Article explains What is Material Information, What is the importance of regulation 30 of SEBI (LODR) Regulations, 2015, Who has power to derive what is material information for the company, Events and activities which are material As per Schedule III of SEBI (LODR) Regulations, 2015, Events which shall be disclosed for materiality as specified in sub-regulation (4) of regulation (30), Events which shall be disclosed upon application of the guidelines for materiality referred sub-regulation (4) of regulation (30), Any other information/event viz. major development that is likely to affect business, Disclosures of event/information as specified by the board and When to disclose the material Information by the Company on public domain (time period).

MATERIAL INFORMATION – as per SEBI (LISTING OBLIGATIONS AND DISCLOSURE REQUIREMENTS) REGULATIONS, 2015

Page Contents

- 1. What is Material Information?

- 2. What is the importance of regulation 30 of SEBI (LODR) Regulations, 2015?

- 3. Who has power to derive what is material information for the company?

- 4. Events and activities which are material As per Schedule III of SEBI (LODR) Regulations, 2015-

- PART A. Events which shall be disclosed for materiality as specified in sub-regulation (4) of regulation (30):

- B. Events which shall be disclosed upon application of the guidelines for materiality referred sub-regulation (4) of regulation (30):

- C. Any other information/event viz. major development that is likely to affect business

- D. Disclosures of event/information as specified by the board

- 5. When to disclose the material Information by the Company on public domain (time period)?

1. What is Material Information?

Material Information generally means information that a rational investor would consider important in making investment decision, an information which has substantial effect on the price of the shares of the company on disclosure with the regulatory authorities.

It means the occurrence of any material act or activity or any business activity or any condition, would or might have reasonable effect, either positive or negative.

Importance of material information of/ or related to a Company is to be determined by the investor for holding the investment or releasing it, holds equivalent importance, by the management and key managerial personnel of the Company to disclose the information and make readily available and made known to the stakeholders by means of uploading it on stock exchanges or by means of newspaper or by means of website of the company.

When a Investor keeps a track on market, in order to maintain certain portfolio of his own, by investing or retaining its funds in form of investment in certain or as determined company, the primary aspects it records by its watchlist.

In accordance with regulations SEBI (Listing and Disclosure Requirements) Regulations, 2015 and SEBI (Prohibition of Insider Trading) Regulations, 2015, the material information is been determined and been given certain occurrence or non-occurrence of events.

2. What is the importance of regulation 30 of SEBI (LODR) Regulations, 2015?

Authors’ View: The said regulation helps to enable transparency and fair disclosures by all listed entities in India, maintaining adequate safety measures and corporate governance to safeguard the interest of the Stakeholders of the Company.

SEBI has always been at the front to protect the interests of the investors and to keep the market transparent and responsible. During these pandemic stricken times, it has become imperative for SEBI to ensure that the trust of the investors is maintained in the financial markets. Recently it is been observed that, the market has already started to experience the effect of the pandemic which can be seen in the high redemption pressure in the mutual funds’ industry. However, SEBI again came to restore the trust of the investors by keeping a check on the risk exposure and liquidity issues of the mutual funds.

Under Reg. (30) of LODR, a listed entity is under obligations, and have to compulsorily require to disclose material information, that the Board of Directors deem fit. The regulation then goes on forward to substantiate what would be considered as a material fact. As per regulation 30, all the events which the board of directors of the listed company think is material, i.e. might have substantial effect on the price of the shares of the company.

The same is elaborated upon under Regulation (30) (4) (i) of LODR. As per this regulation, the listed entities shall consider the following aspects while deciding the materiality of an event: Firstly, whether the omission of such an event or circumstance would lead to a change of the information already available to the public, secondly, whether the information would result in a significant market reaction if disclosed and finally anything that the Board of Directors deem as material.

3. Who has power to derive what is material information for the company?

The Board of Directors shall authorise any one or more Key Managerial Personnel for determining material information derived out of the said events or activity or business. On determination of the said information as material, the KMP or the compliance officer or company secretary needs to disclose the same on the stock exchange, making the information available to the stakeholders of the company, having right to be known for.

The company also need to formulate a policy for determination of material information and material event, which shall also be placed on the website of the company, on approval of board for the policy. The listed company shall disclose on its website all such events or information which has been disclosed to stock exchange(s) and such disclosures shall be updated on the website of the listed entity for a minimum period of five years and thereafter as per the archival policy of the listed entity, as disclosed on its website.

4. Events and activities which are material As per Schedule III of SEBI (LODR) Regulations, 2015-

As per Schedule III of SEBI (LODR) Regulations, 2015, describes few events and few activities which are material and such decision of the Board are Material, and need to be disclosed.

