Introduction–

Employee Stock Ownership Plan enables an employee to establish ownership in the company by obtaining its shares. Earlier, such plans were created by top companies for their employees at managerial level to incentivise them, and to develop a sense of ownership and belongingness in the organisation. However, now Employee Stock Ownership Plans have gained popularity in the start-up ecosystem. Since start-ups face liquidity crunch, they are using these plans as one of the key incentives to attract and retain the talent.

Depending upon features, Employee Stock Ownership Plan can have different forms, such as

i. Employee Stock Option Plan (‘ESOP’)

ii. Employee Stock Purchase Scheme

iii. Restricted Stock Units

An ESOP is a scheme where the employees of the company are given the option to own shares of the company at a predetermined price at a future date. This article mainly focuses on the taxability of ESOP in the hands of employees of the company.

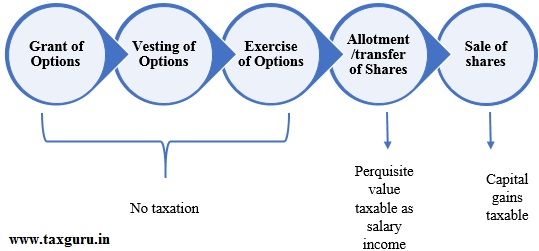

Stages under an ESOP–

When a company grants options to an employee, the employee does not receive any shares of that company at the time of grant. He/she just gets a right to receive the shares of the company at a future date at a pre-determined price on fulfilment of certain conditions. Thus, the shares are received by the employee at a later stage.

In order to understand ESOP taxability, it is important to understand the different stages under an ESOP, which are as follows:

1. Grant of options: The company issues option to the employees that he/she can purchase the shares of the company at a pre-determined price (referred to as ‘Exercise Price’) at future date on fulfilment of certain conditions.

Such conditions may include completion of certain years of employment in the company, performance criteria, etc.

2. Vesting of options: The employee gets the right to apply for purchase of shares of the company in accordance with the terms and conditions of the letter granting the options.

3. Exercise of options: The employee exercises his/her right to apply for purchase of shares at this stage after options have vested.

4. Allotment/transfer of shares: If the employee has exercised his/her options, the employee receives shares at this stage.

Once the employee has received the shares, he/she may also sell these shares in future and earn profit if the sale price is higher than the exercise price.

Tax implications–

The employee receives shares of the company as an incentive under ESOP. This incentive is considered as perquisite given by an employer to employee and taxed as employee’s salary income.

Similar to other salary components, the company is required to deduct tax at source (‘TDS’) on the shares allotted to the employee under ESOP.

With respect to taxability under ESOP, the two question arises:

a. When is the perquisite (received in the form of shares under ESOP) taxable in the hands of employees?

b. How is the amount of perquisite calculated on which tax is levied?

The above questions have been discussed in the ensuing paragraphs-

a. When is the perquisite (received in the form of shares under ESOP) taxable in the hands of employees?

Out of the 4 stages under an ESOP discussed above, it is at the last stage, i.e., allotment/transfer of shares, when the employee actually receives the shares of the company. This is the stage when perquisite (received in the form of shares under an ESOP) are taxable in the hands of employees.

Thus, perquisite arising under ESOPs are taxable as salary income of the employee in the financial year in which shares are allotted/transferred to him/her.

b. How is the amount of perquisite calculated on which tax is levied?

Under an ESOP, the employee needs to pay lesser price (vis-à-vis fair market value) to receive the shares of the company. The incentive received by the employee is equal to the fair market value of shares received less Exercise Price (i.e., amount paid by the employee to receive shares).

In other words,

Incentive received = Fair market value of shares received (-) Exercise Price (i.e., amount paid to receive shares)

The incentive calculated above forms the perquisite value which is taxable under the Indian income tax laws.

Fair market value of shares is the value on the date of exercise of options computed as per the manner prescribed under Indian income tax laws.

To sum up, under ESOP, taxability arises at the time of allotment/transfer of shares on the perquisite value (i.e., incentive received).

It is relevant to note here that the employee does not make any benefit at the time when shares are allotted to him/her. He/she actually makes the profit on selling these shares.

Sale of shares is another point of taxation under income tax laws. Where the sale value of shares exceeds the fair market value (which was considered for computing perquisite amount), capital gain arises in the hands of the employee and taxed accordingly.

