Reporting of Foreign Assets and Income in Income Tax Return

1. In order to report foreign assets and income from a source outside India in Income tax return, firstly you have to determine the residential status of the assessee which is mentioned below in the table along with who is required to report :

| S No. | Residential Status | Income Taxable In India | Whether to report Foreign assets and Income? |

| 1. | Resident and ordinarily resident (ROR) | a. Income received or accrues or arises or is deemed to be received or accrues or arises India during the previous year.

b. Income which accrues or arises outside India even if it is not received or brought into India during the previous year. |

Yes |

| 2. | Resident but not ordinarily resident (RNOR) | a. Income received or accrues or arises or is deemed to be received or accrues or arises India during the previous year.

b. Income derived from business controlled in or profession setup in India. |

No |

| 3. | Non Resident (NR) | Income received or accrues or arises or is deemed to be received or accrues or arises India during the previous year. | No |

2. In order to report in Income tax return, you have to select Yes in S. No. 19 of Part B – TTI Computation of tax liability of total Income as demonstrated below which asked whether you at any time during the previous year :-

a. hold, as beneficial owner, beneficiary or otherwise, any asset (including financial interest in any entity) located outside India or

b. have signing authority in any account located outside India or

c. have income from any source outside India?

3. After selecting Yes as mentioned in point 2, you have to fill Schedule FA : Details of Foreign Assets and Income from any source outside India.

4. In Item no. A1 under schedule FA, assessee have to give details of Foreign Depository Accounts held (including any beneficial interest) at any time during the relevant account period in the following format by giving details of :

| S. No. | Particulars | Remarks (If any) |

| a. | Country Name and code | Country in which such account is maintained. |

| b. | Name of the financial institution | Name of the bank or financial institution with which the account is maintained. |

| c. | Address of the financial institution | Address of the bank or financial institution. |

| d. | ZIP Code | ZIP Code of the area where bank or financial institution is situated. |

| e. | Account Number | Account number of the foreign depository is to be given. |

| f. | Status | Status of the account is to be given, whether you are the owner or the beneficiary. |

| g. | Account opening date | Date when the account is open. |

| h. | Peak Balance during the period | Maximum balance maintained during the previous year. In order to convert the foreign current balance in Indian rupees, as per Instructions contained in Taxmann’s Income tax rules, the rate of exchange for the calculation of the value in rupees of such asset situated outside India shall be the telegraphic transfer buying rate of such currency as on the date of peak balance in the bank account. |

| i. | Closing Balance | Closing balance of the bank account as on 31st March of the previous year is to be reported. In order to convert the foreign depository balance in Indian rupees, as per Instructions contained in Taxmann’s Income tax rules, the rate of exchange for the calculation of the value in rupees of such asset situated outside India shall be the telegraphic transfer buying rate of such currency as on the closing date of accounting period. |

| j. | Gross Interest paid / credited to the account during the period | The amount of interest received in the foreign depository account maintained should be reported. In order to convert the gross interest paid or credited to the account in Indian rupees, as per Instructions contained in Taxmann’s Income tax rules, the rate of exchange for the calculation of the value in rupees of such asset situated outside India shall be the telegraphic transfer buying rate of such currency as on the closing date of accounting period in the bank account. |

5. In Item no. A2 under schedule FA, assessee have to give details of Foreign Custodial Accounts held (including any beneficial interest) at any time during the relevant account period in the following format by giving details as mentioned above in Item no. A1.

