CA Nitin Gupta

1. INTRODUCTION

1. INTRODUCTION

Renting of Immovable property has been taxed under the earlier tax regime vide Section 65 (105) (zzzz). Renting of immovable property has been brought into tax net vide Notification No. 23/2007-ST dated 01.06.2007. But After 1.7.2012, the transition involves shift from taxation of 119 service-specific descriptions to a new regime whereby all services will be taxed unless they are covered by any of the entries in the negative list or are otherwise exempted. Accordingly as per clause (44) of section 65B of the Act it has also been stated that service includes a declared service. And Renting of Immovable property is the part of declared service.

2. Renting of immovable property

(i) Only amount which is received in the nature of rent in respect of immovable property are covered under declared service and accordingly service tax is applicable on such amount. So that I would like to discuss that meaning of “Renting” which has been defined in Section 65B of finance Act, 1994.

(ii) If Security amount is received in respect of immovable property to service provider and such amount is refundable amount then such amount shall not be treated as the part of service and accordingly service tax is not applicable on such security amount.

(iii) But if Security amount is adjusted against the amount of rent then in such amount shall be treated as the part of service and accordingly service tax is applicable on such adjusted amount.

(iv) If Electricity Charges is received in respect for supplying electricity in flats/shops (Charged on actual basis) then such amount shall not be treated as the part of service and accordingly service tax is not applicable on such electricity amount.

(v) If Service provider also provides service of maintenance Service towards maintenance of building/complex then in such case such service is treated as another service and accordingly service tax is applicable on such service.

3. Summary of above discussion

| S. No. | Amount Received | Description | Taxability |

| 1. | Renting Service | Towards of Renting of Immovable Property | Service tax is applicable |

| 2. | Security Amount | Refundable Amount | Service tax is not applicable |

| 3. | Security Amount | Non-Refundable Amount |

Service tax is applicable |

| 4. | Security Amount | Which is Adjusted against Rent Amount |

Service tax is applicable |

| 5. | Electricity Amount | For supplying electricity in flats/shops (Charged on actual basis) |

Service tax is not applicable |

| 6. | Maintenance Service | Towards maintenance of building/complex |

Service tax is applicable |

4. Valuation

As Per N/N 29/2012, the taxable service of renting of an immovable property, from so much of the service tax leviable thereon under section 66B of the said Finance Act, as is in excess of the service tax calculated on a value which is equivalent to the gross amount charged for renting of such immovable property less taxes on such property, namely property tax levied and collected by local bodies.

Provided that any amount such as interest, penalty paid to the local authority by the service provider on account of delayed payment of property tax or any other reasons shall not be treated as property tax for the purposes of deduction from the gross amount charged.

Provided further that wherever the period for which property tax paid is different from the period for which service tax is paid or payable, property tax proportionate to the period for which service tax is paid or payable shall be calculated and the amount so calculated shall be excluded from the gross amount charged for renting of the immovable property for the said period, for the purposes of levy of service tax.

Analysis

|

VALUE OF TAXABLE SERVICE= Gross Amount – PROPERTY TAXES( On Proportionate Basis) NOTE- INT AND PENALTY NOT DEDUCTIBLE Example:- Property tax paid for April to September = Rs. 12,000/- Rent received for April = Rs. 1, 00,000/- Service tax payable for April = Rs. 98,000/- (1, 00,000 -12,000/6) * applicable rate of service tax |

5. If Person Liable to pay service tax has paid excess amount of service tax on account of non-availment of deduction of Property tax Paid.

In Such Case, as per sub rule (4C) of Rule 6 of service tax rules, 1994

Where the person liable to pay service tax in respect of services of renting of immovable property has paid to the credit of Central Government any amount in excess of the amount required to be paid towards service tax liability for a month or quarter, as the case may be, on account of non-availment of deduction of property tax paid in terms of notification No. 29/2012 ice Tax , dated the 20th June, 2012, from the gross amount charged for renting of the immovable property for the said period at the time of payment of service tax, the assessee may adjust such excess amount paid by him against his service tax liability within one year from the date of payment of such property tax and the details of such adjustment shall be intimated to the Superintendent of Central Excise having jurisdiction over the service provider within a period of fifteen days from the date of such adjustment.

