A. Meaning of terms used in section 44AD(1)

To understand the provisions of sec 44AD(1) of the Act, we must study the meaning of following terms:

1. Eligible assessee:

1) Resident Individual

2) Resident Hindu Undivided Family

3) Resident Partnership Firm (not a Limited LiabilityPartnership Firm as defined under LLP Act, 2008)

Note: While explaining the meaning of eligible assessee, a rider also provided in Explanation (a) to Sec. 44AD for eligibility i.e.

NON – ELIGIBLE ASSESSEES UNDER SEC. 44AD

Explanation (a) to sec. 44AD provides the following arenot covered under these provisions:

- An Individual / HUF / a Partnership Firm who is a resident and claiming deduction under chapter III of the Act section10A,10AA,10B,10BA relating to units located in FREE Trade Zone, Hardware & Software Technology Park etc. OR

- Claiming deduction under Chapter VI-A Part-C (deductions in respect of certain Incomes) i.e. Sections80HH to 80RRB.

SO- THE FOLLOWING ARE NOT COVERED U/s 44AD

- Individual /HUF who is not Resident

- Association of Person

- Firm having non-resident Status.

- A local Authority

- A co-operative Society

- LLP both Indian as well as Foreign

- Companies both Domestic and Foreign company

- Every Artificial Juridical Person

2. Eligible business:The presumptive taxation scheme under section 44AD covers all small businesses with total turnover/ gross receipts of up to 2 crores (except the business of plying, hiring and leasing goods carriages covered under section 44AE). Sub- sec. (6) of sec. 44AD states that ―the provisions of this section, notwithstanding anything contained in the foregoing provisions, shall not apply to-

(i) a person carrying on profession as referred to in sub section (1) of section 44AA ;

(ii) a person earning income in the nature of commission or brokerage ;

(iii) A person who is carrying on any agency business.

(Note : An insurance agent cannot adopt the presumptive taxation scheme of section 44AD)

Eligible Business- COVERED

So Eligible Business includes :

- Manufacturing

- Trading

- Wholesale

- Retail

- Job Work

- Service business

- Speculative/ Non speculative.

ASSESSEE AND SEVERAL BUSINESSES

The provisions of Sec. 44AD of the Act apply to an ‗Assessee‘. Hence when a person carries on several businesses, viz. wholesale and/or retail and or manufacture, the turnover or gross receipts of all the businesses are to be considered for the purposes of this section. Whether separate books or combined books are maintained by the assessee is not material. Combined turnover or gross receipts of all the businesses would form the basis for calculation of presumptive income.

Example: Mr. Harjot Singh, A Resident individual, is carrying on three eligible business, the turnover of which is as under ±

Business A (Rs.145 Lac)

Business B ( Rs.35 Lac)

Business C ( Rs.25 Lac).

Whether he can opt for sec 44AD?

The Answer is NO because turnover of eligible business exceeds Rs.2 Crores. It is to be noted that when we take when we take combined turnover of three businesses, it exceeds Rs. 2 crore. Hence, the assessee is not eligible for sec 44AD of the Act.

Example: Mr. Harjot Singh, a Resident individual, is carrying on two businesses, the turnover of which is as under ±

Business A (Eligible Business) Rs.70 Lakhs

Business B (Transport u/s 44 AE) Rs.8 Lakhs

Section 44AD and 44AE both are applicable. In the above said case, turnover of both the business shall not be clubbed and both the business shall be chargeable to tax u/s 44AD ond 44AE of the Act respectively.

Example: A Person doing brokerage business who have received brokerage for Rs. 90,00,000 and declaring income @ 5% of Rs.4,50,000. Should his books of Accounts be audit u/s 44AB since he is offering income less than 8%?

Ans. Audit u/s 44AB is applicable if he is declaring income lower than the rate specified u/s 44AD. But, section 44AD is not applicable to Agency, Commission and Brokerage. Hence, he can declare income less than 8%.

Example: An Eligible Assessee is engaged in trading business of goods both in his own name and also as a consignee for another person. The Total Sales amount to Rs.1.30 Crores, Turnover Details are as follows:

Own Business Turnover = Rs.90 Lakhs

Consignment Sales Turnover = Rs.40 Lakhs

Whether Assessee can opt for Presumptive income computation or not?

For computing Turnover for 44AD, the turnover of sale of goods on his own name should alone to be considered i.e. Rs.90 Lakhs. Here, the commission received on Consignment sales is liable for Tax Audit only when such commission exceeds the limit of Rs.1 Crore. Consignment Commission can be offered at any rate (Even below 8%), provisions of Sec.44AD will not govern the commission income.

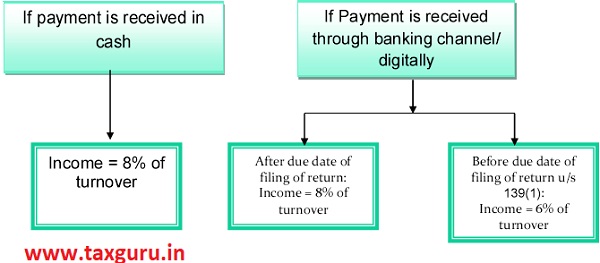

3. Presumptive Rate of Income: The presumptive rate of income would be 8% of total turnover or gross receipts.

However, Proviso to sub-section (1) provides that the presumptive rate of 6% of total turnover or gross receipts will be applicable in respect of amount which is received

- By and account payee cheque or

- By an account payee bank draft

- By use of electronic clearing system through a bank account OR through such other electronic mode as may be prescribed.

During the previous year or before the due date of filing of return under section 139(1) in respect of the previous year.

However the assessee can declare in his return an amount higher than presumptive income so calculated, claimed to have been actually earned by him.

