INTRODUCTION

Before analysing why Insider trading activity is illegal and could affect the stock market, we must understand the meaning of “Insider Trading.”

It can be defined in many ways or have different explanations, which are debatable. To understand Insider trading activity, “how it happens,” “what harm it causes,” “how it can be avoided,” and “what it is,” we must acknowledge the fact that everyone needs to abide by its laws, rule, and regulations before giving it a mind to be indulged in such illegal activities. The recent Insider trading controversy involving “Jena Sisters,” “Chhaparias,” and Progressive Share brokers (“PSB”), where SEBI has penalised them INR 15 Lakh for Front Running Case[1], which is a total of 06(Six) entities indulged in running the trade for DHFL[2]. The primary focus of this research is on Insider trading general laws, rules, and regulations imposed on illegal transactions and activities by SEBI and SEC.

This paper includes a comparative overview of the difference between India’s Insider trading laws and the U.S.’s Insider trading laws. An attempt has been made to understand how these Indigenous laws impact the Market and how they curtail these illegal activities from it. However, at some point, we also need to realise that Indian Laws are so poorly versed and developed that these irregularities repeatedly happen in the Market, the basis on which the parties sometimes must depend on the laws of other jurisdictions before dealing with any cases. The reason for bringing the comparison between the two jurisdictions will enable a broader understanding of how the international district takes the substantive steps through its general laws, rules, and regulation to control illegal trading in the Market, the basis on which the Indigenous laws need to be reframed itself for better way-out for curving these activities.

In Insider Trading activity the dealing is done between the parties, and such dealing is used by the party as an abusive position for the regulation of such illegal activity, which leads to the breaching and breaking of the trust and confidence of the outsiders who are indulged in legally buying and purchasing of stocks. However, this term’s action is considered cheating and not treated equally while dealing in shares in the share market which leads to punishment as per the law.

Although United States (U.S.) became the first country to enact and practice the legislation of regulating the Insider trading law through SEC in 1934 and has been very stringent in practicing the law and punishing the culprits who are indulged in the Insider trading activity, however India thought to take steps and pass the Insider trading laws 1st in 1948; however, the legislation addressing the Insider trading laws was enacted in 1992 in the form of SEBI.

When the Companies Act (“The Act”) was amended in 1965, the concept of prohibition of Insider Trading of securities[3] was enacted further for its usage and was used for applying the same in the market against the Insiders. However, SEBI was replaced with a “2015 regulation.”[4] revamping the capital market structure.

But with passing time there were many formulation/addition/deletions and updation in the provisions for defeating the Insider trading activity from the year of its inception in the year 1948 with the formulation of Thomas Committee till the formulation of ‘T.K. Viswanathan Committee,” in the year 2018.

ARTICLE OVERVIEW:

This Article is divided into four major parts. The 1st part is titled, ‘What impact Insider trading activity has brought up in Indian Capital Market?’ which discuss its formation, including but not limited to the various committee report and their solutions/revisions/amendments/suggestions provided, which needed to be applied then in Companies Act 1956. As a part of the doctrinal and historical research method, extracting data from past case laws, it is essential to look back at the landmark case involving Hindustan Lever Limited (HLL) vs SEBI[5], where we found that HLL purchased almost an 8(Eight) lakh shares of (BBLIL) in March 1996, which actually the two weeks before the public announcement was to be made of the merger of the two companies.

The Second part, “Role of SEBI and SEC on Insider Trading,” which compares the two jurisdictions and their regulations on Insider Trading activities; where I would like to highlight how the laws of India on this subject are not well developed, and the court must heavily depend/rely on the laws of Insider trading of another jurisdiction while concluding and giving any solution for that respective cases including but not limited to the quantum of penalties that gets levied upon the Insiders and its concerned person.

The third part, titled “Why is there a low rate of an investigation by SEBI in the Indian Market”, want to focus mainly on the criticism received, where there has been a failure by SEBI to award a severe punishment for Insider trading.

And the final part, titled “How Sebi can Curb out the Insider Activity Issue?” where I want to focus on the solution what SEBI can look for into for curbing out the Insider trading activities.

Having said that it is utmost important to not only know how these activities arise but also, we need to understand what practice government authorities in different jurisdictions of the country take up to curb out these issues, including knowing their strategies so that the malpractices in the market can be stopped.