6. In Item no. A3 under schedule FA, assessee have to give details of Foreign Equity and Debt Interest (including any beneficial interest) in any entity at any time during the relevant accounting period in the following format by giving details of :

| S. No. | Particulars | Remarks (If any) |

| a. | Country Name and Code | Country in which entity or company is located. |

| b. | Name of the entity | Name of the entity or company of which the equity shares or debt instruments are held by the assessee. |

| c. | Address of the entity | Address of the entity. |

| d. | ZIP Code | ZIP Code of the area where the entity is situated. |

| e. | Nature of entity | Nature of entity means whether the entity is a company or LLP, whether it is listed on stock exchanges. |

| f. | Date of acquiring the Interest | Date of purchase or acquisition of stake in equity or debt instrument. |

| g. | Initial value of the investment | Amount paid on the purchase or acquisition. |

| h. | Peak value of investment Balance during the period | Maximum value of investment during the previous year. In order to convert the peak value of investment in Indian rupees, as per Instructions contained in Taxmann’s Income tax rules, the rate of exchange for the calculation of the value in rupees of such asset situated outside India shall be the telegraphic transfer buying rate of such currency as on the date of peak value of investment. |

| i. | Closing Balance | Closing balance of the investment as on 31st March of the previous year is to be reported. In order to convert the investment in Indian rupees, as per Instructions contained in Taxmann’s Income tax rules, the rate of exchange for the calculation of the value in rupees of such asset situated outside India shall be the telegraphic transfer buying rate of such currency as on the closing date of accounting period. |

| j. | Total gross amount paid / credited with respect to the holding during the period | The amount of interest / dividend received with respect to investment in debt or equity should be reported. In order to convert the gross amount paid or credited to the account in Indian rupees, as per Instructions contained in Taxmann’s Income tax rules, the rate of exchange for the calculation of the value in rupees of such asset situated outside India shall be the telegraphic transfer buying rate of such currency as on the closing date of accounting period. |

| k. | Total gross proceeds from sale or redemption of investment during the period | The amount received on sale of equity stake or redemption of debt instrument should be reported. In order to convert the gross proceeds from sale in Indian rupees, as per Instructions contained in Taxmann’s Income tax rules, the rate of exchange for the calculation of the value in rupees of such asset situated outside India shall be the telegraphic transfer buying rate of such currency as on the closing date of accounting period. |

7. In Item no. A4 under schedule FA, assessee have to give details of Foreign Cash Value Insurance Contract or Annuity Value Contract (including any beneficial interest) at any time during the relevant accounting period in the following format by giving details of :

| S. No. | Particulars | Remarks (If any) |

| a. | Country Name and Code | Country in which entity or company is located where foreign cash value insurance contract or annuity value contract is taken. |

| b. | Name of the Financial Institution | Financial Institution where insurance contracts are held. |

| c. | Address of the Financial Institution | Address of the Financial Institution. |

| d. | ZIP Code | ZIP Code of the area where the entity is situated. |

| e. | Date of Contract | Date of entering insurance contract. |

| f. | The cash value or surrender value of the contract

|

Cash value or surrender value means the amount the policyholder get on cancellation of insurance contract. |

| g. | Total gross amount paid / credited with respect to the contract during the period | Total amount paid with respect to the contract. |

8. In Item no. B under schedule FA, assessee have to give details of Financial Interest in any entity held (including any beneficial interest) at any time during the relevant accounting period in the following format by giving details of :

| S. No. | Particulars | Remarks (If any) |

| a. | Country Name and Code | Country in which entity or company is located in which assessee has financial interest. |

| b. | ZIP Code | ZIP Code of the area where the entity is situated. |

| c. | Nature of entity | Type of entity i.e. Company, LLP, partnership firm etc. |

| d. | Name of entity | Name of the entity in which assessee has financial interest. |

| e. | Address of entity | Address of the entity. |

| f. | Nature of Interest | Type of interest [whether holding equity, preference, debt etc]. |

| g. | Date Since Held | Date from which the financial Interest is held. |

| h. | Total Investment Cost | Total cost incurred in order to acquire the financial interest. |

| i. | Income accrued from such Interest | Income accrued from the financial interest acquired. |

| j. | Nature of Income | Type of Income received from the entity [Interest, Dividend, profits etc].

|

| k. | Income taxable and offered in the return of income | Income offered in the Indian Income tax return including the amount, schedule and item number of schedule where such income is offered to tax. |

