FAQs on How to Register for Income Tax e-Filing (Taxpayer)

Q. 1 Why should I register myself on the e-Filing portal?

Ans. The registration functionality is available to all taxpayers with an active and valid PAN. Registering on the e-Filing portal will enable you to access and use the various functionalities and tax related services that the e-Filing Portal offers.

Q. 2 What are the documents required for registration?

Ans. No documents are required for registering as taxpayer (Except Company). Valid mobile number and email ID, and valid and active PAN are the only pre-requisites.

Q.3 Can I register on behalf of my family member?

Ans. Registration is done basis the PAN and the primary contact details provided. Each PAN has to be registered individually.

Q.4 I am a non-resident user without a mobile number in India. Can I register on the e-Filing Portal?

Ans. Yes, you can provide your foreign mobile number while registering. All details will be communicated to you on your email ID provided and not your foreign mobile number. All OTPs will be sent on email ID only.

Q. 5 Who can register on the e-Filing Portal using this service?

Ans. All taxpayers holding a valid and active PAN can register on the e-Filing portal.

Manual on How to Register for Income Tax e-Filing (Taxpayer)

1. Overview

This pre-login service is available to all taxpayers (except Companies) who want to register on and access the e-Filing portal. The Registration service enables the taxpayer to access and track all tax-related activities.

2. Prerequisites for availing this service

- Valid and active PAN

- Valid Mobile Number

- Valid email ID

3. Step-by-Step Guide

Step 1: Go to the e-Filing portal homepage, click Register.

Step 2: Enter your PAN under Register as a Taxpayer option and click Validate. In case the PAN is already registered or invalid, an error message is displayed.

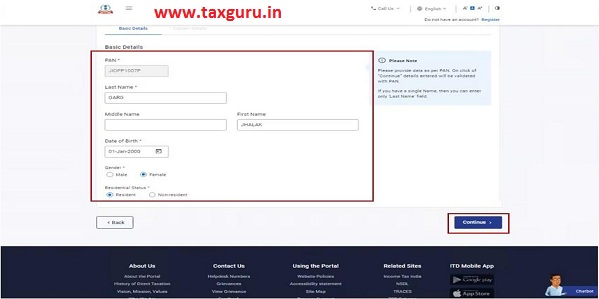

Step 3: Enter all the mandatory details including Name, DOB / DOI, Gender (if applicable) and Residential Status as per your PAN on the Basic Details page and click Continue.

Step 4: After PAN is validated, the Contact Details page appears for individual taxpayers. Enter your Contact Details including Primary Mobile Number, email ID and Address. Click Continue.

Step 5: Two separate OTPs are sent to the primary mobile number and email ID mentioned in Step 5. Enter the separate 6 digit OTPs received on the mobile number and email ID and click Continue.

Note:

- OTP will be valid for 15 minutes only.

- You have 3 attempts to enter the correct OTP.

- The OTP expiry countdown timer on screen tells you when the OTP will expire.

- On clicking Resend OTP, a new OTP will be generated and sent.

Step 6: Edit the details in the page if necessary and click Confirm.

Step 7: On the Set Password page, enter your desired password in both the Set Password and Confirm Password textboxes. Enter your personalized message and click Register.

Note:

- Do not click Refresh or Back.

- While entering your new password, be careful of the password policy:

- It should be at least 8 characters and at most 14 characters.

- It should include both uppercase and lowercase letters.

- It should contain a number.

- It should have a special character (e.g. @#$%).

Step 8: When you are successfully registered, click Proceed to Login to begin the login process.

Note: Log in to the e-Filing portal and update your profile to access all the available services.

ePAN Acknowledge ment please

ePAN Acknowledge ment please