Date : Oct 04, 2017

Fourth Bi-monthly Monetary Policy Statement, 2017-18 Resolution of the Monetary Policy Committee (MPC) Reserve Bank of India

On the basis of an assessment of the current and evolving macroeconomic situation at its meeting today, the Monetary Policy Committee (MPC) decided to:

• keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.0 per cent.

Consequently, the reverse repo rate under the LAF remains at 5.75 per cent, and the marginal standing facility (MSF) rate and the Bank Rate at 6.25 per cent.

The decision of the MPC is consistent with a neutral stance of monetary policy in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below.

Assessment

2. Since the MPC’s meeting in August 2017, global economic activity has strengthened further and become broad-based. Among advanced economies (AEs), the US has continued to expand with revised Q2 GDP growing at its strongest pace in more than two years, supported by robust consumer spending and business fixed investment. Recent hurricanes could, however, weigh on economic activity in the near-term. In the Euro area, the economic recovery gained further traction and spread, underpinned by domestic demand. While private consumption benefited from employment gains, investment rose on the back of favorable financing conditions. The Euro area purchasing managers’ index (PMI) for manufacturing soared to its highest reading in more than six years. The Japanese economy continued on a path of healthy expansion despite a downward revision in growth since March 2017 on weaker than expected capital expenditure.

3. Among the major emerging market economies (EMEs), strong growth in Q2 in China was powered by retail sales, and imports grew at a rapid pace, suggesting robust domestic demand; investment activity, however, slowed down. The Brazilian economy expanded for two consecutive quarters in Q2 on improving terms of trade, even as the impact of recession persists on the labour market. Economic activity in Russia recovered further, supported by strengthening global demand, firming up of oil prices and accommodative monetary policy. Although South Africa has emerged out of recession in Q2, the economy faces economic and political challenges.

4. The latest assessment by the World Trade Organization (WTO) indicates a significant improvement in global trade in 2017 over the lacklustre growth in 2016, backed by a resurgence of Asian trade flows and rising imports by North America. Crude oil prices hit a two-year high in September on account of the combined effect of a pick-up in demand, tightening supplies due to production cuts by the Organization of the Petroleum Exporting Countries (OPEC) and declining crude oil inventories in the US. Metal prices have eased since mid-September on weaker than expected Chinese industrial production data. Bullion prices touched a year’s high in early September on account of safe-haven demand due to geo- political tensions, before weakening somewhat in the second half. Weak non-oil commodity prices and low wage growth kept inflation pressures low in most AEs and subdued in several EMEs, largely reflecting country-specific factors.

5. Global financial markets have been driven mainly by the changing course of monetary policy in AEs, generally improving economic prospects and oscillating geo- political factors. Equity markets in most AEs have continued to rise. In EMEs, equities generally gained on improved global risk appetite, supported by upbeat economic data and expectations of a slower pace of monetary tightening in major AEs. While bond yields in major AEs moved sideways, they showed wider variation in EMEs. In currency markets, the US dollar weakened further and fell to a multi-month low in September on weak inflation, though it recovered some lost ground in the last week of September on a hawkish US Fed stance and tensions around North Korea. The euro surged to a two and a half year high against the US dollar towards end-August on positive economic data, whereas the Japanese yen experienced sporadic bouts of volatility triggered by geo- political risks. Emerging market currencies showed divergent movements and remained highly sensitive to monetary policies of key AEs. Capital flows to EMEs have continued, but appear increasingly vulnerable to the normalization of monetary policy by the US Fed.

