Page Contents

How to file Income Tax Form 10-ID under Section 115BAB – FAQs

Q.1 What is Form 10-ID?

Ans. New Manufacturing Domestic Companies can opt to pay tax at a concessional tax rate of 15% (plus applicable surcharge and cess) under Section 115BAB of the Income Tax Act, 1961 subject to certain conditions. In order to do so, it is essential to file Form 10-ID on or before the due date specified under sub-section (1) of Section 139 for furnishing the returns of income for the first assessment year commencing on or after 1st day of April, 2020 to avail the benefit.

Q. 2 Who is required to file Form 10-ID?

Ans. A New Manufacturing Domestic Company incorporated on or after the 1st day of October, 2019 which has commenced manufacturing or production of an article or a thing on or before the 31st day of March, 2023, and opts to be taxed at concessional rate, is required to file Form 10-ID.

Q. 3 Is it mandatory for all applicable taxpayers (domestic companies) to file Form 10-ID?

Ans. No. This is optional. Form 10-ID is required to filed only if a domestic company chooses to opt for concessional tax rate of 15% (plus applicable surcharge and cess) under Section 115BAB of the Income Tax Act, 1961.

Q. 4 How can I file and submit Form 10-ID?

Ans. You can file form 10-ID through the online mode only (through the e-Filing portal).

Q. 5 What is the timeline for filing this form?

Ans. You will be required to file Form 10-ID before due date for filing of ITR.

Q. 6 Do I need to file the form again for the next assessment year?

Ans. No. If you have opted for concessional tax rates once, it shall apply to subsequent assessment years and cannot be withdrawn.

Q. 7 How do I know that the form has been submitted successfully?

Ans. You will receive a confirmation on your email ID and mobile number registered with the e-Filing portal. Additionally, you can also view the status in your Worklist under For your Actions tab.

Q. 8 Is e-Verification necessary for submitting Form 10-ID? if yes, how can I e-Verify the Form 10-D?

Ans. Yes, it is necessary to e-Verify Form 10-ID. You can e-Verify using Digital Signature Certificate.

How to file Income Tax Form 10-ID under Section 115BAB – Manual

1. Overview

New Manufacturing Domestic Companies have the option to pay tax at a concessional tax rate of 15% (plus applicable surcharge and cess) under Section 115BAA and 115BAB of the Income Tax Act, 1961 respectively, subject to certain conditions. Companies can opt for the concessional tax rates from Assessment Year 2020-21 onwards only.

For opting for the concessional tax rates, to pay tax as per Section 115BAB, it is essential to file Form 10-ID on or before the due date specified under sub-section (1) of Section 139 for furnishing the returns of income for the first assessment year commencing on or after 1st day of April, 2020 to avail the benefit. Such option once exercised shall apply to subsequent assessment years and cannot be withdrawn.

Form 10-ID can be submitted through online mode only.

2. Prerequisites for availing this service

- Registered user on the e-Filing portal with valid user ID and password

- Valid and active Digital Signature Certificate (to e-Verify)

- User is a New Manufacturing Domestic Company

- Date of Incorporation is on or after the 1st day of October, 2019 and on or before the 31st day of March, 2023

- Not filed any return of income in the past assessment years

- Timelines for furnishing the return u/s 139(1) of the Act has not lapsed

3. About the Form

3.1 Purpose

As per Section 115BAB of the Income Tax Act, 1961, New Manufacturing Domestic Companies can exercise an option to pay tax at a reduced tax rate of 15% (plus surcharge and cess), subject to fulfilling certain stipulated conditions.

If the company fails to satisfy the stipulated conditions in any previous year, the option shall become invalid in respect of that previous year and subsequent years and other provisions of the Act shall apply to the company as if the option had not been exercised for that previous year and subsequent years.

3.2 Who can use it?

All users registered as New Manufacturing Domestic Company who have been incorporated on or after the 1st day of October, 2019 and have commenced manufacturing or production of an article or a thing on or before the 31st day of March, 2023.

4. Form at a Glance

Form 10-ID has three sections:

1. Details of Assessing Officers

2. Basic Information

3. Verification

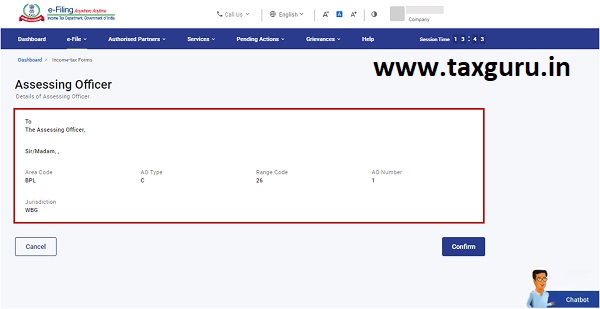

4.1 Details of Assessing Officer

The first section contains details of your Assessing Officer. You have to confirm the details of Assessing Officer displayed on the page.