RESEARCH QUESTIONS ON INSIDER TRADING LAWS:

A. What impact Insider trading activity has brought up in Indian Capital Market?

Having said that the unethical practice involved in the capital market need a proper implementation of ethical practices, being important it is much required steps for every organisation to give a rise of there goodwill in the market.[6] Proper emphasis should be given for implementation of such ethical code of business in order to ensure the satisfaction of all stakeholders in the Company[7]. This will also ensure that employees in an organisation are more satisfied and loyal.[8]

If we take the insider trading activity in general, it not only creates conflict of interest in market between the traders

Although, there has been chronology of events in implementing and upgrading the Insider trading laws in India by the regulatory authorities, there has still been lack in well-developed laws, wherein it provides strong case against such Insider trading activities being regulated in the market. As we know that there are many ethical arguments against the Insider trading activities which has been regarded as problematic[9], but the problem in this capital market is that the equal information is not being held by all traders indulged[10].

Now as we know that BSE[11] was established in 1875 wherein the securities market in India started to regulate and function. However, there were no acts or regulations to govern them, but there were two acts back in 1947, and 1956 named as CIA[12], and the SCA[13]. Insider Trading laws have been repeatedly improved/amended/changed with all leaps and bounds, curbing out the loopholes. However, we need to understand its history and the chronology of the event of the evolution and the changes that have happened to date into it.

Chronology of Insider law evolution with explanation: (Based on publically available news items)

i. 1948: India, back in the 1940s, formulated a government committee named Thomas Committee in 1948, which got evaluated from the books of regulations of the US SEC act 1934 as a short swing profit under section 16 of the Act. This provision was further inserted in the Companies Act[14]

ii. 1979: However further, there were many inadequate provisions for curbing outside Trading activity, so Sachar Committee was formed in 1979 to re-look at the requirements for enforcement in the Companies Act 1956. In this Committee, the report said that the directors, company secretaries, auditors, or any person in the organisation could manipulate the stock market price by having the price-supplied information with them. Hence, they recommended amendments in the provision of the Companies Act 1956 under section 307 and 308 of the Act, which would restrict or prohibits the dealings of employees.

iii. 1986: To reframe the provision further Patel Committee was also formed, where Insider trading was defined and formulated, wherein the person who is engaged in the trading of the shares of a company being already involved himself/herself in the management of the Company or is known very close to the management where they are equipped of the price sensitive pieces of information.

iv. 1989: Abid Hussain Committee further proposed a separate statute regulating Insider trading.

v. 1992: After the formulation of these committees, as said above, the formulation of India’s first standalone legislation on Insider trading, took place and eventually came into existence.[15]

vi. 2002: However, due to certain discrepancies seen in the 1992 regulations, which gave rise to the cases like “HLL VS SEBI” and “Rakesh Agarwal Vs SEBI”, the new amendment came in 2002 was known as the SEBI ([Prohibition of] Insider Trading) Regulations, 1992. Although the 1992 regulation was punitive, 2002 amendment regulations were found to be preventive, where it bound the mandatory disclosure by the directors and the other officers. They were holding 5% or more in company shares.

vii. 2004: The experts group headed by justice M.N. Kania in August 2004 post the relevant discussion on amendments and revision which needs to done, further recommended that section II(2)(i) of the SEBI Act need to be amended and revised, which would give SEBI the power to seek and get the information’s from such professionals or the directors associated with organisation, subject to its rights.

viii. 2008: Regulations were again amended to widen the definition of Insider trading.

ix. 2015: Having said the way the capital, stock and investment market runs, the regulation framed in 1992[16] went under the scanner having loopholes into it, which was chaired by former chief justice of Kerala Justice N.K. Sodhi[17] who stressed the importance of the “party information,” which further resulted in the SEBI holding a board meeting in the month of November and year w2014 where it was approved of such amendments, post which in 2015 it was further notified on in the year 2015, January 15th , which further went for making it effective from May 15, 2015.

x. 2018: However, these regulations were further again revised by the ‘T.K. Viswanathan Committee,” which defined their one policy and practice drawing the line between what would be considered as constituting legitimate conduct being different from the legitimate conduct for the market intermediaries.

