Section 194S of the Income Tax Act, 1961 was introduced in the Finance Act 2022, which became effective from 1 July, 2022. According to this section, if any person is responsible for paying to other person who is a resident of India, any amount on account of transfer of any virtual digital asset, then the payer shall deduct TDS @1% of such amount as income tax.

What is a virtual digital asset?

Virtual digital assets, as specified by the Income Tax Act, 1961, covers the following:

- Crypto currency

- Non fungible tokens

- Any other digital asset as may be prescribed by the Central Government.

Taxation of income from transfer of VDA

The taxation of income earned on account of transfer of virtual digital asset is taxed as per the provisions of section 115BBH of the Income Tax Act, 1961. As per this section, the income earned reduced by the amount of cost of acquisition, any other expense incurred in relation to virtual digital asset shall not be allowed as a deduction, shall be charged at the rate of 30%.

Any loss arising from any other source cannot be set off against income from transfer of VDA and any loss arising from transfer of VDA cannot be set off against any other income. Further, loss from VDA cannot be carried forward to subsequent years.

The gift of VDA shall be taxed in the hands of recipient under the head ‘income from other sources’.

When to deduct TDS?

TDS is to be deducted by the payer at the earlier of:

(i) Credit of such sum in the books of the payer or

(ii) Payment of such sum, by any mode.

What is the threshold limit for deduction of TDS?

a. In case of a ‘specified person’, the threshold for deduction of TDS under section 194S is Rs. 50,000.

b. In case of any other person, the threshold for deduction of TDS under section 194S is Rs. 10,000.

‘Specified person’ means any person:

1. Being an individual or Hindu Undivided Family, whose turnover from business during the year immediately preceding the financial year in which virtual digital asset is transferred, does not exceed Rs. 1 crore;

2. Being an individual or Hindu Undivided Family, whose gross receipts from profession carried out by him in the financial year immediately preceding the financial year in which virtual digital asset is transferred, does not exceed Rs. 50 lakhs;

3. Being an individual or Hindu Undivided Family not having any income from any business or profession.

Special provisions in case of specified persons:

1. Provisions of section 203A of the Income Tax Act, 1961 are not applicable to specified persons i.e. a specified person is not required to obtain a Tax Deduction and Collection Account Number (TAN) when deducting TDS under section 194S.

2. Provisions of section 206AB of the Income Tax Act, 1961 are not applicable to specified persons i.e. a specified person is not required to deduct TDS at higher rates if the person to whom the payment is to be made has not filed income tax return for the financial year preceding the year in which TDS is deducted under section 194S.

Special cases:

Case A: When the transfer of virtual digital asset is wholly in kind or in exchange of another virtual digital asset;

Case B: When the transfer of virtual digital asset is partly in cash and partly in kind.

In both the above cases, the payer has to ensure that the amount of tax to be deducted has been deposited with the Government by the receiver before releasing the consideration.

Process of TDS Deduction

Any Specified person who is responsible for deducting TDS under section 194S, shall file form 26QE within 30 days from the end of the month in which TDS is deducted. This form acts a challan cum statement. Subsequently, a TDS credit of the amount of tax deducted shall be available to the deductee in form 16A, which can be claimed by the deductee while filing income tax return.

Other than specified person having TAN shall file the Form 26Q to report transactions on which TDS is deducted under section 194S.

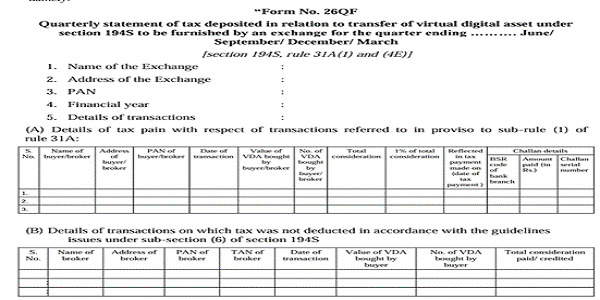

Crypto exchanges shall file Quarterly return in Form 26QF to report the transactions in relation to transfer of VDA. The format of Form 26QF is as under:

Examples of crypto transactions and TDS liability on the same

a. Transfer Of VDA through an exchange (viz. coinDCX, WazirX, etc.)

If the transfer of VDA takes place on or through an exchange, then the exchange shall make the TDS at 1% and remit the balance amount of consideration to the seller. However, if the payment between the seller and the exchange is made through a broker, then both parties are responsible for deducting tax.

Alternatively, the exchange may enter into an agreement with the buyer or their broker stating that the exchange shall pay the due tax on or before the due date of that quarter. In this case, the exchange would be required to furnish a quarterly report in Form No. 26QF on or before the due date.

b. Exchange Of VDA(in kind) Via Broker, Barter For Another One

Unlike the above cases, the payments could be in kind, partly in kind, or in barter for another one. In such cases, the exchange may deduct tax on both legs of the transactions based on its agreement. If the transaction is not done through an Exchange, the person making the payment must deduct and deposit the TDS.

Conclusion

Section 194S of the Income Tax Act, 1961 introduces significant compliance obligations for transactions involving Virtual Digital Assets. Understanding the intricacies of TDS, thresholds, and special provisions is crucial for both payers and recipients to ensure adherence to tax regulations. For detailed guidance, consult with tax experts like Karan Vakharia and Nishika Acharya.

****

Authors: Karan Vakharia, Partner (Email: karan.vakharia@bilimoriamehta.com, Contact: +91 97735 26387), and Nishika Acharya, Consultant