Press Information Bureau

Government of India

Ministry of Finance

Dated: 24-October-2016

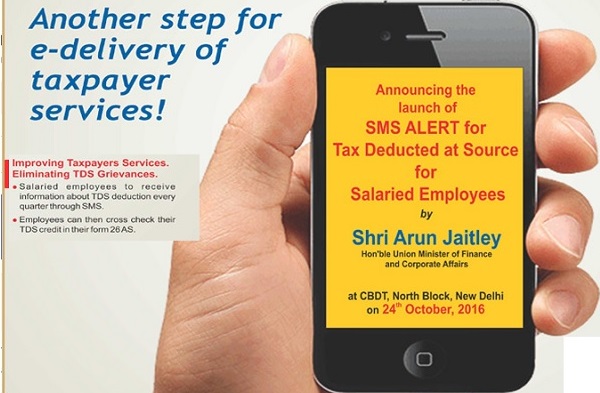

FM: Better tax payer services key to direct tax reforms; Launches SMS Alert Service for about 2.5 crore private and Government salaried employees in order to directly inform them about the deposit of tax deducted at the end of every quarter.

The Union Finance Minister Shri Arun Jaitley said that better facilities and services to the taxpayers are the central to Direct Tax Reforms. He said that the tax payers have a right to know the deductions made from their salary/income on regular basis. He said that more and more tax payer services have to be provided in order to make the people tax complaint. He stressed on the Government’s commitment towards continuously upgrading tax payer services. The Finance Minister Shri Jaitley was speaking after launching the SMS Alert Service for direct taxes for about 2.5 crore private and Government salaried employees at a function in the national capital here today.

The new step is an effort by the Income Tax Department to directly communicate deposit of tax deducted, through SMS alerts to salaried taxpayers, at the end of every quarter. In case of a mismatch, they can contact their deductor for necessary correction. Simultaneously, SMS alerts will also be sent to deductors who have either failed to deposit taxes deducted or to e-file their TDS returns by the due date.

This initiative will initially benefit approximately 2.5 crore salaried cases. The CBDT will soon extend this facility to another 4.4 crore non-salaried taxpayers. The frequency of SMS alerts will be increased, once the process for filing TDS returns is streamlined to receive such information on a real-time basis.

All taxpayers who wish to receive such SMS alerts are advised to update their mobile numbers in their e-filing account.

The CBDT constantly endeavours to provide better taxpayer services and reduce taxpayer grievances. New schemes and e-initiatives to redress and reduce complaints of mismatches in tax deducted at source are key to this effort.

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

New Delhi, 24th October, 2016.

PRESS RELEASE

Sub: Another E-Initiative by CBDT- Launch of SMS alert Service for TDS in case of Salaried Tax payers– reg.

The CBDT constantly endeavours to provide better taxpayer services and reduce taxpayer grievances. New schemes and e-initiatives to redress and reduce complaints of mismatches in tax deducted at source are key to this effort.

In this direction, the Honourable Finance Minister, Shri Arun Jaitley, launched the SMS Alert Service, from Delhi today. He stressed on the Government’s commitment towards continuously upgrading tax payer services. The new step is an effort by the Income Tax Department to directly communicate deposit of tax deducted, through SMS alerts to salaried taxpayers, at the end of every quarter. In case of a mismatch, they can contact their deductor for necessary correction. Simultaneously, SMS alerts will also be sent to deductors who have either failed to deposit taxes deducted or to e-file their TDS returns by the due date.

This initiative will initially benefit approximately 2.5 crore salary cases. The CBDT will soon extend this facility to another 4.4 crore non-salaried taxpayers. The frequency of SMS alerts will be increased, once the process for filing TDS returns is streamlined to receive such information on a real-time basis.

All taxpayers who wish to receive such SMS alerts are advised to update their mobile numbers in their e-filing account.

(Meenakshi J Goswami)

Commissioner of Income Tax

(Media and Technical Policy)

Official Spokesperson, CBDT.