√ Other Electronic Prescribed by CBDT: The Central Board of Direct Taxes has prescribed other electronic modes to provide for the followings as an acceptable electronic mode of payments-

(a) Credit Card;

(b) Debit Card;

(c) Net Banking;

(d) IMPS (Immediate Payment Service);

(e) UPI (Unified Payment Interface);

(f) RTGS (Real Time Gross Settlement);

(g) NEFT (National Electronic Funds Transfer), and

(h) BHIM (Bharat Interface for Money) Aadhaar Pay

For this purpose, a new Rule 6ABBA with the heading ‗Other electronic modes‟ is introduced in the Income Tax Rules, 1962. This rule has been given a retrospective effect and will come into force from 01- 09-2019 even though the notification was issued on 29-01-2020.

This proviso to sub-section (1) has been inserted w.e.f. 01/04/2017 to promote digital transactions. The government has offered incentive to the seller for accepting payment by banking channels or digital means by allowing lower rate of income. This was particularly necessary to encourage digital transactions after demonetization.

Assessee accepting payment through account payee cheque/ account payee draft or ECS through bank or other electronic mode can declare income at 6 % of turnover/ sales or gross receipts. However, the payment must be received before the due date of filing of return.

Example: Mr. Arshdeep Singh, an individual carrying business of laptops has a Turnover of Rs. 80 Lakhs during the F.Y. 19-20. He has received the payments as

Rs.60 Lakh in cash

Rs.10 Lakh by account payee cheque during the previous year

Rs. 4 Lakh by ECS through bank account upto 31st July 2019

Rs. 6 Lakh has not been received yet.

Now, since the TO is below Rs.2 Cr, he has the option of availing benefits of section 44AD. Mr. Arshdeep Singh can exercise this option and declare income as

| 8% of Rs.66,00,000 (60 Lakh + 6 Lakh) | 5,28,000 |

| 6% of Rs. 14 Lakh (10 Lakh + 4 Lakh) | 84,000 |

| Total income from PGBP | 6,12,000 |

Computation of Income under Section 44AD

Benefit reduction of deemed profit rate under Section 44AD of the Income-tax Act to taxpayers who will accept digital payments

Section 44AD of the income tax Act, 1961 provides that if taxpayer is engaged in the any eligible business and having a turnover of Rs. 2 crore or less ,its profits are deemed to be 8 per cent of the total turnover or gross receipts.

in order to achieve the government’s mission of moving towards a cash-less economy and to provide incentive small traders/businesses to proactively accept payments by digital means, it has been decided to reduce the existing rate of deemed profit of 8 per cent under Section 44AD of the Act to 6 per cent in respect of the amount of total turnover or gross receipts received through banking channels digital means.

However, the existing rate of deemed profit of 8 per cent referred to in Section 44AD of the Act, shall continue to apply in respect of the total turnover or gross receipts received in cash.

The benefit to traders and small businesses is explained in following different scenarios considering FY 2020-21:

| Particular | 100% Cash Turnover | 80% Digital Turnover | 100% Digital Turnover |

| Total Turnover | 1.90 Crore | 1.90 Crore | 1.90 Crore |

| Cash Turnover | 1.90 Crore | 38 Lakh | NIL |

| Digital Turnover | NIL | 1.52 Crore | 1.90 Crore |

| Profit on Cash Turnover @ 8% | 15.20 Lakh | 3.04 Lakh | NIL |

| Profit on Digital Turnover @ 6% | NIL | 9.12 lakh | 11.40 Lakh |

| Total Profit | 15.20 Lakh | 12.16 Lakh | 11.40 Lakh |

| Tax Payable under New Regime | 201240 | 122928 | 107120 |

| Tax Saving | NIL | 78312 | 94120 |

From the above table, it is clear that if an assessee makes his transactions in cash on a turnover of Rs. 1.90 crore, then his income under the presumptive scheme will be presumed to be Rs. 15.20 Lakh at the rate of 8 per cent of turnover, his total Tax Liability under new tax regime will be Rs. 201240. However, if an assessee shifts to 100 percent digital transactions and his profit will be presumed to be Rs. 11.40 Lakh at the rate of 6 per cent of turnover, his total Tax Liability under new tax regime will be Rs.107120. It is to be noted that by adopting digital system i.e.non cash system.he will save income tax of Rs.94120.00

Lower Rate of Income in Different Scenarios

As per the proviso to 44AD(1), income can be declared as 6% of the turnover if the payment is received digitally or through banking channel before the due date of return filing u/s 139(1). However, many a times due date for return filing is extended or sometimes it may happen that assessee files his return after due date or he has filed return earlier than the due date. We shall discuss here whether the assessee can claim 6% of turnover as his income under these scenarios.

Case 1- Due date of return filing is extended

The due date of return filing u/s 139(1) is extended by the Income Tax Department due to different reasons such as natural calamities, pandemic, technical glitches etc. The extended date becomes the due date u/s 139(1) of the Act for that assessment year. Therefore, any payment received through banking channel/ digitally up to the extended due date u/s 139(1) of the Act shall be eligible for claiming 6% of turnover as income.

Example: Suppose the due date for filing return u/s 139(1) for the A.Y. 2019-20 has been extended to August 31, 2019. An eligible assessee who has received payment through account payee cheque, account payee draft, ECS through banking channel or other prescribed modes up to 31/08/2020 shall be eligible for declaring profits at the rate of 6% of turnover.

Case 2- If the assessee files his return after the due date of return.

The proviso to sec 44AD(1) of the Act requires payment to be received up to due date of return filing. Any payment received even digitally/ through banking channel after the due date of return filing shall not be eligible for lower rate of income i.e 8% of turnover or higher shall be assumed as income.

