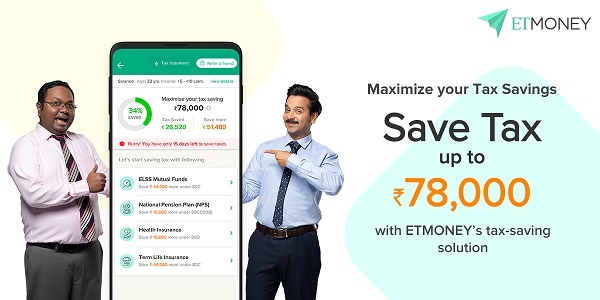

ETMONEY unveils India’s first and only tax saving solution which enables Indians to save up to Rs.78,000 in taxes from one app

-The unique tax solution combines all tax saving options of ELSS, NPS, Health & Term Insurance into one seamless experience on the app.

-It will also recommend ways to maximize tax saving through these options.

-The 100% paperless, online solution also provides instant tax proofs.

New Delhi, January 28, 2020: As Indians gear up for the annual tax savings season, ETMONEY, India’s largest online wealth management app with 7.5 Mn users, has launched a first-of-its-kind tax-saving solution that empowers Indians to maximize their tax-saving & save up to Rs.78,000 in taxes, right from their mobile phone within minutes.

When it comes to tax saving options, there are four big emerging options in India. ELSS (Tax saving mutual funds), NPS (National Pension System), Health Insurance & Life insurance for Self and Parents. Only a handful of Indians are aware that by combining these four options, one can save a massive upto Rs.78,000 in taxes every year. ETMONEY’s Tax Solution attempts to change that by bringing these options to every Indian on a single app.

To avail tax benefits from all the four options, one has to deal with multiple websites or agents which is not only cumbersome but also very confusing as everyone has a different view of each of these options. Finding the right product and how much to save through each of the four options is another problem because of which consumers end up buying the wrong products. Also buying these products requires going through multiple forms, physical documentation and individual payments in different places. To ensure the tax benefits are claimed, one has to collate tax proofs which adds to already painful journey of tax saving. Lastly, once you have done everything, management and tracking of all these products becomes a bigger headache every year.

All these problems result in three big losses for consumers. Firstly, the consumers are saving less in taxes that they ideally could. Secondly, they may end up buying wrong financial products and don’t have a way to manage them. Lastly, they forget that each of the products apart from saving taxes, also serves a very important financial need like protecting your family and end up comprising these critical goals.

This is where ETMONEY Tax Saving Solution comes in & solves all these problems in one go. It’s the first time in India that on one app, Indians will be able to buy and manage all the four tax saving options of ELSS, NPS, Term life insurance and Health Insurance for self and parents from one app.

ETMONEY app will also guide the user in recommending the best possible combination and allocation in each of these options in order to maximize tax saving. So if one already has already exhausted the Rs.1.5 lakh tax saving limit under section 80C of IT act, it will recommend investing in NPS to secure retirement or protect family by buying a health insurance policy.

Once the best allocation is decided, one can buy all the four products within minutes and get instant tax proofs. It will also help you to track the performance of all these products 24*7, 365 days a year.

Mukesh P Kalra, Founder & CEO – ETMONEY said, “Every year Indians end up grossly under-utilizing the tax saving benefits and also end up compromising their financial goals. ETMONEY Tax Solution reimagines tax saving journey for today’s digital India and combines everything from ELSS to NPS to Insurance into one seamless experience on their mobile phone, all without ever needing to sign on a piece of paper”

About ETMONEY- ETMONEY is India’s largest app for financial services that is simplifying the financial journey of Digital India. Consumers use ETMONEY to invest in Zero-commission Direct mutual funds for Free, protect their families with unique Insurance solutions & use ETMONEY Credit Card to take instant loans at low-cost. Growing at 350% yearly, combined with multiple innovative solutions, it has grown to 7.5Mn users from more than 1300+ Indian cities and is driving more than $500Mn of non-payment annual transaction on its platform.