Introduction

The Government of India has introduced a new sub section 1H under Section 206C with regards to “Tax Collection at Source”. The new sub section reads as under.

“(1H) Every person, being a seller, who receives any amount as consideration for sale of any goods of the value or aggregate of such value exceeding fifty lakh rupees in any previous year, other than the goods covered in sub section (1) or sub section (1F) or sub section (1G) shall, at the time of receipt of such collect from the buyer, a sum equal to 0.1 per cent. of the sale consideration exceeding fifty lakh rupees as income tax:

Provided that if the buyer has not provided the Permanent Account Number or the Aadhaar number to the seller, then the provisions of clause (ii) of sub section (1) of section 206CC shall be read as if for the words “five per cent.”, the words “one per cent.” had been substituted:

Provided further that the provisions of this sub section shall not apply, if the buyer is liable to deduct tax at source und er any other provision of this Act and has deducted such amount.

Explanation.

For the purposes of this sub section-

(A)“buyer” means a person who purchases any goods, but does not include,

-

- the Central Government, a State Government, an embassy, a High Commission, legation, commission, consulate and the trade representation of a foreign State; or

- a local authority as defined in the Explanation to clause (20) of section 10; or

- any other person as the Central Government may, by notification i n the Official Gazette, specify for this purpose, subject to such conditions as may be specified therein;

(B) “seller” means a person whose total sales, gross receipts or turnover from the business carried on by him exceed ten crore rupees during the financial year immediately preceding the financial year in which the sale of goods is carried out, not being a person as the Central Government may, by notification in the Official Gazette, specify for this purpose, subject to such conditions as may be specified therein.

WHEN TO COLLECT TAX AT SOURCE

Accordingly, TCS has to be collected in the following scenario w .e.f. 01 .04.2020.

1. If the sales, turnover or gross receipts of the person selling goods is more than Rs. 10 crores during the financial year 2019 2020.

2. The seller sells goods of value Rs. 50 lakhs or more either in single transaction of in aggregate during the financial year 2020 2021.

3.Th e-seller is not liable to collect tax on sale of goods under any other sub section (1), (1F) or (1G) of the value of goods sold by him. Mentioned in the annexure 1 herewith)

4. Th e-buyer is not liable to deduct any TDS for the given sale transaction.

WHAT IS THE RATE FOR COLLECTION OF TAX AT SOURCE

If the above conditions are satisfied, then the seller has to collect an amount equal to 0.1 per cent from the buyer as Tax Collection at Source under this sub section. The tax has to be collected when the aggregate sale exceeds Rs. 50 lakhs during a financial year The is means that there is no need to collect tax on the first 50 lakh of sales consideration received from the buyer. However, if the buyer does not hold or furnish his PAN or Aadhaar number to the seller , the tax has to be collected at the rate of 1%

WHAT IS THE DUE DATE FOR DEPOSIT OF TAX AND OTHER COMPLIANCE ?

The seller has to comply with the following conditions after collection of tax.

1. Deposit the tax collected during the month to the credit of Central Government on or before 7th of subsequent month.

2. File the return of TCS on a quarterly basis on or before the 15th Day from the end of quarter in with tax was collected except for March quarter which is 15th May.

3. Issue TCS certificate in form 27D to the buyer within 15 day from the filing of return in form 27EQ.

All these due dates have been summarized in Annexure 2.

WHAT ARE THE CONSEQUENCES OF NON COLLECTION , NON PAYMENT OR NON FILING OF RETURNS?

If the seller fails to collect the tax at specified rates or fails to pay the tax collected to the Government, he shall be liable for interest at the rate of 1% per month (or part thereof) from the date of collection to date of payment.

If the seller fails to furnish the quarterly return in form 27EQ on or before the due date , he shall be liable to pay late fees of Rs. 200 per day till the default continues subject to maximum of tax collected during the quarter.

ARE THERE ANY EXEMPTIONS?

Tax is not required to be collected in following cases:

1. If the buyer is

a. Central Government, State Government, an embassy, a High Commission, legation, commission, consulate and the trade representation of a foreign state , or

b. A local authority

c. Any other person exempted by the Central Government

2. If the seller is exempted by the Central Government by any notification in this regard. (No such notification is yet

issued.)

Due Date for Filing of Returns in Form 27EQ and Issue fo TDS Certificate in Form 27D

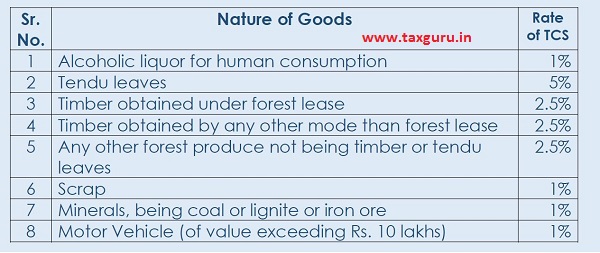

TCS Rates under other provisions of Income Tax Act, 1961

The tax has to be collected when the aggregate sale exceeds Rs. 50 lakhs during a financial year. As per this statement this year seller has to collect TCS in all the sales after crossing 50 L so when it comes to next FY 20-21 whether seller should collect TCS on his first sale onwards or again threshold limit 50 L will calculate from 1st April 2021? please clarify

Sir,

Please clarify in case of Export,

Whether TCS is to be collected on Export sales?

Sir,

Please clarifyin case of Export,

Whether TCS is to be collected on Export sales?

Whether this provision has received assent?

in case of advance collection, first we have collect TCS but what about TCS if we have to return the advance amount collected?

Whether TCS is to be collected on Export sales?