Related Party Transactions Under Companies Act, 2013 (Section 188 and Rule 15 of Companies (Meetings of Board and its Powers) Rules, 2014. Rule 15 is related to Contract or Arrangement With a Related Party and Section 188 is related to Related Party Transactions.

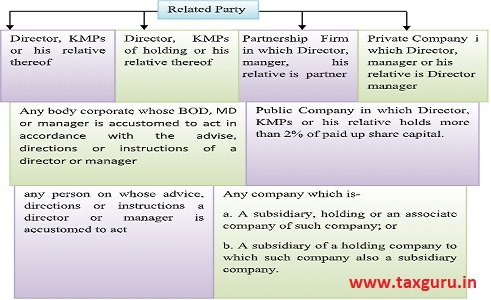

Who is Related Party?

2. Board Resolution Section 188(1)

For entering into a related party transaction consent of the Board of Directors shall required in the First step.

3. Conditions Rule 15 of the Companies (Meetings of Board and its Powers) Rules, 2014

As per Rule 15 of the Companies (Meetings of Board and its Powers) Rules,2014 the following conditions shall be fulfilled for related party transactions;

a. There shall be proper agenda for the Board meeting and shall disclosed the followings-

i. Related Party’s name and nature of relationship with related party;

ii. Particulars of the contract or arrangements;

iii. Nature and term of the Arrangement or contract

iv. Any amount in advance paid or received for contract or arrangement;

v. methods of determining the pricing;

vi. All other factors relating to the contract or arrangement shall be considered;

b. Directors interested in any contract or arrangement with the related party shall not present at the meeting during discussion on the subject matter of the resolution relating to contract or arrangement. (2nd Proviso of the section 188)

Exception: This proviso is not applicable to the Company in which 90% or more, member in number, are relative of promoters or are related party.

4. Kinds of contracts or arrangements Section 188(1)

a. Purchase, sale or supply of any goods or material;

b. Disposed off or selling or buying of any kind of property;

c. Renting or leasing of any kind of property;

d. Rendering or providing or availing any services;

e. Appointment of any agent for purchase or sale of any goods or material;

f. Appointment of any related party in office or place of profit in the company, its Subsidiary company or associate company;

g. underwriting the subscription of any securities or derivatives of the company.

5. Office or Place of office meaning

1. if the director holding such position, receive from company anything by way of remuneration over or above the remuneration to which he is entitled as director.

2. held by an individual other than a director or by any firm, private company or other body corporate, if the individual, firm, private company or body corporate holding it receives from the company anything by way of remuneration, salary, fee, commission, perquisites, any rent-free accommodation, or otherwise;

6. Special Resolution when required? 1st Proviso to section 188(1) and rule 15

A Company shall required to pass a Special resolution, where the transaction to be entered into-

| a | Purchase, supply, or sale of any goods or material, directly or through agent | Equal to 10% of turnover or more |

| b | Disposing of, selling, buying of any kind of property, directly or through agent | Equal to 10% of the Net worth or more |

| c | Renting or leasing of any kind of property directly or through agent | Equal to 10% of turnover or more |

| d | Providing or availing any kind services directly or through agent | Equal to 10% of turnover or more |

| e | Appointment of any related party in office or place of profit in the company, its Subsidiary company or associate company | monthly remuneration exceeding two and a half lakh rupees |

| f | underwriting of subscription of any securities or derivatives of the company | exceeding one percent of the net worth |

7. Explanatory Statement

A explanatory statement shall be attached to the notice of the general meeting, which shall contain the following particulars;

a. Related Party’s name;

b. Name of the KMP or director who is relative thereof;

c. Nature of the relationship;

d. Particulars about the contracts or arrangements,

e. any other relevant information

8. 3rd Proviso to Section 188(1)

Section 188(1) shall not apply to any transaction entered into by Company in ordinary course of business other than transaction which are not Arm length basis.

9. Arm length Basis transactions

Means a transaction between two related parties that is performed or conducted as if they were unrelated, so that there is no conflict of interest.

10. Exception to 1st proviso of section 188 4th proviso of section 188(1)

The requirement of passing SR shall not be applicable for transaction which entered into between holding company and its WOS whose accounts are consolidated with such holding company and approved in the General Meeting.

11. Disclosure in Board Report Section 188(2)

Every contract or arrangement with related party shall be referred to in the Board report along with proper justification of the same.

12. When these Contract or arrangements considered voidable? Section 188(3)

When company entered into these transactions without the approval of the board or shareholders as the case may and it is not rectified by the board or shareholders as the case be within 3 months from the date of entering into such transactions or contracts and if the contract or arrangement is with a related party to any director, or is authorised by any other director, the directors concerned shall indemnify the company against any loss incurred by it.

13. Proceed against directors Section 188(4)

it shall be open to the company to proceed against a director or any other employee who had entered into such contract or arrangement in contravention of the provisions of this section for recovery of any loss sustained by it as a result of such contract or arrangement.

14. Situation in case of Contravention of the provisions of section 188

Any director or any other employee of a company-

a. in case of listed company, be punishable with imprisonment for a term which may extend to 1 year or with fine which shall not be less than 25,000 rupees but which may extend to 5,00,000 rupees, or with both; and

b. In case of any other company, be punishable with fine which shall not be less than 25,000 rupees but which may extend to 5,00,000 rupees