The Income Tax Department launched the new completely revamped Income Tax Website 2.0. Now, there is a lot of discussion on the social media whether this update was really required or not or regarding the multiple issues which everyone is facing. The old website was project was proposed in 2006 and launched sometime in 2007. So this is almost after a good long 14 years the income tax portal is getting a facelift.

I have tried to summarize the key changes and the new additions to the income tax website. I have purposely left assessment portion as that portion of website is not yet up and running as on the date of this article.

1. Generating Form 15CA / CB

The Income Tax Department has completely revamped the process of obtaining the Form 15CA – Part A & C. Earlier the Assessee’s were required to send all the documents to Chartered Accountant who would generate the Form 15CB and the Assessee was required to enter the acknowledgement number and generate the Form 15CA.

Now, in the new website the Assessee would be required to give four set of details instead of the detailed form.

a. Recipient Details – The Company is required to give the business details of the recipient of the transaction stating the Name of the remitter, PAN Details, Address of the recipient.

b. Remittance Details – The Company is required to select the Country to which the remittance is being made. The system automatically selects the currency. This can be an issue when amount which is being transferred to a country other than its national currency. This can be a real challenge in cases amounts are being transferred to countries where its national currency is very volatile say countries like Venezuela or certain African countries where majority of the vendors require amounts in US Dollar or the Euro. It seems that once the website settles with the technical errors this might be rectified to allow users to choose the currency they want to make remittance.

The Assessee is required to state the amounts to be transferred both in local currency and foreign currency. It is important to note that there is no location to where the Assessee is required to enter the details of the amount of withholding taxes or whether the Assessee would be withholding the taxes as the income tax law or the DTAA agreements. This field would be required to be filled in by the Chartered Accountant through their authorized representative login. This is actually a positive change for the CA’s as instead of Chartered Accountant filling the business transaction details like country of remittance, would only require feed the details regarding the taxation portion.

c. Chartered Accountant Details – The Company is required to enter the details of the CA who is signing the form. The Assessee is required to enter the membership number; the other details are automatically fetched by the system. It is important to note that the CA should be added in the list of “My Chartered Accountant” under Authorized Partner details.

d. Attachments – The Company can attach all the documents relating to the transaction like Form 10F, No PE Certificate, Tax Residency Certificate (TRC) and the invoice. These documents can be viewed by the Chartered Accountant to determine the rate of tax. Also the Income Tax Department would be able to access the documents to confirm whether the withholding tax has been deducted correctly or not.

It is very important that the correct documents are uploaded at all times. In case the Assessee submits incorrect documents or the tax rate is incorrectly determined by the CA it may potentially lead to assessment proceedings u/s. 201(1) / (1A) of the Act or in certain cases may also call for TDS survey u/s. 133A of the Act.

Once all the details are filled in the Assessee would have to send the details to the CA, who would authorize the transaction and add the withholding tax details. Once the 15CB is authorized the Assessee can download the documents from worklist menu.

Further, the new portal allows the Assessee to download all the details for the 15CA in excel.

Further in case a recipient of the funds has furnished a certificate to the Company u/s. 197 / 195(2) / 195(3) and the certificate details would be imported while the filing of Form 15CA – Part B.

2. Details of Company Information.

As a new requirement the new Income Tax website as a part of KYC information requires the Companies to submit information regarding its Key Persons namely the Managing Director, CFO, Directors, Principal Officer and Managers. This data would also include the persons who have been authorized by the Company to sign documents for the purpose of Income Tax.

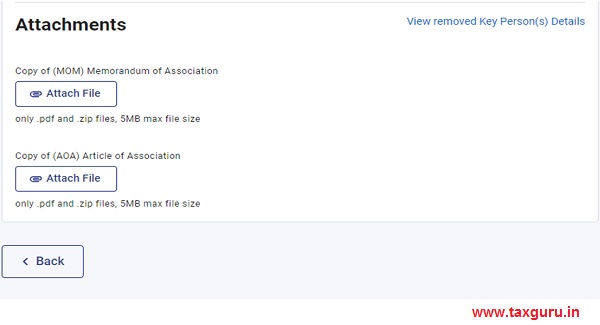

Additionally the Company is now also required to upload its Memorandum of Association (“MoA”) and Articles of Association (“AoA”). Now as the Company is providing the MOA and AOA it becomes very important that the income stated under Business Income should be from the business which is stated in the MoA/ AoA