Example: Suppose the due date for filing return u/s 139(1) for the A.Y. 201 9-20 is July 31, 2019 and the assessee files his return on Dec 26, 2019. Whether receipts through banking channel/ digitally up to Dec 26, 2019 will be eligible for claiming 6% of turnover as profits?

The receipts through banking channel/ digitally up to July 31, 2019 shall be eligible for claiming 6% of turnover as profits. The payments received after the due date i.e 31/07/2019 shall not be eligible for lower rates and these payments received after the due date of filing return will not be given the benefit of 6% of turnover .

Case 3- If the assessee files his return before the due date of return.

When the assessee files his return before the due date u/s 139(1) of the Act, he would have considered the facts on the date of filing of return and not assumed the facts beyond that date. The receipts through banking channel/ digitally up to date of return filing are considered for lower rate of income and the amount not received yet shall be considered for 8% of turnover as profits. The interesting issue here is what about the payments received through banking channel/ digitally after the date of return filing but before the due date of return filing. Whether these will be considered for 8 % of turnover or 6% of turnover as profits? If 6% is to be considered whether the return can be revised? Let us understand this with help of an example.

Example: Mr. Raj has a turnover of Rs. 80 Lakh for the A.Y. 2019-20. The due date of return filing is July 31, 2019. He files his return on May 15, 2019. He has received the following payments by account payee cheque:

| Up to 31/03/2019 – | Rs. 50,00,000 |

| Up to 15/05/2019 – | Rs. 15,00,000 |

| From 16/05/2019 to 31/07/2019 | Rs. 10,00,000 |

| Received after 31/07/2019 | Rs. 5,00,000 |

Mr. Raj has filed return on 15/05/2019. Till that date, payments to the extent of Rs.65,00,000 has been received by account payee cheque. Mr. Raj can declare progits from business as:

| 6% of Rs. 65,00,000 | = Rs. 3,90,000 |

| 8% of Rs. 15,00,000 (80L –65L) | = Rs. 1,20,000 |

| Total profits | = Rs. 5,10,000 |

Mr. Raj has received Rs. 10,00,000 after date of return filing but before due date of return filing. Mr. Raj can can not claim 6% of Rs. 10,00,000 as profits by revising the return. There is no doubt that the return can be revised u/s 139(5) before the end of assessment year or up to completion of assessment whichever is earlier. But,as per the provisions of sec 44AD of the Act, the income claimed by Mr.Raj in his income tax return will be final and subsequently by revising return ,the same cannot be reduced.

The assessee has to maintain complete records about the receipts from customers, whether they are received in cash or through banking channel/ digitally and whether they are received up to due date of return filing or not. Further, the record maintenance is for two financial years. Maintenance of all these records is a cumbersome task for a small business person. It is also against the basic object of presumptive taxation which is to make the taxation system simple, easy and hassle-free for small taxpayers. There is a need to create a balance between the object of less-cash economy and creating “ease of doing business” environment.

4. The Section 44AD(1) begins with “Notwithstanding Anything to contrary contained in section 28 to 43C”

Section 44AD of the Act begins with a non-obstante clause ―(1) Notwithstanding anything to the contrary contained in sections 28 to 43C‖… Therefore by virtue of the non-obstante clause, Section 44AD of the Act has a superior position vis-à-vis the other provisions of the Income Tax Act. Nevertheless, Section 44AD(2) of the Act also specifically mentions that any deductions allowable under Section 30 to 38 shall be deemed to have been given full effect. Therefore, there are no specific deductions available for the assessee opting for presumptive taxation under Section 44AD of the Act

Therefore, Section 44AD (1) determines the taxability by invoking a deeming clause.

Further, the section is titled as ―Special provision for computing profits and gains business on presumptive basis‖. Hence one may infer that Section 44AD is a selfcontained code by its own means devoid of Section 28 to 43C as both chargeability and computation are embedded in it. Having inferred that Section 44AD(1) is a separate code by itself wherein it determines the profit computation without referring to Section 29 of the Act, Section 44AD(2) of the Act specifically mentions that the deduction allowable under Section 30 to 38 of the Act are deemed to have been allowed. Such a provision, prima facie appears unnecessary especially considering that Section 44AD (1) begins with a non-obstante clause ―(1) Notwithstanding anything to the contrary contained in sections 28 to 43C‖ which on a literal reading specifies that Section 44AD will override all the other provisions relevant for computing profits and gains from business i.e., Sections 28 to 43C of the Act, even if the same are contrary.

It is to be noted here that the non-obstante clause stresses on the term contrary. However, a similar non-obstante clause employed in the newly inserted Section 44ADA of the Act (Special provision for computing profits and gains of profession on presumptive basis), mentions ―Section 44ADA. (1) Notwithstanding anything contained in sections 28 to 43C‖. On a comparison of Section 44AD and Section 44ADA of the Act, the term ‘contrary’ is absent in the latter section. Now aquetion arises that whether the term ‘contrary’ used in Section 44AD is superfluous. However it does not appear to be superfluous since the proviso to Section 44AD(2) prior to Finance Act 2016 amendment, specifically mentioned that while determining the income deemed to be profits and gains of business under Section 44AD of the Act, deduction under Section 40(b) shall be allowed subject to the limits specified.

Therefore, Section 44AD of the Act which appears to be a separate self-contained code, specifically uses the term contrary in its non-obstante clause so as to enable the eligible assessee to avail the deduction under Section 40(b) of the Act prior to Finance Act 2016.

The new Section 44ADA of the Act does not provide for any deduction while determining the presumptive profits and this may be considered the reason for the absence of the word contrary in the non obstante clause.

