How to deal with Disallowances Under Section (u/s) 43B(h) of the Income Tax Act On Delayed Payments to Micro & Small Enterprises (MSEs) as defined under the MSME Development Act 2006 (effective from FY beginning 01.04.2023)

1. Introduction

In a bid to give further boost to the MSME sector and especially the Micro and Small enterprises, the Finance Act 2023 last year had introduced an important amendment to section 43B of the Income Tax Act to the effect that if payments against purchases from “Micro” and “Small” enterprises are delayed beyond the specified credit period, the corresponding expenses shall be disallowed in the year of incurrence and shall be admissible for deduction on payment basis in the financial year in which paid.

This article delves into the significance of this amendment with detailed provisions, what it means for the businesses/ professionals and the tax auditors and how to deal with the same in the simplest manner possible.

2. Section 43B(h) as inserted vide Finance Act 2023 w.e.f. 01.04.2024 (e. effective from financial year beginning 1st April 2023) is reproduced as under :

Certain deductions to be only on actual payment.

43B. Notwithstanding anything contained in any other provision of this Act, a deduction otherwise allowable under this Act in respect of—

..

Following clause (h) shall be inserted after clause (g) of section 43B by the Finance Act, 2023, w.e.f. 1-4-2024:

(h) any sum payable by the assessee to a micro or small enterprise beyond the time limit specified in section 15 of the Micro, Small and Medium Enterprises Development Act, 2006 (27 of 2006),

shall be allowed (irrespective of the previous year in which the liability to pay such sum was incurred by the assessee according to the method of accounting regularly employed by him) only in computing the income referred to in section 28 of that previous year in which such sum is actually paid by him :

Provided that nothing contained in this section 55[[except the provisions of clause(h)]] shall apply in relation to any sum which is actually paid by the assessee on or before the due date applicable in his case for furnishing the return of income under sub-section (1) of section 139 in respect of the previous year in which the liability to pay such sum was incurred as aforesaid and the evidence of such payment is furnished by the assessee along with such return56.

55. Italicised words shall be inserted by the Finance Act, 2023, w.e.f. 1-4-2024.

56. Rule 12 provides that the return of income shall not be accompanied by any document or copy of any account or form or report of audit required to be attached with return of income under any of the provisions of the Act.

Following clause (e) shall be substituted for the existing clause (e) of Explanation 4 to section 43B by the Finance Act, 2023, w.e.f. 1-4-2024:

(e) “micro enterprise” shall have the meaning assigned to it in clause (h) of section 2 of the Micro, Small and Medium Enterprises Development Act, 2006 (27 of 2006);

Following clause (g) shall be substituted for the existing clause (g) of Explanation 4 to section 43B by the Finance Act, 2023, w.e.f. 1-4-2024:

(g) “small enterprise” shall have the meaning assigned to it in clause (m) of section 2 of the Micro, Small and Medium Enterprises Development Act, 2006 (27 of 2006).

3. Relevant paras from the Memorandum of the Finance Bill 2023 explaining the necessity of insertion of such provisions:

B. Socio Economic Welfare Measures

Promoting timely payments to Micro and Small Enterprises Section 43B of the Act provides for certain deductions to be allowed only on actual payment. Further, the proviso of this section allows deduction on accrual basis, if the amount is paid by due date of furnishing of the return of income.

2. In order to promote timely payments to micro and small enterprises, it is proposed to include payments made to such enterprises within the ambit of section 43B of the Act. Accordingly, it is proposed to insert a new clause (h) in section 43B of the Act to provide that any sum payable by the assessee to a micro or small enterprise beyond the time limit specified in section 15 of the Micro, Small and Medium Enterprises Development (MSMED) Act 2006 shall be allowed as deduction only on actual payment. However, it is also proposed that the proviso to section 43B of the Act shall not apply to such payments.

3. Section 15 of the MSMED Act mandates payments to micro and small enterprises within the time as per the written agreement, which cannot be more than 45 days. If there is no such written agreement, the section mandates that the payment shall be made within 15 days. Thus, the proposed amendment to section 43B of the Act will allow the payment as deduction only on payment basis. It can be allowed on accrual basis only if the payment is within the time mandated under section 15 of the MSMED Act.

