Introduction

– In her budget speech, the Hon’ble Finance Minister, Smt. Nirmala Sitharaman had announced launching of a scheme in 2019 that would provide e-Assessment of Income-tax in electronic mode, in a phased manner, with no human interface.

– On 7th of October 2019, the Revenue Secretary has launched the faceless assessment in the Income Tax Department by inaugurating the NeAC (NeAC) in Delhi.

– Under e-Assessment scheme 2019: –

(i) There would be a setup of Digital Technology for Risk Management by way of automated examination tool, Artificial Intelligence and Machine Learning,

(ii) The e-Assessment Scheme introduces the concept of team based assessment with dynamic jurisdiction which would bring about transparency, efficiency and standardisation of procedures by eliminating the human interface between the taxpayer and the Income-tax Department.

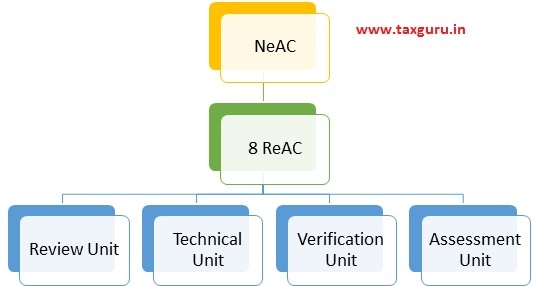

(iii) There would be a NeAC in Delhi to be headed by Principal Chief Commissioner of Income-tax,

(iv) 8 Regional e-Assessment Centres (ReAC) at Delhi, Mumbai, Chennai, Kolkata, Ahmedabad, Pune, Bengaluru and Hyderabad which would comprise Assessment unit, Review unit, Technical unit and Verification units.

(v) Cases for the specified work shall be assigned by the NeAC to different units by way of automated allocation systems

- Till now, the scope of E-assessment is limited to regular assessment under section 143(3). However, notice for income escaping assessment under section 147, may be sent through E-proceeding portal

How E-assessment scheme will operate

Procedure for Draft Assessment

- The NeAC shall serve a notice under section 143(2) specifying the issues for which the case was selected for scrutiny. It can be either Limited Scrutiny or Complete Scrutiny.

- The assessee can see the notice under E-proceeding menu on Income Tax Portal and can submit his response within fifteen days from the date of receipt of notice. If the response cannot be filed within the said period, the window for online submission will close and assessee has to wait for further notice.

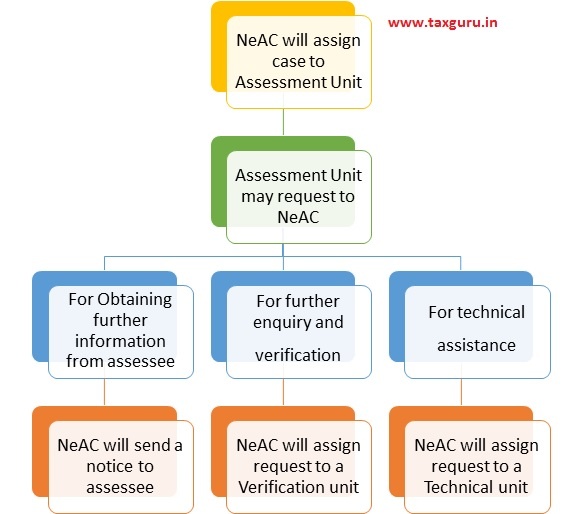

- The NeAC shall assign the case selected for the purposes of assessment under this Scheme to a specific assessment unit in any one Regional e-assessment Centre through an automated allocation system;

- The assessment unit may make a request to the NeAC for—

a. obtaining such further information, documents or evidence from the assessee or any other person, as it may specify;

b. conducting of certain enquiry or verification by verification unit; and

c. seeking technical assistance from the technical unit;

- When a request is made by Assessment Unit for obtaining further information, documents or evidence from the assessee, the NeAC shall issue appropriate notice or requisition to the assessee for obtaining the information, documents or evidence as required by the assessment unit;

- When a request for conducting of certain enquiry or verification has been made by the assessment unit, the request shall be assigned by the NeAC to a verification unit through an automated allocation system to conduct enquiry or verification as required by the Assessment Unit;

- When a request for seeking technical assistance from the technical unit has been made by the assessment unit, the request shall be assigned by the NeAC to a technical unit in any one ReAC through an automated allocation system;

- The assessment unit shall, after taking into account all the information and relevant material obtained from assessee and received from Verification and Technical unit make a draft assessment order either accepting the returned income of the assessee or modifying the returned income of the assessee and send a copy of such order to the NeAC;

- The Assessment unit shall, while making draft assessment order, provide details of the penalty proceedings to be initiated therein, if any;

Procedure for Final Assessment

- The NeAC shall examine the draft assessment order in accordance with the risk management strategy and using automated examination tool and decide to follow procedures as mentioned below,

