Article contains Quick Referencer to National Financial Reporting Authority (NFRA), Things to be remembered about NFRA, Note on Jurisdiction of NFRA, Who is liable to file return in NFRA-1, Who is not liable to File NFRA -1 Return, How to file NFRA Form, Recommendation, Monitoring, Investigation And Enforcement Of Accounting And Auditing Standards, Investigative Powers And Powers To Take Disciplinary Actions and details on Monetary Penalties.

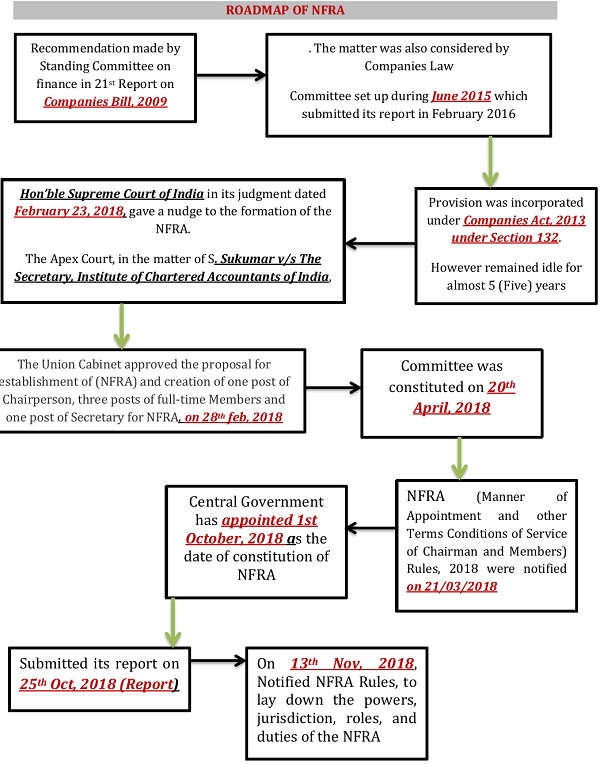

Quick Referencer:

| Applicability | All Companies |

| Applicable Section | Section 132 : Total 15 Sub Sections

Sub Section (3) & (11) were notified: 21/03/2018 Sub Section (1) & (12) were notified: 01/10/2018 Sub Section (2), (4), (5), (10), (13), (14), (15): 24/10/2018 Sub Section (6), (7), (8), (9): omitted Companies Amendment Act, 2017Provisions related NFRA Rules 13/11/2018 |

| Applicable Rules | The National Financial Reporting Authority (Manner of Appointment and other Terms Conditions of Service of Chairman and Members) Rules, 2018

The National Financial Reporting Authority Rules 2018 NFRA (Recruitment, Salary, Allowances and Other Terms and Conditions of Service of Secretary, Officers and Other Employees of Authority) Rules, 2019. National Financial Reporting Authority (Meeting for Transaction of Business) Rules, 2019 |

THINGS TO BE REMEMBERED ABOUT NFRA

An Independent Indian body constituted by central government to monitor the quality of audit undertaken across the corporate sector in India, apart from those who regulates same.

NFRA has overriding powers over other laws with respect to its various powers & functions.

NFRA is permitted with same powers vested in Civil Courts under the Civil Procedure 1908, while trying a suit.

- recommendations for accounting and auditing standards,

- enforcement of compliance with accounting and auditing standards,

- Overseeing of professionals engaged in ensuring compliance with accounting and auditing standards,

- Investigation into professional misconducts by chartered accountants empowered with powers of civil court similar to trying a suit, and for imposing penalties and debarment.

JURISDICTION OF NFRA [RULE 3 IF NFRA RULES 2018]

Entities covered under NFRA (Rule 3(1) of NFRA Rules, 2018):

| Listed Entities Rule 3(1)(a) | LISTED COMPANIES in India as well outside India |

| Unlisted Entities Rule 3(1)(b) | Certain UNLISTED PUBLIC COMPANIES

|

| Companies governed by other regulators Rule 3(1)(c) |

(In nutshell The NFRA will also have oversight over auditors of banks, insurers, electricity firms and also those body corporates referred to it by the Centre) |

| Entities referred by Central Government Rule 3(1)(d) | The Central Government seems to have been given the discretion to make a referral to the NFRA, of any body corporate or company or person(Auditor), or any class of bodies corporate or companies or persons (Auditors), in public interest |

| Material Foreign Subsidiaries & Associates Rule 3(1)(e) | Offshore associate or subsidiaries of the aforementioned entities, if the income or net worth of such subsidiary or associate company exceeds 20 % (Twenty percent) of the consolidated income or consolidated net worth of the relevant aforementioned entities |

IMPORTANT NOTE: NON APPLICABILITY OF NFRA ON FOLLOWING COMPANIES

- Private companies

- Limited Liability Partnership

- Unlisted Public Companies below threshold limit as stated above

- Offshore subsidiaries or associates which does not have material impact as mentioned under Rule (3)(1)(e)

The Central Government seems to have been given the discretion to make a referral to the NFRA of even private companies or such unlisted public companies, in public interest.