Authors’ View: The events and information the company needs to disclose on stock exchanges, not only have compliance prospect from the company’s part its also for the stakeholders and investors who need to be made aware with regards to the information pertaining to their holding, returns and status of the investment in the said Company.

PART A. Events which shall be disclosed for materiality as specified in sub-regulation (4) of regulation (30):

1. Acquisition(s) (including agreement to acquire), Scheme of Arrangement (amalgamation/ merger/ demerger/restructuring), or sale or disposal of any unit(s), division(s) or subsidiary of the listed entity or any other restructuring.

Explanation. – For the purpose of this sub-para, the word ‘acquisition’ shall mean, –

(i) acquiring control, whether directly or indirectly; or,

(ii) acquiring or agreeing to acquire shares or voting rights in, a company, whether directly or indirectly, such that –

(a) the listed entity holds shares or voting rights aggregating to five per cent or more of the shares or voting rights in the said company, or;

(b) there has been a change in holding from the last disclosure made under sub-clause (a) of clause (ii) of the Explanation to this sub-para and such change exceeds two per cent of the total shareholding or voting rights in the said company.

Authors’ View: The sub point (ii) of the explanation been comprised in Point 1 also forms under Regulation 29 of SAST Regulations, 2011, where the acquirer needs to disclose the shareholding and shares acquired aggregating to 5% or more or change in holding by 2% in the Target Company, to stock exchange as well the Target Company. The need of disclosing the same is, to understand and make the investors be in learning, about the ownership and/or control over the company and its decision making. As decision making power and control derives the pace of growth and return on investment.

2. Issuance or forfeiture of securities, split or consolidation of shares, buyback of securities, any restriction on transferability of securities or alteration in terms or structure of existing securities including forfeiture, reissue of forfeited securities, alteration of calls, redemption of securities etc.

Authors’ View: The need of disclosing the said information in point 2 of Part A, as the investor need to be made aware about the status of the securities been held by them, where at times the Company is not able to trace the investor by the correspondence address been available with them and the RTA, in such situation the disclosures might help the investors to secure and avail the information. (situations or difficulties faced might differ)

3. Revision in Rating(s).

Authors’ View: Few companies need to receive credit ratings from the credit rating agencies mandatorily, for instance NBFC’s forming part of compliance, further few banks or financial institution before granting loan or advances. On disclosure of ratings received from credit rating agencies, it helps the investor in reliability trust factor and credibility regarding the Company.

4. Outcome of Meetings of the board of directors

The listed entity shall disclose to the exchange(s), within 30 minutes of the closure of the meeting, held to consider the following:

(a) dividends and/or cash bonuses recommended or declared or the decision be paid/dispatched;

(b) any cancellation of dividend with reasons thereof;

(c) the decision on buyback of securities;

(d) Fund Raising or proposal

(e) increase in capital by issue of bonus shares issued/dispatched

(f) reissue of forfeited shares or securities, or the issue of shares or securities held in reserve for future issue or the creation in any form or manner of new shares or securities or any other rights, privileges or benefits to subscribe to;

(g) alterations of capital, including calls;

(h) financial results;

(i) decision on voluntary delisting by the listed entity from stock exchange(s).

Authors’ View: The decision been taken and board resolution been passed in the board meeting, with relation to the aforementioned items and which may be not in ordinary course of business, such details need to be disclosed on stock exchange and website of the company.

5. Agreements (viz. shareholder agreement(s), joint venture agreement(s), family settlement agreement(s) (to the extent that it impacts management and control of the listed entity), agreement(s)/treaty(ies)/contract(s) with media companies) which are binding and not in normal course of business, revision(s) or amendment(s) and termination(s) thereof.

Authors’ View: Importance of disclosing to the stakeholders/investors the agreements or any joint ventures or any understanding on business terms and contracts making involvement of new management, results in change in decision making, which also impacts on returns and growth of the business. Tying up with huge reliable and credible brand or organisation, would lead to gain more trust into the company.

6. Fraud/defaults by promoter or key managerial personnel or by listed entity or arrest of key managerial personnel or promoter.

7. Change in directors, key managerial personnel (Managing Director, Chief Executive Officer, Chief Financial Officer, Company Secretary etc.), Auditor and Compliance Officer.

(7A) In case of resignation of the auditor of the listed entity, detailed reasons for resignation of auditor, as given by the said auditor, shall be disclosed by the listed entities to the stock exchanges as soon as possible but not later than twenty-four hours of receipt of such reasons from the auditor.

