Introduction

The taxation of capital gains is one of the most interesting sections in the Indian income tax law. It is quite easy to attribute this to not just the complexity of some of the provisions but also to the complexity in the nature of transactions. Among these, taxation of shares is a significant one. While we have come to understand the nuances involved in rights issues and bonus issues, when it comes to amalgamation/merger and stock splits, the situation remains a trifle tricky. However, it is not beyond us to understand the intricacies involved in these situations as well.

A standalone transaction involving allotment of shares of amalgamated company to the shareholders of the amalgamating company would not be tedious in terms of understanding as the law has specifically spelled this out in the Income Tax Act, 1961. Many have confusion around stock splits though. Apparently, the confusion stems from two things. Treatment of rights shares and bonus shares have been clearly laid out while stock splits have not been as clear, one would have to say. The second point is with reference to the introduction of Section 112A and the date of 1 February 2018 introduced in Section 55 of the Income Tax Act. Understanding the law clearly mitigates any incorrect perception or interpretation. There is also bound to be some additional complexity when there is a transaction of a stock split followed by an amalgamation of the companies in which a shareholder holds shares.

Through this document, we attempt to remove the ambiguity surrounding these important aspects as well as examine a practical example in the interests of providing better clarity.

Period of holding

We know that the period of holding should be more than 12 months for a capital asset in the form of listed shares to be categorized as long-term in nature [Proviso to Section 2(42A]. In the case of unlisted shares, this period is 24 months. Once we reduce the cost of acquisition from the sale consideration, we will arrive at the long term or short-term capital gains on transfer of shares depending on the period of holding [Section 48(i) & (ii)].

In the case of amalgamation/merger, the law is very clear. Clause (c) to Explanation 1 of Section 2(42A) of the Income Tax Act, 1961 states that in a scheme of amalgamation, where a person is allotted shares in an amalgamated company, the period of holding of shares in the amalgamating company will also be counted towards the period of holding in the amalgamated company.

A acquired 100 shares of Company X on 17 January 2014. Company X was subsequently amalgamated with Company Y on 1 July 2015. For the purposes of capital gains, the period for which shares in Company Y are held by A will include the period for which she held shares in Company X as well. In other words, the period of holding will be reckoned from 17 January 2014.

In the case of stock splits, while there is no specific provision, we cannot consider it similar to rights and bonus shares because of the difference in structure of the transaction. Also, there is nothing in Section 2(42A) which indicates that it includes within its ambit stock splits. Eventually, we have to rely Clause (ii) of Explanation 1 to this section which says:

In respect of capital assets other than those mentioned in clause (i), the period for which any capital asset is held by the assessee shall be determined subject to any rules which the Board may make in this behalf.

Even Rule 8AA which has been notified in this regard is silent on the treatment of stock splits.

A stock split does not change the value of the holding so it is akin to increasing or decreasing the shares already held. Since the underlying test is holding of shares, it would be logically fair to consider the period of holding from the date the original shares were held, in the case of stock splits.

A bought 100 shares of Company X on 1 April 2023. The face value of these shares was ₹ 100. The company decided to reduce the face value of shares in a 1 to 10 ratio. The face value of the shares has now reduced to ₹ 10. Since the total value of holding does not increase as a result of the stock split, the number of shares held will increase to 1,000. The period of holding of the original 100 shares and the additional 900 shares will be reckoned from 1 April 2023.

Cost of acquisition

Now that we have resolved our understanding of the period of holding in case of stock splits and amalgamation, we can now turn our eyes to the next important aspect which is the cost of acquisition. Section 49 and Section 55 of the Act deals with this.

Let us tackle the case of amalgamation first. Since shares in the amalgamated company is allotted to the assessee by virtue of holding shares in the amalgamating company, the cost of acquisition will need to be determined per Section 49(2). This part of the law says:

Where the capital asset being a share or shares in an amalgamated company which is an Indian company became the property of the assessee in consideration of a transfer referred to in clause (vii) of section 47, the cost of acquisition of the asset shall be deemed to be the cost of acquisition to him of the share or shares in the amalgamating company.