6. On the domestic front, real gross value added (GVA) growth slowed significantly in Q1 of 2017-18, cushioned partly by the extensive front-loading of expenditure by the central government. GVA growth in agriculture and allied activities slackened quarter-on-quarter in the usual first quarter moderation, partly reflecting deceleration in the growth of livestock products, forestry and fisheries. Industrial sector GVA growth fell sequentially as well as on a y-o-y basis. The manufacturing sector – the dominant component of industrial GVA – grew by 1.2 per cent, the lowest in the last 20 quarters. The mining sector, which showed signs of improvement in the second half of 2016-17, entered into contraction mode again in Q1 of 2017-18, on account of a decline in coal production and subdued crude oil production. Services sector performance, however, improved markedly, supported mainly by trade, hotels, transport and communication, which bounced back after a persistent slowdown throughout 2016-17. Construction picked up pace after contracting in Q4 of 2016-17. Financial, real estate and professional services turned around from their lacklustre performance in the second half of 2016-17. Of the constituents of aggregate demand, growth in private consumption expenditure was at a six-quarter low in Q1 of 2017-18. Gross fixed capital formation exhibited a modest recovery in Q1 in contrast to a contraction in the preceding quarter.

7. Turning to Q2, the south-west monsoon, which arrived early and progressed well till the first week of July, lost momentum from mid-July to August – the crucial period for kharif sowing. By end-September, the cumulative rainfall was deficient by around 5 per cent relative to the long period average, with 17 per cent of the geographical area of the country receiving deficient rainfall. The live storage in reservoirs fell to 66 per cent of the full capacity as compared with 74 per cent a year ago. The uneven spatial distribution of the monsoon was reflected in the first advance estimates of kharif production by the Ministry of Agriculture, which were below the level of the previous year due to lower area sown under major crops including rice, coarse cereals, pulses, oil seeds, jute and mesta.

8. The index of industrial production (IIP) recovered marginally in July 2017 from the contraction in June on the back of a recovery in mining, quarrying and electricity generation. However, manufacturing remained weak. In terms of the use-based classification, contraction in capital goods, intermediate goods and consumer durables pulled down overall IIP growth. In August, however, the output of core industries posted robust growth on the back of an uptick in coal production and electricity generation. The manufacturing PMI moved into expansion zone in August and September 2017 on the strength of new orders.

9. On the services side, the picture remained mixed. Many indicators pointed to improved performance even as the services PMI continued in the contraction zone in August due to low new orders. In the construction segment, steel consumption was robust. In the transportation sector, sales of commercial and passenger vehicles as well as two and three-wheelers, railway freight traffic and international air passenger traffic showed significant upticks. However, cement production, cargo handled at major ports, domestic air freight and passenger traffic showed weak performance.

10. Retail inflation measured by year-on-year change in the consumer price index (CPI) edged up sequentially in July and August to reach a five month high, due entirely to a sharp pick up in momentum as the favorable base effect tapered off in July and disappeared in August. After a decline in prices in June, food inflation rebounded in the following two months, driven mainly by a sharp rise in vegetable prices, along with the rise in inflation in prepared meals and fruits. Cereals inflation remained benign, while deflation in pulses continued for the ninth successive month. Fuel group inflation remained broadly unchanged in August even as inflation in liquefied petroleum gas (LPG), kerosene, firewood and chips rose. Petroleum product prices tracked the hardening of international crude oil prices.

11. CPI inflation excluding food and fuel also increased sharply in July and further in August, reversing from its trough in June 2017. The increase was broad-based in both goods and services. Housing inflation hardened further in August on account of higher house rent allowances for central government employees under the 7th central pay commission award. Inflation in household goods and services in health, recreation and clothing & footwear sub-groups increased. Quantitative inflation expectations of households eased in the September 2017 round of the Reserve Bank’s survey. However, in terms of qualitative responses, the proportion of respondents expecting the general price level to increase by more than the current rate rose markedly for the three-month as well as one-year ahead horizons. Farm and industry input costs picked up in August. Real wages in the rural and organized sectors continued to edge up. The Reserve Bank’s industrial outlook survey showed that corporate pricing power for the manufacturing sector remained weak. In contrast, firms polled for the services sector PMI reported a sharp rise in prices charged.

