Introduction:

Yes, you read it right! The number of transactions on Google Pay & Phonepe going to be restricted. The point to be noted is that restriction is for players providing UPI services on the market share they are holding and not on individuals doing UPI transactions. This article covers an understanding of the industry, the reasoning for such restriction (including the market size of major players), and a basic understanding of Standard Operating Procedures (SOPs) released by The National Payments Corporation of India (NPCI).

Understanding the UPI industry:

Market Size & Transaction Volumes:

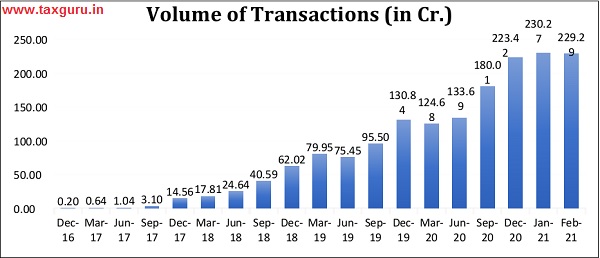

UPI industry is growing at a rapid rate for the past 5 years owing to various external factors favoring the market. Those factors include demonetization of Rs.500 and Rs.1000 currency notes in Nov-16 and fear of transmission of corona through the usage of currency notes etc. The UPI market has started growing since late 2016. The number of banks going live on UPI has increased from 35 in Dec-16 to 213 banks in Feb-21 as displayed below:

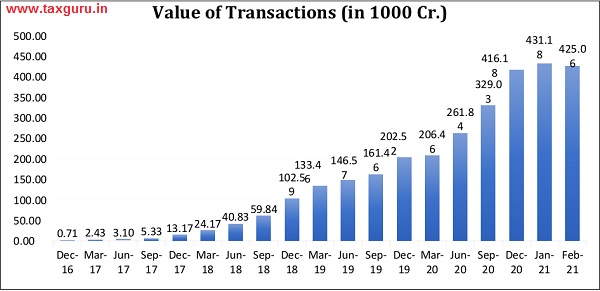

The increased number of banks going live on UPI led to a substantial increase in volume & value of transactions in the above-mentioned period.

–

The number of banks that are live on UPI has increased at a CAGR of 54.25% per annum whereas the number of UPI transactions per month has increased at a CAGR of 442.89% and the value of transactions has increased at a CAGR of 364.27% per annum. This evidences how emerging the market is.

Product Mix:

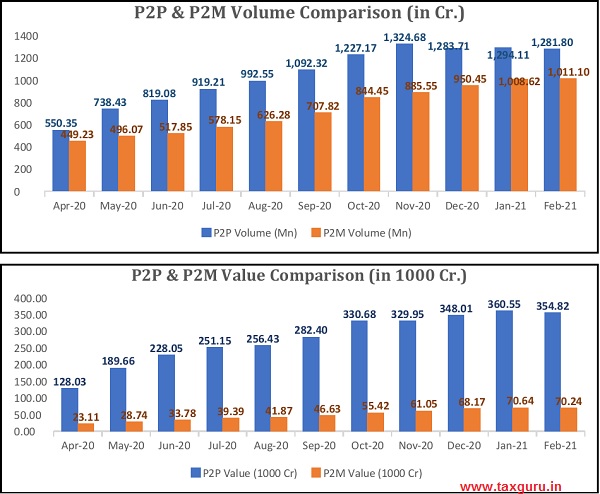

This market comprises two main segments namely the P2P (Person to Person) & P2M (Person to Merchant) market. Since P2P & P2M data is made available by NPCI from Apr-20, analysis is being made on the same. Below charts explain the market mix of the above two segments:

From the above diagrams, it can be understood that the P2M market accounts for around more than 40% of the volume of transactions but accounts for only 15-20% of the value of transactions each month.

Phonepe is having more than 1.75 Crore outlets whereas Google Pay & Paytm are having more than 1 Crore outlets which in total accounts for 4-5 Crore outlets. In a diversified country like India, this penetration covers only a minor portion of the market. These evidence growth opportunities especially in the P2M segment.

Government’s Assistance to the industry:

To reduce cash transactions and the flow of physical cash in the economy, the Government is introducing various initiatives and amending Acts to curb transactions in physical currency and to encourage usage of various methods of fund transfer including UPI.

Section 269SU of the Income Tax Act, 1961 has prescribed certain classes of companies (i.e., Companies having turnover or gross receipts more than Rs.50 Crore in the previous year) should provide facilities for accepting payments through prescribed methods. These methods include Debit Card powered by RuPay, UPI & UPI QR Code facilities.

Further, Income Tax Act has included these methods of payment as a prescribed electronic mode which acts in favor of this industry.

