Board resulting from the Project. Advisor will have may execute the option at any time by delivery to Counterpart of written notice of Advisor’s election to take payment of the Performance Fee in CER’s. If CER’s have been issued to Counterpart when such notice is issued, Counterpart will, within 5 days, transfer the CER’s according to Advisor’s instruction. If CER’s have not been issued when Counterpart receives notice of Advisor’s election to receive payment in CER’s, the CERs will be transferred to Advisor directly upon issuance by the CDM Executive Board pursuant to the relevant transfer instruction.

.

.

.

2.4 The Fixed Fee and the Performance Fee shall be transferred by Counterpart net of any withholding or similar taxes. In case such withholding tax is applied, the amount to be paid shall be increased such that the amount received by Advisor will be equal to the amount that would be due in absence of such tax.”

(Emphasis applied)

13. From the above conditions in the agreement, it can be seen that the service provider is to be paid the actual consideration agreed for the service rendered. It is also agreed that TDS amount cannot be deducted from the consideration so agreed. In other words, it is agreed by the parties that TDS has to be borne by the appellant who is the service recipient.

14.1.1 Section 67 of the Finance Act, as reproduced above, would show that Service tax is payable on the gross amount charged by the service provider. The Department does not dispute that the TDS amount is borne by the appellant. The case of the Department is that when the TDS amount is grossed up with the actual consideration agreed between the parties, the TDS portion would become part of the consideration and has to be included in the taxable value.

14.1.2 Section 195 of the Income Tax Act, 1961, is basically concerned with the Tax Deducted at Source (TDS) for the non-residents. The Act lays out a provision to avoid revenue loss as a result of tax liability in the hands of a foreign resident, by deducting such tax at source from the payments made to them. This is to ensure that the tax due from non-residents is secured at the earliest point of time so that there is no difficulty in its collection for the reason that the non-resident may sometimes have no assets in India. Failure to do so will render the person liable to penalty.

14.1.3 On perusal of Section 195, it uses the word “any sum chargeable under the provisions of the Act”. Unlike other provisions in Chapter XVII (TDS provisions), Section 195 uses “any sum” instead of “any income by way of”. This would mean any sum that is paid to the non-resident which bears the character of income and gross amount, the whole of which may or may not represent income or profits. It is also a requirement that the document should mention that the Indian Counterpart of the transaction would bear the tax for deducting TDS by grossing up the value. To comply with this provision, as per the accounting practice, the appellant has grossed up the TDS amount with the actual consideration. Section 195A of the Income Tax Act reads as under:

“where under an agreement or other arrangement, the tax chargeable on any income referred to in the foregoing provisions of this Chapter is to be borne by the person by whom the income is payable, then, for the purposes of deduction of tax under those provisions such income shall be increased to such amount as would, after deduction of tax thereon at the rates in force for the financial year in which such income is payable, be equal to the net amount payable under such agreement or arrangement.”

14.1.4 The TDS is paid / deposited to Government by the appellant out of a statutory liability. Such activity of deducting the tax at source is a legal obligation and the amount so deducted cannot be taken as consideration for services rendered. The amount on which the parties have reached a consensus ad idem can only be the consideration for the services. Further, the amount of tax deducted varies and depends upon the rate in force. There is no agreement by the parties with regard to the amount of TDS that has to be deducted. It wholly depends upon the law prevailing in the direct tax regime.

14.2.1 Section 2(d) of the Indian Contract Act, 1872, defines “consideration”. Compliance with statutory provisions cannot be considered as rendering of service. Again, “consideration” is not doing something which a person is bound by law to do. When the amount is paid at the will of a person not party to the agreement, such amount does not bear the character of consideration. It has to be noted that in the present case, there is no consent from the foreign counterpart to reduce his consideration by deducting the income tax liability from the agreed consideration. While doing business with the foreign counterpart and making payment, they are bound to deduct the tax and deposit with the Government. The appellants have thus grossed up the TDS and complied with the statutory obligation. The situation would be different if the TDS is deducted from the actual consideration and is not borne by the Indian counterpart. When the foreign counterpart does not agree to forego the TDS portion from the consideration agreed, then it becomes legally incumbent upon the appellant to gross up the value as under Section 195A.