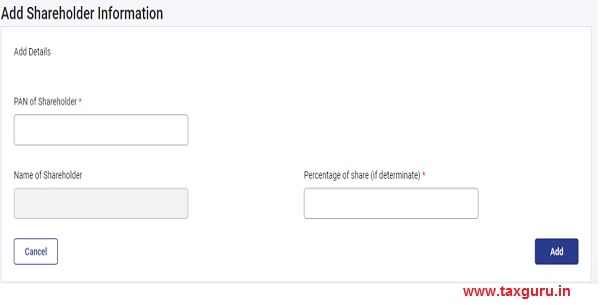

Further the Company is also required to submit the details of its Shareholders stating the PAN and the percentage holding in the Company. Now the website only states that information regarding the shareholder to be given in case its holding is determinate. The website does not specify what is determinate, however the Assessee may keep a threshold say shareholders having more than 5% of the shares on the lines of the declaration in the annual report./ This might be a challenge specifically for public listed companies where the shares keep changing hands.

3. Bank Details

The Assessee’s are now as a part of KYC information required to also give details of the Bank Accounts which are held in their name. Once the Assessee updates the bank details, the income tax department validates the information with the bank to confirm whether the bank accounts actually pertains to the Assessee or not. This data would most likely come prefilled in the income tax utility and those banks which are not validated the Assessee would not be able to obtain the refunds in those accounts. This is a positive step as this would reduce refund failures due to incorrect bank details in the ITR Form.

There are many more changes which have been incorporated in the new website like the Annual Information Statement, E-proceedings, Refund reissue validation, compliance and reporting portals.

There is a lot of discussion on the social media that the website change was unnecessary and it is only creating new issues as all the major functions are not working. In my personal opinion the old website was getting dated also it is important to consider that it was created in an era of personal hearings and where the tax audit reports and other forms were manually signed. Though the department was updating the website now and again it was more like a patch work which would ultimately require bringing a complete overhaul. With the new era of online filing of all documents, faceless assessments, appeals and online grievances, I would say this website is a much needed upgrade to the existing system. Though it has certain technical glitches as of now but I am sure they would be fixed and the new Income Tax Portal 2.0 would be possibly would be a much user friendly website. Overall I consider that the website is a positive step towards making the income tax portal more user friendly and updated with the tech age.

Author

Sanket Bakshi

CAN YOU ADD BACK REMOVED KEY PERSON ON INCOME TAX PORTAL 2.0?

I CAN’T ADD IT BACK .

Hi Sir,

I am also facing the same issue. Is this issue has been resolved ? if yes could you please guide me on this.

Hi, any solution to this? Please let me know

THE PRESENT PORTAL IS DIFFICULT TO OPERATE .PREVIOUS SYSTEM WAS EASY AND WORKABLE. .26AS CAN,T BE APPROACHED TO CHECK TDS ETC. IN PREVIOUS SYSTEM ONE COULD CHECK THE FIGURES FROM 26 AS AS AND WHEN REQUIRED. BETTER GO BACK TO OLD SYSTEM TILL PRESENT ONE IS WORKABLE,THANK U

I am a senior citizen 78+. Have been filing my income tax return diligently every year electronically and was very satisfied with that specially with pre filled information about your income , TDS and Bank Account details etc. I had only to check and verify the correctness of these and incase of a change,or additional income, haf to populate that also and after depositing additional income tax , if any and verification, the return filing was over with an acknowledgement from income tax department.

Now I don’t even know how to go about filing my return this year. Do I have to register again? The portal simply doesn’t open. They should have given s detailed instructions manual about how to go.about – step by step.

It appears it’s turned out to be farce. Compared to the previous version, too much of navigation is annoying. Filing ITR 1 and 4 could be completed in a few minutes on old portal. With unnecessary comments like ‘you’re almost there’ popping up with every click and error msg the moment, it appears some.dumbheads were heading this job.