It means section 28 to 43C of Income Tax Act, 1961 is not applicable on eligible assessee carrying on eligible business. Hence, no disallowance / no deemed income under Section 40(a), 40A, 40A(3), 40A(3A), 41 can be made. It has been specifically provided that if the taxable income is to be calculated at eight percent of turnover or gross receipts, then in that case provisions of section 28 to 43C are not to be taken into consideration for the purpose of computing taxable income. It is pertinent to note whether any adverse inference can be drawn by which any amount that would have been added, while calculating taxable income, such amount can be added while calculating income on presumptive basis. By exclusion clause in respect of section 28 to 43C it seems that no disturbance can be made on account of provisions of sec 28 to 43C if the total income is arrived at on the presumptive basis.

Example: Mr. Y has claimed bad debts written off of Rs. 50,000 in year 2014-15. In P.Y. 201 9-20 he has recovered Rs. 30,000. Separate addition of bad debts recovered may not be made if the profits are declared under presumptive taxation scheme.

- Issue on Disallowance U/S 43B

A very interesting issue on the disallowance u/s 43B of the Income Tax Act,1961 has been considered by Panaji Tribunal in case of Good Luck Kinetic v. ITO (2015) 58. The Tribunal held that 44AD starts with ―notwithstanding anything to the contrary contained in Sec. 28 to 43C‖ whereas section 43B starts with the words ―notwithstanding anything contained in any other provisions of this Act‖. The non-obstante clause in Sec. 43B has far wider amplitude. Hence, disallowance could be made by invoking the provisions of Sec. 43B.

This is because the said provisions u/s 28 to 43C are provisions relating to the computation of business income of the Assessee. However, a perusal of the provisions of Sec. 43B shows that the said provision is a ―restriction‖ on the allowance of a particular expenditure representing statutory liability and such other expenses, claimed in the profit and loss account unless the same has been paid before the due date of filing the return.

Further, the non-obstante clause in Sec. 43B has far wider amplitude because it uses the words ―notwithstanding anything contained in any other provisions of this Act‖. Therefore, even assuming that the deduction is permissible or the deduction is deemed to have been allowed under any other provisions of this Act, still the control placed by the provisions of Sec. 43B in respect of the statutory liabilities still holds precedence over such allowance. This is because the dues to the crown has no limitation and has precedence over all other allowances and claims. The disallowance made by the AO by invoking the provisions of Sec. 43B of the Act in respect of the statutory liabilities are in order even though the Assessee‘s income has been offered and assessed under the provisions of Sec. 44AF of the Act.

Therefore, considering the view held by the aforesaid Tribunal, addition/ disallowance can be made u/s 43B even though the income has been declared u/s 44AD, 44ADA or 44AE.

Example: Mr. Dawar, having turnover of Rs. 70,00,000 declared profit at 8% amounting to Rs. 5,60,000. He has not deposited employer‘s share of EPF of Rs. 25,000 up to due date of return filing. Also, he has not paid bonus amounting to Rs.40,000 to his employees. Whether addition can be made u/s 43B if Mr. Dawar opts for sec 44AD?

Yes, addition can be made u/s 43B even if income is declared u/s 44AD. In this case the income will be assessed as:

| Profits declared u/s 44AD | Rs. 5,60,000 | |

| Add-Disallowances u/s 43 B | ||

| EPF not deposited upto due date of return filing | Rs. 25,000 | |

| Bonus not paid upto due date of return filing | Rs. 40,000 | |

| Assessed Income | Rs. 6,25,000 | |

- Issue of disallowance u/s 40

Sec 40 begins with ―Notwithstanding anything to the contrary in sections 30 to 38‖ It is to be noted that Section 40 is clothed in a negative language and it says that certain amounts shall not be deducted while computing income under the head ―profits & gains of business or profession .whereas section 44AD begins with ―notwithstanding anything to the contrary contained in sec 28 to 43C‖. On analysis of both the sections, the amplitude of non-obstante clause of section 44AD is higher than the non-obstante clause of section 40. Section 40 relates to disallowance of certain expenses due to non-deduction of TDS or non-deduction/ non-payment of equalisation levy, remuneration/ interest by firm to partners in excess of allowed etc.

Therefore, these expenses would not be disallowed even if TDS has not been deducted. However, the assessee may be deemed as assessee in default as per section 201 as sec 44AD override provisions of section 28 to 43C but not the provisions of TDS.

Example: Mr. Saurav declaring income u/s 44AD has made payment of interest to non-resident. However, no TDS has been deducted. Whether the expense will be disallowed u/s 40(a)?

The interest expense will not be disallowed as sec 44AD overrides sec 40(a). The assessee was required to deduct TDS as per sec 195. Although, he has not deducted the TDS, expense will not be disallowed. However, he may be considered as assessee in default as per sec 201 and other penal provisions may be applicable as sec 44AD does not override TDS provisions. This issue is discussed in detail later in this book.

- Issue of disallowance u/s 40A

Sec 40A relates to disallowance related to excess payment of related party, cash payment to a person in excess of Rs. 10,000 in a day, payment to unapproved fund, mark to market losses etc. The comparison of sec 44AD and 40A is very interesting and different from sec 43B and sec 40. Sec 40A overrides all the other provisions of PGBP.

The section begins with ―The provisions of this section shall have effect notwithstanding anything to the contrary contained in any other provisions of this Act relating to the computation of income under the head ―Profits and gains of business or profession‖. The non-obstante clause of this section seems to override provisions of sec 44AD. However, the Panaji Tribunal in case of Good Luck Kinetic v. ITO (2015) 58 relating to disallowance u/s 43B have considered two points:

i) Amplitude of non-obstante clause

ii) Payment to crown i.e statutory dues

The provisions of sec 40A are not related to statutory dues and such other dues. It just imposes restrictions on payments and disallows amount which is not paid as per the provisions of the Act. It is also to be noted that provisions of sec 40A of the Act are with regard to allowability of expenditure which has been actually incurred and claimed by the assessee from sec 30 to 38 of the Act. Therefore, if the assessee declares income as per the provisions of sec 44AD of the Act, no disallowance shall be made u/s 40A of the Act.

