Salaried employees may get arrears payment due to pay revision. In that case, the tax burden for the salaried employee may increase because of the burden of past dues paid in the current year.

The Government has made provisions to provide relief to salaried employees in case of salary arrears in a particular year. The tax relief under Section 89 covers salary arrears and advance salary as well.

The relief under section 89 can be claimed by furnishing particulars of income in Form 10E.

Prerequisites to file Form 10E are valid user ID and password of e-filing portal.

Also Read: Tax Relief From Arrears – Filing of Form 10E In New Tax Portal

STEP BY STEP PROCEDURE TO FILE FORM 10E ON NEW I TAX PORTAL: –

Step 1: Log in to the e-Filing portal with user ID and password.

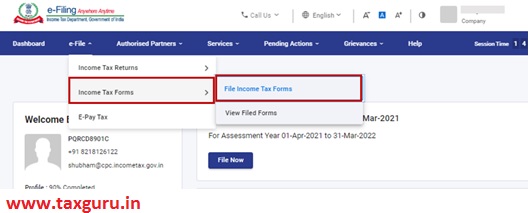

Step 2: On Dashboard, click e-File > Income tax forms > File Income Tax Forms.

Step 3: On the File Income Tax Forms page, select Form 10E.

Step 4: Choose the Assessment Year (A.Y.) and click Continue.

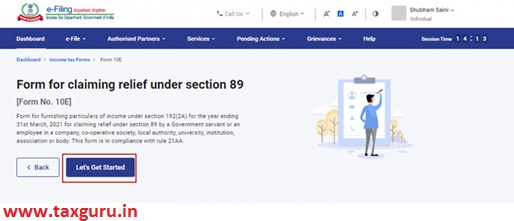

Step 5: On the Instructions page, click Let’s Get Started.

Step 6: Choose the required sections to be filled and click Continue.

Step 7: Once all the details are filled in, click Preview.

Step 8: On the Preview, click Proceed to e-Verify.

Step 9: You will be taken to the e-Verify page.

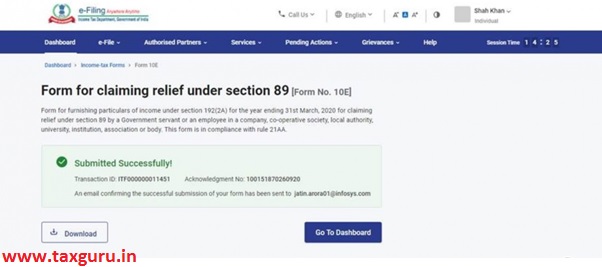

After successful e-Verification, a success message is displayed along with a Transaction ID and Acknowledgement Receipt Number.

Please keep note of the Transaction ID and Acknowledgement Receipt Number for future reference. An email confirming the successful submission of the form is sent to the email ID and mobile number registered with the e-Filing portal.

OTHER RELEVANT POINTS

(a) It is mandatory to file Form 10E if you want to claim tax relief on your arrear/advance income.

(b) Form 10E can be submitted through online mode only.

(c) Form 10E has to be filed before filing your Income Tax Return.

(d) In the case of non-filing of Form 10E, the Income Tax Return will be processed but the relief claimed u/s 89 will not be allowed, even the details of the relief claim are entered in the ITR.

(e) In case the relief claimed u/s 89 is disallowed, the same shall be communicated by the department through an intimation u/s 143(1) after the processing of ITR is complete.

Note: Form 10E is not yet enabled in the new portal.

The author can be approached at caanitabhadra@gmail.com

Dear Anita, what to fill in the previous year column (FY or AY) in Table-A of Form 10E?

Dear Anita,

Form 10E was filed on 28 Mar 2021 and then the ITR was revised. In new site, Form 10E is being shown as “Form not Verified”. What does that mean ? As far as I know, there is no process as such to verify the Form 10E.

Do I need to enter Total Income (salary, capital gain, dividend) in Form 10E? or only Total Income from Salary will suffice?

Only Salary income

How to check on new IT site whether 10e form has already been filed or not.