My dear, first you test the portal and then published the articles. It is just bogus portal to lot the people of tax paying community. This community do not have any voice in the parliament hence it is like this. Nothing is going to improve,it will work like this, people need to make juggad for the same. Please start IT portal juggad app.

My own feeling is that the Old portal is very efficient. In the name of reducing processing time the Government has entrusted the task to the already proved (in GST handling) an inept inefficient Organization and has put the Assessees to a lot of inconvenience. I am of the opinion that Assessees may be given the option to choose between Old Portal with delay but efficient & good and between the difficult harassing inefficient New Portal and suffer more delay

New portal is poorly made and difficult to use for taxpayers kindly rectify it and test it before use let the old portal be in use for this year

RESTORE THE OLD INCOME TAX PORTAL AS TAX GURU’S FACES HELPLESS IN OPENING NEW PORTAL, HOW THE SR. CITIZEN OR ORDINARY ASSESSEE CAN FILE ITR HASSLE FREE. MY REQUEST TO F.M. RESTORE OLD SYSTEM IMMEDIATELY WITH ANY DELAY.

Whether really new website was required? Everybody was comfortable and at ease to do the things. There was no complaint of any type working with the old website, but all of sudden everything has become mesh and nobody knows how much time it will take to normalize.

This new portal is true sense most complicated. Very slow data and time consuming. It is not at all friendly. Jeson utility is also a bogus. Not functioning at all.

It is absolutely true that change is required…. It is a continuous process… However, in my opinion, no proper testing was done by the developers, keeping in mind, that the website will be used by the tax payers, from the nook and corner of the country.. Besides, atleast for a month or two, the old website should have been continued… As of now, the website is not at all user-friendly and cumbersome….

A classical case of spoiling a perfectly working old portal . And a star performer Infosys responsible for this. TCS would never have done such errors.

Unable to login to file itr for fy 2020 21

It is quite cumbersome to use and operate. The site does not open easily. ITR 2 could be made more user-friendly for income tax return filers. Things are too cumbersome for the filer if he has Capital Gain .

I am a Retired Senior citizen, till last year I could log on to my account very easily,by putting my PAN as ID, & putting my password, but now I am unable to log on,trying several times.This site is not at all user friendly.Thanks

AGREE WITH

In my profile address ‘Mumbai’ comes thrice instead of once.. Even after trying 4 times, mistake is not corrected.

Stress ful for me a 85 year old who has an appeal allowed but has received 4 notices for penalty proceedings .Frustrating to be bombarded with notices with deadlines, but no facility available to respond.It is about time for the authorities to take corrective action and open some alternative channels for a harassed honest 84 year old to respond.will the concerned authority respond.Thanks

It does not let me log in even after 9 days.

1. e Proceedings page not opening. Can’t file replies and submission to notices even for show cause of draft asst. Orders that have to be passed by 30.06.22. Page says “coming soon”

2. Can’t file Form 10A for 12AA, 80G of 35 . Since yesterday form has also been removed from site.. last date here again is 30.06.21

Read 30.06.21

I am a Senior Citizen from Kerala. After several attempts, I could file my Income tax return on 13/06/2021 and got e-filing acknowledgement. The funny thing is Nobody won’t be able to download a filed return copy from the new portal at present. According to guidelines in the new portal, refund will be hassle free and taxpayer will get refund after ITR process.

I don’t know when they will process my return.

ITR-2 is too complicated to encourage small investors to invest even in mutual funds and what to think of investing in shares .

Unable to e-filing as assessment years data is taking current year tax details.. unable. To file itr

The website is not at all user friendly.

It is more complicated than before. Everyone is supposed to e-file, but every body is not computer literate, a lot of people will actually stop filling because they are not able to use it. The bank for refund shows up as not pre validated, even when it validated and ecn approved in bank details in my profile.

IN SPITE OF LOTS OF GLITCHES LIKE WE ARE UNABLE , TO FILE ITR, REPLY 148, PENALTY NOTICE, SUBMIT WRITTEN STATEMENT IN APPEALS, ETC. YOU ARE SAYING THE NEW WEBSITE IS USER FRIENDLY. GOOD COVER FIRE TO THE INFOSYS .