Example : If any person opting for sec 44AD has made cash purchases worth Rs. 15,000 no disallowance can be made u/s 40A(3), even if the cash payment to a person exceeds Rs. 10,000 in a day. Cash payment to transporter in excess of Rs. 35,000 in a day shall not be disallowed.

Similarly, disallowance u/s 40A for excess payment to relatives cannot be made. No addition u/s 41 can be made.

- Issue of Section 43CA vs. Section 44AD

It is a very special case which also try to disturb the scope of sec 44AD of the Act.To understand this concept, we must see the sec 43CA of the Act, which reads as under:

“ where the consideration received or accruing as a result of the transfer by an assessee of an asset (other than a capital asset), being land or building or both, is less than the value adopted or assessed or assessable by any authority of a State Government for the purpose of payment of stamp duty in respect of such transfer, the value so adopted or assessed or assessable shall, for the purposes of computing profits and gains from transfer of such asset, be deemed to be the full value of the consideration received or accruing as a result of such transfer.

Provided that where the value adopted or assessed or assessable by the authority for the purpose of payment of stamp duty does not exceed one hundred and ten per cent of the consideration received or accruing as a result of the transfer, the consideration so received or accruing as a result of the transfer shall, for the purposes of computing profits and gains from transfer of such asset, be deemed to be the full value of the consideration.”

It is to be noted that section 44AD starts with “Notwithstanding anything to the contrary contained in sections 28 to 43C….” meaning thereby, indirectly, section 44AD is subject to section 43CA. This is not correct position of law. It is to be noted that the open ended coverage of section 44AD(1) is puzzling since sale of immovable property held as stock in trade governed by section 43CA is not brought within the provisions of section 44AD. Section 44AD starts with non-obstante clause by saying that the provisions would prevail over sections 28 to 43C of the Act. The applicability of the section is however optional. Only when the taxpayer opts for the provisions of section 44AD, it would prevail over the provisions of sections 28 to 43C. Now a question arises, whether the provisions of sec 43CA of the Act are applicable in case of presumptive tax. In this connection it is to be noted that both these sections i.e.44AD and 43CA of the Act are deeming sections. A legal fiction is created only for a definite purpose and is limited to that purpose and should not be extended beyond it. It should be within the framework of the purpose for which it is created. Deemed to be is not an admission that it is in reality, rather it is an admission that it is not in reality what it is deemed to be.

‘The meaning of total turnover/ gross receipts has not been defined u/s 44AD of the Act. But if we carefully read the provisions of sec 44AD(1), the words used are total turnover of such business. This means the assessee has to take actual turnover or gross receipts’ and not the deemed turnover or receipts. Further, the terms ‘total sales, turnover or gross receipts’ are fiscal facts and cannot include deeming fiction created by section 43CA which categorically apply only ‘for the purpose of computing profits and gains from transfer of asset’ and is meant for taxing sale of immovable assets held as stock in trade where value adopted for stamp duty purposes by State Government authorities is more than 110% of the consideration. Similarly, new provision of section 43CA should not apply in cases governed by section 44AD for assessment of presumptive profits on sale of land/building.

Example: Mr. X is engaged in business of sale and purchase of property. He sells a property for Rs. 10,00,000. The stamp duty value of the same is Rs. 15,00,000. His total turnover other than is property is Rs. 60,00,000. What will be his total turnover?

The stamp duty value of the property is more than 110% of consideration i.e Rs. 11,00,000 (110% of 10,00,000). If Mr. X opts for sec 44AD Rs. 10,00,000 will be added in turnover as sec 43CA is not applicable in case income is declared u/s 44AD. The total turnover will be Rs. 70,00,000.

If Mr. X not opts for sec 44AD, Rs. 15,00,000 will be added in turnover. His total turnover will be considered as Rs. 75,00,000.

5. Meaning of words claimed to have been earned by the eligible assessee‟

The section has been amended for the benefit of the assessee and the words claimed to have been earned by the eligible assessee. By the introduction of these words in section 44AD(1), the legislature shows his intention to accept specified income as returned income even if higher sum is earned by eligible assessee unless it is claimed by assessee in his Income Tax Return. The word ―Claim‖ signifies the right of assessee, and it is not an obligation of the assessee. The distinction between Right and obligation is very necessary here. The language of section 44AD(1) requires claims to have been made by an assessee for returning higher income. If there is no claim made by assessee in return for higher income, there is no higher income. The assessee, who has opted presumptive taxation system, is under no obligation to explain individual entry of cash deposit in bank unless such entry has no nexus with gross receipts.

FCIT v. Surinder Pal Anand F2010] 192 TAXMAN 264 (PUNJ. & HAR.)

Example: Mr. Sham is carrying on business. The Turnover is Rs.90 Lacs. The profit as per his books or calculation is Rs.9 Lakhs. However, he opts to return the income under section 44AD @ 8% i.e. Rs.7.20 lacs. Now a question arises regarding the power of AO to assess the difference of 1.8 lacs as undisclosed income. In this case Mr. Sham has claimed the income of Rs.7.20 lac as in his return of income as his claim. The assessee is free to exercise this option at his will. Legally he is given the option by the statute and such an option cannot be equated with obligation cast upon the assessee. There is a definite difference between OPTION and OBLIGATION and an Option granted to the assessee cannot be construed to be his obligation when his actual income is more than 8% of Turnover. The AO cannot make any addition on this count as there is no provision under the Act permitting to make such addition. Further, the words used are ―higher income claimed to have been earned by the assessee‖. It is to be clarified that if the assessee has not made a claim in the Return of Income regarding any higher income, it implies there is no claim for Higher Income made by assessee. AO cannot claim that the assessee has earned higher income, because under the statue, he is not entitled to do so

B. No further deduction would be allowed:Section44AD (2)- All deductions allowable under sections 30 to 38 shall be deemed to have been allowed in full and no further deduction shall be allowed. However, Deduction u/s 80C to 80U will be given from GTI of the assessee even from the deemed income included in the GTI.