4.2 Basic Information

The next section contains basic details (including personal information and nature of business activities) of the domestic company. You are required to select the Date of commencement of the manufacturing operation and the details of the nature of business applicable to you.

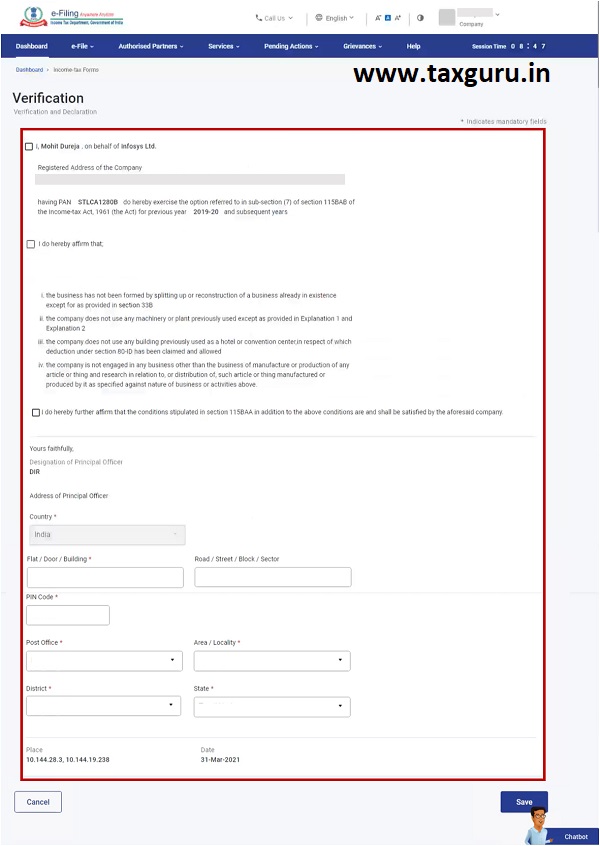

4.3 Verification

The final section contains a self-declaration form containing criteria as per the Section 115BAB of the Income Tax Act, 1961. Agree to the terms and conditions displayed on the Verification page.

5. How to Access and Submit

You can fill and submit Form 10-ID through the following method:

- Online Mode – through e-Filing Portal

Follow the below steps to fill and submit Form 10-ID through online mode.

5.1 Submitting Form 10-ID (Online Mode)

Step 1: Log in to the e-Filing portal using your user ID and password.

Step 2: On your Dashboard, click e-File > Income tax forms > File Income Tax Forms.

Step 3: On the File Income Tax Forms page, select Form 10-ID. Alternatively, enter Form 10-ID in the search box to file the form.

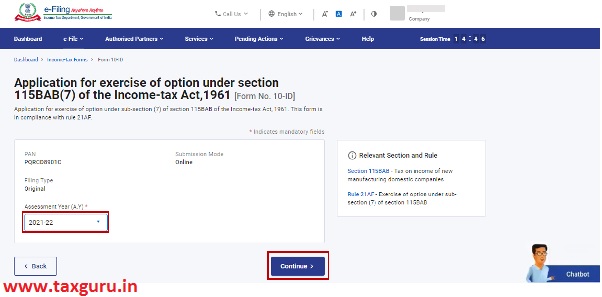

Step 4: On the Form 10-ID page, select the Assessment Year (A.Y.) and click Continue.

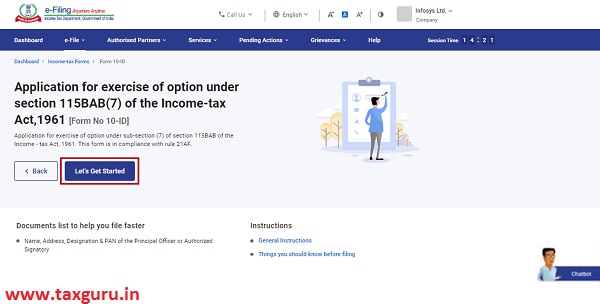

Step 5: On the Instructions page, click Let’s Get Started.