14.2.2 For the purposes of discharging their obligation of deducting tax at source, the appellants have grossed up the TDS to the actual consideration. After deposit of TDS, the service provider has received only the amount that has been agreed between the parties. There is no dispute about the fact that TDS amount has been borne by appellant. It is mentioned in paragraph 3 of the Show Cause Notice dated 19.11.2007 itself, which reads as under:

“As per Section 67 of the Finance Act, 1994, ‘…where service tax is chargeable on any taxable service with reference to its value, then such value shall- (i) in a case where the provision of service is for a consideration in money, be the gross amount charged by the service provider for such service provided or to be provided by him.’ In view of the above, it appears that the TDS charges, which was borne by the assessee, has to be included in the value of taxable services received by the assesse from the Service Providers and hence it appears that the assessee has short paid Service Tax to the extent of TDS deducted from the value of service charges.”

(Emphasis applied)

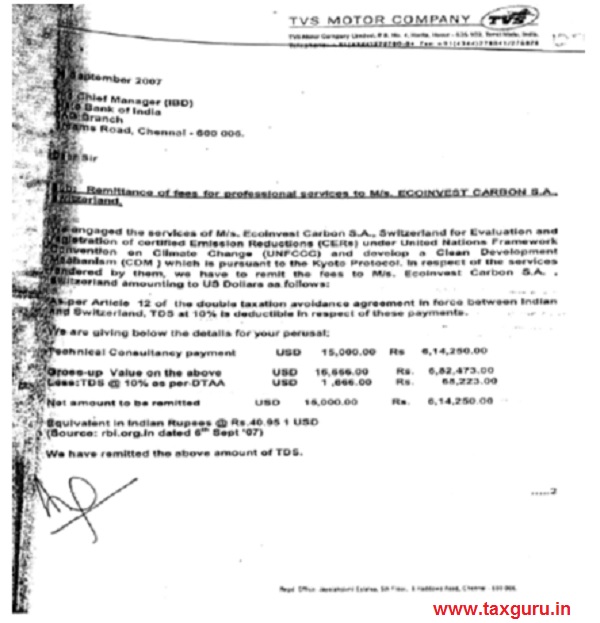

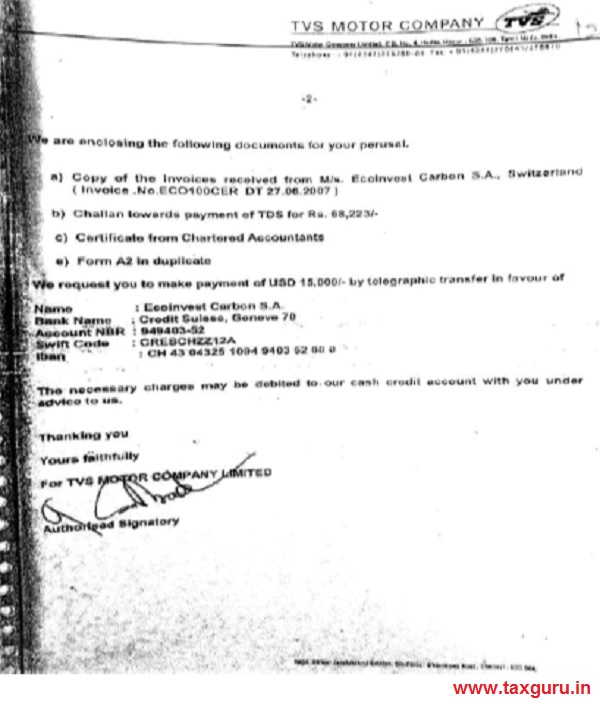

14.3.1 The grossing up of the consideration along with TDS can be seen from the documents issued by the appellants to their bank, which are reproduced below:

14.3.2 The Form of application for remittance under Section 195 of the Income Tax Act for the given transaction is as under:

14.3.3 The above application establishes that if the appellants fail to deduct the tax at source and remit the same to the Government, they would be subject to provisions of penalty under the Income Tax Act, 1961. Thus, activity of deducting tax at source is an obligation under the statute. When the TDS is grossed up and borne by the assessee and the service provider receives only the actual consideration agreed between parties, in our view, the TDS amount cannot be included in the taxable value.