WHO HAS TO FILE ANNUAL REPORT IN FORM NFRA-1………?

As per Rule 3 (2) and Rule 3 (3) particulars of Auditor is required to be filed with NFRA: categories in two ways (1) One Time returns and (2) Event based return on appointment of Auditor

| SR.NO | AS PER RULE 3(2): | REQUIRED TO FILE | SPECIFICATION |

| 1. | Listed Entitles in India | × | These Companies are not required to file.

Their Auditor details are already being filed through Form ADT-1 with MCA |

| 2. | Listed Entities Outside India | × | |

| 3. | Unlisted Entities with prescribed threshold limits | × | |

| 4. | Insurance Company | × | |

| 5. | Banking Company | × | |

| 6. | Company engaged in the generation or supply of electricity | × | |

| 7. | Companies governed by any special statute | × | |

| 8. | Body Corporate or class of Body corporate referred by Central Government | √ | They have to file particulars of Auditor in form NFRA-1 in 30days from deployment of form on MCA website. This is regarded as One Time return |

| 9. | Body Corporate incorporated under Special Law not Company Law

Example: Life Insurance Company under the Act of Parliament, State Bank of India, Damodar Valley Corporation, Oil and Natural Gas Corporation etc have to file NFRA |

√ | |

| 10. | Further As per Rule 3 (2):

|

||

| As per Rule 3(2) Indian Body Corporate + Offshore Subsidiaries and Associate having material Impact

|

They are also required to file appointment of auditor particulars within 15 days from date of his appointment | ||

HOW TO FILE NFRA FORM

1. E- FORM NFRA-1 is available on website https://eformnfra.nic.in/.

2. NFRA form needs to be files online

3. User have to create Login ID and password credentials for same (Login ID is required Entity wise as the Authority letter would be Entity wise.)

4. In case entity, authorised official (authorised by Authority Letter/ Board Resolution)of entity is required to file NFRA, holding one of the following position:

(a) Director

(b) Chief Executive Officer

(c) Chief Financial Officer

(d) Manager

(e) Company Secretary

Such official needs to have an Identification Number like DIN / ICSI membership number, etc. to file NFRA – 1 form.

5. Detail Steps are available on

https://eformnfra.nic.in/readwrite/NFRA%20User%20Registration%20Instructions.pdf

INVESTIGATIVE POWERS AND POWERS TO TAKE DISCIPLINARY ACTIONS [Section 132 (5) read with RULES

The NFRA is given the power to investigate or initiate disciplinary proceedings not just against individual auditors but also against audit firms for professional misconduct or other misconduct.

- if it has decided to undertake investigation into any matter on the basis of its compliance or oversight activities

- if it has received any reference from the Central Government

- if it has decided to undertake suo motu investigation into any matter

- or on the basis of material otherwise available on record.

No other authority can initiate or continue proceedings where the NFRA has initiated an investigation

Whereas, all cases of professional or other misconduct against auditors of companies or body corporates who do not fall within the ambit of the NFRA shall be dealt with ICAI unless a specific reference is made to the NFRA by the Central Government.

AS per Section 132(5) any person aggrieved by the order of the NFRA may prefer an appeal before the Appellate Tribunal in such manner and on the payment of such fee as may be prescribed.

MONETARY PENALTIES:

NFRA have powers to impose penalty, for professional or other misconduct: Committed by any member or firm of Chartered Accountant:

i. In case of Individuals: not less than one lakh rupees,but which may extend to five times of the fees received

ii. In case of firms; not less than five lakh rupees,but which may extend to ten times of the fees received.

CLOSING NOTES:

Thus ICAI will continue to retain its regulatory powers in respect of, proprietorship firms, LLPs, Partnership firms, charitable trusts, Societies, AOP/ BOI, along with private companies and unlisted public companies below the above-prescribed threshold and will have discretionary powers to provide rules and regulations.

Notes:

1. Rule 3 of NFRA Rules, 2018

2. Body Corporate defined under section 2(11) of the Companies Act, 2013

3. AS per rules issued, form NFRA-1, reporting was previously to be made within 30 days of commencement of NFRA Rules instead of deployment of forms.

Disclaimer: Appreciate your support and so happy to have you as reader.

This article is only knowledge sharing initiative and is not intended to be a part of any advertising. The information contained therein is of general nature and the entire contents of this document have been developed based on relevant information and are purely the views of the authors. Though the authors have made utmost efforts to provide authentic information however, the authors expressly disclaim all or any liability to any person who has read this document, or otherwise, in respect of anything, and of consequences of anything done, or omitted to be done by any such person in reliance upon the contents of this document . READER SHOULD SEEK APPROPRIATE COUNSEL FOR YOUR OWN SITUATION. AUTHOR SHALL NOT BE HELD LIABLE FOR ANY OF THE CONSEQUENCES DIRECTLY OR INDIRECTLY.

(Author-CS Anjali Gorsia, an Associate Member of the Institute of Company Secretaries of India and a Commerce Graduate)