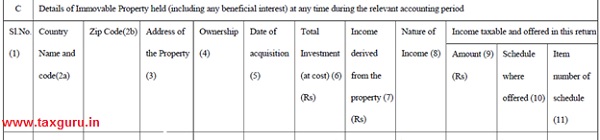

9. In Item no. C under schedule FA, assessee have to give details of Immovable property held (including any beneficial interest) at any time during the relevant accounting period in the following format by giving details of :

| S. No. | Particulars | Remarks (If any) |

| a. | Country Name and Code | Country where such immovable property is situated. |

| b. | ZIP Code | ZIP Code of the country. |

| c. | Address of the property | Address of the immovable property. |

| d. | Ownership | Ownership of the Immovable property (whether co-owned or single owner). |

| e. | Date of acquisition | Date on which the property was acquired. |

| f. | Total Investment (at cost) | Total amount paid to acquire such immovable property. |

| g. | Income derived from such property | Amount of income derived from immovable property. |

| h. | Nature of Income | Rent etc. |

| i. | Income taxable and offered in the return of income | Income offered in the Indian Income tax return including the amount, schedule and item number of schedule where such income is offered to tax. |

10. In Item no. D under schedule FA, assessee have to give details of any other capital asset held (including any beneficial interest) at any time during the relevant accounting period in the following format by giving details of :

| S. No. | Particulars | Remarks (If any) |

| a. | Country Name and Code | Country where such capital asset is held. |

| b. | ZIP Code | Zip of the country. |

| c. | Nature of Asset | Type of asset |

| d. | Ownership | Ownership of the capital asset. |

| e. | Date of acquisition | Date on which such capital asset is acquired. |

| f. | Total Investment (at cost) | Total amount paid to acquire such capital asset |

| g. | Income derived from such asset | Total income derived from such asset. |

| h. | Nature of Income | Nature of income derived from such capital asset. |

| i. | Income taxable and offered in the return of income | Income offered in the Indian Income tax return including the amount, schedule and item number of schedule where such income is offered to tax. |

11. In Item no. E under schedule FA, assessee have to give details of account(s) in which it has the signing authority held (including any beneficial interest) at any time during the relevant accounting period and which is not included in A to D above in the following format by giving details of :

| S. No. | Particulars | Remarks (If any) |

| a. | Name of the Institution in which account is held | Institution in which the account is maintained where the assessee has the signing authority. |

| b. | Address of the Institution | Address of such institution. |

| c. | Country Name and Code | Country where such institution is situated. |

| d. | ZIP Code | ZIP code of the country. |

| e. | Name of the Account Holder | Name of the account holder where the assessee has the signing authority. |

| f. | Account Number | Account number of the account(s) held. |

| g. | Peak Balance / Investment during the year | Maximum value of investment during the previous year. In order to convert the peak value of investment in Indian rupees, as per Instructions contained in Taxmann’s Income tax rules, the rate of exchange for the calculation of the value in rupees of such asset situated outside India shall be the telegraphic transfer buying rate of such currency as on the date of peak value of investment. |

| h. | Whether income accrued is taxable? | If yes, provide below. |

| i. | Income taxable and offered in the return of income | Income offered in the Indian Income tax return including the amount, schedule and item number of schedule where such income is offered to tax. |

12. In Item no. F under schedule FA, assessee have to give details of trusts, created under the laws of a country outside India, in which you are a trustee, beneficiary or settlor in the following format by giving details of :

| S. No. | Particulars | Remarks (If any) |

| a. | Country Name and Code | Country where such trust is located. |

| b. | ZIP Code | ZIP Code of the country. |

| c. | Name of the Trust | Name of the trust in which assessee is a trustee, beneficiary or settlor. |

| d. | Address of the Trust | Address of the Trust. |

| e. | Name of Trustees | The trustee is the person who possesses the assets for the interest of the Beneficiary. While in complete charge of the ‘trust assets,’ the trustee is obliged a legal duty to manage the trust property in the best possible manner for the advantage of the Beneficiaries. The trustee is prevented from practicing the trust asset for his ends. |

