Securities and Exchange Board of India

Discussion Paper

Review of Rights Issue Process

1. Objective

1.1. The objective of this discussion paper is to seek comments / views from the public and market intermediaries on Review of Rights Issue Process.

2. Background

2.1. Securities market, including the primary markets, is dynamic and needs to keep pace with the evolving economic and technological environment. Accordingly, there has been a significant change in the regulatory framework governing the primary markets, particularly initial public offerings, thereby making the product timelines and processes efficient.

2.2. While SEBI has enabled rights issue through the fast track route, subject to certain conditions, cutting down significantly on the timelines, SEBI is further exploring ways to make the rights issue process more efficient. Issuers perceive a higher exposure to price risk due to current rights issue process while investors expect allotment and listing timelines to be shortened. The current process of trading of rights entitlement, which is settled physically with low liquidity, is also needed to be addressed.

2.3. This discussion paper evaluates means to (i) reduce time between announcement of terms of the issue and issue closing thereby reducing price risks, and (ii) make the application and allotment process more efficient by using the banking and depository infrastructure and provide issuers with an efficient mechanism for raising funds, and to streamline the process, reduce post issue timeline for rights issues and methodologies associated with rights issue fund raising process.

3. Issue

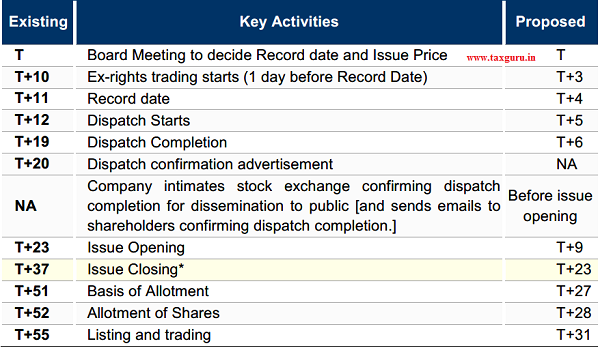

3.1. A current rights issue process, through the fast track route, typically takes about 55-58 days from the time the Company decides to launch the rights issue till listing. This timeline (excluding the period taken for completing the letter of offer and any statutory and regulatory approvals) has three broad components:

3.1.1. 26 days from the notice of the Board Meeting to the opening of the Rights Issue

3.1.2. Issue Period of at least 15 days and not more than 30 days from the opening of the Rights Issue to the closing of the Rights Issue – this is a requirements under the Companies Act 2013

3.1.3. 12 working days [~15 days] for allotment and listing The key activities and timeline in the current process are as follows:

![12 working days [~15 days] for allotment and listing The key activities and timeline in the current process are as follows](https://taxguru.in/wp-content/uploads/2019/05/12-working-days-15-days-for-allotment-and-listing-The-key-activities-and-timeline-in-the-current-process-are-as-follows.png)

3.2. During the period specified in 3.1.1 and 3.1.2 above, the issuer company and the shareholders of the Company are exposed to price risk. It can be observed from past transactions that once the rights issue price and terms are announced, the stock price or the company and the rights issue price begin to converge, leaving little incentive to shareholders to benefit from the rights issue price, which is typically at a discount to the trading price at the time of announcement. Also chances of macro events impacting stock performance of companies, from the time issue price is announced are high, given current rights issue timelines.

3.3. Further, while in IPOs, with the introduction of UPI based payments coupled with ABSA facility, it is proposed that allotment and trading is completed in 3 working days from issue closure, in a rights issue, allotment and trading processes take up to 12 working days from issue closure. This is largely on account of physical verification of forms and requests that deal with renunciation, consequently allowing non ASBA payments for renouncees.

3.4. Given the above timelines, there is a need to reduce the timelines both in the pre issue opening phase and after issue closure such that the issuer and shareholders benefit from process efficiencies.