14.4.1 The said issue has been considered by the Tribunal in various decisions. In the case of M/s. Hindustan Oil Exploration Co. Ltd. (supra), the Tribunal had held has under:

“5.1 The first issue is with regard to non-inclusion of TDS part which is paid under reverse charge mechanism for the services provided by foreign company. The ld. counsel for appellant has explained that there were two types of contracts and in the second category, the tax has to be borne by the service recipient which is the appellant herein. There is no dispute with regard to the service tax that is payable under the first category as a services provider. The demand is only with regard to the second type of contracts. The appellant has furnished documents to show that though TDS amount is deposited the same is borne by the appellant and has not been made part of the consideration. On perusal of documents, we are convinced that TDS has been borne by the appellant. For example, the letter dated 10.5.2006 shows that the appellant has to pay USD 319710 to the foreign company, namely, Thai Nippon Steel Engineering & Construction Corporation Ltd. The said amount has been fully paid as per the foreign certificate remittances. They have not deducted TDS but in fact have discharged the TDS liability. The appellant has borne the same as expenses of their company. On such score, we find that the demand of service tax alleging that TDS has not been included in the gross value is incorrect on facts and cannot sustain. We find that the issue is covered by the decision relied upon by the ld. counsel in the case of Magarpatta Township Development & Construction Co. Ltd. (supra), wherein the facts are as under:-

3. The learned Counsel took us through the facts of the case and submits that the agreement entered by the appellant with the foreign architect is very clear as the said agreement states that amount to be paid by the foreign architect not to be taxed i.e. by the appellant. He would take us through the agreement and bring to the notice specific clauses; appellant has discharged the Service Tax liability on the actual amount paid by them to such consultant. He would then take us through the provision of Section 67 of the Finance Act, 1994 and submit that the said Section contemplates discharge of Service Tax liability on the gross amount charged by the service provider. He would submit that the architect has charged the gross amount that indicated in the agreement. Subsequently, learned Counsel would take us through the provision of Service Tax (Determination of Value) Rules, 2006, as per Rule 7 during the relevant period, the provisions were very clear as to actual consultant charges need to be taxed. For this purpose, he relied upon the judgment of the Tribunal in the case of Commissioner of Central Excise, Raigad v. Jawaharlal Nehru Port Trust P. Ltd. – 2015 (40) S.T.R. 533 (Tri.-Mumbai).

The Tribunal in the above decision had set aside the demand. Following the same, the demand under this category requires to be set aside, which we hereby do.”

14.4.2 In M/s. Indian Additives Ltd. (supra), the issue has been discussed as under:

“5. The issue to be decided is whether the appellant is liable to pay service tax on the alleged deducted portion of TDS from the royalty paid to the foreign company. The allegation of the department is that the appellant has deducted TDS and therefore being the part of royalty the appellant is liable to pay service tax. The Ld. Counsel has produced a copy of the agreement and demonstrated that the appellant has paid TDS to the Government over and above the royalty paid to the foreign company. On the royalty the appellant has discharged the service tax. The Commissioner (Appeals) has set aside the demand prior to 18.04.2006. The Mumbai Bench of the Tribunal in Magarpatta Township Dev. & Construction Co. Ltd. (supra) has held that the demand of service tax on TDS portion cannot sustain. Relevant portion of the said decision is reproduced as under:-

8. Service Tax Valuation Rules, 2006 before amendment by Notification No. 24/2012-S.T., specifically Rule 7 needs to be read to arrive at the correct value of taxable service provided from outside India relevant Rule is reproduced : –

“7. Actual consideration to be the value of taxable service provided from outside India

(1) The value of taxable service received under the provisions of Section 66A, shall be such amount as is equal to the actual consideration charged for the services provided or to be provided.

(2) Notwithstanding anything contained in sub-rule (1), the value of taxable services specified in clause (ii) of rule 3 of Taxation of Services (Provided from Outside India and Received in India) Rules, 2006, as are partly performed in India, shall be the total consideration paid by the recipient for such services including the value of service partly performed outside India.”

It can be seen from the above reproduced Rule that for the purpose of discharge of Service Tax for the service provided from outside India, the value is equal to the actual consideration charged for the services provided or to be provided. In the case in hand, we specifically asked for the invoice/bill raised by the service provider and on perusal of the same, we find that appellant had discharged the consideration as raised in the said invoice/bill. There is nothing on record that indicates that the appellant had recovered that amount of Income Tax paid by them on such amount paid to the service provider from the outside India and any other material to hold that this amount is paid as consideration for services received from service provider.