Illustration: Mr. Prince is running a Printing Press. His gross receipts from this business during year is Rs. 85,00,000 and declared income as per the provisions of section 44AD. After computing the income @ 8% of such gross receipts, he wants to claim further deduction on account of depreciation on the press building. Can he do so as per the provisions of section 44AD?

As per the provisions of section 44AD, from the net income computed at the prescribed rate, i.e., @ 8% of sales or gross receipts from the eligible business during the previous year, an assessee is not permitted to claim any deduction or any business expense from such income. Thus, in this case Mr. Shan cannot claim any further deduction from the net income of Rs. 6,80,000 i.e., @ 8% of gross receipts of Rs. 85,00,000.

C. Written down value of asset:Section 44AD (3): The WDV of any asset of such business shall be deemed to have been calculated as if the assessee has claimed and had been actually allowed the deduction in respect of depreciation for each of the relevant assessment years.

It is to be noted that if an assessee who has opted for presumptive taxation system, then any deduction allowable under sections 30 to 38 shall be deemed to have been already given effect to and no further deduction under those sections shall be allowed. It is to be noted that deduction for depreciation which is allowed u/s 32 shall be deemed to be allowed. Therefore, current year depreciation as well as unabsorbed depreciation i.e. brought forward depreciation shall not be allowed. However, WDV of the block of assets shall be calculated as if the depreciation has been allowed.

Sec 44AD overrides sec 28 to 43 C but does not override chapter VI. Therefore, current year losses & brought forward losses can be set off against deemed income. The same was held by ITAT, Pune in the case of DCIT v. Sunil M. Kankariya [2008].

Example:

Mr. Y has turnover of Rs. 50,00,000 for the P.Y. 2019-20. He has declared profits at the rate of 8% amounting to Rs. 4,00,000. He has bought machinery worth Rs. 12,00,000 on 15/04/2019. He has loss from house property of Rs. 75,000. Can he deduct depreciation of Rs.1 ,80,000 (15% of Rs.12,00,000) and set off loss from the above profit of Rs.4,00,000?

No, depreciation shall not be reduced from the above profits. It is deemed that depreciation has been already claimed and allowed. The closing WDV as on 31/03/2020 shall be Rs. 10,20,000 (12,00,000 ± 1,80,000).

Mr. Y shall be allowed to set off the loss of Rs. 75,000. The total income will be Rs.3,25,000 (4,00,000 ± 75,000).

EXAMPLE:

Mr. Ashmeet Singh is engaged in the business of Civil Construction undertakes small government projects. He received the following amounts by way of contract receipts:

| Particulars | Rs. |

| Towards contract work for supply of labour | 80,00,000 |

| Value of materials supplied by Government | 15,00,000 |

| Gross receipts | 95,00,000 |

Mr. Ashmeet Singh paid Rs. 40,00,000 to labour in cash. He has brought forward loss and unabsorbed depreciation of the discontinued business Rs.55,000 and Rs. 25,000 respectively. Compute income under the head ―PGBP‖ assuming that he opts for section 44AD.

Solution:

| Particulars | Rs. |

| Presumptive income under section 44AD [Rs. 80,00,000 x 8%] | 6,40,000 |

| Less: unabsorbed depreciation | Nil |

| Less: Business loss brought forward u/s 72 | (55,000) |

| Business Income | 5,85,000 |

Notes:

(1) As per para 31.1 of the circular no. 684 of CBDT dated 10-06-1994, gross receipts are the amount received from the clients for contract and will not include the value of material supplied by the client.

(2) Once assessee opts for section 44AD, deduction under section 30 to 38 shall be deemed to have been allowed. Therefore, question of disallowance in respect of labour payment of Rs. 40,00,000 in cash under section 40 A(3) does not arise.

(3) Once assessee opts for section 44AD, deduction under section 30 to 38 shall be deemed to have been allowed. Since depreciation is governed by section 32(2), it cannot be adjusted while computing income under section 44AD of the Act. But brought forward business loss is governed by section 72, same shall be adjusted against presumptive income computed under section 44AD.

EXAMPLE: RSK & Co. a partnership firm engaged in the manufacturing business has a gross receipt of Rs.59,00,000 from such business. The partnership deed provides for payment of salary of Rs.20,000 p.m. to each of the partners i.e. C and K. The firm uses machinery for the purpose of its business and the WDV of the machinery as on 1.04.2016 is Rs.2,00,000. The machinery is eligible for depreciation @15%. Compute the profits from the business for the assessment year 2017-18, if firm opts for the scheme under section 44AD and has received the following amount by account payee cheques:

1. Rs. 25,00,000 till 31 .3.17

2. Rs. 6,00,000 between 31 .3.17 and 31 .7.17

3. Rs.5,00,000 after 31.7.17

Solution:As per section 44 AD the profits will be computed as under:

| 1. | 6% of gross receipts of ₹31,00,000 | ₹1,86,000 |

| i.e. the amount received till the due date of filing the return u/s 139(1) | ||

| 2. | 8% of gross receipts of ₹28,00,000 | ₹2,24,000 |

| ₹4,10,000 |

No deduction will be allowed on account of depreciation.

The WDV of the machinery for next year shall be taken as ₹1,70,000 (2,00,000 –

15% of ₹2,00,000) assuming as if depreciation has been allowed.