12. Surplus liquidity in the system persisted through Q2 even as the build-up in government cash balances since mid-September 2017 due to advance tax outflows reduced the size of the surplus liquidity significantly in the second half of the month. Currency in circulation increased at a moderate pace during Q2, by ₹ 569 billion as against ₹ 1,964 billion during Q1, reflecting the usual seasonality. Consistent with the guidance given in April 2017 on liquidity, the Reserve Bank conducted open market sales operations on six occasions during Q2 to absorb ₹ 600 billion of surplus liquidity on a durable basis, in addition to the issuances of treasury bills (of tenors ranging from 312 days to 329 days) under the market stabilization scheme (MSS) during April and May of ₹ 1 trillion. As a result, net average absorption of liquidity under the LAF declined from ₹ 3 trillion in July to ₹ 1.6 trillion in the second half of September. The weighted average call rate (WACR), which on an average, traded below the repo rate by 18 basis points (bps) during July, firmed up by 5 bps in September on account of higher demand for liquidity around mid-September in response to advance tax outflows.

13. Reflecting improving global demand, merchandise export growth picked up in August 2017 after decelerating in the preceding three months. Engineering goods, petroleum products and chemicals were the major contributors to export growth in August 2017; growth in exports of readymade garments and drugs & pharmaceuticals too returned to positive territory. However, India’s export growth continued to be lower than that of other emerging economies such as Brazil, Indonesia, South Korea, Turkey and Vietnam, some of which have benefited from the global commodity price rebound. Import growth remained in double-digits for the eighth successive month in August and was fairly broad-based. While the surge in imports of crude oil and coal largely reflected a rise in international prices, imports of machinery, machine tools, iron and steel also picked up. Gold import volume has declined sequentially since June 2017, though the level in August was more than twice that of a year ago. The sharper increase in imports relative to exports resulted in a widening of the current account deficit in Q1 of 2017-18, even as net services exports and remittances picked up. Net foreign direct investment at US$ 10.6 billion in April-July 2017 was 24 per cent higher than during the same period of last year. While the debt segment of the domestic capital market attracted foreign portfolio investment of US$ 14.4 billion, there were significant outflows in the equity segment in August-September on account of geo- political uncertainties and expected normalization of Fed asset purchases. India’s foreign exchange reserves were at US$ 399.7 billion on September 29, 2017.

Outlook

14. In August, headline inflation was projected at 3 per cent in Q2 and 4.0-4.5 per cent in the second half of 2017-18. Actual inflation outcomes so far have been broadly in line with projections, though the extent of the rise in inflation excluding food and fuel has been somewhat higher than expected. The inflation path for the rest of 2017-18 is expected to be shaped by several factors. First, the assessment of food prices going forward is largely favorable, though the first advance estimates of kharif production pose some uncertainty. Early indicators show that prices of pulses which had declined significantly to undershoot trend levels in recent months, have now begun to stabilize. Second, some price revisions pending the goods and services tax (GST) implementation have been taking place. Third, there has been a broad-based increase in CPI inflation excluding food and fuel. Finally, international crude prices, which had started rising from early July, have firmed up further in September. Taking into account these factors, inflation is expected to rise from its current level and range between 4.2-4.6 per cent in the second half of this year, including the house rent allowance by the Centre (Chart 1).

15. As noted in the August policy, there are factors that continue to impart upside risks to this baseline inflation trajectory: (a) implementation of farm loan waivers by States may result in possible fiscal slippages and undermine the quality of public spending, thereby exerting pressure on prices; and (b) States’ implementation of the salary and allowances award is not yet considered in the baseline projection; an increase by States similar to that by the Center could push up headline inflation by about 100 basis points above the baseline over 18-24 months, a statistical effect that could have potential second round effects. However, adequate food stocks and effective supply management by the Government may keep food inflation more benign than assumed in the baseline.