(7B) Resignation of auditor including reasons for resignation

In case of resignation of an independent director of the listed entity, within seven days from the date of resignation, the following disclosures shall be made to the stock exchanges by the listed entities:

i. Detailed reasons for the resignation of independent directors as given by the said director shall be disclosed by the listed entities to the stock exchanges.

ii. The independent director shall, along with the detailed reasons, also provide a confirmation that there is no other material reasons other than those provided. (Conflict of interest if involved)

iii. The confirmation as provided by the independent director above shall also be disclosed by the listed entities to the stock exchanges along with the detailed reasons as specified in sub-clause (i) above.

8. Appointment or discontinuation of share transfer agent.

9. Corporate debt restructuring

10. One-time settlement with a bank

11. Reference to BIFR and winding-up petition filed by any party / creditors.

12. Issuance of Notices, call letters, resolutions and circulars sent to shareholders, debenture holders or creditors or any class of them or advertised in the media by the listed entity.

13. Proceedings of Annual and extraordinary general meetings of the listed entity.

14. Amendments to memorandum and articles of association of listed entity, in brief.

15. Schedule of Analyst or institutional investor meet and presentations on financial results made by the listed entity to analysts or institutional investors;

16. The following events in relation to the corporate insolvency resolution process (CIRP) of a listed corporate debtor under the Insolvency Code:

a) Filing of application by the corporate applicant for initiation of CIRP, also specifying the amount of default;

b) Filing of application by financial creditors for initiation of CIRP against the corporate debtor, also specifying the amount of default;

c) Admission of application by the Tribunal, along with amount of default or rejection or withdrawal, as applicable;

d) Public announcement made pursuant to order passed by the Tribunal under section 13 of Insolvency Code;

e) List of creditors as required to be displayed by the corporate debtor under regulation 13(2)(c) of the IBBI (Insolvency Resolution Process for Corporate Persons) Regulations, 2016;

f) Appointment/ Replacement of the Resolution Professional;

g) Prior or post-facto intimation of the meetings of Committee of Creditors;

h) Brief particulars of invitation of resolution plans under section 25(2)(h) of Insolvency Code in the Form specified under regulation 36A(5) of the IBBI (Insolvency Resolution Process for Corporate Persons) Regulations, 2016;

i) Number of resolution plans received by Resolution Professional;

j) Filing of resolution plan with the Tribunal;

m) Approval of resolution plan by the Tribunal or rejection, if applicable;

k) Salient features, not involving commercial secrets, of the resolution plan approved by the Tribunal, in such form as may be specified;

l) Any other material information not involving commercial secrets.

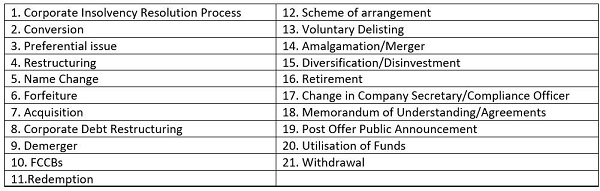

B. Events which shall be disclosed upon application of the guidelines for materiality referred sub-regulation (4) of regulation (30):

1. Commencement or any postponement in the date of commencement of commercial production or commercial operations of any unit/division.

2. Change in the general character or nature of business brought about by arrangements for strategic, technical, manufacturing, or marketing tie-up, adoption of new lines of business or closure of operations of any unit/division (entirety or piecemeal).

3. Capacity addition or product launch.

4. Awarding, bagging/ receiving, amendment or termination of awarded/bagged orders/contracts not in the normal course of business.

5. Agreements (viz. loan agreement(s) (as a borrower) or any other agreement(s) which are binding and not in normal course of business) and revision(s) or amendment(s) or termination(s) thereof.

6. Disruption of operations of any one or more units or division of the listed entity due to natural calamity (earthquake, flood, fire etc.), force majeure or events such as strikes, lockouts etc.

7. Effect(s) arising out of change in the regulatory framework applicable to the listed entity

8. Litigation(s) / dispute(s) / regulatory action(s) with impact.

9. Fraud/defaults etc. by directors (other than key managerial personnel) or employees of listed entity.

10. Options to purchase securities including any ESOP/ESPS Scheme.

11. Giving of guarantees or indemnity or becoming a surety for any third party.

12. Granting, withdrawal, surrender, cancellation or suspension of key licenses or regulatory approvals.

Authors’ View: As pointed above, the shareholders need to know the reason impacted on the business operations of the company, for instance as mentioned in part B, if the company have stopped its manufacturing unit as it affects the production and later its impact on revenue generation; certain awards, recognition, licenses and certification also needs to be disclosed as it represents the ethical and morally strong.