Analysis

|

SELF- ADJUSTMENT OF S.TAX WITHIN 1 YEAR from the date of payment of such property tax – IF EXCESS S.TAX PAID DUE TO NON DEDUCTION OF PROPERTY TAX. AND The details of such adjustment shall be intimated to the Superintendent of Central Excise having jurisdiction over the service provider within a period of fifteen days from the date of such adjustment.

|

6. Rate of Service Tax

There shall be levied a tax (hereinafter referred to as the service tax) at the rate of twelve percent. On the value of all services, other than those services specified in the negative list, provided or agreed to be provided in the taxable territory by one person to another and collected in such manner as may be prescribed.

7. Abatement value

As Per N/N – 26/2012

| Entry No. | Description of taxable Service | Taxable Portion | Exempted Portion | Condition |

| 6. | Renting of hotels, inns, guest houses, clubs, campsites or other commercial places meant for residential or lodging purposes | 60% | 40% | CENVAT credit on inputs and capital goods, used for providing the taxable service, has not been taken under the provisions of the CENVAT Credit Rules, 2004. |

8. Place of Provision of Service Rule

In this service place of provision of service is depends upon the following situation:-

(i) Where “Service Provider” and “Service receiver” is situated in taxable-territory.

As per Rule 8 of Place of Provision of Service Rules, 2012

(Place of provision of services where provider and recipient are located in taxable territory).-

Place of provision of a service, where the location of the provider of service as well as that of the recipient of service is in the taxable territory, shall be the location of the recipient of service.

(ii) Where any one is (i.e. either “Service Provider” or “Service receiver”) is situated in non-taxable territory and Renting Service is availed only for one Immovable Property.

As per Rule 5 of Place of Provision of Service Rules, 2012

(Place of provision of services relating to immovable property).-

The place of provision of services provided directly in relation to an immovable property, including services provided in this regard by experts and estate agents, provision of hotel accommodation by a hotel, inn, guest house, club or campsite, by whatever, name called, grant of rights to use immovable property, services for carrying out or co-ordination of construction work, including architects or interior decorators, shall be the place where the immovable property is located or intended to be located.

(iii) Where any one is (i.e. either “organizer” or “Service receiver”) is situated in non-taxable territory and Renting Service is availed for more than one Immovable Property.

As per Rule 7 of Place of Provision of Service Rules, 2012

(Place of provision of services provided at more than one location).-

Where any service referred to in rules 4, 5, or 6 is provided at more than one location, including a location in the taxable territory, its place of provision shall be the location in the taxable territory where the greatest proportion of the service is provided.

Analysis

9. Point of Taxation Rule

CASE 1:- “if Service shall not be treat as import of service.”

As per Rule 3 of Point of Taxation Rules, 2011

Determination of point of taxation.- For the purposes of these rules, unless otherwise provided, ‘point of taxation’ shall be,-

(a) the time when the invoice for the service provided or to be provided is issued:

Provided that where the invoice is not issued within the time period specified in rule 4A of the Service Tax Rules,1994, the point of taxation shall be the date of completion of provision of the service”;

(b) in a case, where the person providing the service, receives a payment before the time specified in clause (a), the time, when he receives such payment, to the extent of such payment.

Provided that for the purposes of clauses (a) and (b), —

(i) in case of continuous supply of service where the provision of the whole or part of the service is determined periodically on the completion of an event in terms of a contract, which requires the receiver of service to make any payment to service provider, the date of completion of each such event as specified in the contract shall be deemed to be the date of completion of provision of service;

(ii) Wherever the provider of taxable service receives a payment up to rupees one thousand in excess of the amount indicated in the invoice, the point of taxation to the extent of such excess amount, at the option of the provider of taxable service, shall be determined in accordance with the provisions of clause (a).”

Explanation .- For the purpose of this rule, wherever any advance by whatever name known, is received by the service provider towards the provision of taxable service, the point of taxation shall be the date of receipt of each such advance.”.

Analysis

Determination of point of taxation

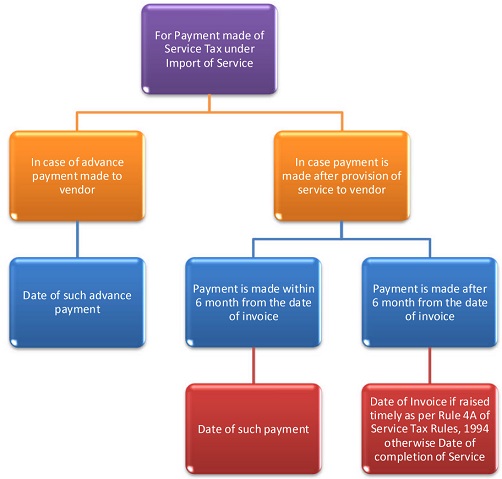

CASE 2:- “if Service shall be treat as import of service.”