4. This amendment will take effect from 1st April, 2024 and will accordingly apply to the assessment year 2024-25 and subsequent assessment years.

[clause 13]

4. Relevant Provisions Under the Micro, Small and Medium Enterprises Development Act, 2006 (27 of 2006)

i. Latest Definitions of Micro, Small and Medium Enterprises under the MSME Dev Act, as effective from 01.07.2020 :

It is to be noted that the classification has been done on a composite criteria of Investment into Plant & Machinery/ Equipment AND Annual Turnover, for e.g.

– a micro enterprise is one where the investment in Plant and Machinery or Equipment does not exceed one crore rupees and turnover does not exceed five crore rupees;

– a small enterprise is one where the investment in Plant and Machinery or Equipment does not exceed ten crore rupees and turnover does not exceed fifty crore rupees

ii. Liability of the Buyer to make payment u/s 15 of the MSME Development Act :

Where any supplier supplies any goods or renders any services to any buyer, the buyer shall make payment therefore on or before the date agreed upon between him and the supplier in writing or, where there is no agreement in this behalf, before the appointed day:

Provided that in no case the period agreed upon between the supplier and the buyer in writing shall exceed forty-five days from the day of acceptance or the day of deemed acceptance.

iii. “Appointed Day” has been defined u/s 2(b) of the MSME Dev Act as under :

(b) “appointed day” means the day following immediately after the expiry of the period of fifteen days from the day of acceptance or the day of deemed acceptance of any goods or any services by a buyer from a supplier.

Explanation.–For the purposes of this clause,–

(i) “the day of acceptance” means,–

(a) the day of the actual delivery of goods or the rendering of services; or

(b) where any objection is made in writing by the buyer regarding acceptance of goods or services within fifteen days from the day of the delivery of goods or the rendering of services, the day on which such objection is removed by the supplier;

(ii) “the day of deemed acceptance” means, where no objection is made in writing by the buyer regarding acceptance of goods or services within fifteen days from the day of the delivery of goods or the rendering of services, the day of the actual delivery of goods or the rendering of services;

iv. Other definitions as given u/s 2 of the MSME Development Act and relevant here may be noted as under :

(d) “buyer” means whoever buys any goods or receives any services from a supplier for consideration;

(n) “supplier” means a micro or small enterprise, which has filed a memorandum with the authority referred to in sub-section (1) of section 8, and includes,– …..

(h) “micro enterprise’ means an enterprise classified as such under sub-clause (i) of clause (a) or sub-clause (i) of clause (b) of sub-section (1) of section 7;

(m) “small enterprise” means an enterprise classified as such under sub-clause (ii) of clause (a) or sub-clause (ii) of clause (b) of sub-section (1) of section 7;

(e) “enterprise” means an industrial undertaking or a business concern or any other establishment, by whatever name called, engaged in the manufacture or production of goods, in any manner, pertaining to any industry specified in the First Schedule to the Industries (Development and Regulation) Act, 1951 (55 of 1951) or engaged in providing or rendering of any service or services;

5. Significance of this Amendment to Section 43B and what it means to Businesses/ Professions

- Any BUYER (being an assessee doing business or profession and claiming deduction of expenses against turnover, irrespective of whether under audit or not);

- Having bought goods and/ or services,

- on or after 01.04.2023;

- from a supplier being a MICRO or SMALL enterprise and NOT a Medium enterprise (registered under the MSME Development Act and having certificate of ‘Udyam’ registration) AND registered as a ‘manufacturing’ or ‘service’ enterprise (and not as ‘trading’ enterprise)

- MUST pay to the supplier against such supplies

- WITHIN the time- frame of :

- In case of written agreement with supplier : within the time limit specified in the agreement or within 45 days, whichever is earlier;

- In case of no written agreement : within 15 days

from the actual date of delivery of goods or rendition of services

-

- In case an objection regarding acceptance of goods/ services is made in writing by the buyer, within 15 days from date of delivery/ rendition : within 45/ 15 days from the date on which such objection is removed by the supplier

- FAILING WHICH the whole of such expenses shall be disallowed u/s 43B(h) and added back to book profit for the purpose of computation of taxable profit, meaning more income tax liability !!

