In this piece of writing, we will discuss the concept and procedure for transfer of shares by the Company to “Investor Education and Provident Fund”, a fund established by Central Government under section 125 of the Companies act, 2013 for specific purpose and recent amendments by Central Government in Investor Education and Protection Fund Authority (Accounting, Audit, Transfer and Refund) Rules, 2016 (hereinafter further referred as IEPF Rules, 2016) issued by MCA via Notification[1] dated 13th October, 2017 and General circular[2] No 12/2017 dated October 16, 2017.

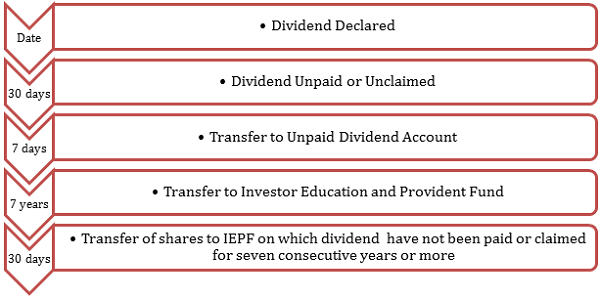

Prior to this, Lets discuss about the roots of this concept, which is arising from Section 124 of the Companies Act, 2013: “Unpaid Dividend” which provides for transfer of unpaid/unclaimed dividend i.e dividend which is not paid or claimed within 30 days from its date of declaration, then the company within 7 days shall transfer such amount to a special account namely “Unpaid Dividend Account” which will be opened by Company in a schedule bank as per section 124(1) of the Act, 2013.

Further any amount transferred to “Unpaid Dividend Account” remains unpaid or unclaimed for a period of 7 years from date of transfer, and then as per section 124 (5) same shall be transferred to ‘Investor Education and Provident Fund”, a fund established by Central Government.

At last, pursuant to the provisions of section 124 (6) of the Companies Act, 2013 read with the IEPF Rules, 2016 as amended from time to time, the Company is mandated to transfer all the shares in the name of Investor Education and Provident Fund in respect of which dividends have not been paid or claimed for seven consecutive years or more.

The aforesaid procedure for transfer of shares by the Company to “Investor Education and Provident Fund is explained below in diagrammatic format for better understanding:

Please Note: For the removal of doubts it is hereby clarified that in case any dividend is paid or claimed for any year during the said period of seven consecutive years, the share shall not be transferred to Investor Education and Protection Fund as per sub section 124 (6).

| Question: Whether a shareholder, whose shares have been transferred to IEPF, can claim back shares and whether he can attend general meeting and vote thereat?

Answer: Yes, a shareholder (even their legal heirs & representative) can claim their shares transferred to IEPF by making an application in Form IEPF-5 to IEPF authority. (Refer first proviso of sub section (6) of section 124 of the Act, read with Rule 7 of IEPF Rules, 2017) |

As per MCA vide notification, following amendments have been carried in Investor Education and Protection Fund Authority (Accounting, Audit, Transfer and Refund) Rules, 2016:

| in sub-rule (1) of Rule 6 | for the second proviso, the following proviso shall be substituted, namely:

“Provided further that in cases where the period of seven years provided under sub-section (5) of section 124 has been completed or being completed during the period from 7th September, 2016 to 31st October, 2017, the due date of transfer of such shares shall be deemed to be 31st October, 2017.”; |

| in sub-rule (1) of Rule 6

|

after the second proviso, the following proviso shall be inserted, namely:—

“Provided further that transfer of shares by the companies to the Fund shall be deemed to be transmission of shares and the procedure to be followed for transmission of shares shall be followed by the companies while transferring the shares to the fund.” It is to be treated as “Deemed Transmission” |

| in sub-rule(3) of Rule 6

|

for clause (d), the following clause shall be substituted, namely;—

‘(d) For the purposes of effecting the transfer shares held in physical form- (i) the Company Secretary or the person authorised by the Board shall make an application, on behalf of the concerned shareholder, to the company, for issue of a new share certificate; (ii) on receipt of the application under clause (a), a new share certificate for each such shareholder shall be issued and it shall be stated on the face of the certificate that “Issued in lieu of share certificate No….. for the purpose of transfer to IEPF” and the same be recorded in the register maintained for the purpose; (iii) particulars of every share certificate shall be in Form No. SH-1 as specified in the Companies (Share Capital and Debentures) Rules, 2014; (iv) after issue of a new share certificate, the company shall inform the depository by way of corporate action to convert the share certificates into DEMAT form and transfer in favour of the Authority.’; |

| after sub-rule (12) of Rule 6 | the following sub-rules shall be inserted, namely

“(13) Any amount required to be credited by the companies to the Fund as provided under sub-rules (10), (11) and sub-rule (12) shall be remitted into the specified account of the IEPF Authority maintained in the Punjab National Bank. (14) Authority shall furnish its report to the Central Government as and when noncompliance of the rules by companies came to its knowledge.”. |

| after sub-rule (2) of Rule 7 | the following sub-rule shall be inserted, namely:—

“(2A) Every company which has deposited the amount to the Fund shall nominate a Nodal Officer for the purpose of coordination with IEPF Authority and communicate the contact details of the Nodal Officer duly indicating his or her designation, postal address, telephone and mobile number and company authorized e-mail ID to the IEPF Authority, within fifteen days from the date of publication of these rules and the company shall display the name of Nodal Officer and his e-mail ID on its website.”; |

| after sub-rule (3) of Rule 7 | the following proviso shall be inserted, namely:—

“Provided that in case of non-receipt of documents by the Authority after the expiry of ninety days from the date of filing of Form IEPF-5, the Authority may reject Form IEPF-5, after giving an opportunity to the claimant to furnish response within a period of thirty days.”; |

| after Rule 7 | the following proviso shall be inserted, namely:—

“Provided that in case of non-receipt of rectified documents by the Authority after the expiry of ninety days from the date of such communication, the Authority may reject Form IEPF-5, after giving an opportunity to the claimant to furnish response within a period of thirty days.”. |

PROCEDURE FOR TRANSFER OF SHARES BY THE COMPANY TO IEPF AUTHORITY:

1.Transfer of Shares by Company to IEPF Authority in DEMAT Account, within 30 days of completion of 7 years of the date of Dividend transferred to the “Unpaid Dividend Account’.

2. Please note that:

a) Shares will not be transferred, if beneficial owner has encashed any dividend warrant during the last 7 years.

b) the period of seven years provided under sub-section (5) of section 124 has been completed or being completed during the period from 7th September, 2016 to 31st October, 2017, the due date of transfer of such shares shall be deemed to be 31st October, 2017.”; it means that shares must be transferred within 30 days i.e till 30th November, 2017.

3. Board Resolution for authorising Company Secretary or any person for giving effect to necessary acts required to be done for such purpose.

4. Concerned Shareholder to be informed of such transfer to IEPF at 3 months before the due date of transfer of shares.

5. Newspaper advertisement to be given, prescribing the names of shareholders whose shares are proposed to be transferred and their complete details pertaining to shares along with websites address of company.

6. For effecting the transfer of shares:

a) If in DEMAT form- corporate actions form to be filed with depository

b) Where shares are in physical form:

i) the Company Secretary or the person authorised by the Board shall make an application, on behalf of the concerned shareholder, to the company, for issue of a new share certificate;

ii) a new share certificate for each such shareholder shall be issued and it shall be stated on the face of the certificate that “Issued in lieu of share certificate No….. for the purpose of transfer to IEPF” and the same be recorded in the register maintained for the purpose.

iii) after issue of a new share certificate, the company shall inform the depository by way of corporate action to convert the share certificates into DEMAT form and transfer in favour of the Authority.

c) Company shall send a statement to the authority in IEPF -4 Form containing details of such transfer while affecting such transfer.