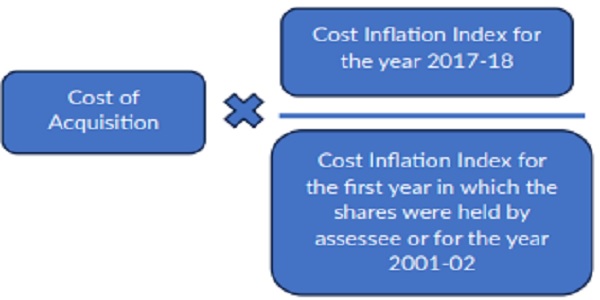

However, Section 55(2)(ac) stipulates that if capital gains arise from an equity share which is a long-term capital asset acquired before 1 February 2018, then the cost of acquisition shall be higher of:

i. Actual cost of acquisition

ii. Lower of:

a. Fair Market Value (FMV) of the equity share as on 31 January 2018

b. Full value of consideration received on transfer of such shares

A question that arises at this juncture is how to calculate the FMV of the shares as on 31 January 2018. The Explanation to the clause provides an answer to this and the provisions are summarized in the table.

| Situation | FMV |

| Shares are listed on any recognized stock exchange as on 31 January 2018 | Highest price of the share quoted on the exchange on the date

If no trading on the said date, the highest price of the share on a date immediately preceding 31 January 2018 when shares were traded on that exchange |

–

| Situation | FMV |

| Shares not listed on a recognized stock exchange as on 31 January 2018 but is listed as on the date of transfer |  |

| Shares acquired in consideration of shares which were not listed as on 31 January 2018 and listed on a recognized stock exchange on date of transfer |

Therefore, if the shares of the amalgamating company were acquired prior to 1 February 2018, recourse can be had to the above table to determine the FMV depending on the listing scenario.

Once again, the law is nearly quiet on the cost of acquisition of shares acquired by way of stock split. Unlike bonus shares where the value is considered NIL since the law explicitly says so (with the exception of bonus shares acquired on or before 31 January 2018), shares acquired as a result of stock split cannot be considered NIL. This is where Section 55(2)(b)(v) comes into the picture. It is an interesting clause in the sense that it talks about cases where shares of a company became the property of the assessee on account of consolidation of shares into larger amount or sub-division of shares into smaller amounts which is exactly what a stock split does. The concerned clause says that the cost in such cases will be cost with reference to the cost of the shares from which such asset is derived. In other words, the cost of the split shares will be taken with reference to the cost of original shares and apportioned accordingly.

| For example,

A acquired 100 shares of Company A (face value ₹ subsequently went ahead with a stock split. The shares 10. The cost of acquisition will be computed as follows. |

100) for ₹ 120 were split into | per share. The company 1,000 shares of face value ₹ |

| Category | Data | Remarks |

| Original Shares | 100 nos. | |

| Additional shares on split | 900 nos. | |

| Total Shares | 1,000 nos. | |

| Total Cost | ₹ 12,000 | 100 shares@ 120 each |

| Cost per share | ₹ 12 | ₹ 12,000/1000 shares |

| Cost of acquisition of original 100 shares | ₹ 1,200 | ₹ 12 * 100 |

| Cost of acquisition of additional 900 shares on stock split | ₹ 10,800 | ₹ 12 * 900 |

Practical Situation

Stock Split followed by amalgamation and issue of shares in a certain ratio

Let us consider a practical situation to better understand the law and its interpretation. We have considered a case where there is a stock split as well as a subsequent amalgamation, not too far in the future.

Case Study

X holds 50 shares in Company A and 100 shares in Company B. These shares were acquired on 1 January 2018 at a cost of ₹ 40,000 and ₹ 7,000 respectively and are listed on the Bombay Stock Exchange. The shares of Company B were split in a 1 to 10 ratio in 2022. Also, Company A merged with Company B in February 2024.

In February 2024, X received 79 shares in Company B for every 10 shares held in Company A. In March 2024, X sold 1,295 shares in Company B for a consideration of ₹ 194,250.

How will the cost of acquisition and capital gains be computed for X?

