It has been observed that the number of taxpayers who have filed FORM GSTR-3B is substantially higher than the number of taxpayers who have furnished FORM GSTR-1.

✔Non-furnishing of FORM GSTR-1 is liable to late fee and penalty as per the provisions of the GST law.

✔In order to encourage taxpayers to furnish FORM GSTR-1, a one-time scheme to waive off late fee payable for delayed furnishing of FORM GSTR-1 for the period from July, 2017 to September, 2018 till 31.10.2018 has been launched.

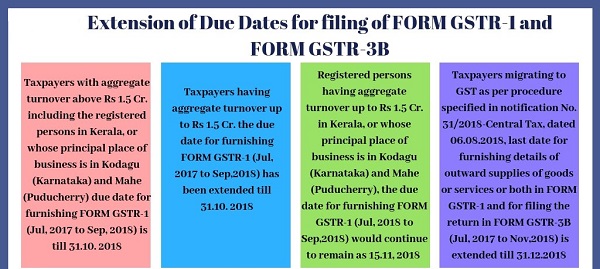

✔In this regard, the due date for furnishing FORM GSTR-1 for the period from July, 2017 to September, 2018 has been extended till 31st October, 2018 for all registered persons having aggregate turnover above Rs 1.5 crores including the registered persons in Kerala, or whose principal place of business is in Kodagu (Karnataka) and Mahe (Puducherry).

✔For taxpayers having aggregate turnover up to Rs 1.5 crores, the due date for furnishing FORM GSTR-1 for the quarters from July, 2017 to September, 2018 has been extended till 31st October, 2018.

Notification Nos. 43 and 44/2018 – Central Tax dated 10th September, 2018 have been issued in this regard. For registered persons having aggregate turnover up to Rs 1.5 crores in Kerala, or whose principal place of business is in Kodagu (Karnataka) and Mahe (Puducherry), the due date for furnishing FORM GSTR-1 for the quarter July, 2018 to September, 2018 would continue to remain as 15th November, 2018 as notified vide notification No. 38/2018-Central Tax dated 24th August, 2018.

✔ Further, for those taxpayers who will now be migrating to GST as per the procedure specified in notification No. 31/2018-Central Tax, dated 06.08.2018, the last date for furnishing the details of outward supplies of goods or services or both in FORM GSTR-1 and for filing the return in FORM GSTR-3B for the months of July, 2017 to November, 2018 has been extended till 31.12.2018.

✔ Notification Nos. 45, 46 and 47/2018 – Central Tax dated 10th September, 2018 have thus been issued for extension of dates for filing FORM GSTR-3B.

It is hereby clarified that as per the provisions of section 16 (4) of the Central Goods and Services Tax Act, 2017, the registered person shall not be entitled to take input tax credit in respect of any invoice after the due date of furnishing of the return for the month of September following the end of financial year to which such invoice pertains; or furnishing of the relevant annual return, whichever is earlier.

The taxpayers are thus, advised to furnish their returns on time to ensure that input tax credit does not become time barred.

For further clarification and professional assistance, feel free to contact at sandeeprawatca@gmail.com

GSTR 3B ki penalty waive kb hui… any notification

What about those who have paid the late fees and filed the returns? Will it be returned back?

Please advice.