Pop up message will be there if already filed

I got Rs.75000/- as salary arrears during the current financial year. Can i split up and use Rs.50,000/- for previous financial year using 1o E and show Rs.25000/- in the current year

while filling form 10E it is not saving personal information

while submitting form 10BA , OTP received through adhaar but after feeding it is showing value errors again and again. Can anybody tell solution of this error

While filing form 10E unable to save personal information

I HAVE NOT FILED PREVIOUS TWO YEARS RETURN,I RECEIVED ARREARS LAST FY.SHALL I CLAIM RELIEF UNDER FORM10E BY FILING THIS YEAR ITR-1

Sir,

I havn’t filed last 2 yeard IT return, but I have received Arears, shall I submit Form 10E, and claimed arears

realistic question please give reply to me too

Unable to file form 10 E. Unable to save Personal Information.

same issue for me and raised grievance through the portal and the reply was.. issue escalated to concerned team, please wait for some time. so no option other than to wait for the bug to be resolved by the team.

I have 50k of da arrears & 40k salary arrear from last 3 years. Is it mandatory to put actuals for all 3years or I can file 10 e only 50k (da arrear) in these years maximum tax benefits? E.g. I can put 40K in Current year I received because total income stays less than 5L. Rest 50K I can put last to last 3 years. Do we have the flexibility?

10 e verify , but amount of arrears not deduct to total income . My question is how adjust arrears amount in itr

Amount of Arrears will not be deducted from Salary .Relief amount will be deducted from tax payable.

I have 40k of arrears from last 4 years. Is it mandatory to put actuals for all 4 years or I can split these 40k in these years maximum tax benefits? E.g. I can put 25K in the year I received because total income stays less than 5L. Rest 15K I can put last to last year. Do we have the flexibility?

It is mandatory to enter the actual amount as your employer must have issued the statement of Arrear bifurcating the year-wise summary.

Thanks for quick response.

Employer, Pb Govt., did not provide the year wise breakup of last 10 years arrear. Does it leave choice on us to split the values in last 3-4 years for form 10E?

Which assessment year we have to select to submit form 10E if received arrears salary of previous two years in current A.Y i.e. 21-22 ? and if wrongly selected assessment year 20-21 then how to select fresh A.Y.21-22 in this new portal ?

Form 10E is to be filed in the year of receipt of Arrears.

The incorrect AY entered in Form 10E can be deleted/ edited.

Dear Anita,

Madam can you please tell me how to edit or deleted the wrong Assessment year in form 10 E. I am not able to get it in new portal. Can you please guide me with the steps.

Is the relief under section 89 allowed under the new tax regime?

I am finding Form 10E in ITR site under Income Tax forms. Please help find it where it is…

TIA

Go to Dash Board Click on Income tax forms & you will get Form10E

After Login – Go to

E File > Income Tax Forms >

Click on the middle TAB ” Other than business and Professions”

I filled 10E form correctly but for e verification the otp in regd. Aadhaar mobile no. was obtained and submitted. I did it several times but always the message appears that Form data has some error, fix it and try again. I am very sure that there is no error in form data. So how can I submit my 10e form under such situation.

Software issue in new Portal. No option but to wait for some time

for successful verification of Form 10E, first select all the annexures and feed some figures and save, then start from the beginning and uncheck all the irrelevant annexures, then go for e verification. It will work

10 e form is not taking 0 as previous year income,also not taking 0 as tax on previous year income.

If we feed a non zero value as income or tax,and try to edit it as 0 , then again new portal is not accepting 0 during editing.

Is there any other solution of it or we can hope any improvisation in new portal in some days????

It’s a software issue. Put Rs 1.00, it will accept. Edit the amount later on while submitting Form 10E

How to fill form 10E if amount is in negative form?

How can it be negative?

If there is recovery out of Arrears, then no relief is due to you.

i have filled form 10 E and got relief of 17000,i have

already validated my tax return but not up loaded .

i am not able to ener relief under 89 pl correct me.

Sir please help I am unable to fill form 10 e website says after e verify option and entering otp it says forms has some error please try again

Seems to be software issue in new I tax Portal

What is the “Previous Years” in the Table A of Form 10E means. Is it previous Financial Years or is it previous Assessments Year. Please clarify. I got arrears for the FY 2017-18, 2018-19, 2019-20 in the FY 2020-21. So in the “Previous Years” column should i use the data of previous FYs or previous AYs

Previous years mean the financial year. Arrears for 2017-18 will be in PY 2017-18 in Table A.

For more details and method of calculation, refer to my article:- Tax Relief From Arrears – Filing of Form 10E In New Tax Portal dated 16.07.2021 on Tax Guru

I am not able to choose FY 2019-20 as the same is not appearing in the dropdown of ‘Previous Year’. Can you please help.

