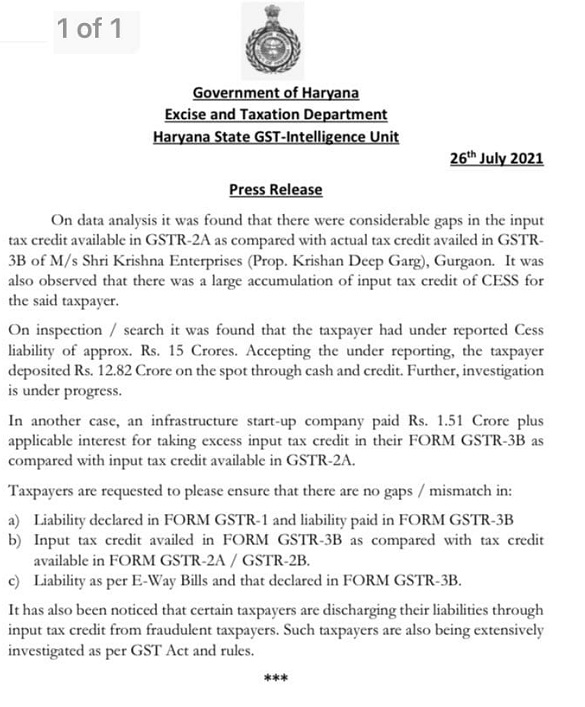

Government of Haryana

Excise and Taxation Department

Haryana State GST-Intelligence Unit

26th July 2021

Press Release

On data analysis it was found that there were considerable gaps in the input tax credit available in GSTR-2A as compared with actual tax credit availed in GSTR-3B of M/s Shri Krishna Enterprises (Prop. Krishan Deep Garg), Gurgaon. It was also observed that there was a large accumulation of input tax credit of CESS for the said taxpayer.

On inspection / search it was found that the taxpayer had under reported Cess liability of approx. Rs. 15 Crones. Accepting the under reporting, the taxpayer deposited Rs. 12.82 Crore on the spot through cash and credit. Further, investigation is under progress.

In another case, an infrastructure start-up company paid Rs. 1.51 Crore plus applicable interest for taking excess input tax credit in their FORM GSTR-3B as compared with input tax credit available in GSTR-2A.

Taxpayers are requested to please ensure that there are no gaps / mismatch in:

a) Liability declared in FORM GSTR-1 and liability paid in FORM GSTR-3B

b) Input tax credit availed in FORM GSTR-3B as compared with tax credit available in FORM GSTR-2A / GSTR-2B.

c) Liability as per E-Way Bills and that declared in FORM GSTR-3B.

I t has also been noticed that certain taxpayers arc discharging their liabilities through input tax credit from fraudulent taxpayers. Such taxpayers are also being extensively investigated as per GST Act and rules.

***