In this case point of taxation is determine as per Rule 7 of Point of Taxation Rules, 2011

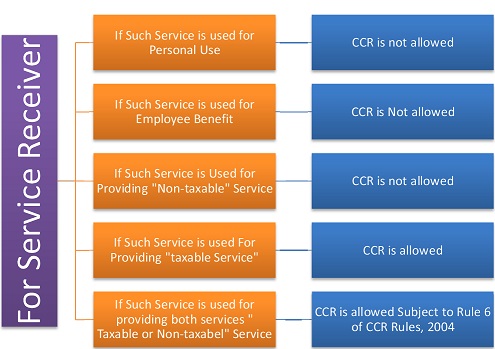

10. CENVAT Credit Rule

11. When such is considered as “Non-Taxable Service” or “Exemption Service”

(i) Non-Taxable Service

Covered Under Negate List

- Renting of vacant land, with or without a structure + incidental to its use, relating to agriculture.

- Renting of residential dwelling + for use as residence.

- Renting out of any property by Reserve Bank of India.

- Renting out of any property by a Government or a local authority to + a non business entity.

- Sale of Space of Immovable Property for advertisement Purpose.

(ii) Exempted Service

Covered Under Mega Exemption

• Renting of precincts of a religious place meant for general public.

• Renting of a hotel, inn, guest house, club, campsite or other commercial places meant for residential or lodging purposes, having declared tariff

of a room below rupees one thousand per day or equivalent.

• Renting to an exempt educational institution.

(iii) Other Exemption

Threshold level exemption up to Rs. 10 lakh. (I.e. Small Service Provider)

12. Situations

|

CASE |

Whether Service Tax is Liable or Not |

| permitting usage of a property for a temporary purpose like conduct of a marriage or any other social function | Service tax is Applicable |

| Renting of property to an educational body for the purpose of education | Service tax is not applicable (As Per Mega Exemption) |

| Renting of vacant land for animal husbandry or floriculture | Service tax is not applicable (As Per Negative List). |

| Permitting use of immoveable property for placing vending/dispensing machines | Service tax is Applicable |

| Allowing erection of a communication tower on a building for consideration. | Service tax is Applicable |

| Renting of land or building for entertainment or sports | Service tax is Applicable |

| Renting of theaters by owners to film distributors (including under a profit-sharing arrangement) | Service tax is Applicable |

| Hotels/restaurants/convention centers letting out their halls, rooms etc. for social, official or business or cultural functions | Service tax is Applicable |

| Commercial Property For Commercial Use | Service tax is Applicable |

| Residential Property For Residential use | Service tax is not liable (As Per Negative List). |

| Residential Property For Commercial Use | Service tax is Applicable |

13. Flow Chart for “Renting of Immovable Property”

Note: – If any query relating, please sent mail at nitin.gupta52@yahoo.com.

Sir

Service Tax on Renting of Immpovable property give to Education institutional is service tax applicable, if applicable from with effective date and Notification No and Circular No. Please revert by return mail is highly appreciated.

Thanks and Regards

DESHPANDE

HUBLI-KARNATAKA

Sir,

Our Pramotor/Director has given land on lease to the company.We have made provision of lease rent payable of Rs.506250/- every quarter.From 5-6 years we have made only provision No Rent has been paid

Whether such transactions is taxable under Service Tax?

Whether residential property is leased for a period of 3 years, is taxable under Income tax?

i have 2 doubts on my mind on the Renting of immovable Property. Please clarify with section and clauses

1. if a Property Owner have 2 Commercial property on rent, Income received from One tenant of Rs. 7 Lakh and other tenant of Rs. 5 Lakh, is service tax aaplicable on Owner? Given with example

2. if a Property Owner have 2 Commercial property on rent, one is individual and 2nd property in joint with other Co-Owner? Rental income from first Tenat of Rs. 7 lakh and Rs. 5 Lakh from other tenant (2.5 Lack Each). Now Service tac applicable on it? if yes given detailed with example

thank you

sir iam a running an computer showroom in an rented commercial building vide an ageement . my rent is 5500 per month my landlord has imposed service tax along my rent in order to run the bussiness.whether i am applicable to pay service tax along the rent.pls give information.st was not mentioned on the agreement.but he gets rent above 10,00,000.whether landlord will pay or i have to bear.can the landlord take st from me.