It can, however, be claimed as deduction on payment basis in the financial year (FY) in which it is actually paid.

It essentially means following 3 situations arising :

|

Sr |

Purchase Invoice | Deduction under Income Tax |

| i. | Paid within or after its due date BUT before the end of the FY | Allowed in the same FY, i.e. in the year of accrual/ payment |

| ii. | Paid within its due date BUT after the end of the FY | Allowed in the same FY, i.e. in the year of accrual |

| iii. | Paid after its due date AND after the end of the FY | Allowed in the next FY, i.e. in the year of payment |

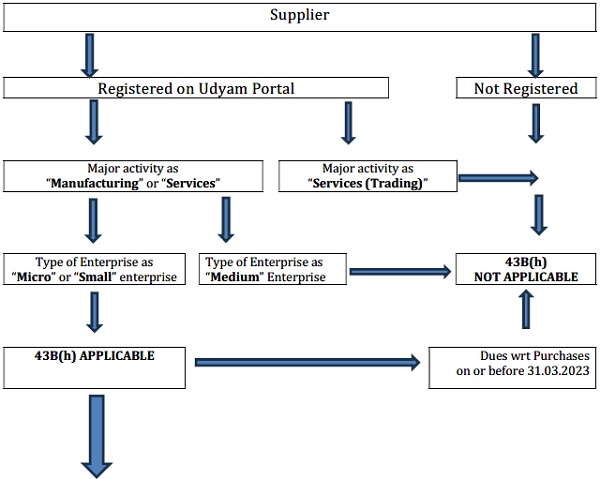

A Pictorial Illustration of the Applicability of Section 43B(h) is given in Appendix below for easy understanding.

Few more important points to note here :

i. the proviso to Section 43B regarding deductibility of expenditure if paid before the due date of furnishing the return of income, as normally applicable for others, has been expressly denied for this MSME related clause 43B(h) !!

ii. Disallowance here will be 100% of expenses paid in next FY beyond the credit period and NOT just @ 30% as it happens when TDS not deducted or deducted but deposited in next FY beyond the ITR due date !!

iii. Apart from the consequence of disallowance if paid beyond the prescribed credit period of 45/ 15 days, there are other stringent provisions for such delay as already in force under the same MSME Dev Act, which are worth noting here :

-

- The buyer is statutorily liable to pay compound interest with monthly rests at 3 times of the bank rate notified by the Reserve Bank, despite anything contained in any agreement between the buyer and the supplier;

- Such interest not to be allowed as deduction under the Income Tax Act;

- The provisions of sections 15 to 23 of the MSME Dev Act shall have effect notwithstanding anything inconsistent therewith contained in any other law for the time being in force (i.e. absolute over-riding powers given).

6. Exclusions under this new Amendment to Section 43B

This new amendment shall not be applicable if :

i. the purchase invoice is dated prior to 01.04.2023;

ii. the supplier is not registered under the MSME Dev Act;

iii. the supplier is registered but is a MEDIUM enterprise;

iv. the supplier is registered but is only a retail or wholesale trader;

This is because as per O.M. 5/2(2)/2021-E/P & G/Policy dated 02.07.2021, wholesale and retail traders are entitled for Udyam Registration only for the benefit of Priority Sector lending.

v. the purchase is basically a capital expenditure or where an expense has not been claimed as expenditure in the Profit & Loss a/c;

vi. income from any business or profession is being offered for taxation under presumptive scheme of taxation u/s 44AD, 44ADA, etc. (since income there deemed at specified percentage of turnover)

