Summary: Tax due diligence is a critical process in evaluating a company’s tax liabilities and financial health before completing a transaction. It involves a thorough examination of a company’s tax records to uncover any unrecognized tax expenses, assess potential tax exposure, and identify opportunities for tax savings. This process is crucial for both buyers and sellers to ensure they understand the full tax implications of a transaction. Tax due diligence helps determine the maximum potential tax liabilities, check for any outstanding back taxes, and explore ways to mitigate tax burdens. By conducting this due diligence, parties involved in a transaction can make informed decisions and potentially adjust the transaction terms to reflect any discovered tax issues. This practice is part of a broader due diligence effort that includes financial, operational, IT, legal, intellectual property, human resources, commercial, and environmental assessments.

Due diligence is a process or effort to collect and analyze information before making a decision. The process ensures that a party is aware of all the details of a transaction before they agree to it. It involves examining a company’s numbers, comparing the numbers over time, and benchmarking them against competitors to assess an investment’s potential in terms of growth.

> What are the various types of Due diligence?

Due diligence is a process conducted in many different fields but the aim is always the same, to ensure the transaction you’re about to make is a good idea. Here are some types of due diligence:

a) Financial: Financial health

b) Operational: Business processes

c) IT: IT systems

d) Legal: Legal compliance

e) IP: Intellectual property

f) HR: Human resources

g) Tax: Tax liabilities

h) Commercial: Market and model

i) Environmental: Environmental risks etc

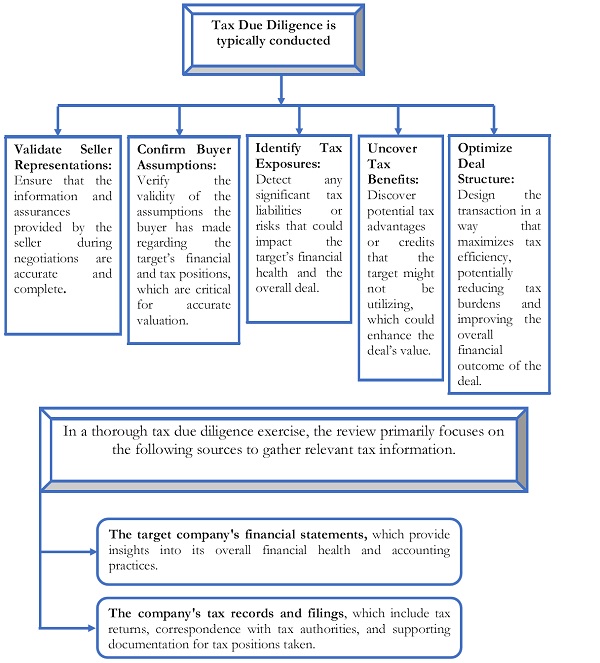

> What is Tax Due Diligence?

> Tax due diligence refers to investigate target company’s pre-acquisition procedures implemented unrecognized tax expenses and other tax issues.

> Tax due diligence seeks to determine a company’s maximum potential tax exposure, its tax position, whether it may owe any back taxes, and where it can reduce its tax burden. This assist to add/reduce the over-all cost of transaction.

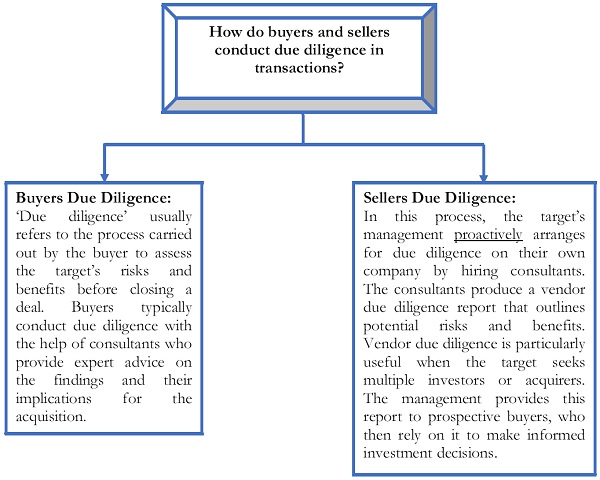

Due diligence is conducted by the parties involved in a transaction, typically the buyer and the seller. The goal for both parties is to maximize the benefits of the transaction.

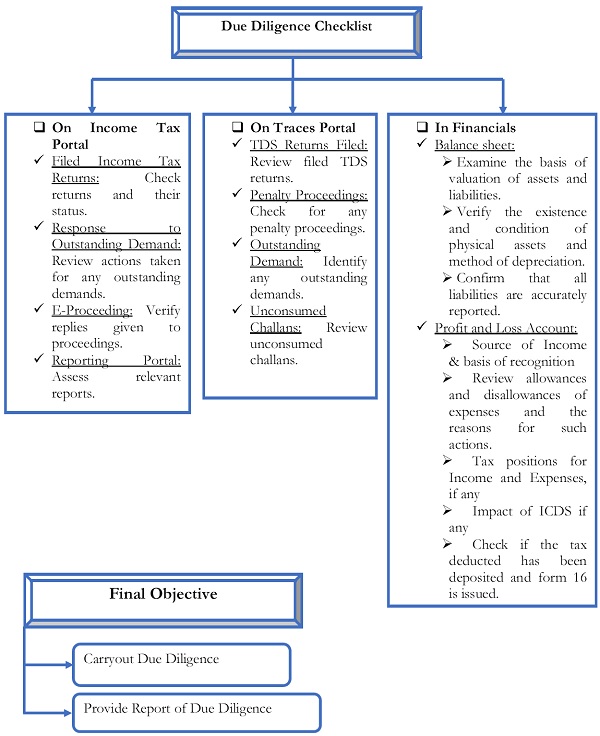

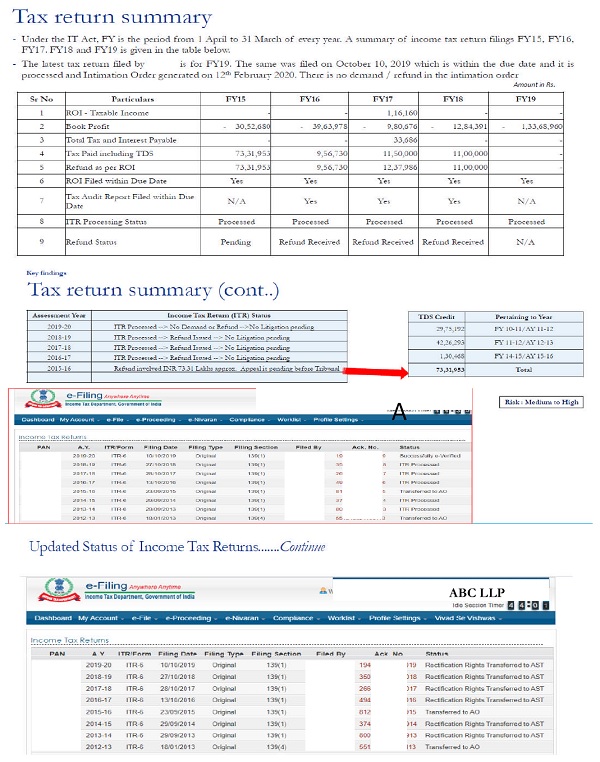

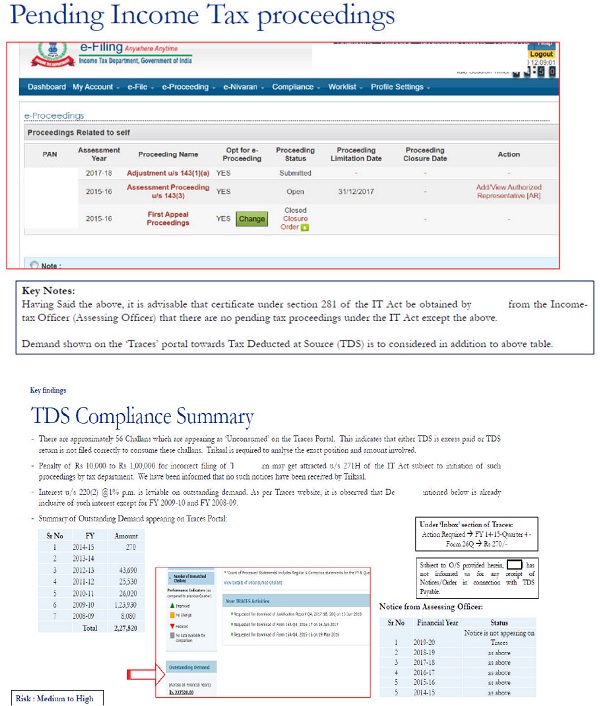

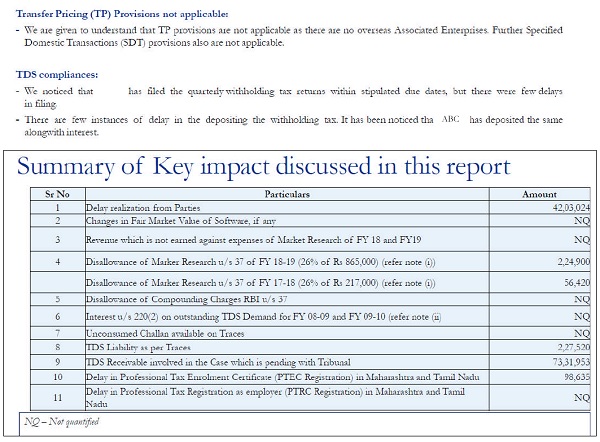

Let us understand this with help of Content of Report:

ABC LLP – Extract of Due Diligence Report – Sample

Similarly, we can include the impact for other Due Diligence carried out during a deal.

Compiled by: Mr. Sujal Shrivastav

Compiled by: Mr. Sujal Shrivastav

For further information, please contact us on –+91 9833 88 44 64 / utkarsh.m@cauma.in / sujal.s@cauma.in

Disclaimer: The information contained herein is of a general nature and does not contain any expert view or opinion. Please refer source documents for detailed information. Although we try to provide accurate information, there can be no guarantee that such information is accurate as of the time it is received or in the future. We request readers to seek professional advice before arriving at any decision / conclusion after reading of this document. We are not responsible for any loss arising to anyone after referring and relying on this document.