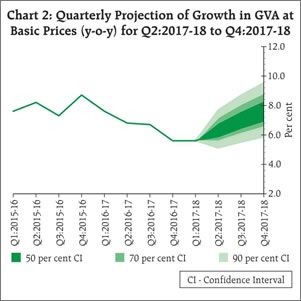

16. Turning to growth projections, the loss of momentum in Q1 of 2017-18 and the first advance estimates of kharif food grains production are early setbacks that impart a downside to the outlook. The implementation of the GST so far also appears to have had an adverse impact, rendering prospects for the manufacturing sector uncertain in the short term. This may further delay the revival of investment activity, which is already hampered by stressed balance sheets of banks and corporates. Consumer confidence and overall business assessment of the manufacturing and services sectors surveyed by the Reserve Bank weakened in Q2 of 2017-18; on the positive side, firms expect a significant improvement in business sentiment in Q3. Taking into account the above factors, the projection of real GVA growth for 2017-18 has been revised down to 6.7 per cent from the August 2017 projection of 7.3 per cent, with risks evenly balanced (Chart 2).

17. Imparting an upside to this baseline, household consumption demand may get a boost from upward salary and allowances revisions by states. Teething problems linked to the GST and bandwidth constraints may get resolved relatively soon, allowing growth to accelerate in H2. On the downside, a faster than expected rise in input costs and lack of pricing power may put further pressure on corporate margins, affecting value added by industry. Moreover, consumer confidence of households polled in the Reserve Bank’s survey has weakened in terms of the outlook on employment, income, prices faced and spending incurred.

18. The MPC observed that CPI inflation has risen by around two percentage points since its last meeting. These price pressures have coincided with an escalation of global geo- political uncertainty and heightened volatility in financial markets due to the US Fed’s plans of balance sheet unwinding and the risk of normalization by the European Central Bank. Such juxtaposition of risks to inflation needs to be carefully managed. Although the domestic food price outlook remains largely stable, generalized momentum is building in prices of items excluding food, especially emanating from crude oil. The possibility of fiscal slippages may add to this momentum in the future. The MPC also acknowledged the likelihood of the output gap widening, but requires more data to better ascertain the transient versus sustained headwinds in the recent growth prints. Accordingly, the MPC decided to keep the policy rate unchanged. The MPC also decided to keep the policy stance neutral and monitor incoming data closely. The MPC remains committed to keeping headline inflation close to 4 per cent on a durable basis.

19. The MPC was of the view that various structural reforms introduced in the recent period will likely be growth augmenting over the medium- to long-term by improving the business environment, enhancing transparency and increasing formalization of the economy. The Reserve Bank continues to work towards the resolution of stressed corporate exposures in bank balance sheets which should start yielding dividends for the economy over the medium term.

20. The MPC reiterated that it is imperative to reinvigorate investment activity which, in turn, would revive the demand for bank credit by industry as existing capacities get utilized and the requirements of new capacity open up to be financed. Recapitalizing public sector banks adequately will ensure that credit flows to the productive sectors are not impeded and growth impulses not restrained. In addition, the following measures could be undertaken to support growth and achieve a faster closure of the output gap: a concerted drive to close the severe infrastructure gap; restarting stalled investment projects, particularly in the public sector; enhancing ease of doing business, including by further simplification of the GST; and ensuring faster roll out of the affordable housing program with time-bound single-window clearances and rationalization of excessively high stamp duties by states.

21. Dr. Chetan Ghate, Dr. Pami Dua, Dr. Michael Debabrata Patra, Dr. Viral V. Acharya and Dr. Urjit R. Patel were in favour of the monetary policy decision, while Dr. Ravindra H. Dholakia voted for a policy rate reduction of at least 25 basis points. The minutes of the MPC’s meeting will be published by October 18, 2017.

22. The next meeting of the MPC is scheduled on December 5 and 6, 2017.

Jose J. Kattoor

Chief General Manager

Press Release: 2017-2018/923

——

Date : Oct 04, 2017

Statement on Developmental and Regulatory Policies Reserve Bank of India

This Statement sets out various developmental and regulatory policy measures for further improving monetary transmission; strengthening banking regulation and supervision; broadening and deepening financial markets; and, extending the reach of financial services by enhancing the efficacy of the payment and settlement systems.