Procedure 1: Finalise the assessment as per the draft assessment order and serve a copy of such order and notice for initiating penalty proceedings, if any, to the assessee, along with the demand notice; or

Procedure 2: In case of any modification is proposed, serve an SCN calling upon him to show cause as to why the assessment should not be completed as per the draft assessment order; or

Procedure 3: Assign the draft assessment order to a review unit in any one Regional e-assessment Centre, through an automated allocation system, for conducting review of such order;

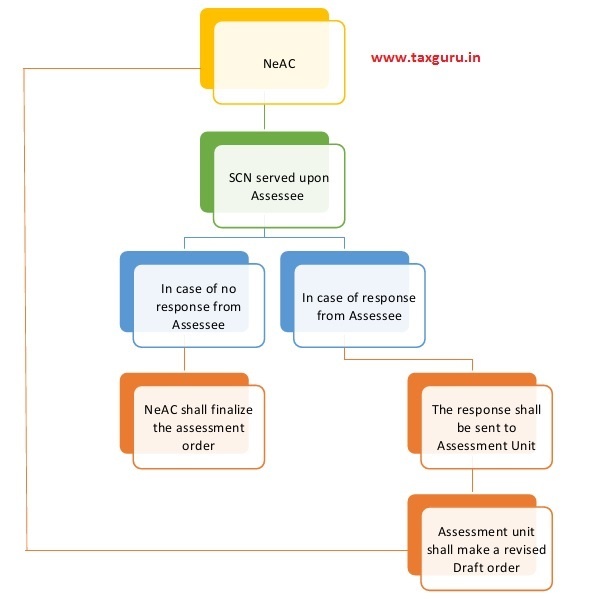

Procedure 2: Issue of SCN

- In case of SCN, the assessee may furnish his response to the NeAC on or before the date and time specified in the notice;

- The NeAC shall,

a. in a case where no response to the SCN is received, finalise the assessment as per the draft assessment order, as per the procedure 1;

b. in any other case, send the response received from the assessee to the assessment unit;

- The assessment unit shall, after taking into account the response furnished by the assessee, make a revised draft assessment order and send it to the NeAC;

- The NeAC shall, upon receiving the revised draft assessment order,

a. finalise the assessment in case the revised draft assessment order is not prejudicial to the interest of the assessee as per the procedure 1; or

b. in case the revised draft assessment order is prejudicial to the interest of the assessee, provide another opportunity to the assessee, as per the procedure 2.

c. the response furnished by the assessee shall be dealt with as per the procedure 1, 2 and 3

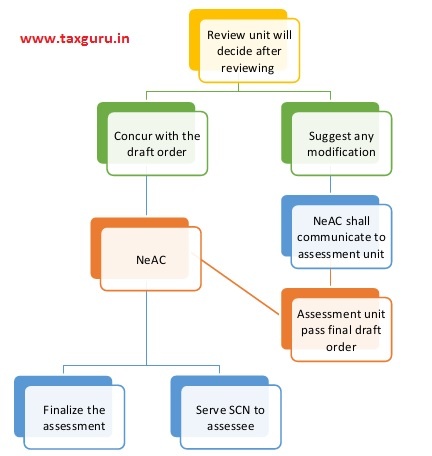

Procedure 3: Draft order sent to Review unit

- The review unit shall conduct review of the draft assessment order, referred to it by the NeAC whereupon it may decide to,

a. Concur with the draft assessment order and intimate the NeAC about such concurrence; or

b. Suggest any modification, as it may deem fit, to the draft assessment order and send its suggestions to the NeAC

- The NeAC shall, upon receiving concurrence of the review unit, follow the procedure 1 and procedure 2, as the case may be;

- The NeAC shall, upon receiving suggestions for modifications from the Review unit, communicate the same to the Assessment unit;

- The assessment unit shall send the final draft assessment order to the NeAC after considering the modifications suggested by the Review unit;

- The NeAC shall, upon receiving final draft assessment order, follow the procedure 1 and procedure 2, as the case may be;

- The NeAC shall, after completion of assessment, transfer all the electronic records of the case to the Assessing Officer having jurisdiction over such case. For,

(a) imposition of penalty;

(b) collection and recovery of demand;

(c) rectification of mistake;

(d) giving effect to appellate orders;

(e) submission of remand report,

(f) proposal seeking sanction for launch of prosecution and filing of complaint before the Court;

- The NeAC may at any stage of the assessment, if considered necessary, transfer the case to the Assessing Officer having jurisdiction over such case.

Other notable points

- Where a modification is proposed in the draft assessment order and an SCN has been served upon the assessee, he shall be entitled to seek personal hearing for making his oral submission or present his case before income tax authority in any unit prescribed under the scheme.

- Such hearing shall be conducted exclusively through video conferencing by use of any telecommunication software which support video telephony

- Any examination or recording of the statement during the assessment proceeding shall be conducted by any unit exclusively through video conferencing

- Any unit may during the course of assessment proceeding, send the recommendation for initiation of penalty for non-compliance of any notice or direction

- The NeAC shall serve an SCN before levying any penalty under this act.