Table 1 – Total Shares held on date of sale

| Transaction | Shares | Remarks |

| Acquisition of shares – Company A | 50 | |

| Acquisition of shares – Company B | 100 | |

| Stock Split – Company B | 1,000 | 900 additional shares |

| Allotment of shares in Company B consequent to merger of Company A with Company B | 395 | 50 /10 * 79;

345 additional shares |

| Total shares held on date of transfer | 1,395 | 1000+395 or 50+100+900+345 |

Table 2 – Cost of shares consequent to stock split and amalgamation allotment

| Particulars | Company A | Company B |

| Original shares | 50 | 100 |

| Increase due to stock split | – | 900 |

| Increase due to amalgamation | 345 | – |

| Total shares | 395 | 1,000 |

| Price paid to acquire shares | 40,000 | 7,000 |

–

| Particulars | Company A | Company B |

| Cost per share | 40,000/395 | 7,000/1,000 |

| =₹ 101.27 | = ₹ 7 | |

| Cost of original shares | 50*101.27 | 100*7 |

| =5,063 | =700 | |

| Cost of shares acquired due to stock split | – | 900*7 |

| =6,300 | ||

| Cost of shares allotted on amalgamation | 345*101.27 | – |

| =34,938 | ||

| Total Cost | 5,063+34,938 | 700+6300 |

| =40,001 | =7,000 |

Table 3 – Cost of acquisition (CoA) of 1,295 shares sold for capital gains purposes (FIFO method)

| Category | Cost | FMV | Sale Value | CoA |

| 50 Shares in Company A (acquired prior to 1 February 2018) | 5,063a | 45,653c | 7,500 | 75001 |

| 100 Shares in Company B (acquired prior to 1 February 2018) | 700b | 7,500c | 15,000 | 7,5001 |

| 900 shares in Company B (acquired in 2022 as a result of stock split) | 6,300b | NA | 135,000 | 6,3002 |

| 245 shares in Company A (acquired in 2024 as a result of allotment of shares by amalgamated company) | 24,810a | NA | 36,750 | 24,8102 |

Notes:

a Cost per share ₹ 101.27 (see Table 2) multiplied by 50 in case of original shares and by 245 in case of shares allotted on amalgamation

b Cost per share ₹ 7 (see Table 2) multiplied by 100 in case of original shares and by 900 in case of shares acquired through stock split

c FMV of Company A shares was ₹ 913 per share and of company B is ₹ 75 per share as on 31 January 2018

1 Since the shares were acquired prior to 1 February 2018, the cost of acquisition will be determined in two stages:

1. Lower of FMV and sale value

2. Higher of value in 1 and cost

2 Since the shares were acquired after 31 January 2018, the cost of acquisition will be the actual cost

Table 4 – Calculation of capital gains

| Category of shares | Shares (See Note) | Sale Value (₹) | CoA (₹) | Capital Gains (₹) |

| Original shares of Company A | 50 | 7,500 | 7,500 | 0 |

| Original shares of Company B | 100 | 15,000 | 7,500 | 7.500 |

| Split shares of Company B | 900 | 135,000 | 6,300 | 128,700 |

| Allotted shares of Company B | 245 | 36,750 | 24,810 | 11,940 |

| TOTAL | 1,295 | 194,250 | 46,110 | 148,140 |

Note:

1. The order of sale of 1,295 shares would be:

50 shares of company A +

100 shares of company B +

900 split shares of company B +

245 allotted shares of company B (balancing figure)

2. The gains will be long-term in nature. The original shares of company A and B have been held for more than 12 months. The period of holding of stock split will be considered the same as that of original shares. The period for which shares were held in Company A will also be considered in determining the period of holding of shares in Company B. Therefore, all the categories would fall under long-term capital gains

There is a capital gain of ₹ 148,140 for the financial year 2023-24 (Assessment Year 2024-25) in this case. The situation would not be different if the original shares of Company B appear first in the demat account and is sold first per FIFO method.

Conclusion

It is quite clear that when it comes to share split and amalgamation together or within a short timeframe, things could be more intricate than when an amalgamation or share split alone happens. It is important to allocate the costs properly per Section 55(2)(b)(v) in case of share split. While the cost of shares of the amalgamating company is deemed as cost of acquisition of shares of amalgamated company, it is necessary to make an allocation there as well for proper capital gains computation. Much of the complexity can be shed if the understanding of the law is correct and then it only becomes a matter of computation. Nevertheless, it is an interesting aspect of the Income tax law and hopefully, the hazy picture around this will turn clearer over time.