You can click on add details and select any FY

It will allow

WHILE FILING FORM 10E FOR ARREAR SALARY(ANNEXURE-I);IN TABLE A, 2019-2020 IS NOT SHOWING UNDER PREVIOUS YEAR DROP DOWN. I HAVE RECIEVED ARREARS FOR FY: 2019-20 IN FY:2020-21. I AM UNABLE TO APPROPRIATE THE ARREARS RECIEVED FOR FY:2019-2020 DUE TO NON AVAILABITY IN DROP DOWN MENU. KINDLY ASSIST.

Sir, I beg to say that form 10 E does not catch tax 0 under 5 Lac taxable Income in Table A, kindly clear it..

Write Rs 5 ( or any other amount )and later on edit the same.

This is a new portal issue.

I have mentioned this in my article Tax Relief From Arrears – Filing of Form 10E In New Tax Portal dated 16 July 2021.

Go thru, step by step procedures, issues, and advice related to it.

I am not able to save personal details on form 10 e

Tried many times but the datails are not saved

No error is coming but details are not saving even after clicking save link

Yes, it is happening with many of the taxpayers. Seems to be a portal issue.

I Hope, it will get resolved soon.

Unable to save personal details in form 10E. everytime i try to click on save button, iam unable to save. no error is coming and saving is also not happening. simply clicking multiple times. so that unable to claim form 10e. anyone else facing same problem

Yes me also faced that problem. Author please help how to solve this problem.

hello Mam,

Thanks for the details.

I tried to file 10E for ay 2021-22. I furnished all details properly but I couldn`t submit my 10 E return, as error raised after applying otp. and the errors is not displayed.

pls do the needful

What will be filled in the cell of tax on total income as per column 2.

Will it be the net tax payable or the actual tax paid as per ITR.

Actually my net tax payable is 7029 for fy 17-18 as per ITR AY 2018-19 and the i got refunded the amount after filing it. So actual tax paid is 0.

So kindly tell me what tp put in that cell.

It will be net tax payable on taxable income. You got refund means your net tax payable was zero

Enter the amount 0 in the coloum

At the time of submission of form 10e after entering otp a error massage shown ” error in data. Pleas fix and try then.” I have tried many times but same error is showing. Kindly guide me how to fix it. Is it technical problem or data entering problem. Regards

At the time of submission of form 10e after entering otp a error massage shown ” error in data. Pleas fix and try then.” I have tried many times but same error is showing. Kindly guide me how to fix it. Regards

Seems to b portal error at e verification stage.

Hope it will b resolved soon by portal Team

Hello, in form 10E, for the previous 3 years, net arrears amount or gross arrears amount is to be entered? I had received net arrears after tax and pf, nps deductions.

Net Arrears, after deduction of PF etc to be considered for Relief

Hi madam, net arrears before tax is to be entered in form 10E right?

Yes, You are Right. Net Arrears before Tax is to be entered

Madam,

Net arrears before tax is to be entered in form 10E

Right?

As gross arrear is included in taxable income this year including of and nps contribution..how can we distribute net arrears??

Madam

My income for FY 2019-20 includes arrears of previous 3 years.My taxable income includes gross arrears ie including pf and nps portion.so if I distribute net arrear pertaining to previous years , my taxable income for this year will contain previous year’s pf and nps portion which increase my taxable income this year. So my doubt is why can’t we distribute gross arrear instead of net arrear? Clarification will be much helpfull..thanks in advance..

Form 10e same problem i also facing. Is it technical problem??

Gross salary or net salary to be given in form 10e. As system calculated tax does not auto take into account the deductions.if net salary is considered the tax amt tallies as per system and actually deducted.

Net Salary is to be considered for Form 10E

what is “Total income of the relevant previous year”

is it the total income as per form 16 or the taxable income after deductions?

do reply.

It shall be Net Income after deductions

If salary arrears are in negative and recovered by employer, can we fill form 10 E. These negative arrears (recoveries) are not updated by employer in form 26 AS. Tax for amount of negative arrears has already been paid in previous years.

Negative arrears means recovery. The employer will not deduct TDS on recovery, where are the question of relief under sec 89(1) and filing of Form 10E.

I am unable to submit 10E form. At e-verify stage it shows.

“Form data has some error. Please fix and try again,

Kindly guide

At the E-Verification stage, there is a problem with New I Tax Portal.

Hope , it will be resolved soon

The same happened for me.

Same problem I am also facing

Unable to submit form 10e its show error as form data contain some error.

Please resolve

I am unable to submit 10E form. At e-verify stage it shows.

“Form data has some error. Please fix and try again,

Kindly guide

E verification stage, there is a problem at Portal End.

I received Salary Arrears for the previous three years, while filing Form 10E on new portal it shows an error: ‘Form Data Has some Errors. Please fix it and then try again.’

