FAQs on How to Register for e-Filing (CA) on New Income Tax Portal

1. Who is a Chartered Accountant?

A Chartered Accountant (CA) is a registered member of Institute of Chartered Accountants of India. A CA can file ITRs, Audit Reports and other statutory forms on behalf of his/her clients.

2. What are the prerequisites for registering as a CA?

The prerequisites for registering as a CA are Membership Number and Enrollment Date. Your PAN should be registered on the e-Filing portal and a valid and active DSC should be registered with the specified PAN.

3. Do I need a DSC to register as a CA?

Yes, you need a DSC to register as a CA. If your DSC is not registered, you need to first register it on the e-Filing portal.

4. Do I need the emsigner utility to register on the e-Filing portal as a CA?

Yes, you will need to download and install the emsigner utility. The link for the download is made available to you at the time of registration

Manual on How to Register for e-Filing (CA) on New Income Tax Portal

1. Overview

This pre-login service is available to Chartered Accountants (CAs) who want to register and access the e-Filing portal. The Registration service enables the user to access and track all tax-related activities.

2. Prerequisites for availing this service

- CA Membership Number

- Enrolment Date for registering as CA

- PAN registered on the e-Filing portal

- Valid and Active DSC registered with the specified PAN

3. Step-by-Step Guide

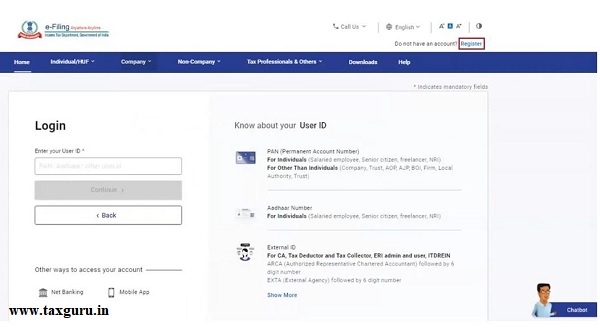

Step 1: Go to the e-Filing portal homepage, click Register.

Step 2: Click Others and select the Category as Chartered Accountant and click Continue.

Step 3: Enter all the mandatory details like PAN, Name, DOB, Membership Number and Enrollment Date on the Basic Details page and click Continue.

Note:

- If your PAN is not registered on the e-Filing Portal, an error message is displayed. You can register as a CA only if your PAN is registered.

- At this stage, the system checks if DSC is linked to the specified PAN. If DSC is not registered or if DSC linked to the PAN has expired, an error message is displayed. Register/ Update your DSC to the PAN to proceed.

Step 4: On successful validation with the ICAI database, the Contact Details page appears. Enter all the mandatory details like Primary Mobile Number, Email ID and Address and click Continue.

Step 5: Two separate OTPs are sent to your mobile number and email ID entered in Step 4. Enter the separate 6-digit OTPs received on your mobile number and email ID and click Continue.

Note:

- OTP will be valid for 15 minutes only.

- You will have 3 attempts to enter the correct OTP.

- The OTP expiry countdowntimer on screen tells you when the OTP will expire.

- On clicking Resend OTP, a new OTP will be generated and sent.

Step 6: Check if all the details entered are correct. Edit the details in the screen, if necessary, then click Confirm.

Step 7: On the Set Password page, enter your desired password in both the Set Password and Confirm Password textboxes, set your personalized message, and click Register.

Note:

- Do not click Refresh or

- While entering your new password, be careful of the password policy:

- It should be at least 8 characters and at most 14 characters.

- It should include both uppercase and lowercase letters.

- It should contain a number.

- It should have a special character (e.g. @#$%).

Step 8: Click Proceed to Login to begin the login process. Your login details will be emailed to your primary email ID.

Note: Log in and update your profile to access all the features available to you on the e-Filing Portal.

4. Related Topics

- Dashboard and Worklist

- Register Yourself- Taxpayer

registered as ARCA on old site of income tax. logged in in new site successfully but while updating profile it asking for GST No which I don’t have and it has * means mandatory. so it is not saving and asking for GST No if NA typed it is not accepting, pl help me,

DEAR

I AM FACING THE PROBLEM THAT MEMBERSHIP NUMBER DOES NOT EXSIST

ALTHOUGH MY PAN CARD DETAILS AND ICAI RECORDS ARE PERFECTLY MATCHING AND HAVE OBTAINED COP FROM ICAI

ANY HELP FROM YOU

I am facing the same issue on income tax website as date of enrollment is invalid. If any one got the solution please update me also..

My mobile no 9632043640. Even I have raised the ticked in SSP, but no use.

While trying to register as Chartered accountant on new portal, I’m getting my enrollment date as invalid. I’ve checked this with Icai ssp portal and date is correct.

Called to IT department helpline various times. But no help from them yet.

Hi sir,

I am also facing the same problem, pls let me know have you resolved u r issue or not.

If u resolve how u solve.

Hi Lokesh Even i am facing the issues my mail id is raghul@gradllp.com – please let me know if you have resolved it

Even I am facing the same issues Prajna – Do let me know if you have got yours resolved

I am facing the same issue on income tax website as date of enrollment is invalid

It is the date that you have applied for membership no, You may receive a mail from ICAI for membership enrollment.