D. Section 44AD (4): Consequences of opting out of the section 44AD(1):• Where an eligible assessee declares profit for any previous year in accordance with the provisions of this section and he declares profit for any of the 5 assessment years relevant to the previous year succeeding such previous year not in accordance with the provisions of sub-section (1), he shall not be eligible to claim the benefit of the provisions of this section for five assessment years subsequent to the assessment year relevant to the previous year in which the profit has not been declared in accordance with the provisions of sub-section(1).

The above provision postulates as the following:

a. The assessee should have declared profit as per section 44AD for any previous year; and

b. The assessee should have declared profit not in accordance with section 44AD in any of the five assessment years succeeding the previous year in which profit was declared as per section 44AD as per condition (a).

If above two conditions are satisfied, such assessee shall not be eligible to claim the benefits of Section 44AD for five assessment years subsequent to the assessment year in which profit was not declared as per section 44AD as given in condition (b) above. Further from plane reading of the provision, it is understood that the restrictions provided in sub-section (4) shall not be applicable to the assessees having business income for the first time during the financial year 2016-17 and declare income below the limits prescribed under sub-section (1) of section 44AD for the AY 2017-18.

E. Section 44AD (5):Notwithstanding anything contained in the foregoing provisions of this section, an eligible assessee to whom the provisions of sub-section (4) are applicable and whose total income exceeds the maximum amount which is not chargeable to income-tax, shall be required to keep and maintain such books of account and other documents as required under sub-section (2) of section 44AA and get them audited and furnish a report of such audit as required under section 44AB.

Sub Section 5 will be applicable if following conditions are satisfied.

a. An eligible assessee to whom the provisions of sub-section (4) are applicable; and

b. The total income of that assessee has exceeded the maximum amount which is not chargeable to income-tax.

In other words, sub-sections (4) and (5) are mutually inclusive. Provisions of sub-section (4) shall not be applicable to an assessee who never opted for the scheme in any of the earlier previous years, as it provides that the eligible assessee should have declared profits as per section 44AD for any previous year. Under this situation, assessees who have never ever opted for the scheme till the AY 2016-17 can enjoy the benefits by showing lesser profits for the subsequent assessment years.

Controversial Issue – Needs CBDT Clarification

The amendment was brought by Finance Act, 2016 wef 01/04/2017. The government is discouraging taxpayers from misusing the scheme and constantly changing their option often. If any assessee opts for presumptive taxation, he has to continue it for 5 years and if he wants to opt out, he will be barred from resuming presumptive taxation for a period of 5 years. There is an important issue which emerges for reckoning the period of 5 years. Amendment to section 44AD (i.e., new sub section (4) and (5) is applicable from 01/04/2017 i.e., from Assessment Year 2017-18. Now, question arises regarding the counting of the continuous 6 assessment years for the purpose of sub section (4). Will it be done initially from the Assessment Year 2017-18 itself or even the options exercised in the earlier years can also be counted? Another important question is, if the person has continuously opted for 5 years period in the past then the provision of 5 years restrictions will not be there as the sub section means that if a person has opted for 44AD for 5 years period continuously then no 5 years restrictions would be there if assessee decides to opt out. The issues are controversial and it would be in the interest of the masses if the CBDT clarifies it suitably.

For example, Ashmeet claims to be taxed on presumptive basis under Section 44AD for AY 2019-20, he offers income on basis of presumptive taxation scheme. However, for AY 2020-21 ,he did not opt for presumptive taxation Scheme. In this case, he will not be eligible to claim benefit of presumptive taxation scheme for next five Assessment years i.e. from AY 2021-22 to 2025-26.

Further, he is required to keep and maintain books of account and he is also liable for tax audit as per section 44AB from the AY in which he opts out from the presumptive taxation scheme if his total income exceeds the maximum amount not chargeable to tax.

This can be explained with the help of following table:

| Assess ment Year | Turnover | Rate of Profit | Whether Total Income more than Basic exemptio n | Whether Section Applicable | Remarks | ||

| 44AA | 44AB | 44AD | |||||

| 2018-19 | 3.00 Crore | 7% | Yes | Yes | Yes | No | A |

| 201 9-20 | 1.20 Crore | 9% | Yes | No | No | Yes | B |

| 2020-21 | 85 Lakh | 5% | Yes | Yes | Yes | No | C |

| 2021-22 | 75 Lakh | 10% | Yes | Yes | Yes | No | D |

| 2022-23 | 1.20 Crore | 4.5% | No | Yes | Yes | No | E |

| 2023-24 | 88 Lakh | 4.5% | No | No | No | No | F |

| 2024-25 | 92 Lakh | 6% | Yes | Yes | Yes | No | G |

| 2025-26 | 95 Lakh | 9% | Yes | Yes | Yes | No | H |

| 2026-27 | 2.50 Crore | 6% | Yes | Yes | Yes | No | I |

–

| Remarks | Explanation |

| A | Turnover exceeding 1 Crore and hence,he is liable to keep books of account & Audit 44AB(a). |

| B | Since, Ashmeet opted 44AD, he is not required to maintain books and not required to get audited u/s 44AB |

| C | Since, Asmeet fails to opt sec 44AD.The benefit of section 44AD shall not be available to the assessee for A.Y. 2021-22 to 2025-26. Therefore he is liable to keep books of account & Audit u/s 44AB(e). |

| D | Ashmeet is liable to keep books of account & Audit u/s 44AB(e). |

| E | Ashmeet is liable to keep books of account & Audit u/s 44AB(a). |

| F | Ashmeet is not liable to maintain books of account and not required to get them audited u/s 44AB(e). |

| G | Ashmeet is liable to keep books of account & Audit u/s 44AB(e). |

| H | Ashmeet is liable to keep books of account & Audit u/s 44AB(e). |

| I | Ashmeet is liable to keep books of account & Audit u/s 44AB(a). |

From the perusal of the above table, it is clear that if in any Previous Year, Mr.Ashmeet fails to opt the provisions of Section 44AD(4) of the Act, then for the next 5 Previous Years he will not be eligible to claim the benefit u/s 44AD of the Act. In such case, he will be required to maintain the books of account and he will also be liable for tax audit as per section 44AB from the AY in which he opts out from the presumptive taxation scheme if his total income exceeds the maximum amount not chargeable to tax. From the above table, it can also be concluded that the period of five years shall be counted next to the year when assessee opts not to avail the benefits of sec 44AD of the Act. .After the expiry of five years, this cycle again will start from the year in which he opts to adopt the provisions of sec 44AD of the Act.

