#1 I have been served with a SCN for a refund application. From where can I get the SCN and reply to the same?

Reply : Please visit the common portal www.gst.gov.in and you can check the additional orders and notices where the SCN would be present.

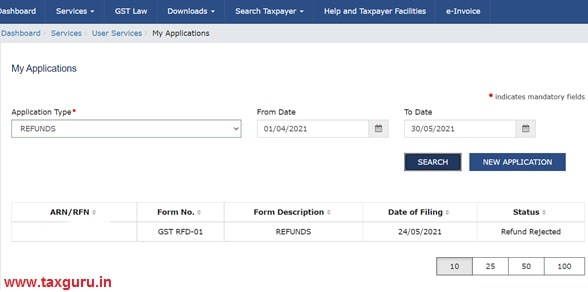

Alternatively Please visit the common portal www.gst.gov.in and go to the user services tab and then to My applications tab. Then select the refund option and key the period of application. Then select the ARN. Then click on the ARN hyperlink.

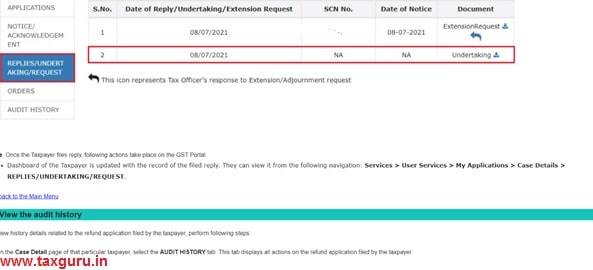

Then you will be taken to the next window where you can check the SCN on the left hand side tab. And you can also upload the reply for the reply tab on the left hand side.

#2 I have got a sms saying that my refund application is rejected. Where can I get to know about the refund rejection order?

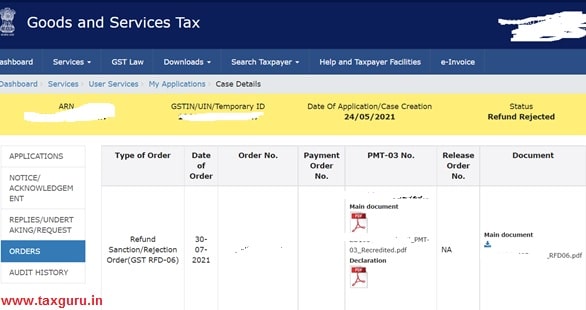

Reply : Please visit the common portal www.gst.gov.in and go to the user services tab and then to My applications tab. Then select the refund option and key the period of application. Then select the ARN. Then click on the ARN hyperlink.

Then you will be taken to the next window where you can check the order on the left hand side tab.

#3 How can I get the ITC re credited to my Electronic Ledger Balance?

Reply : As per Explanation to Rule 93 of CGST Rules, 2017 either the appeal has to be concluded or an undertaking has to be furnished that no appeal shall be filed against the said order which is rejected.

So the taxpayer would need to furnish an undertaking to this effect. Till lately this undertaking had to be furnished manually. However now this facility is available online.

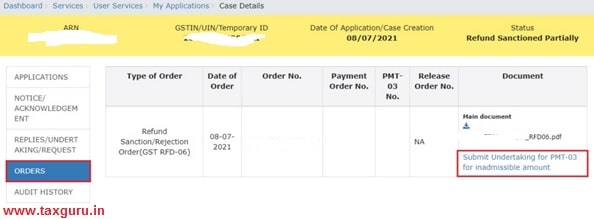

So we need to go to the orders tab as per flow mentioned above and then click on the hyperlink for submitting undertaking.