i have 3 doubts on my mind on the Renting of immovable Property. Please clarify with section and clauses

1. if a Property Owner have 2 Commercial property on rent, Income received from One tenant of Rs. 8Lakh and other tenant of Rs. 6 Lakh, is service tax aaplicable on Owner? if yes then how can they charged from Tenant . Given with example

2. if a Property Owner have 2 Commercial property on rent, one is individual and 2nd property in joint with other Co-Owner? Rental income from first Tenat of Rs. 8lakh and Rs.6Lakh from other tenant (3-3 Lack Each). Now Service tac applicable on it? if yes given detailed with example

Sir,

Let out the property to education institution and it was crossed Rs.10.00 lakhs in 2014-15. Is it applicable for or attracted for Service tax. May I apply for service tax registration? Can I got exemption of Rs.10.00 lakhs first year. Kindly advise me.

We have made an agreement for letting out a office @ Rs. 1.00 Lac Per month(fixed amoount) on 1.4.2014. i.e. total Rs. 12.00 Lacs. is we requires to pay service tax on whole amount of Rs. 12.00 lacs or on Rs. 2.00 lacs as we have made an agreement on 1.4.2014 itself.

please clarify the legal provision

I have a query.If a firm has charged rent p.a. Rs.7,00,000/- and taken a security deposit of Rs.70 lakhs. The firm has given the only one property in rent and hence rent income is below thresold limit. Whether the firm is liable to charge service tax from the tenant in view of higher amount of interest free security deposit has taken ? pl. give a reply

lucidly defined great

superb article

In Kerala sub leasing is not allowed, but a partnership firm taking a building for rent and distributing the space of the building to different firms for starting counters for serving cooked food (FOOD COURT CONCEPT). For which the each counters pays rent to the partnership firm and the firm collecting service tax from them ( renting of immovable property basis).

Is it applicable for service tax in Kerala where subleasing is not allowed ?

Is there any reverse charges on Rent a office in Delhi, if the landlord is individual and charging ST on rent. Is it necessary for Tenant to register under Service tax if the tenant paying ST on rent? Please advise.

sir i have given for rent and collecting ST in my name. now i am starting a business at individual capacity and rent a premises for which i should pay ST can i vat ST and pay only the difference only.both is in the same account no.

For your advise, pl

My gross rental income is Rs.10,24,000/- in a particular FY and in the same FY I have paid Rs. 31,000/- towards property tax to local Municipal Corporation.

My question is:

Do I become liable to pay Service tax as the net rental received in that particular FY is Rs. 9,77,000/- which is less than Rs. 10,00,000/- threshold limit?

SIR, I WANT TO KNOW WHEATHER SERVICE TAX IS LEVIABLE ON DAMAGE CHARGES (IN FORM OF RENT) RECEIEVED AFTER EXPIRY OF LEASE PERIOD??

what is the status of tax applicability in case,

a) commercial property let out for residential purpose (for some period)

b) residential property let out partly commercial and partly for residential

c) is there any valuation norms for rent receipt (say Rs.xx per sq. ft depends on the area)

d) how to identify this property is commercial property or residential property.

what is the status in case the commercial property is let out for residential purpose..!!

whether service tax is payable on rental income from immovable property used for agriculture produce

In reply to

MR. Ganesh Rao,

In case of declared tarrif is equal to or more than 1000/- , then mega exemption is not available.

In such case , abatement under notification under 26/2012 is possible, where service tax is charged on 60% of the amount of Actual rent charged (subject to rule 5 for inclusions & rule 6 for excursions )( a bit technical ) is to be charged & paid by the service provider..

what will be the place of registration in renting of service tax.

Place where the property is situated or in other place also we can take the registration.

Sir

I have paid luxury tax on the rent receipts from my lodging business. Whether I am liable to pay service tax also in addition to luxury tax?. Whether there is any exemption? please clarify

PERIASAMY

sir,

Mega Exemption no.25-S.No.18

It says renting by hotels with declared tariff less than rs.1000 or equalent ?

What if declared tariff is Rs.1000 ?

whether Mega Exemption no.25-S.No.18 can be applied…?

Department person said Rs.1000 is Taxable..

Please clarify..