| f. | Address of Trustees | Address of Trustees. |

| g. | Name of Settlor | The Settlor is the person who creates the trust by placing a particular asset that s/he owns into the trust, i.e., by transferring that asset to other person (trustee) along with clear instructions that the asset be held for the profit of a third party. The Settlor may be either an separate or a legal entity. |

| h. | Address of Settlor | Address of Settlor. |

| i. | Date since position held | Date from which the assessee has held the position of trustee, beneficiary or settlor. |

| j. | Whether Income derived is taxable? | If yes, provide below. |

| k. | Income taxable and offered in the return of income | Income offered in the Indian Income tax return including the amount, schedule and item number of schedule where such income is offered to tax. |

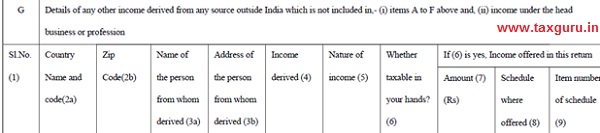

13. In Item no. G under schedule FA, assessee have to give details of any other income derived from any source outside India which is not included in items A to F above and income under the head business or profession in the following format by giving details of :

| S. No. | Particulars | Remarks (If any) |

| a. | Country Name and Code | Country where such income is derived. |

| b. | ZIP Code | ZIP Code of the country. |

| c. | Name of the person from whom derived | Name of the person (company, Financial Institution etc.) from where the income is derived. |

| d. | Address of the person from whom derived | Address of the person. |

| e. | Income derived | Amount of Income derived. |

| f. | Nature of Income | Type of income derived. |

| g. | Whether taxable in the hands of assessee? | Whether income derived by assessee is taxable? If yes, provide below. |

| h. | Income taxable and offered in the return of income | Income offered in the Indian Income tax return including the amount, schedule and item number of schedule where such income is offered to tax. |

Note

1. Cash value Insurance contract means an insurance contract (other than an indemnity reinsurance contract between two insurance companies) that has a cash value.

2. Annuity contract means a contract under which the issuer agrees to make payments for a period of time determined in whole or in part by reference to the life expectancy of one or more individuals.

3. Custodial account is an account maintained for the benefit of a beneficiary, and administered by a legal guardian or custodian who has fiduciary obligation to the beneficiary.

–xx–

we resident indian have purchased insurance policy in singapore and in reporting data in investment in foreign assets, column total gross amount paid or credited with respect to the contract is required to be disclosed after converting the same into Indian currency. here period means calender year 1.1.23 to 31.12.23 or f y 1.4.23 to 31.3.24?

It should be Calendar year (01-01-2023 to 31-12-2023).

Great Article!

I have one query,

suppose I have 100 RSUs allocated to me in 2014-2015 by a US MNC Listed and I still have them in 2022 -2023 thenIn table A3 and

1. for `the peak value of the investment during the accounting period’ – What should be the price of stock I need to use. Is it the peak price during 2014-2015 or 2022-2023 ?

2. `the closing value of the investment during the accounting period` – What should be the price of stock I need to use. Is it the closing price on Dec 31 2015 or Dec 11 2022 ?

Your advise will be immensely helpful!

Hi Navneet,

Thanks for this great article and it is really helpful.

I have a doubt regarding determination of peak value in A3.

It is mentioned by IT department to provide peak value during Accounting period. If shares were sold in the June (as example) and peak value for the year falls in September.

Then Peak value for the sold shares should be between January to June (till sold date) or It is same for all the shares (from September)

Regards

Mudit

Hello, thanks for the article. One question regarding initial value. Consider I bought 100 shares and later sold 20 in 2021, in ITR of AY 2022-23 I have declared initial value for 100 shares, declaring the gain/loss on sale of 20 shares. Now in 2022 there was no sale. What will be the initial value to be filled in AY 2023-24? Do I consider the initial value at which 100 shares was bought, or the value for 80 shares on date of purchase?