B. Role of SEBI and SEC on Insider Trading

1. Role of SEBI (Kumar, 2018)[18]

a. SEBI’s roles and powers:

As a statutory body, SEBI has various roles and power[19], which helps them safeguard investors’ interests and ensure the proper regulations of trading activity are started. SEBI can set up an inquiry committee if any individual or group has violated the Act’s provisions. They will appoint the officers who will look after the “Insiders.”[20] and its “connected persons.”[21]

The SEBI must provide reasonable notice to that Insider and connected person[22] before commencing the investigation process.

However, as part of the investigation process, the board of the Company also has to appoint an independent auditor to inspect the books of accounts, where the Insiders need to provide a necessary document to the investigating officers/agency/authorities/auditors, whomever the case may be, the basis on which the investigation will commence, and the investigating officers need to submit the report within 01(one) month detailed under the provisions of SEBI regulations 1992.

Once the investigation officer submits the reports to the SEBI, it needs to further communicate back in 21(Twenty-one) days, issuing a show-cause notice to such Insiders or its connected person[23] indulged in Insider trading activity and the basis on which they need to respond within 21 days of such communication received from SEBI.

Hence, considering the above, if the Insiders or any connected persons[24] can file an appeal can appeal to SAT[25] as per the rules detailed under the provision of Regulation 15 of the Act within 45(Forty-Five) days if they feel aggrieved and are not ready to accept the investigation decision by SEBI.

We understand that the Insiders and their connected persons[26] have access to the UPSI[27] of the Company.

b. Measures and penalties by SEBI:

SEBI has given a list of punishments and penalties on the Insiders and its connected persons[28], where they find the same on the same post the completion of the investigation by the investigating agency. It has been defined under SEBI ACT[29], where the penalties have been addressed under sections 15(G)(i), 15(G)(ii) and 15(G)(iii), which are as below:

- If the Insiders or its concerned person is indulged either of their own or on any one behalf of a Company for UPSI, shall be subsequently fined with the penalty amount of 25 crores or 03(Three) times of the profit earned, whichever is higher he/she has made: or

- If the Insider has given or shared any UPSI, then he/she may be fined with a penalty amount of 25(Twenty-Five) crores, or 03(Three) the profit made out of it: or

- Suppose the individual (“Insider”) has tried to procure any third party for dealing in the securities of another corporate based on UPSI. In that case, he/she may again be fined with a penalty of 25 crores or three times the profit, whichever is higher.

c. Case Laws:

We have encountered many past cases where SEBI has charged hefty fines on such Insider trading activities involving either the person or the organisation. A few landmark cases are as below:

When Organisations were regarded as an Insider and connected persons[30]:

- HLL vs SEBI (1996), where, as per section 2(e) of the 1992 regulation, HLL was found to be the Insider, wherein SAT observed that although there was merger between the two companies, there was chances that either of the companies information can be leaked, considering the fact that the information which was shared with HLL, was equipped with UPSI or not, which made SEBI further to introduce the details of price sensitive[31] under the provision of SEBI regulation.

- DSQ Holding Ltd vs SEBI, where, as per section 2(c) of the 1992 regulation, DSQ was regarded as the connected person[32], wherein post the investigation got completed it was found out that DSQ who failed to give the proof of his AGM, which would further prove the fact of the jump of shares that rose form Rs. 20 to Rs 92, which actually didn’t happen, and it was further held in the case that DSQ tried to make advantage of the investors who were associated with them.

When Organisations were charged hefty fines from SEBI for Insider trading activities:

- SEBI slaps a whopping 447 crore of penalty on reliance industries[33], where RIL was barred from trading activities in the derivative Market. SEBI issued an order regarding the 2007 reliance petroleum Insider trading activity case.

- SEBI charged Aptech Ltd[34] 1(one) crore for violating the norms of Insider trading rules back in 2016.

ii. Role of SEC

The United States, leading with examples for forbidding the Insider trading activity, and eventually became the first country to tackle and take actions against the Insider trading activities, which formulated the SEC Act regulations in 1934. It was in 1929 that the Market crashed, and the U.S. economy had a massive depression following the distrust in faith by Investors in the U.S. securities market. The SEC rules and regulations not only gave faith to Americans, but they believed to have more faith in investing in the stock market instead in commercial banks. This era of trust of Americans in the stock market enables the SEC to ensure all possible ways to punish the Insiders and take every step and ensure that Americans are not exploited. However, as we all know, that is how SEC was equipped with its reputation when the American Stock market was hit mainly by the famous case of high-profile individuals named Martha Stewart and former McKinsey global head Rajat Gupta.

