> Introduction

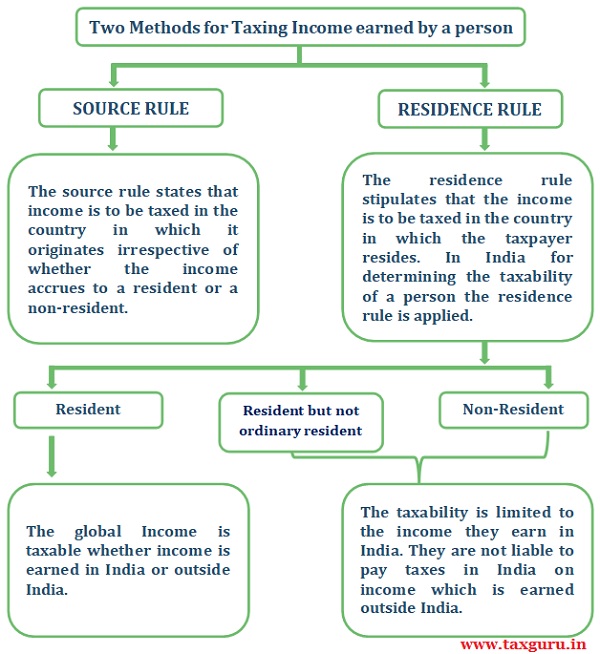

Nowadays on account of the globalized environment and expansion of business outside India, a person may earn income from more than one country and sometimes the same income may be taxed twice, once in the source country and other in the resident country as well. Let us know these two methods for taxing income earned by a person in more detail.

Section 90, Section 90A and Section 91 of Income Tax Act, 1961 (‘Act’) deal with the concept of claiming credit for taxes paid in foreign countries. Section 90 of the Act specifies the provisions related to relief from double taxation in scenarios where India has entered into double taxation avoidance agreement (‘DTAA’) with that particular foreign country. Section 91 provides guidance on claiming foreign tax credit in scenarios when there is no DTAA between India and that particular foreign country.

> Double Taxation Avoidance Agreement

To avoid the situation of double taxation in case of an individual earning income from a foreign country and to ensure the exchange of information for prevention of tax evasion, the Government of India enters into an agreement with various other countries which is called DTAA. DTAA broadly stipulates the terms between the two contracting countries for taxing the income of the person who is a resident of one country and earning income from other country. If a person who is non-resident, earns income in India and wants to claim the benefit under DTAA then the non-resident is required to furnish Tax Residency Certificate (‘TRC’). TRC is considered as an evidence that the person is resident of foreign country and the income tax authorities in India will not impose taxes on the income earned in India by that non-resident.

> Methods of calculating Tax Credit:

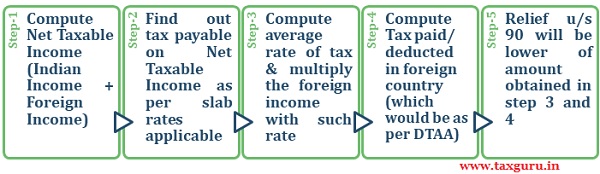

- Steps to compute relief under Section 90

- Steps to compute of tax relief under Section 91

> Documents to be furnished for claiming FTC

For the purpose of claiming FTC, the taxpayer is required to file on or before due date of filing of return the following documents-

1. A statement of-

- Income from foreign country or specified territory outside;

- Foreign tax deducted or paid on such income in Form No. 67.

2. Certificate or statement specifying the nature of income earned from foreign country and the amount of tax deducted/paid from that income by the taxpayer-

- Issued by the tax authorities of the foreign country where income is earned (Similar to TDS Certificate in India);

- Issued by the person responsible for the deduction of such tax.

The statement must be accompanied by the proof of payment of taxes outside India.

> Procedure for filing Form 67

Form 67 plays an important role in the whole process of claiming credit of taxes paid in foreign countries and it is a mandatory document for claiming FTC. It provides details regarding the income earned in a foreign country and amount of tax paid/deducted from that income in the foreign country. As per Section 139(1) of the Act, Form 67 should be provided on or before the due date of filing the income tax return. Form 67 is available on the e-filing portal of the income tax department in the taxpayer’s account. To submit Form 67 Digital Signature Certificate (DSC) or Electronic Verification Code (EVC) is mandatory.

Conclusion:

FTC in context to Indian resident is becoming more critical and important to get the benefit of taxes paid outside India. Especially with Indians who are resident of India and have foreign income, careful analyse of such income and collating the necessary documents related to the tax paid on foreign income in other country is important. While the law relating to foreign tax credit has evolved over a period of time and it has become much simpler to claim the credit today, it is also hoped that the government takes cognisance of the practical difficulties and address the same in near future.

(This article represents the views of the authors only and does not intent to give any kind of legal opinion on any matter)

Authors:

Vishal Kothari | Director | +91-9320614111 | Email: vishal.kothari@masd.co.in

Gyanesh Shukla | Director | +91-8898773607 | Email: gyanesh.shukla@masd.co.in

hello Sir,

I read your article “Claiming credit of taxes paid in foreign countries” is very informative and helpful. I have a query in my case. I am oil Rig worker and since Nov 2021 I am working as Independent consultant for a company in Malaysia. Company will be paying for my monthly invoices in local bank account after deducting for local Malaysia tax. I am Indian resident and I will not be completing 182 days out of India in the financial year.

For my monthly expenditure If I sending monthly remittance from my income account in Malaysia to my bank account in India. While filing income tax returns in India, how I can show that remittance amount source link to my income in Malaysia for avoiding double tax on it based on DTAA.

Please guide.

Many Thanks.

— KY