How to respond the notices sent for Assessment?

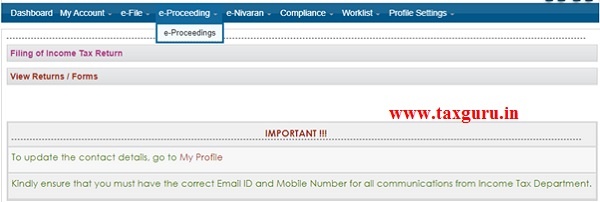

- Step 1: Login into Income tax portal by providing PAN and password,

- Step 2: Click e-Proceeding menu,

- After clicking on e-Proceeding menu, below screen will appear,

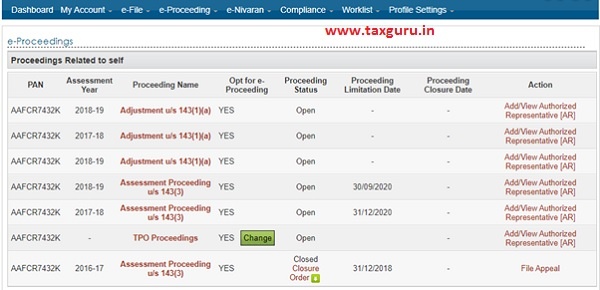

- Step 3: Click on the link provided against the Assessment Year for which the assessment proceeding shall be carried. After clicking, below screen will appear,

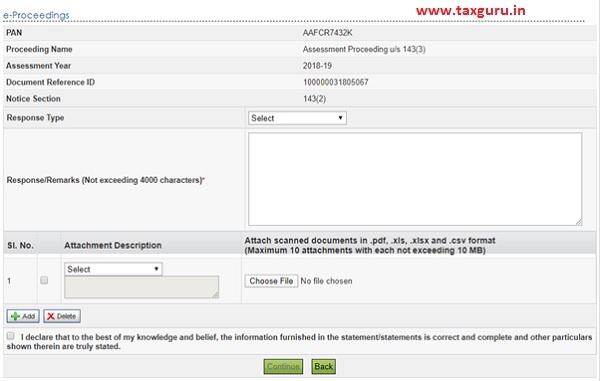

- Step 4: Click on ‘Submit’ button. After clicking, below screen will appear,

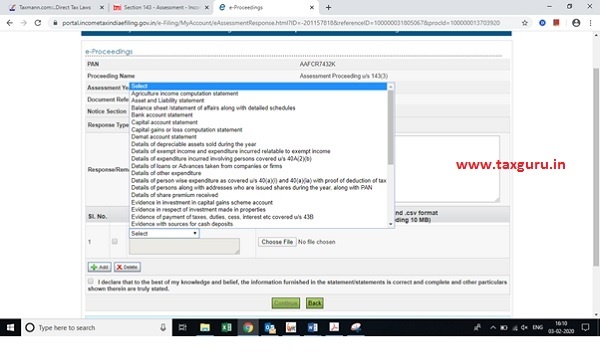

- You can select either full response or partial response from drop down menu provided against ‘Response type’ column.

- Thereafter, you have to type your response against the notice in the box which is a mandatory field.

- After that, you have to upload required documents as mentioned in the notice after selecting the category of documents attached.

- Step 5: After uploading all the documents, click on ‘Continue’ button after checking the box of self-declaration. After clicking on ‘Continue’ button, below screen will appear,

- You can submit using DSC/EVC or you may choose to submit without using DSC/EVC.

- A mail acknowledging the submission will be sent to registered mail id.

Points to be kept in mind while submission

- Every submission shall be accompanied with a covering letter

- In the typing box, it is advised to write your reply in letter format giving reference to the notice and covering letter

- The attachment shall be in PDF or Excel format and the maximum size of the attachment shall not be more than 5 MB

- Maximum ten attachments in one submission can be made. In case, there are more than ten attachments, you can submit the same again on the same link

- The attachment name shall not contain any special character or space

- It is advisable, in case you are submitting full response, to reply each and every points of notice. In case, any requirement is not applicable to the assessee, please mention that the certain point is not applicable to the assessee along with the reason in the covering letter

- It is advisable to submit reply within fifteen days of receipt of the notice. If not, the submission window will be closed and an ex-parte order may be passed.

- It is advised to make a system wherein on alternate days, you check on e-Proceeding if any notice has been issued by the department.

About the Author

Author is Amit Jindal, ACA working as Manager Taxation in Neeraj Bhagat & Co. Chartered Accountants, a Chartered Accountancy firm helping foreign companies in setting up business in India and complying with various tax laws applicable to foreign companies while establishing their business in India.

Author is Amit Jindal, ACA working as Manager Taxation in Neeraj Bhagat & Co. Chartered Accountants, a Chartered Accountancy firm helping foreign companies in setting up business in India and complying with various tax laws applicable to foreign companies while establishing their business in India.