SEC regulates and tracks[35] Insider trading activities in numerous ways, as below:

a. They are indulged in market surveillance

b. They use the Tips and Complaints method

c. They are also indulged in getting the details from the sources of the SEC division, self-regulatory organisations including but not limited to the media.

Considering any of the above processes or ways, if the SEC must retrieve any details and they have acquired the basic facts that there has been a possible securities violation in the Market, it launches a complete investigation where they interview the witness followed by tracking and examine the trading records including but not limited to the review of phone records of such Insiders indulged in securities violations of the stock market.

As per the provision stated in SEC Rule 10b-5, it prohibits the officers, directors, or other employees of the organisation from using any corporate confidential information, hence making an undue advantage by trading in the Company’s stock to avoid any loss to itself.

Also, the 1934 regulation is directly addressed by section 16(b).[36] This provision of the act disallows any kind of transaction which relates any purchase and sales made within six months by any director, officers, any other employee or stakeholders owning 10% of the firm shareholder.

Although there has been a formulation of the SEC Act 1934, we also need to understand other co-related acts interconnected with SEC for curbing Insider trading activities through its case laws, which are as follows:

- ITSA & SEA[37] provide penalties for illegal Insider trading activities, which are almost three times higher the profit gained, or the loss which has been kept away from the act of illegal trading activity because of the relevant court decision and judgement which came up from the case between SEC vs Texas Gulf Sulphur Co[38].

- In the case of Dirks vs SEC[39], we also got an understanding of the concept of “constructive Insiders” wherein U.S. Supreme court has stated that such persons will not be considered as insider, who although have the access of UPSI information, and the information further is expected to remain non-public.

- Further, the U.S. Supreme court brought in the definition of “misappropriate theory”[40] where they hold the person involved in or in connection with any securities transaction, thereby violating the 10(b) and rule 10b-5 of 1934 regulations.

- Further, the SEC also enacted Rule 10b5-1[41], which focused on defining “what is trading” and “based on”, which makes way for such inside information, which any person trades at any time while being aware of non-public information.

- In 2007, a bill entitled “STOCK[42] ACT” was introduced by representatives like Brian Baird and Louise Slaughter, which enabled them to hold congressional and federal employees liable for trading stocks via the information gathered through their jobs where they are employed into.

C. Why is there a low rate of investigation by SEBI in the Indian Market?

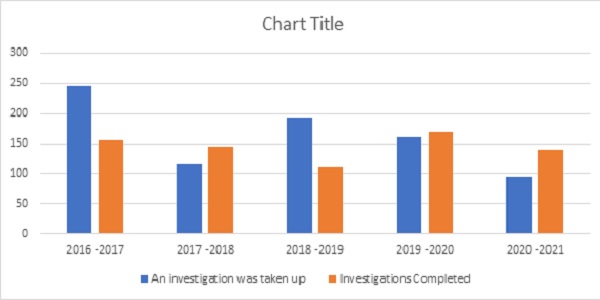

It has been a talk in a town where SEBI has been highly criticised, irrespective of any jurisdictions. It has been found that they lack basic checks for detecting and punishing the Insiders who were found to be indulging in illegal trading has been challenging. This happens due to the lack of proper investigation using proper tools and mechanisms in place, a reason why there are very low prosecutions for Insider trading. However, it has been widely accepted that Insider trading activity is planted in the securities market. However, the regulations against insider trading activity have time and again revised by the regulatory authorities. The chart below highlights the number of searches, investigations and completion done by SEBI in last 05(Five) years, which are highlighted as below:

“Why has there been a low rate in the investigation?” has been an enormous question mark, but there have been several reasons for such the low rate of the investigation by SEBI, which are as follows:

i. Firstly SEBI doesn’t have the proper human resources and we know from the fact that SEBI has almost 800 numbers of old employees who lack the knowledge for such searches and investigations being the laws getting updated, which indirectly impacts the proper investigations which needs to be done by the regulatory authorities.

ii. Secondly, SEBI does not have the proper infrastructure wherein they would be able to wiretap phone calls or check the conversation of the chats between the Insiders or the suspects.

iii. As rightly said, SEBI lacks a basic check for retrieving the data from phone records. In a recent past case (Saradha Scam)[43] in 2013, there was a standoff between the government of West Bengal and the CBI.

iv. It has also failed to utilise its power per the provision of 1992 regulations, wherein they have been given additional power by the government to exercise against the insiders and take relevant actions.