I. Measures to Improve Monetary Policy Transmission

2. As indicated in the Statement on Developmental and Regulatory Policies of August 2, 2017, an internal Study Group (Chairman: Dr. Janak Raj) was constituted by the Reserve Bank to study various aspects of the marginal cost of funds based lending rate (MCLR) system from the perspective of improving monetary transmission. The Study Group, which submitted its report on September 25, 2017, observed that internal benchmarks such as the base rate/MCLR have not delivered effective transmission of monetary policy. Arbitrariness in calculating the base rate/MCLR and spreads charged over them has undermined the integrity of the interest rate setting process. The base rate/MCLR regime is also not in sync with global practices on pricing of bank loans. The Study Group has, therefore, recommended a switchover to an external benchmark in a time-bound manner. The report of the Study Group will be released on the Reserve Bank’s website today to solicit comments from members of public and stakeholders. The Reserve Bank will take a final view on the recommendations of the Study Group after taking into account the feedback received until October 25, 2017.

II. Banking Regulation and Supervision

3. Reduction in the Statutory Liquidity Ratio (SLR) – As a part of the transition to a Liquidity Coverage Ratio (LCR) of 100 per cent by January 1, 2019, it is proposed to reduce the Statutory Liquidity Ratio (SLR) by 50 basis points from 20.0 percent to 19.50 per cent of banks’ net demand and time liabilities (NDTL) from the fortnight commencing October 14, 2017. The ceiling on SLR securities under ‘Held to Maturity’ (HTM) will also be reduced from 20.25 per cent to 19.50 per cent of banks’ NDTL in a phased manner, i.e., 20.00 per cent by December 31, 2017 and 19.50 per cent by March 31, 2018.

4. High-level Task Force on Public Credit Registry – As announced in the statement on developmental and regulatory policies of August 2017, a High-level Task Force on Public Credit Registry (PCR) for India has been constituted (Chairman : Shri Yeshwant M. Deosthalee). It consists of representatives from various stakeholders including the Reserve Bank, banks, non-banking financial companies (NBFCs), industry bodies, and experts in information technology. The Task Force will review the current availability of information on credit, the adequacy of existing information utilities, and identify gaps that could be filled by a PCR. It will study best international practices to determine the scope of the PCR and the type of information and credit markets that the PCR should cover. The Task Force will propose a state-of-the-art information system, allowing for existing systems to be strengthened and integrated, and suggest a modular, prioritized roadmap for developing a transparent, comprehensive and near-real-time PCR for India. The Task Force will submit its report within six months from the date of its constitution, i.e., by April 4, 2018.

5. Legal Entity Identifier (LEI) – It has been decided to require banks to make it mandatory for corporate borrowers having aggregate fund-based and non-fund based exposure of Rs. 5 crore and above from any bank to obtain Legal Entity Identifier (LEI) registration and capture the same in the Central Repository of Information on Large Credits (CRILC). This will facilitate assessment of aggregate borrowing by corporate groups, and monitoring of the financial profile of an entity/group. This requirement will be implemented in a calibrated, but time-bound manner. Necessary instructions will be issued by end-October 2017.

6. Opening of Current Accounts by Co-operative Banks – At present, non-scheduled co-operative banks (NSCBs) face problems in opening current accounts with the Reserve Bank on account of certain requirements prescribed for the purpose. As a result, co-operative banks are constrained to maintain cash reserve ratio (CRR) balances with public sector banks, state co-operative banks and district central co-operative banks, and these balances are considered as inter-bank deposits. As inter-bank deposits are subject to an overall limit of 20 per cent of a bank’s total deposits as on the date of the last annual balance sheet, co-operative banks find it difficult to maintain sufficient liquid funds for the purpose of clearing/settlement, government securities transactions, remittance, and currency chest operations. Accordingly, the regulatory norms have been eased in order to enable all co-operative banks to open current accounts and maintain CRR with the Reserve Bank. All the regional offices of the Reserve Bank have been advised to issue no objection certificates for opening current accounts for all licensed co-operative banks other than those under all-inclusive directions.