What is the solution to it?

Getting error while submitting 10e data error.how to rectify?

While submitting OTP at form10 error is displaying like _form has errors please fix and try later

Please can any on help mr

Hello Madam,

I am unable to find AY 2020-2021 to enter previous years data in 10E. Please guide in this regard

I am unable to submit 10E form. At e-verify stage it shows.

“Form data has some error. Please fix and try again”

I am getting error after I enter my adhar top, saying “Form data has some error. Please fix and try again” please guide

In Form 10E, no need to enter Aadhar details

It seems some error in the new portal at the e-verification stage.

I am trying to fill my 10 E form.i m salaried employee.i have received arrears of last year in this financial year.when I fill tax liability of last year 0 it does not accept and needs some value.what should be filled there?

I am facing the same problem of not accepting zero, and also not submitting after Aadhar otp enter, on submitting it showing error and fix the error but i checked 100times that there is no error, what should i do

Just add Rs 10 in place of Zero and go ahead.

The amount is editable before filing 10E.

I have tried and succeeded .

Just add Rs 10 in place of Zero and go ahead.

The amount is editable before filing 10E.

I have tried and succeeded.

After entering Rs. 10 still unable to e verify form 10e please help me

Even i tried with Rs.10. No Luck! Has anyone found a solution.

Hi Mam,

Thanks for the Articles, Regarding the Compensation on Termination of employment-

Few clarifications:

1. Total Income(including Compensation)-I received around 3 lakhs for the compensation. Can I enter the total income of the income received from the different employer or only the particular impacted employer Total Income?

2. What does it mean “ Total Income of three previous years immediately preceding the Previous year in which compensation is received”- What my understanding we need to add( Three years total income) and enter the details. Correct me if am wrong on this?

3. Can it possible to add leave encashment relief under which section? It’s around 74K.

Required your thoughts on this and thank you for your time in advance

Regards,

Akash

I have received arrear on salary since 2017 to 2020 on January 2021. I have only the details of amount I have received as arrear. TDS deducted is not segregated year wise. Can you help me to segregate the tax details year wise .

Your employer can provide the details of arrear calculation and Tax deduction ( based on investments in the earlier years ).

where is form 10e on new portal???i m not getting it

Form 10E is enabled now. Login to portal

The path is E File > Income Tax Form > File Income Tax Form

There will be three tabs.

Click on the middle one:- Person not having business Income

Mam, kindly advise I am unable to file. perhaps column 2 isn’t enabled.

where is form 10E on new portal????

Please refer Note at the end of the article – Form 10E is not yet enabled in a new tax portal.

I hope, it will be enabled soon.

Whenever it will be enabled, the procedure to file Form 10E will be as explained in the article.

Thanks for the detailed information. The category ‘Persons not having income from business or profession’ has not yet been enabled in File Income Tax Forms. When do you think it will be enabled?

Where are you trying to find this category? It filing for everybody enabled

Hello Anita,

I had to leave a company where I worked for 6 years and joined another company after 6 months. I received Gratuity & ex-gratia from the previous company after tax deduction (TDS).

Is it possible to avail tax relief for Gratuity received from my previous company while filing IT Returns? If that so, is it by furnishing: Form 10E ?

How about ex-gratia, is there any option for tax exception for ex-gratia as well?

Thanks,

Sajitha

Sir

Ex Gratia amount is exempted maximum up to Rs 20 Lakhs

The exemption amount is subject to parameters i.e. Govt / Non- Govt Employee/ Applicability of Gratuity Act Etc

The exemption is available under sec 10(10) of the Act. While filing your IT, enter the gratuity amount in Exemption U/S TAB

Your Form 26AS / Form 16 must be showing the deduction amount.

Enter the same in Tax Deducted TAB. Depends upon your total income from both the employers and eligible deductions etc, you will get refund on excess tax deducted by the previous employer

Form No 10E is not available in the New Poral…

Please refer Note at the end of the article – Form 10E is not yet enabled in a new tax portal.

I hope, it will be enabled soon.

Whenever it will be enabled, the procedure to file Form 10E will be as explained in the article.

i am also facing same problem.

Form 10E portal is opened. But the personal information portion is not getting saved. So could not continue to validate Form 10E. Anybody already submitted Form 10E , please help me.

Same problem is being faced by me and no yet resolved. I have submitted my form 10e and the personal information got saved easily on single click but when i tried to submit my GF’s form 10e saving problem exist. I also lodge grievance but no resolution yet.