Now, no doubt due to these low rates of investigation by SEBI, they have no doubt been criticized in last 02(Two) decades, although the miscreants has been caught time and again caught, but the failure of prosecuting the miscreants has always been on low side. Although they are caught, the penalties levied on them are so low, it hardly impacts or effect these perpetrators.

No doubt, we are looking for solutions, although the law has been amended time and again, it has been questionable on the regulations, the way it has been implemented.

D. How Sebi can Curb out the Insider Trading Activity Issue?

As we know, any offences committed by such Insiders and their connected persons[44], who can investigate the matter without any hiccups and look upon it seriously. SEBI also has the power under, to initiate criminal prosecution[45]; despite having such powers, they have failed to take appropriate actions against the Insider and its connected persons[46].

In the U.S., we have already seen how the SEC has strong legislation against Insiders. However, despite the SEBI Act, the investigation rate is shallow in India, or they have indirectly depended upon the government. We have already seen in the Sharadha Scam how it resulted an Indian government taking immediate action in passing a securities law (Amendments) in 2013, which was a second ordinance further allowing SEBI and giving them open hand to get for the details of those phone records of all such person or group of persons who were involved in the insider trading activity and who need to be part of its investigations, which eventually got affect from 2014.

Instead of depending on the government, it is the SEBI that needs to curb the problems in below ways:

i. They should intake the usage of the method opted from SEC (us jurisdictions) and formulate the plans to catch such Insiders

ii. Punish the Insiders with maximum penalties

iii. Search for the ways through which Insider activity can happen and accordingly formulate the laws, rules, and punishment

iv. Be an independent regulating body instead depending on the government to pass any securities law after the crime has already commenced.

BENEFITS OF INSIDER TRADING ACTIVITY

Insider trading activity is no doubt illegal, but this activity gives huge increase in financial benefits to traders, or the participants associated with it. Let us understand few benefits that can be given to the participants which are:

a. It provides huge financial gains and income benefits.

b. It engages the participants into profitable trades

c. It helps participants to avoid risk attraction to be received from the trading market.

d. With profitable income, it also helps the participants to get bonus or promotions as a reward.

Now, it depends on person to person, of how you want to use the trading market. If the individual has the appetite of taking risk, they can use this radar as a powerful took to gain the success in shorter period.

ISSUES IN INSIDER TRADING

However as already clarified that it also brings risks with huge penalty if got caught by the regulating authorities. It literally hurt and give pain to the stock market. There are few negatives/disadvantages too of this insider trading which are:

a. Its illegal, and the same is not allowed by the Government authorities.

b. It impacts a person, a company reputation.

c. It affects market liquidity.

d. It reduces investor returns from the market.

e. It makes the transaction cost higher.

f. If caught by the government regularities, huge fines and penalties are imposed.

g. Further it may lead to longer jail term.

Considering above issues lot of investors stake in financial market is brought into risk. Hence, it is utmost necessary to be precautions as the insider trading activity no doubt will give short term benefits, but it will bring back certain misfortunes too in traders and participants life.

When we are seeking details for the list of issues of Insider Trading, wherein I can re-call the classic movie of Oliver Stone’s 1987 (“Wall Street”) in which the financier Gordon Gekko, made millions of incomes by trading the inside information of various organisations/companies via obtaining details from protégé and bud fox, although he was jailed by end of the film, post detailed investigation from the Investigation Agency and the regulatory authority.

Considering the same, USA has been very stringent in curbing the issues of insider trading activity in its region, India is still lacking the proper regulation to totally curb issues out, as year on year the investigation is taken up and they need to resolve the same if the same is found.

It has been found from 2020 study that sometimes very difficult to prove as well prevent the insider trading activity, as the insider find the some or the other way to do their notorious act. Let’s take some more example of insider trading activity from USA:

i. Stewart Stock Scandal[47], wherein a businesswomen and Martha Stewart was convicted based on wrongful process of selling the shares based on the tips received from the broker.

ii. Conviction of Ex-Congressman Chris Collins[48], wherein he was convicted for almost 0(Two) years for sharing insider information with his son and simultaneously hiding facts from FBI[49].

iii. Galleon Case[50], which is regarded as one of the biggest insider scandals in the history of USA, wherein the convict Raj Rajaratnam was imposed the jail term of almost 11(Eleven) long years.