Diagrammatic representation of various stages under ESOP and taxability–

Amendments through Finance Act, 2020–

ESOP provides advantage to both start-ups and its employees. On one hand, it allows an employee to gain benefit on the success of the start-up, on the other hand, it helps start-ups to attract talent at a relatively lower salary by balancing it through ESOPs.

However, the major drawback of ESOPs is from taxation perspective as the taxability in the form of perquisite arises at the time when shares are allotted/transferred. Though shares are received in kind, taxes are required to be paid in cash. This leads to cash flow problem as shares of start-ups are illiquid in nature and there is no ready market available to sell these shares. As a result, the employees end up paying tax from their own pockets.

Understanding the challenges faced, the provisions were introduced through Finance Act, 2020 to defer the tax payment to future years on perquisite arising on allotment of shares by eligible start-ups.

Post amendments via Finance Act, 2020, the tax is required to be deducted by the employer (or paid by the employee if TDS is not deducted by the employer), within 14 days of the following:

a. After the expiry of 5 years from the end of the financial year in which shares are allotted; or

b. From the date of when the employee ceases to be an employee of the start-up which had allotted the shares; or

c. From the date of sale of shares by the employee,

whichever is the earliest.

It must be noted that the Finance Act, 2020 has only granted the relaxation for deferred payment of tax on perquisite arising under ESOPs. There has been no change with respect to timing of taxation of these perquisites. This implies that the perquisite arising under ESOPs are still considered as salary income in the financial year in which shares are allotted to the employees and taxes are computed accordingly. However, the tax portion on the perquisite arising due to allotment of shares is paid later at the specified date as discussed above.

Also, the benefit of deferred tax payment is not available to all start-ups/their employees. It is limited to only certain start-ups (‘eligible start-ups’) fulfilling following criteria:

a. the start-up is incorporated on or after April 01, 2016 and before April 01, 2022;

b. total turnover of its business in the financial year does not exceed Rs. 100 crores;

c. business carried out by the start-up is in innovation, development or improvement of products or processes or services or a scalable business model with a high potential of employment generation or wealth creation; and

d. it holds a certificate of eligible business as per section 80-IAC of the Income Tax Act, 1961 (This certificate is obtained by start-ups to avail tax deduction for the profits derived from their business. The application can be filed online by logging on the start-up India web portal).

Summary–

To sum up, the position post amendment through Finance Act 2020 is as follows:

a. The perquisite value (i.e., fair market value of allotted shares at the time of exercising the option less Exercise Price) is taxable as salary income in the hands of employee in the financial year in which shares are allotted to him/her.

b. The tax liability arising on such perquisite can be deferred in case shares are allotted by the eligible start-ups. The tax amount shall be deducted as TDS by the employer within 14 days of the earliest of the three specified events (which were discussed earlier in detail). Where TDS is not deducted by the employer, the tax shall be paid by the employee himself.

c. In case shares are allotted by a company other than an eligible start-up, benefit of deferred tax payment is not available.

d. For computing capital gains on sale of shares, fair market value referred in point a. above shall be considered as costs of acquisition (in other words, purchase cost) of the shares.

Concluding remarks–

Amendment introduced through Finance Act 2020 for deferring the tax payment is a welcome move, considering that receipt of shares by employees does not result in any immediate cash benefits but leads to cash outflows in the form of tax. However, the employee planning to leave the job will still have to pay taxes even though he may not have sold his shares.

In addition, the benefit could have been extended to all unlisted companies as there is no readily available market for the shares of unlisted companies.

Also, the eligible start-ups are now required to keep check on trigger event (any of three specified events discussed above) as liability to deduct tax at source has been deferred to such event, but not done away with.

******

Authors:

1. Prachi Jain | FCA. (AIR 1 & 8), LL.B., B. Com.(Hons.)

2. Nikunj Goyal | CA Final Student

Disclaimer: This article is for general information purpose only and does not constitute any advice. Please get in touch with your consultant before taking any step(s). We shall not be responsible for any loss incurred due to step(s) taken basis the information shared in this article.

What if employee has option to exercise ESOP after leaving employment, will it be the duty of previous employer to deduct TDS

Yes

Suppose at the time of Allotment of Shares, the Exercise Price is More than the Fair and Market Value, in that case what would be tax liability..? Will it be a negative perks and adjustable against the total Income of the employee.