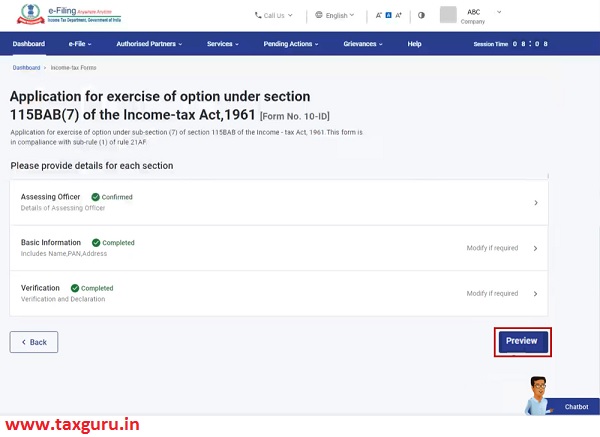

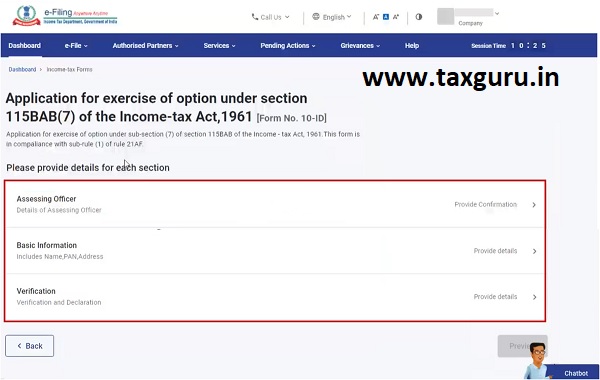

Step 6: On click of Let’s Get Started, Form 10-ID is displayed. Fill all the required details and click Preview.

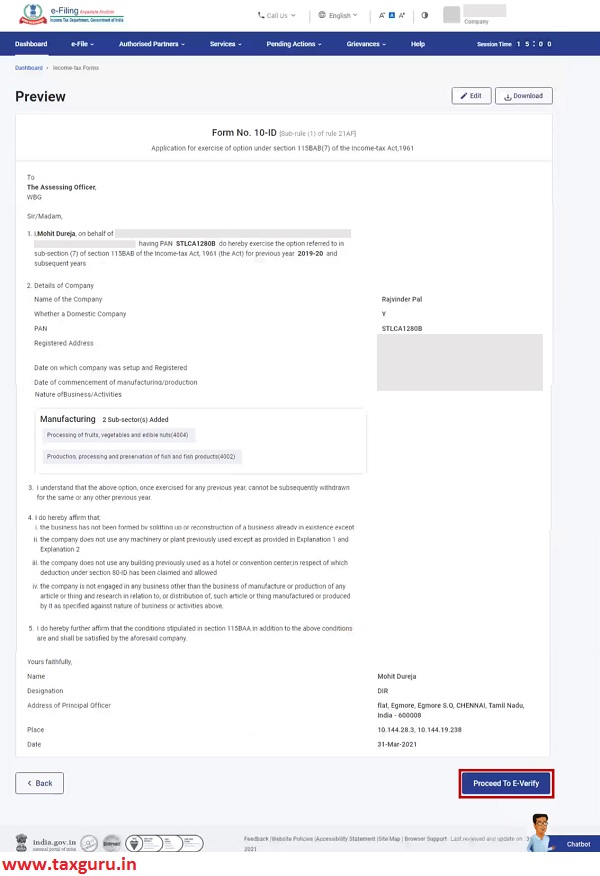

Step 7: On the Preview page, verify the details and click Proceed to e-Verify.

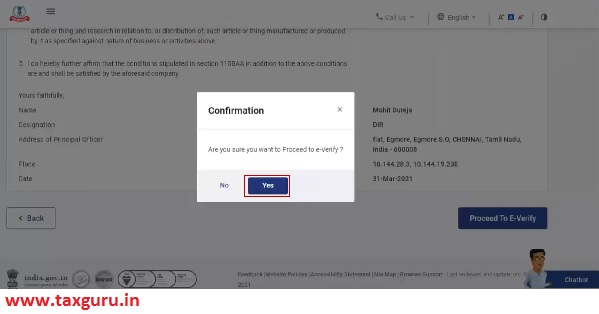

Step 8: Click Yes to submit.

Step 9: On clicking Yes, you will be taken to the e-Verify page where you can verify using Digital Signature Certificate.

Note: Refer to the How to e-Verify user manual to learn more.

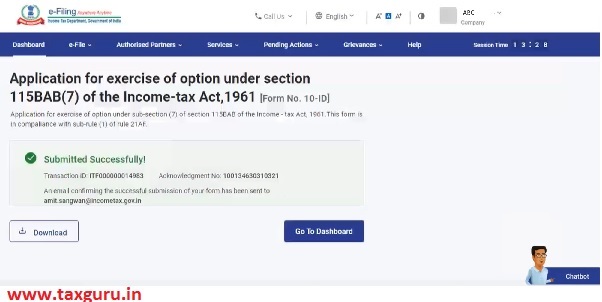

After successful e-Verification, a success message is displayed along with a Transaction ID and Acknowledgement Receipt Number. Please keep a note of the Transaction ID and Acknowledgement Reference Number for future reference. You will also receive a confirmation message on the email ID and mobile number registered on the e-Filing portal.