These are above few lists of major cases from USA market, wherein the regulatory bodies have been taking stringent action against the convicts, however the laws framed in India is no doubt stringent, but it takes irrelevant timeline to proceed ahead for taking the actions against the major scandals/convicts/insiders. We have already studied Indian Cases too wherein SEBI has fined Reliance Industries[51] and Aptech Ltd[52], including what are negatives and disadvantages it can cause to the investors as well as the market.

We cannot be a scapegoat saying that no one is harmed in the market, and just for earning quantum of money in short term might satisfy few, but indirectly it impacts the potential sellers in the market who become the actual victim in the market, who sells there stocks anonymously to the insiders.

Now the damage done by insiders cannot be measured, but the government authorities and the regulatory bodies need to ensure to impose harsh penalty on the quantum of damage done.

Trust is main key activity which keep the relationship intact between the investor and the company. Companies need to ensure that they have stringent corporate governance laws which would enable them to act for best interests in respect for the shareholders of the company. Now if any insider trading activity happens, it will be regarded as a betrayal with the shareholders as well as with the investors with the company.

So, the conclusion is that if the trust is once broken, even the potential investor who are indirectly not the part of the company tries to avoid the market as they are not going to get anything in return, until and unless a better policy is framed and brought into the picture for smooth transaction in the Stock market. This is where the regulatory authority need to act in a pro-active way.

CONCLUSION:

Individuals need to understand the difference between the “buying” and “selling” of the shares from the share market, including they should also understand how share market works. Having said, that with UPSI, taking a short route for trading in the market it is not only regarded illegal, but a crime as already detailed under SEBI Act regulations and its provisions.

Now it is utmost important from Company perspective too that they need to protect their IPO before issuing it before nobody knows or get indulged into insider trading activity. The way business and this startup world is operating in India, every company should have the long-term goal from their operation point of view to maximize their growth and wealth but the same should be operative in ethical way. They should ensure to have good corporate governance established and setup in their organisation.

Hence, before changing any individual it’s the organisation duty to change themselves with better governance in place.

Notes:

[1] “Sebi Fines 6 Entities in Deutsche Mutual Fund Front-Running Case” (The Economic Times) <https://economictimes.indiatimes.com/markets/stocks/news/sebi-fines-6-entities-in-deutsche-mutual-fund-front-running-case/articleshow/95082499.cms>accessed November 7, 2022

[2] Dewan Housing Finance Corporation Ltd

[3] Prohibition of Insider Trading, Regulation 1965.

[4] SEBI (Prohibition of Insider Trading) Regulations, 2015

[5] Shreya, “Insider Trading And Recent Cases In India – Desi Kaanoon” (Desi Kaanoon, January 27, 2021) <https://desikaanoon.in/insider-trading-and-recent-cases-in-india/>accessed November 7, 2022

[6] Jalil, M.A Dr., etal, “Implementation Mechanism of Ethics in Business Organizations” – An Analysis.

[7] Ibid

[8] Ibid

[9] O’Hara, P.A in his paper “Insider trading in financial markets” – An Analysis

[10] Ibid

[11] Bombay Stock Exchange

[12] Capital issues Act, 1947

[13] Securities Control Act, 1956

[14] Companies Act 1956 under sections 307 and 308.

[15] SEBI (Insider Trading) Regulations 1992

[16] Ibid

[17] N.K. Sodhi Committee, 7th December 2013.

[18] Kumar G, “Role of SEBI in Curbing Insider Trading in India – An Analysis – iPleaders” (iPleaders, June 4, 2018) <https://blog.ipleaders.in/sebi-insider-trading-offences/>accessed November 7, 2022

[19] section 11 of the SEBI Act 1992

[20] Defined under clause (e) of regulation 2 of SEBI Act 1992

[21] Defined under clause (c) of regulation 2 of SEBI Act 1992

[22] Supra 21

[23] Supra 28

[24] Ibid

[25] Securities Appellate Tribunal

[26] Supra 29

[27] Unpublished Price Sensitive Information

[28] Supra 32

[29] chapter VI-A of the SEBI Act

[30] Supra 34

[31] Defined under section 2(ha) of SEBI regulation 2015.