The organisation disclosing the product launch, diversification, tying up for new assignments, for instance, taking up new infrastructural projects, solar or renewable energy source, etc, holds significant impact for the investor, as it might create spurt in the volume of shares traded on stock exchange, by rise in its share price.

Disclosure for closure of plant/manufacturing activities/ registered offices in view of the COVID-19 pandemic to ensure safety and health of all the employees of the company and to ensure compliance with various directives being issued by central/state/municipal authorities with effective from lockdown imposed.

C. Any other information/event viz. major development that is likely to affect business

Any other information/event viz. major development that is likely to affect business, e.g. emergence of new technologies, expiry of patents, any change of accounting policy that may have a significant impact on the accounts; and brief details thereof and any other information which is exclusively known to the listed entity which may be necessary to enable the holders of securities of the listed entity to appraise its position and to avoid the establishment of a false market in such securities.

D. Disclosures of event/information as specified by the board

Without prejudice to the generality of para (A), (B) and (C) above, the listed entity may make disclosures of event/information as specified by the board from time to time.

5. When to disclose the material Information by the Company on public domain (time period)?

Under regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (‘SEBI LODR Regulations’) a listed entity shall disclose to stock exchange(s) all events or information, which are material, as soon as reasonably possible and not later than twenty-four hours from the occurrence of event or information.

The decision been taken and Board Resolution been passed in the Board Meeting, as outcome of the Board and Shareholders Meeting and which may be/may not be in ordinary course of business, such details need to be disclosed on Stock Exchange and Website of the Company, pertaining to financials, agreements, appointment or cessation of KMP or Directors of the Company, within 30 minutes from the conclusion of the Board Meeting/General Meeting.

Accordingly, newspapers publications also need to comply with respect to bringing the material information on public domain, in accordance with the regulation 47 of the SEBI (LODR), 2015, within 48 hours of approval of financials, bonus, dividends etc (being few of the events as specified in PART A of the regulation 30) by the board/ shareholders of the company in their respective meetings.

As per Circular no. LIST/COMP54/2019-20 dated January 20, 2020

Updation of information on BSE website. Information regarding statutory auditor and secretarial auditor is to be mandatorily updated in the management details section (Tab 3 and 4) under BSE listing centre as a one-time exercise and should be updated as and when there are any changes. In case there are any changes / updates in Key Managerial Personnel or registrar and share transfer agent details the same may be updated in the management details section (Tab 1 and 2) except corporate announcements.

As per circular SEBI/HO/CFD/CMD1/CIR/P/2019/140 dated November 21, 2019

SEBI requires disclosures by listed entities of defaults on payment of interest/ repayment of principal amount on loans from banks / financial institutions and unlisted debt securities as disclosure of material events / information, applicable to all listed entities which have listed any of the following: specified securities (equity and convertible securities), NCDs and NCRPS.

As per SEBI Circular on dated 31.10.2019

Disclosure of divergence in the asset classification and provisioning by banks. RBI vide Notification No RBI/2016-17/283; DBR.BP.BC.No. 63/21.04.018/ 2016-17 dated April 18, 2017 and amended Notification No. RBI/2018-19/157;DBR.BP.BC.No.32/21.04.018 /2018-19 dated April 1, 2019 mandated banks to disclose certain cases of divergence in the asset classification and provisioning in the Notes to Accounts in the ensuing Annual Financial Statements published immediately following communication of such divergence by RBI to the bank.

As per NSE Circular dated 24.09.2019

Developments such as signing of Inter Creditor Agreement (ICA) by the lenders of the listed company, is deemed to be ‘material’ and requires timely disclosures as per Regulation 30.

As per NSE Circular dated 22.03.2019

Filing of information, describing the announcements to be done on NEAPS on electronic platform, where additional in short should be disclosed:

As per NSE Circular dated 19.12.2018

NSE has clarified that NEAPS Platform provided by NSE is only for submitting information required to be disclosed under Regulation 30.

As per NSE Circular No. NSE/CML/2018/22 dated 06.06.2018

Compliance and Disclosure Requirements for Listed Companies undergoing Corporate Insolvency Resolution Process (CIRP), promptly inform the Stock Exchanges, regarding the events pertaining to the IRP process (where companies are involved) and also maintaining unpublished price sensitive information in the course of Insolvency proceedings, shall maintain the confidentiality of such information.

Disclaimer: This is not a legal advice and shall not be held liable for any action taken on the basis of above article. Aforementioned article is subject to amendments in the rules and regulations of the law.