4. Proposal

4.1. Reduction in period of notice for Record Date: Regulation 42 of the SEBI (LODR) Regulations 2015 requires companies to give 7 clear working days (i.e. excluding date of notice and record date) for setting a record date. Regulation 73(1) of ICDR requires issue price to be determined before determining record date. Both these regulations combined together require issuer to set issue price when board of the company decides record date. Record date, due to requirement of 7 clear working days’ notice, assuming no holidays other than weekend, in practice works out to period of 11 to 13 days.

Suggestion: To reduce the notice period under Regulation 42 of LODR to 3 clear working days (instead of 7 clear working days), and the requirement to determine issue price prior to record date may continue.

Rationale: Three clear working days’ notice would actually result in dissemination of information to shareholders and other investors at least 4 days before record date and at least 3 days before share starts trading on an ex-rights basis. It, therefore, gives enough time for shareholders and investors to trade in the shares. Notice of 3 clear working days would enable execution and settlement of any trades consequent to decision on terms of the rights issue.

| Board Meeting to decide Record date and Issue Price | T |

| Ex-rights trading starts (1 day before Record Date) | T+3 |

| Record date | T+4 |

4.2. Replacing the requirement to publish a newspaper advertisement confirming completion of dispatch with giving intimation to the stock exchanges: Regulation 84 of the SEBI ICDR Regulations requires issuer to publish an advertisement in newspapers confirming completion of dispatch of the letter of offer and composite application forms to shareholders of the company, at least 3 days before the date of opening the issue. Further, Section 62 of the Companies Act, 2013 prescribes that dispatch has to be completed 3 days before issue opening. In addition, the companies shall be required to send emails to shareholders whose email addresses are available with depositories, informing them about the dispatch completion.

Suggestion: The Companies Act, 2013 requires companies to complete dispatch of the letters of offer and composite application forms to shareholders of the company 3 days before issue opening. Since this requirement has to be complied with and there are other process changes suggested that will ensure shareholders are aware of the rights issue, this requirement of publishing advertisement may be done away with. It is suggested that issuers may intimate stock exchanges before issue opening about dispatch completion,

which would be notified to shareholders/ investors through the corporate announcements module on the exchange websites.

Rationale: A public advertisement process adds time and cost to the rights issue process. All material information is communicated to shareholders/ investors through stock exchange announcements. In addition, companies often use electronic means to communicate with their shareholders, on an ongoing basis. Hence, the requirement to give a newspaper advertisement can be replaced with requirement to intimate the shareholders through the stock exchanges and through email where such details are available.

4.3. Moving to electronic modes of receiving entitlements, processing, payment and settlement in a Rights Issue: Currently rights entitlements (“RE”) are intimated to shareholders through composite application form (“CAF”). Registrar overprints RE in the CAF based on rights ratio post the record date and dispatches the same to shareholders. This process of printing and dispatch currently takes ~7 days or more depending on number of shareholders. Shareholders can use the CAF for either applying in the issue or renouncing the entire entitlements or request registrar for split forms if partial renouncement is required. Further RE can be traded on the exchanges, however the settlement is physical.

Further, renouncer or renounces, in the current process, cannot apply through ASBA as the registrar needs to verify validity of renouncement by verifying the CAF. Application by a renouncee requires payment through bank and not ASBA. As a result, post issue process stretches up to 13-15 days till allotment and 17 days till listing, within the 12 working days’ limit prescribed in the regulations for rights issues.