Reasons for such restrictions:

Market Mix – To prevent the market from becoming an Oligopoly:

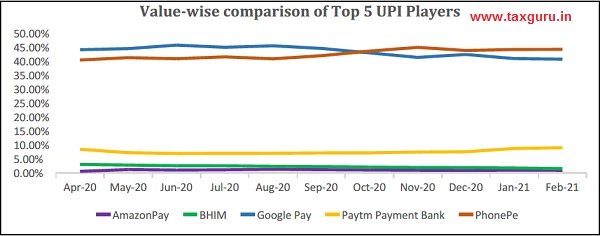

Even though the UPI market has more than 60 players, this market can be better termed as a duopoly/oligopoly market since the top 2 players namely Google Pay & Phonepe account for more than 80% of the volume and value of transactions. The next major player is Paytm Payments Bank which accounts for around 10-15% of the volume of transactions with less than 10% share in the value of transactions. Volume & value share of top-5 consistent players are pictographed below:

–

Since entity-wise market share of volume and value of transactions are being published from Apr-20, analysis is being made on the same. Further, some other payment apps like Axis Bank Apps, ICICI Bank Apps, Yes Bank Apps, WhatsApp, etc. were in the top 5 positions only in few months, market share of consistent players was displayed above.

To prevent risks related to UPI infrastructure & to stop dependence on a single player:

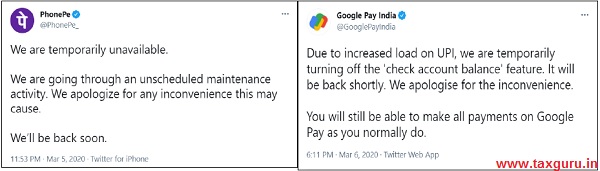

As evidenced above, the market is mainly owned by two big players (Google Pay & Phonepe). So, any disruption in the provision of services by a big player causes chaos in the market and increases the load on other players.

The best example of this can be when RBI imposed a moratorium on yes bank [which is the market leader in Payment Service Provider Services with its customers including Phonepe, Angel Broking, Mudra Pay, etc.], all its customers could not process its UPI services which caused chaos in the market. Everyone moved to the next biggest player namely Google Pay. Increased overload led to G Pay not able to provide some services to its customers. Below tweets evidences the same:

SOPs released by NPCI:

National Payments Corporation of India has released Standard Operating Procedures (related to Circular No. NPCI/UPI/OC-97/2020-21 dated 05th November 2020) for Market Share Cap of Third-Party Application Providers on 25th March 2021.

Before explaining the SOPs, few terms used below are explained herewith:

– Payment Service Provider (PSP) – Means a bank that processes a UPI transaction

– Third-Party Application Provider (TPAP) – Refers to an app providing UPI services like Phonepe, Google Pay, etc.

Restrictions are imposed on the volume of transactions. Hence, the value of transactions is not restricted and no cap is imposed on the same. Summary of those SOPs are explained below:

- PSP and each TPAP should ensure that the total volume of the transactions initiated through the TPAP shall not exceed 30% of the overall volume of transactions processed in UPI, during the preceding 3 months (on a rolling basis).

- These volume cap restrictions are effective from 01st January 2021. TRAPs exceeding the volume cap as of 31st December 2020 are given 2 years from the effective date to comply with the provisions.

This means Phonepe & Google Pay should reduce their volume cap to less than 30% by 31st December 2022.

- If a TPAP wants to increase its market cap beyond 30%, it shall make an application through PSP and exemption may be provided for a period of up to 6 months.

- The Volume Cap is applicable only for the transactions initiated from a TPAP UPI App (acting as Payer) and not applicable for the recipient end, i.e., Payee TPAP end. To be precise, If the limit is breached by Phonepe, a user cannot pay the amount through it but can receive the amount from Phonepe, if initiated through another UPI platform.

- Merchant or customer cashback/reward, merchant settlements, corporate disbursements, vendor payments, refunds, and any financial incentive – not be calculated for calculating TPAP UPI Transactions. However, this shall be considered as part of the Total Volume of UPI Transactions.

- Restrictions and communications of volume cap are tabulated below:

| Level | Market Share of TPAP (Threshold) | Alert |

| Level 1 | 25% to 27% | First alert to the TPAP and PSP Bank(s) by way of Email/Letter to which TPAP and PSP Bank(s) must acknowledge |

| Level 2 | 27.1% to 30% | Second alert to the TPAP and PSP Bank(s) by way of Email/Letter, to which TPAP and PSP Bank(s) must provide evidence of actions taken in compliance with the Volume Cap. |

| Level 3 | >30% | TPAP and PSP Bank(s) must stop the on-boarding of new customers and provide an undertaking with regards to the same to achieve compliance.

NPCI may offer an Exemption to ensure the smooth implementation of the user onboarding restrictions from the customer perspective. |

Conclusion:

This volume cap restriction gives scope to other players namely Paytm, Amazon Pay, BHIM, WhatsApp, etc. It will be interesting to see who wins a major stake in the remaining 40% stake.

******

Disclaimer: The contents of this article are for information purposes only and do not constitute an advice or a legal opinion and are personal views of the author. It is based upon relevant law and/or facts available at that point of time and prepared with due accuracy & reliability. Readers are requested to check and refer relevant provisions of statute, latest judicial pronouncements, circulars, clarifications etc before acting on the basis of the above write up. The possibility of other views on the subject matter cannot be ruled out. By the use of the said information, you agree that Author / TaxGuru is not responsible or liable in any manner for the authenticity, accuracy, completeness, errors or any kind of omissions in this piece of information for any action taken thereof. This is not any kind of advertisement or solicitation of work by a professional.

Basically what it means is rules are altered to favour Government friends like Jio and paytm