7. Practical Solutions for BUYERS

It is suggested that every buyer first carefully understands the nuances of these provisions and take appropriate safeguards against increased tax liability he may get into. Few such steps shall be :

i. To insist at the time of empanelment or first purchase from any vendor, a declaration of its status whether an MSME Vendor or not and if yes, to submit a copy of its registration under the MSME Dev Act – such details to be updated in the accounting software itself for records and proper segregation, as also kept in a separate file for any audit as applicable;

ii. To have clear written agreement on the payment terms with the vendor (maximum allowed shall be 45 days only) and negotiate/ decide for purchases only if it can release payments within agreed credit period (remember such credit period shall be only 15 days if no written agreement);

iii. To analyse all purchase invoices as outstanding on current date and segregate all such dues as payable to micro & small enterprises as outlined above (based on details of MSME registration noted in their invoices or asking for specific written confirmation from them on emails or otherwise at the earliest possible);

iv. Making arrangements for payment of invoices of all such Micro & Small enterprises as having fallen due, either immediately or at the soonest possible but surely within 31.03.2024 to avoid disallowance;

v. Be especially careful on all such purchase invoices wherein 15 days have not expired from date of delivery, whether the subject goods or services is acceptable to you or not ? If not, make sure to communicate a written objection or else it will be deemed as accepted after expiry of 15 days !

vi. Be very careful on all purchases from micro & small enterprises from now onwards and track their payments to ensure they are done IN TIME as explained above so as not to fall into the nuances of this new amendment.

vii. Extra precaution to be taken for any such purchase invoice pertaining to FY 2023-24 having fallen DUE few days BEFORE or AFTER the critical date of 31.03.2024 :

In case of online payments, date of online transfer becomes the effective date of payment to vendor in all essence. So take care to record date of payment in books as date when online transfer actually done !

In case it is paid by an account- payee cheque, it must get honored within its normal validity period of 90 days from date of issue (and copy of such cheque may be retained in records for proof of issuance).

8. Responsibility of Tax Auditor

The tax- auditor is required to report all such amounts as relevant for disallowances or otherwise under section 43B of the Income Tax Act at Para 26) of the Tax Audit Report in Form no.3CD. He shall now be liable to identify such amounts as relevant for disallowance or otherwise under this new provision of 43B(h) also for the purpose of reporting at Para 26) of Form 3CD.

It requires him to carefully examine all the amounts showing outstanding on balance sheet date prepared on FY end to identify amounts as relevant for 43B(h), which may be a voluminous task for him depending upon how the data has been maintained by the assessee to ease his verification process and the audit procedures.

9. Conclusion

The government has proposed this amendment with a powerful objective to empower the MSME sector and especially the ‘Micro’ and ‘Small’ enterprises by helping them to improve their cash- flows. However, since the buyers themselves are mostly MSME enterprises or businesses with troubled cash flows, this amendment as introduced by government with a noble objective will do more bad than good if not taken care of appropriately due to increased tax liability caused by disallowance(s) u/s 43B(h).

Hence, purchasing entities are required to develop a robust mechanism to monitor various due dates while making payments to multiple micro and small enterprises to avoid disallowance of huge amounts as also compulsory liability on interest payments as elaborated above. They may also need to consider getting their own registration under the MSME laws if entitled to but not yet obtained in view of several benefits available to “suppliers” under such laws as they will appreciate from the detailed provisions outlined above. By embracing these insights, businesses can navigate the regulatory landscape effectively, fostering strategic thinking and financial prudence alongwith adherence to legal requirements.

************

Disclaimer: The information contained herein is of general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in future. No one should act on such information without appropriate professional advice after thorough examination of the particular situation. We neither accept nor assume any responsibility or liability to any reader of this newsletter in respect of the information contained in it or for any decision he may take or decide not to or fail to take. No part of this document should be distributed or copied by anyone without our express written permission.

Appendix :

Pictorial Illustration of the Applicability of Section 43B(h)

|

Expenses Incurred On or After 01.04.2023 |

Payment Made In | Whether Paid Within Credit Period (#1) | Expenses When Allowable under ITax | Basis of Allowance |

| Current FY | Current FY | Not relevant (#2) | Current FY | Not relevant (#2) |

| Current FY | Next FY | Within Credit Prd | Current FY | Accrual Basis |

| Current FY | Next FY | Beyond Credit Prd | Next FY | Payment Basis |

#1 : Credit Period upto max 45 days (in case of agreement) or 15 days (when no agreement)

#2 : not relevant since expense paid in same year when incurred; hence deductible either way