Books of Accounts

An assessee having turnover up to Rs. 2 crore and opting for sec 44AD is not required to maintain books of accounts. As provided in section (5) of 44AD the eligible assessee who claims to be taxed on presumptive basis is not required to maintain books of account as provided in section 44AA. If the turnover is below Rs. Two crores and opting for sec 44AD, audit u/s 44AB is not required. However, if the turnover is exceeding Rs. Two crores, the assessee is outside the ambit of section 44AD, as provided in section 44AD. It will be interesting to note that the presumption of income is to work on the basis of the turnover or gross receipts. The question would be if the books are not maintained how the turnover would be proved? Therefore, when the income is computed as per the provisions of section 44AD, it would be necessary to prove for the assessee the figure of turnover or gross receipts. Which records are to be maintained will depend upon the type of the business of the eligible assessee. Figures adopted under GST Act provisions would be good evidence. Copies of invoices issued may also be maintained as evidence of turnover. If the correct turnover or gross receipts is not ascertainable from the records maintained, it is likely that the same may be estimated by the Assessing Officer in absence of proper records of turnover or gross receipts. Therefore it would be necessary for the eligible assessee to maintain such records with evidences so that the turnover or gross receipts can be conclusively proved.

Extract of Section – 44AD of Income Tax Act, 1961 – Special provision for computing profits and gains of business on presumptive basis.

4AD. (1) Notwithstanding anything to the contrary contained in sections 28 to 43C, in the case of an eligible assessee engaged in an eligible business, a sum equal to eight per cent of the total turnover or gross receipts of the assessee in the previous year on account of such business or, as the case may be, a sum higher than the aforesaid sum claimed to have been earned by the eligible assessee, shall be deemed to be the profits and gains of such business chargeable to tax under the head “Profits and gains of business or profession” :

Provided that this sub-section shall have effect as if for the words “eight per cent”, the words “six per cent” had been substituted, in respect of the amount of total turnover or gross receipts which is received by an account payee cheque or an account payee bank draft or use of electronic clearing system through a bank account 53[or through such other electronic mode as may be prescribed] during the previous year or before the due date specified in sub-section (1) of section 139 in respect of that previous year.

(2) Any deduction allowable under the provisions of sections 30 to 38 shall, for the purposes of sub-section (1), be deemed to have been already given full effect to and no further deduction under those sections shall be allowed.

(3) The written down value of any asset of an eligible business shall be deemed to have been calculated as if the eligible assessee had claimed and had been actually allowed the deduction in respect of the depreciation for each of the relevant assessment years.

(4) Where an eligible assessee declares profit for any previous year in accordance with the provisions of this section and he declares profit for any of the five assessment years relevant to the previous year succeeding such previous year not in accordance with the provisions of sub-section (1), he shall not be eligible to claim the benefit of the provisions of this section for five assessment years subsequent to the assessment year relevant to the previous year in which the profit has not been declared in accordance with the provisions of sub-section (1).

(5) Notwithstanding anything contained in the foregoing provisions of this section, an eligible assessee to whom the provisions of sub-section (4) are applicable and whose total income exceeds the maximum amount which is not chargeable to income-tax, shall be required to keep and maintain such books of account and other documents as required under sub-section (2) of section 44AA and get them audited and furnish a report of such audit as required under section 44AB.

(6) The provisions of this section, notwithstanding anything contained in the foregoing provisions, shall not apply to—

(i) a person carrying on profession as referred to in sub-section (1) of section 44AA;

(ii) a person earning income in the nature of commission or brokerage; or

(iii) a person carrying on any agency business.

Explanation.—For the purposes of this section,—

(a) “eligible assessee” means,—

(i) an individual, Hindu undivided family or a partnership firm, who is a resident, but not a limited liability partnership firm as defined under clause (n) of sub-section (1) of section 2 of the Limited Liability Partnership Act, 2008 (6 of 2009); and

(ii) who has not claimed deduction under any of the sections 10A, 10AA, 10B, 10BA or deduction under any provisions of Chapter VIA under the heading “C. – Deductions in respect of certain incomes” in the relevant assessment year;

(b) “eligible business” means,—

(i) any business except the business of plying, hiring or leasing goods carriages referred to in section 44AE; and

(ii) whose total turnover or gross receipts in the previous year does not exceed an amount of two crore rupees.

Author has explained very well.There is a lobby which always says, if actual income is more than 8%, then it is obligation of the assessee to declare actual profit. Here author has well explained, why AO cannot question or add additional income, considering profit is more than declared. This has been confirmed by some judgements also. With this logic, a partner in partnership firm which files return under 44AD, can draw any amount from the firm which is profit and tax free in his hand as long as money is available and money has come from the turnover only. A clarification in this regard, will clear all the doubts.

Hi.. even i have same query. Partnership firm declares profit @6%. Actual profit may be more. How does partner book profit from firm or how much can he draw from firm as non taxable profit in his hands.