7. Regulation of NBFC: Peer to Peer (P2P) – The Reserve Bank had issued a discussion paper on regulation of the peer-to-peer (P2P) lending platform as a non-banking finance company (NBFC). The P2P platform has been notified as an NBFC under section 45I (f) (iii) of the Reserve Bank of India Act, 1934 as per the gazette notification published on September 18, 2017. Consequently, the Reserve Bank is issuing regulations for NBFC (P2P) today.

8. Banking Facility for Senior Citizens and Differently abled Persons – It has been reported that banks are discouraging or turning away senior citizens and differently abled persons from availing banking facilities in branches. Notwithstanding the need to push digital transactions and use of ATMs, it is imperative to be sensitive to the requirements of senior citizens and differently abled persons. It has been decided to instruct banks to put in place explicit mechanisms for meeting the needs of such persons so that they do not feel marginalised. Ombudsmen will also be advised to pay heed to complaints in this context. Necessary instructions in this regard will be issued by end-October 2017.

III. Financial Markets

9. Framework for Authorizing Electronic Trading Platforms (ETP) – Trading on electronic platforms is being encouraged across the world as it enhances pricing transparency, processing efficiency and risk control. It also enables better market surveillance and, therefore, discourages market abuse and unfair trading practices. The Reserve Bank shall put in place a framework for authorisation of electronic trading platforms (ETP) for financial market instruments regulated by the Reserve Bank. The framework shall inter alia include detailed eligibility criteria, technology requirements and reporting standards. While all new electronic trading platforms would be required to obtain authorisation under this framework, existing platforms would also be required to obtain post facto authorisation from the Reserve Bank. A draft framework will be placed on the website of the Reserve Bank for public feedback by end-October 2017.

10. Foreign Exchange Trading Platform for Retail Users – The issue of transparent and fair pricing for retail users (individuals and Micro, Small and Medium Enterprises) in the foreign exchange market has been raised in various fora and in public interactions. A mechanism is proposed for improving the pricing outcome for the “retail user” (to be defined in terms of transaction size) under which client pricing is directly determined in the market by providing customers with access to an inter-bank electronic trading platform where bid/offers from clients and Authorised Dealer banks can be matched anonymously and automatically. Such a mechanism will provide transparency while enhancing competition and lead to better pricing for customers. Direct execution of orders by the customer would bring down the risk that banks face in warehousing transactions until they can be aggregated to a market lot. Banks may charge their customers a pre-agreed flat fee towards administrative expenses, which should be publicly declared. Overall, this should bring down the total cost faced by the retail customer in the foreign exchange market. The Clearing Corporation of India Limited (CCIL) will develop access to its platform FX-CLEAR through an internet-based application. A discussion paper on the proposal will be issued by end-October 2017 for public comments.

11. Hedging Rupee (INR) Invoiced Trade Exposure: Operational Flexibility to Non-resident Importers and Exporters – In March 2017, the Reserve Bank permitted non-resident centralized treasuries of multinational companies to hedge the rupee (INR) risk on current account transactions of their Indian subsidiaries. It has been decided to broaden the scope of this initiative by permitting non-resident importers and exporters (NRIE) entering into rupee invoiced trade transactions with residents to hedge their INR exposures through their centralised treasury/group entities. This is expected to facilitate internationalisation of the rupee by encouraging rupee invoicing of trade transactions while also encouraging non-residents to hedge INR risks onshore. A circular to this effect will be issued by end-October 2017.