Thank you

Sir,

I have crossed 10 Lakhs rental income from my commercial property. I have registered with Service Tax Department and received the service tax after threshold limit and paid to the Service Tax Department. Shall I avail the same limit in Second Year and subsequent years. If my second year collection proposed to be 8 lakhs, shall i collect the service tax monthly from the tenant or not.

please brief me sir,

KMRao.

we have a pvt ltd company registered as service recepient of GTA service and paying rent for warehouse alongwith service tax charged by landlord. Is the service tax paid against rent be claimed as we are registered as Service recepient of GTA, where the service tax paid on rent is higher than service tax payable for GTA service.

Respected sir,

Kindly note we had purchased property in 2011 just in front of our house . ground floor was rented to the allahabad bank in 1979 by earlier landlord as a godown. It’s been three years since we are requesting to bank to vacant the godown .In spite of several reminder and written application nothing

has happened .pls.note it is ranted on simple rent agreement.pls.advise any way or action which canbe taken against the bank to vacant the godown as we need reconstruct our house from ground floor. Please comment.

Regards

Wajiha

Is Service tax chargeable on renting of immovable property by a state / Centre govt dept./ local authority to another govt department in india

say for e.g. an Estate office renting a land to post office?

very useful one to all..

sir I have a one question about rent for immovable property by a government that means Director of Handlooms it under come government ?, and it is cover by taxable service or not, already include negative list as per notification No 23/2007 dated 01.06.2007, but then after 01.07.2012 any notification is there, please suggest to me sir Thank You.

Please Guide

Corporation of State Government engaged in Transport Service to Public allowing hawkers to sell their commodity to passengers in Bus Stand. Said corporation permit eligible hawkers only to sell commodity against nominal fees. Whether Service Tax is Applicable on fees collected from hawkers ?

Sir,

What is the minimum amount of rental income from immovable properties given to commercial establishments such as educational institution and guest houses to come under the purview of service tax. What is the percentage of service tax payable?

Prithviraj

Rent received is 12 lacs in two names i.e 6 lacs each. Service tax registration is required or not.

Respected sir,

We are service tax paid on renting of immovable property service.But we are collected other charges i.e. Maintenance Charges then this charges included in this service or other service applicable for this service

If a Government/ University building is rented for a Post Office, is that building taxable under service tax.

Please notify

Dear nitinji,

renting of warehouse for agri commodities in village area is comes under service tax? please suggest.

regards,

tejash

Respected Sir

I have given a space to Airtel on rent for installation of mobile tower and my query regarding this is weather rent received on mobile tower is liable for service tax or not as because there are different opinion regarding the same.

According to Essar Telecom Infrastructure Pvt. Ltd. vs. Union of India (Karnataka High Court) the court said that renting of mobile tower is liable to Vat and not service tax so in this connection will you please tell me to know weather service tax is applicable or not and if it is applicable then please let me know from which date the service tax is applicable on the same.

Please help me in this regard I will be waiting for your reply

In case of both owner of commercial property, if rent received Rs 20 Lakh to both owner through separate cheque of Rs 10 lakh each, limit of Rs 10 lakh will be applicable to each owner or not ?

I am taking a commercial property on rent from the owner and renting it out to a tenant. I am paying the owner ST on the rent paid. The tenant is paying me ST on the rent received.

Can I set off ST Paid against ST Received and pay the net amount? Is that my net liability?

Whether rent from a hospital/nursing home on lease is taxable under service tax?

Service Tax on renting of immovable property:

If in a FY the gross rent received/recievable is less than Rs.10.00 lakhs, while in previous year it is higher, what are the implications?

How to file return /claim benifit if any?

Kindly enlighten.

Thanks a lot.

I have purchase an resale property at navi-mumbai, i would like give it for rental basis, expected mthly rent would be 10000/- pm, what would be service tax amt.

Thanks for your effort and sharing the knowledge.

Dear Nitin ji

Kindly suggest about the taxability of renting of farm house meant for banquet hall purpose by the landlord.Annual rent receivable is Rs 15 lacs(i.e Rs 1.25 lacs per month will be received by the landlord from tenant who will then use it for letting out for marriage purposes). Land is agricultural land as per land records and application for CLU is pending.Will service tax be applicable on such receipt? Or can that income be treated as agricultural income till CLU is granted?

Had the TDS on Service Tax been covered and its calculation + accounting entry shown the article would have been wholesome.

Dear Adinarayana

No, Service tax is not leviable If Renting of residential dwelling for use as residence.

Thanks Nitin

Is service tax is leviable on Renting of immovable property (Houses) for Residential purposes also or is it exempt?

yes, rent from a mobile tower on a vacant land is taxable under service tax

notify me

Whether rent from a mobile tower on a vacant land is taxable under service tax?