[32] Supra 36

[33] “SEBI Imposes Penalty on Mukesh Ambani and Reliance Industries for Manipulative Trading” (Business Insider, January 2, 2021) <https://www.businessinsider.in/business/news/sebi-imposes-penalty-on-mukesh-ambani-and-reliance-industries-for-manipulative-trading/articleshow/80071715.cms>accessed November 7, 2022

[34] “SEBI Slaps Rs 1 Cr Penalty on Aptech for Violating Insider Trading Rules” (Business Today, April 28, 2021) <https://www.businesstoday.in/latest/economy-politics/story/sebi-slaps-rs-1-cr-penalty-on-aptech-for-violating-insider-trading-rules-294532-2021-04-28>accessed November 7, 2022

[35] Picardo E, “How the SEC Tracks Insider Trading” (Investopedia, July 13, 2022) <https://www.investopedia.com/articles/investing/021815/how-sec-tracks-insider-trading.asp> accessed November 7, 2022

[36] Mohsin K, “Insider Trading in India in Comparison With USA” (Insider Trading in India in Comparison With USA by Kamshad Mohsin : SSRN, November 17, 2020) <https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3687905> accessed November 7, 2022

[37] Insider Trading and Sanction Act of 1984 & Securities and Enforcement Act of 1988

[38] JM Quinn Brian, “SEC v Texas Gulf Sulphur” (SEC v Texas Gulf Sulphur, July 2017) <https://h2o.law.harvard.edu/collages/8888> accessed November 8, 2022

[39] JM Quinn B, “SEC v Texas Gulf Sulphur” (SEC v Texas Gulf Sulphur, November 2017) <https://h2o.law.harvard.edu/collages/8888> accessed November 8, 2022

[40] United states vs O’Hagan, 521 U.S. 642, 655(1997)

[41] Year 2000

[42] Stop Trading on Congressional Knowledge Act

[43] News Desk T, “What Is Saradha Scam? How Did India’s Biggest Ponzi Scheme Unravel” (What is Saradha scam? How did India’s biggest Ponzi scheme unravel | India News – India TV, February 5, 2019) <https://www.indiatvnews.com/news/india-what-is-saradha-scam-how-did-india-s-biggest-ponzi-scheme-unravel-502950> accessed November 8, 2022

[44] Supra 38

[45] section 24 of the SEBI Act, 1992

[46] Supra 50

[47]The Associate Press, “ Timeline of Events in Stewart Stock Scandal” (2005) <https://www.chicagotribune.com/sns-ap-martha-stewart-chronology-story.html> accessed 03rd January 2023.

[48] Renae Merle, “Ex-congressman Chris Collins sentenced to 2 years on insider-trading, false-statements charges” (2020) <https://www.washingtonpost.com/business/2020/01/17/former-rep-chris-collins-be-sentenced-insider-trading-case/> accessed 03rd January 2023.

[49] Federal Bureau of Investigation

[50] Nejat Seyhun, “Has Insider Trading Become More Rampant in the United States? Evidence from Takeovers” (2012)<https://www.academia.edu/65519459/Has_Insider_Trading_Become_More_Rampant_in_the_United_States_Evidence_from_Takeovers> accessed 03rd January 2023.

[51] Supra 39

[52] Supra 40

***

List of Abbreviations:

SEBI: Securities Exchange Board of India.

SEC: Securities and Exchange Commission.

ITSFEA: Insider Trading and Securities Fraud Enforcement Act.

USA: United State of America.

PSB: Progressive Share brokers.

DHFL: Dewan Housing Finance Corporation Ltd.

BBLIL: Brooke Bond Lipton India.

HLL: Hindustan Lever Limited.

UPSI: Unpublished Price Sensitive Information.

SAT: Securities Appellate Tribunal.

STOCK: Stop Trading on Congressional Knowledge Act.

ITSA: Insider Trading and Sanction Act.

SEA: Securities and Enforcement Act.

BSE: Bombay Stock Exchange.

FBI: Federal Bureau of Investigation

List of Case:

1. Hindustan Lever Limited vs SEBI 1996

2. Rakesh Aggarwal vs SEBI (2004) 1 CompLJ 193 SAT, 2004 49 SCL 351 SAT

3. DSQ Holdings Ltd. v. SEBI (1994)

4. SEC v. Texas Gulf Sulphur Co, 394 U.S. 976 (1969)

5. Dirks v. SEC, 463 U.S. 646 (1983)