12. Review of Foreign Portfolio Investment (FPI) Policies – The regulatory regime for foreign portfolio investors’ (FPI) debt investments in India is a part of the larger framework for capital account management. This regulatory framework has evolved over the years, influenced by capital flows and evolving macroeconomic conditions. As FPI interest in India has grown significantly, a detailed review of current regulations on FPI debt investment shall be undertaken to facilitate the process of investment and hedging by FPIs, keeping in mind macro-prudential considerations, such as ensuring the resilience of net international investment position. Regulatory changes to be finalised in consultation with the Government of India and the Securities Exchange Board of India (SEBI) will be effective from April 2018.

13. Review of Short Selling Directions – Introduction of short selling in Government Securities (G-sec) in 2005 with the objective of encouraging diversity in interest rate views has resulted in a more active G-sec market. Smoother settlement of short sale transactions is necessary for orderly functioning of the market. Towards this end, it has been decided that (i) a short seller need not borrow securities for ‘notional short sales’, wherein it is required to borrow the security even when the security is held in the held-for-trading/available-for-sale/held-to-maturity portfolios of banks; and, (ii) over-the-counter (OTC) G-sec transactions by FPIs may be contracted for settlement on a T+1 or T+2 basis. Directions in this regard will be issued by end-October 2017.

14. States’ Market Borrowing: Adoption of Best Practices – As a part of the development of the state market borrowing programme, several best practices have been put in place. In order to further develop liquidity in the State Development Loan (SDL) market, spread the issuance of SDLs, move towards market-based pricing that is sensitive to individual state’s fiscal risk metrics, and reduce uncertainties in announcement of auction results, the following measures are being proposed:

- Consolidation of state government debt will be undertaken to improve liquidity in SDLs through reissuances and buybacks, so as to even out redemption pressures and elongate residual maturity.

- SDL auctions will be conducted on a weekly basis and the auction results will be announced latest by 3.00 PM on the same day.

- High frequency data relating to finances of state governments available with the Reserve Bank will be disclosed on its website.

Final guidelines will be issued by end-October 2017. These guidelines will constitute the initial steps in overall reforms to be unveiled by the Reserve Bank over the next 12 months to reduce the currently inadequate reflection of risk asymmetries across states in the SDL market (as noted, for example, in the Fiscal Responsibility and Budget Management Review Committee Report, April 2017).

15. Retail Participation in Primary Auctions: Stock Exchanges as Aggregators – The Central Government and the Reserve Bank have been taking various measures in the G-Sec market as a part of the overall strategy of diversifying the investor base. Modification in the Government Securities Act, 2006, introduction of odd lots in the NDS-OM secondary market, improvement in the settlement mechanism, retailing of G-Secs by primary dealers, and introduction of non-competitive bidding in primary auctions, are some of these initiatives. In line with this overall stance, the Union Budget 2016-17 announced that the Reserve Bank will facilitate retail participation in the primary and secondary markets through stock exchanges. Accordingly, after consultation with the SEBI, it is proposed that:

- specified stock exchanges, in addition to scheduled banks and primary dealers, will be permitted to act as aggregators/facilitators for retail investor bids in the non-competitive segment for the auction of dated securities and treasury bills of the Government of India.

Final guidelines will be issued by end-October 2017.

IV. Payment and Settlement

16. Master Directions on Prepaid Payment Instruments (PPIs) – The Reserve Bank had issued guidelines for issuance and operations of prepaid payment instruments (PPIs) in April 2009 in order to foster an orderly development of the PPI ecosystem. In the light of the experience gained, a draft of Master Directions on the subject was placed in the public domain for comments on March 20, 2017. The feedback received has been examined and it has been decided to rationalize the operational guidelines with a view to encouraging competition and innovation, and strengthening safety and security of operations, besides improving customer grievance redressal mechanisms. In line with the Vision for Payment and Settlement Systems in the country, the revised framework will pave the way for bringing inter-operability into usage of PPIs. Inter-operability amongst KYC compliant PPIs shall be implemented within six months of the date of issuance of the revised Master Directions, which will be issued within a week, i.e., by October 11, 2017.

Jose J. Kattoor

Chief General Manager

Press Release: 2017-2018/924