SAMPLE NOTICE GIVING EFFECT TO SUCH TRANSFER

NOTICE

Sub: Transfer of Shares of the Company to DEMAT Account of IEPF Authority.

Pursuant to the provisions of section 124 (6) of the Companies Act, 2013 read with the Investor Education and Protection Fund Authority (Accounting, Audit, Transfer and Refund) Rules, 2016 as amended from time to time, the Company is mandated to transfer all the shares in the name of Investor Education and Provident Fund in respect of which dividends have not been paid or claimed for seven consecutive years or more.

In compliance with said Rules, the company has communicated individually to the concerned shareholders whose shares are liable to be transferred to the DEMAT account of IEPF Authority and also published in the Notices in the ___________________(English Newspaper) and ______________(Vernacular language newspaper) respectively to the effect. The company has also uploaded on websites www.__________________________under investors section, the details of shareholders whose shares are liable to be transferred to IEPF Authority. The Company shall take necessary steps to transfer the concerned shares held by such shareholders in physical or DEMAT form to the DEMAT account to the IEPF Authority within 30 days from the due date i.e 30th November, 2017 in accordance with notification dated 13th October, 2017 and General circular No 12/2017 dated October 16, 2017 issued by MCA.

The shareholder may please note that no claim shall lie in against the company in respect of the shares and dividends thereof credited to the Account of IEPF Authority. On transfer of the dividends and shares to IEPF Authority, the shareholder may however claim the same y making an application IEPF Authority in Form IEPF-5 as per the procedure prescribed in the Rules.

In case the the shareholders and queries on the subject Matter, they may contact the company Registrar and Transfer Agent_______________________________________________________________________________________________________________(at given details)

For_______________________________

(Company Secretary/Authorised Person)

Date :

Place:

******************

DISCLAIMER: The entire contents of this document have been developed on the basis of relevant information and are purely the views of the authors. Though the authors have made utmost efforts to provide authentic information however, the authors expressly disclaim all or any liability to any person who has read this document, or otherwise, in respect of anything, and of consequences of anything done, or omitted to be done by any such person in reliance upon the contents of this document. READER SHOULD SEEK APPROPRIATE COUNSEL FOR YOUR OWN SITUATION. AUTHOR SHALL NOT BE HELD LIABLE FOR ANY OF THE CONSEQUENCES DIRECTLY OR INDIRECTLY.

(Author-CS Anjali Gorsia, Company Secretary from Nagpur (Maharashtra) and can be contacted at csanjali.gorsia@gmail.com)

[1] http://www.mca.gov.in/Ministry/pdf/IEPFNotification_13102017.pdf

[2] http://www.mca.gov.in/Ministry/pdf/GC12TranferofShares_16102017.pdf

Dear sir,

Mere hdfc bank ke share iepf me trfr ho gye h ab muje dmat account me lena h to uska process kya h app bt skte h kya…

Dabur Pharma Ltd had declared dividend during the year 2004-05,2005-06 and 2006-07. Company has have no proof to send the dividend to me on my address registered with the co. Now, Company has transferred my shares to IEPF Account. They did not send me any letter to me regarding unpaid dividend What can I do ? My email is ratneshdubey 1961@ rediffmail.com Kindly advice me.

the dispute with the company from 1995 still pending in court the matter is subjudiced the stop transfer taken place in 1995 and 1996 for further transfer since there is no claim of dividend for 7 years it has gone to iepf since it open document purchase in stock exchange the registered holder is already sold in circulation further stop transfer how to find out when share transfered to iepf with only cetifiate number and distinctive number

Dear Investors,

Please contact me on my number 09315645898 or my email ankitgarg.attorney@gmail.com with your queries about IEPF and how to reclaim shares from the IEPF.

Regards,

Ankit Garg, Advocate

Garg Law Chambers