Suggestion: In order to address these issues, certain process changes are suggested.

a. Dematerialization of entitlements under a separate ISIN – rights entitlements (“RE”) shall be credited to shareholders’ demat account only.

b. Shareholder can use such dematerialized RE for applying in the rights issue or renouncement, either full or in part. The need to request of split forms would be done away with.

c. Based on communication in the exchange notification for dispatch completion, shareholders holding shares in physical form would be required to provide details of their demat account to the Registrar at least 7 days before issue closing. Registrars would credit the entitlements to the Demat account of such shareholder within 2 days of receipt of information.

d. Overprinting of CAFs would not be required and application form in a format similar to current IPO form would be used. Such blank forms would be also available on the website of exchanges.

e. Shareholders and renouncees would fill up the form/use online application facility provided by ASBA banks. Investors would need to indicate in the form the number of shares they intends to apply for, based on entitlements and any additional quantity.

f. All investors would be required to mandatorily use ASBA as payment mode, whether shareholders/ renouncers or renouncees.

g. Post the closure of the issue, the ISIN for the rights renunciation will be temporarily suspended. This would ensure that no trading/transfer is permitted thereafter.

h. Registrar would receive application details from the Stock Exchange. Facility for correction of bid data on T+1 i.e. next working day after issue closing may be provided.

i. Registrar would use the application file provided by exchanges, along with details of actual RE available in the demat account of all the applicants and details of amount blocked in the ASBA accounts. After the basis of allotment is approved, shares shall be credited to the demat account of the applicants.

j. Post allotment, the ISIN for REs would be cancelled. Company shall thereafter obtain listing and trading permission.

k. In cases where promoter/ promoter group conducts an inter-se transfer of renunciation, the trading platform of the stock exchange can provide this facility through a separate window, pursuant to a request. This would ensure that flexibility provided for inter-se transfer between promoters and promoter group can be met.

i. Stock exchanges may permit trading of rights entitlements and such facility would be available to ensure that renouncees will be able to participate in the rights issue.

m. No withdrawal of applications will be permitted for any shareholder after issue closure.

n. Fractional entitlements currently are rounded down, but preference for allotment of one share is given if such shareholder makes application for additional shares. Registrar shall follow existing process in this regard under the new process.

o. In certain cases, due to the rights entitlement ratio decided by the company, the entitlement of shareholder may be less than one share. In such cases, shareholder receives CAF with zero entitlement but is eligible to apply in the current process. In the proposed system also, similar process would be adopted.

Rationale: Electronic credit and trading of rights renunciation will make the process of renunciation more transparent and efficient. Payment through ASBA facility is investor friendly and enables faster completion of the post issue process. As a result of these measures, post issue timeline would be reduced by 11 days.

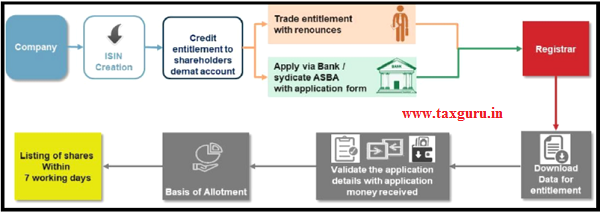

A. Proposed Process & Timeline:

A process diagram of the proposed flow is given below:

It is expected that if the above changes are carried forth, the new timeline will be as follows:

*Issue Open Period in the table above is considered as 15 days, which is the minimum period under the Companies Act, 1956

The process indicated above can be used for securities other than equity shares offered on rights basis to the shareholders also.

5. Public comments

5.1. Considering the implications of the said matter on the market participants including listed companies, market intermediaries and investors, public comments on the policy framework proposed above are solicited. The comments on above, may be sent by email or through post, in the format below:

| Name of entity / person :

Contact Number & Email Address : |

|||

| Sr. No. | Reference Para of the discussion paper | Suggestion/ Comments | Rationale |

While sending email, kindly mention the subject as “Comments on discussion paper for Review of Rights Issue Process”.

The comments may be sent by email to [email protected] or sent by post at the following address latest by June 21, 2019:

Ms. Amy Menon

Deputy General Manager

Corporation Finance Department

Securities and Exchange Board of India

SEBI Bhavan

Plot No. C4-A, “G” Block

Bandra Kurla Complex

Bandra (East), Mumbai – 400 051

Ph.: +91-22-26449584

Issued on: May 21, 2019