Introduction

The income-tax department has started to reach out to certain taxpayers who have either not filed income-tax returns (ITR) or failed to accurately report high-value transactions in their returns. Objective of the e-campaign is to facilitate taxpayers to validate their financial transaction information against information available with the IT department and promote voluntary compliance, especially for the assessee for the FY 2019-2020 (AY 2020-21) so that they do not need to get into notice and scrutiny process. Department has started sending SMS & Emails to such taxpayers about e-campaign on High Value Transactions on Compliance Portal.

Also Read- Submission of Response on High Value Transactions – FAQs

Page Contents

- Launch of e-Campaign

- SMS/Email from Income Tax on High Value Transaction under e-Campaign

- What is the source of information for e-Campaign?

- What is Compliance Portal?

- How to login to Compliance Portal?

- Facing Issue regarding Email/SMS received but Non Display of Information in e-Campaign (i.e. Blank Data)

- Functionalities under e-Campaign on Compliance Portal?

- What is a Non-filing of return case?

- How a Non-filing of return case is identified?

- What is ‘Taxability of Transaction Relating to Sale of Immovable Property’?

- What is ‘Source of Funds’?

- What if I don’t Respond to Compliance Alert ?

- Response to reported Transaction

- How can taxpayer view the submitted response on each Information?

- