Under the new law, in relation to every RPT, directors have to necessarily check, most importantly, the following two criteria:

– Whether the contracts or arrangements is in the ‘ordinary course of the business’ of the company

– Whether the terms and conditions of such contracts or arrangements are on ‘arms length basis’?

(i) The transaction will be with Related Party in case it is with any of the following :-

- With any Director of Company;

- With any Relative of a Director;

- With any KMP or Relative of a KMP;

- With any Firm in which Director or his relative is a Partner;

- With any Private Company in which a Director is a Member or Director;

- With a Public Company in which a Director of Company is a Director and additionally holds alongwith his relative(s) 2% or more paid-up share capital of Public Company;

- With a Subsidiary Company;

- With an Associate Company in which company has more than 20% shareholding;

- With a Body Corporate which is significantly influenced by a Director

- With a person who significantly influences a Director of Company;

- With a person who has control or significant influence over Company;

- Director or KMPs of Company and their Relatives will be deemed to be Related Parties to Subsidiary and Associate Companies ; and

- With an Entity which is a Related Party under the applicable Accounting Standards.

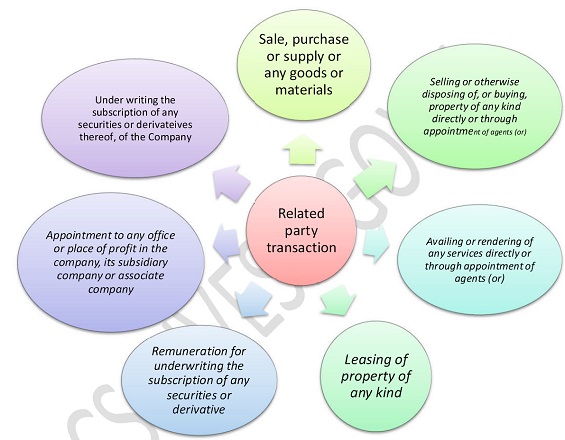

(ii) Following Transactions with above Related Parties will constitute Related Party Transactions :

- Sale, Purchase or Supply of any goods or materials by Company;

- Selling or disposing off or buying any Property by Company; 8

- Leasing of any Property by Company;

- Availing or rendering of any services by Company

- Appointment of any agent for purchase or sale of goods, materials, services or property by Company;

- Any Related Party’s appointment to any office or place of profit in Company

- Company or its Subsidiary Company or its Associate Company (where Company holds more than 20% shareholding);

- Underwriting the subscription of any securities or their derivatives of Company

- Company by a Related Party.

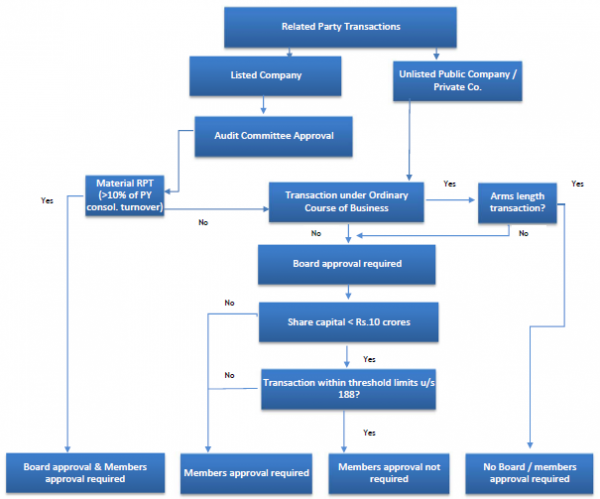

(iii) In case a Transaction being entered into by a Company satisfies the test given above at point (i) and (ii) for being a Related Party Transaction, following actions to be ensured :

- To ensure that Related Party Transaction is entered on an Arm’s Length Basis, i.e., treating the Related Party as unrelated and on a fair market transaction basis to avoid any conflict of interest.

- To take prior approval of Audit Committee of the Board in respect of all Related Party Transactions subject to further provisions as at Para III(2)(a) to (f) of the Policy on Related Party Transactions.

- In case a Related Party Transaction individually or taken together with previous Related Party Transactions during a financial year exceeds 10% of annual consolidated turnover of Company, as per the last audited financial statements, it will fall under Material Related Party Transactions category and will require Shareholder’s approval through Special Resolution subject to further provisions as at Para III(3) of the Policy on Related Party Transactions.

- In case a Related Party Transaction is not in the ordinary course of business and not on an Arm’s Length Basis, it will require prior approval of the Board.

- In case a Related Party Transaction is not in the ordinary course of business and not on an Arm’s Length Basis and exceeds the limits of sums prescribed under Para III(4) of the Policy on Related Party Transactions, it will also require prior approval of Shareholders through Special Resolution.

Kindly Refer to

Privacy Policy &

Complete Terms of Use and Disclaimer.

Could a transaction of sale of property owned by a Company to a Registered Charitable Trust, running a school, be a Related Party Transaction, if one of the Promoter – Directors of the Company is a Trustee of the Trust?

Did you get an answer to this?