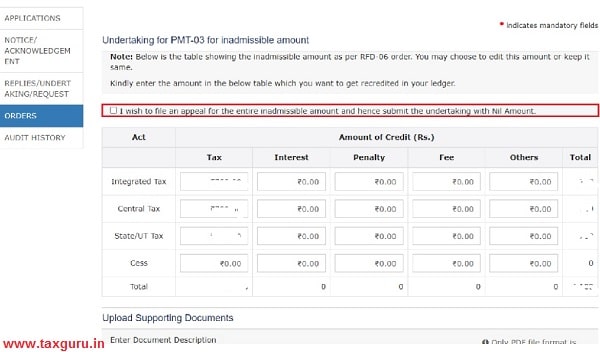

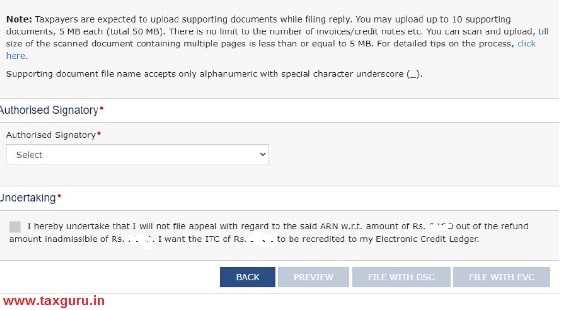

Once we click on the hyperlink the undertaking form shall be opened wherein we need to furnish the details of inadmissible credit against which we would not go in appeal.

#4 After I file the undertaking do I need to contact my proper officer?

Reply : Once the undertaking is filed, it will reflect on the refund dashboard as mentioned above against the tab of the related ARN. As and when the PMT 03 order is issued for re credit of ITC, you can view the order from this tab. However an email and sms is also received on passing of the PMT 03 order by the proper officer.

#5 Can I file undertaking for partial amount of the refund ?

Reply : Of course, the tax payer can apply for recredit only for the inadmissible amount of refund which he thinks is not justified and he would not like to go in appeal. For example in a refund of 130000 under inverted duty structure, as per the estimate of the taxpayer around 30000 is not due refundable for which he would not go in appeal but for the rest 100000 he would go in appeal, he can file the undertaking only for 30000 which will be recredited. For balance 100000 he can file appeal within the prescribed time period.

#6 I have filed undertaking for PMT 03 for the entire refund rejection order. Can I reapply the refund under the same head for the same period?

Reply : No, since you have waived your rights of going in for appeals in relation to the concerned refund application under the relevant head for the relevant period, you cannot reapply the refund under the same head for the same period.

For example a refund under the head excess payment of tax was made for the period February 21 and the same was rejected. Post the rejection you have filed the undertaking for PMT 03 for the entire refund amount. In this case, you cannot again apply under the head excess payment of tax for the period February 21.

So while submitting the undertaking we need to be careful about our future intended course of action.

#7 I had applied for a refund but I realised that I have made a mistake in the application. Can I go back to the Proper officer and request him to ignore the application?

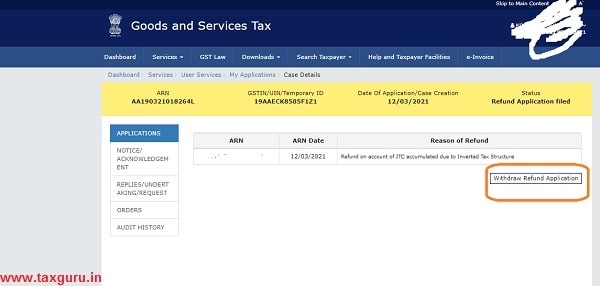

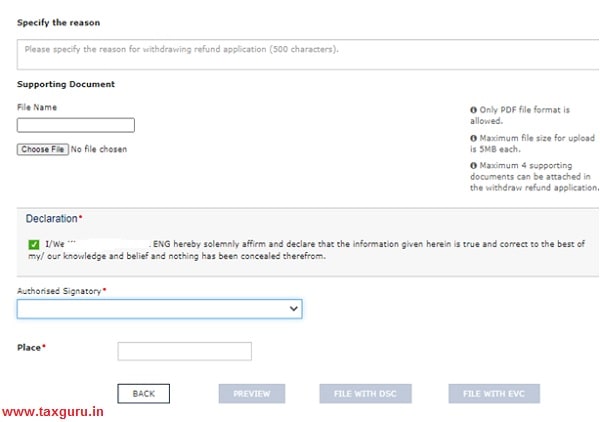

Reply : Yes considering this challenge faced by many taxpayers, a new facility has been given to taxpayers to withdraw their refund application prior to issuance of Deficiency Memo in RFD 03 or the Acknowledgement in RFD 02 for the refund. So it will be considered as if the application was never made.

(For any further queries in this regard the author can be reached at dgarup@gmail.com)

Arun da very useful and excellent compilation.

Congratulations