9. In our considered view, the plain reading of Section 67 with Rule 7 of Service Tax Valuation in this case in hand, Service Tax liability needs to be discharged on amounts which have been billed by the service provider.”

14.4.3 In the case of M/s. Centre for High Technology (supra), the Tribunal discussed the issue and held in favour of the assessee, which reads as under:

“10. After the considering the arguments made by both sides and perusal of record, we note that dispute is with reference to the amount paid as Withholding Tax which was on top of the amounts paid to M/s Shell for the consultancy. It is not in dispute that the entire consideration for consultancy, as per the agreement, has been offered for payment of Service Tax by the appellant. The Revenue’s view is that the withholding tax also needs to be included for payment of Service Tax is not justified as has been held by the Tribunal in the cited decision. We reproduce below the relevant part of the decision.

“8. Service Tax Valuation Rules, 2006 before amendment by Notification No. 24/2012-ST, specifically Rule 7 needs to be read to arrive at the correct value of taxable service provided from outside India relevant Rule is reproduced:-

Actual consideration to be the value of taxable service provided from outside India.

1. The value of taxable service received under the provisions of Section 66A, shall be such amount as is equal to the actual consideration charged for the services provided or to be provided. 2. Notwithstanding anything contained in sub-rule (1), the value of taxable services specified in clause (ii) of rule 3 of Taxation of Services (Provided from Outside India and Received in India) Rules, 2006, as are partly performed in India, shall be the total consideration paid by the recipient for such services including the value of service partly performed outside India.

It can be seen from the above reproduced Rule that for the purpose of discharge of Service Tax for the service provided from outside India, the value is equal to the actual consideration charged for the services provided or to be provided. In the case in hand, we specifically asked for the invoice/bill raised by the service provider and on perusal of the same, we find that appellant had discharged the consideration as raised in the said invoice/bill. There is nothing on record that indicates that the appellant had recovered that amount of Income Tax paid by them on such amount paid to the service provider from the outside India and any other material to hold that this amount is paid is consideration for services received from service provider.

9. In our considered view, the plain reading of Section 67 with Rule 7 of Service Tax Valuation Rules, in the case in hand, Service Tax liability needs to be discharged on amounts which have been billed by the service provider.

10. In view of the foregoing, in the facts and circumstances of this case it is to be held that that impugned order is sustainable and liable to be set aside and we do so.”

11. By following the decision (supra) we set aside the impugned order and allow the appeal.”

14.5 The above decisions have categorically held that when the TDS amount has been borne by the assessee and only the consideration for the services as agreed upon by the parties has been paid to the service provider, the same cannot be included in the taxable value for determining the Service Tax liability.

15. From the discussions made above and following the decisions cited supra, we hold that the demand for the entire period (3/2004 to 9/2007 and 10/2006 to 9/2007) cannot sustain and requires to be set aside, which we hereby do. The second issue is also found in favour of the appellant.

16.1 Learned Counsel for the appellant has argued on the ground of limitation also. As discussed above, the issue is wholly an interpretational one and there were several litigations pending before different fora. So also, it has to be noted that the appellant has dutifully discharged the Service Tax liability on the entire consideration paid by them. The demand is only on the TDS portion remitted under the Income Tax Act. There is no positive act of wilful suppression with intention to evade payment of Service Tax brought out by the Department for invoking the extended period.

16.2 We therefore hold that the demand is time-barred and cannot sustain. The appellant succeeds on the ground of limitation as well.

17. Service Tax Appeal No. 41077 of 2013 is the appeal wherein the issue is whether appellant is eligible for cum-tax benefit. Since we have held that there is no liability to pay the differential tax, the issue of cum-tax benefit has no relevance and the demand confirmed cannot sustain and requires to be set aside, which we hereby do.

18. In the result, the impugned orders in both appeals are set aside. The appeals are allowed with consequential reliefs, if any, as per law.

(Order pronounced in the open court on 31.08.2021)

*****

(Author can be reached at info@a2ztaxcorp.com)