In order to encourage timely payments to Micro and Small Enterprises under the MSME Development Act 2006 , a new addition to the list of disallowances is being made vide S- 43B(h) .

The provision addresses to disallow expenditures which are supplied or procured from a Micro or Small Enterprises and are not paid within the time limit prescribed U/s 15 MSME Development Act 2006.

In such cases expenses can be claimed only in the year in which expenses are actually paid , unlike other disallowances U/s 43B where disallowance will not be attracted even if the payment is made after the Financial Year but before the due date prescribed u/s 139(1) of the return filing.

In order to classify MICRO or SMALL Enterprises the definitions of Micro and Small Enterprises under the MSME Development Act 2006 are reproduced below :-

S-2(h) – Micro Enterprise means –

“an enterprise classified as such under sub-clause (i) of clause (a) or sub-clause (i) of clause (b) of sub-section (1) of section 7;”

S-2(m) – Small Enterprise means –

” an enterprise classified as such under sub-clause (ii) of clause (a) or sub-clause (ii) of clause (b) of sub-section (1) of section 7;”

S-2(e) – Enterprise means –

“an industrial undertaking or a business concern or any other establishment, by whatever name called, engaged in the manufacture or production of goods, in any manner, pertaining to any industry specified in the First Schedule to the Industries (Development and Regulation) Act, 1951 (65 of 1951) or engaged in providing or rendering of any service or services”

S-15 Time Limit for payment under MSME Development Act 2006 :-

“Where any supplier, supplies any goods or renders any services to any buyer, the buyer shall make payment therefor on or before the date agreed upon between him and the supplier in writing or, where there is no agreement in this behalf, before the appointed day :

Provided that in no case the period agreed upon between the supplier and the buyer in writing shall exceed forty-five days from the day of acceptance or the day of deemed acceptance.

From the above definitions the following important points are to be considered while determining the dues Payable to Micro or Small Enterprises :-

a) the classification of the enterprises from the above definitions is tabulated below :-

| Enterprise | Investments * | Turnover |

| Micro | Not More than 1 Crore | Not More than 5 Crore |

| Small | Not More than 10 Crore | Not More than 50 Crore |

| Medium | Not More than 50 Crore | Not More than 250 Crore |

| * Investments in Plant & Machinery and Equipments | ||

b) As per the definition of Enterprises, only persons dealing in either Manufacturing of Goods or Providing any services will be classified as an Enterprise. Trader / Retailer/ Distributor etc; would not be classified as an Enterprise and would not be covered under the Micro or Small Enterprise Definition

c) As per S-15 of MSME Development Act 2006, due date for an invoice is to be determined as per the Terms of the Invoice or 45 days from the date of invoice whichever is earlier.

d) Supplier under the MSME Development Act 2006 is defined as a person who is registered under the Act, hence Micro or Small Enterprise who are not registered under the Act would not be covered under the Definition of S-43B(h)

It’s advised to obtain a :-

a) Declaration on the classification of an Enterprise from a supplier and

b) The certificate under MSME Development Act 2006

from each supplier of goods or services in order to keep a track of the dues payable to MSME , the same would also help in complying with various Statutory Provisions Under Income Tax Act and Companies Act 2013

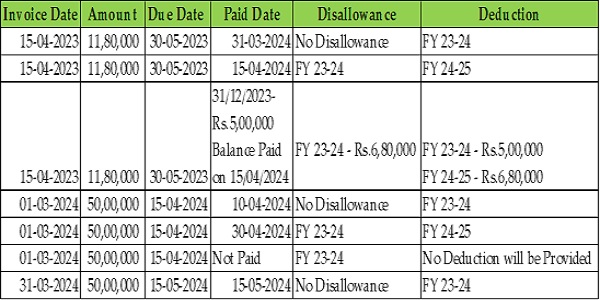

The Below table summarises the various scenarios under which disallowances will be attracted and the year in which deductions can be claimed :-

Plz check your definition of Small Ent

If a Fixed Asset is purchased and if the vendor is not paid within time due as per MSME ACT than whether such payment will attract disallowance U/s. 43B(h)?

U/s. 43B(h) says

any sum payable by the assessee to a micro or small enterprise beyond the time limit specified in section 15 of the Micro, Small and Medium Enterprises Development Act, 2006 (27 of 2006),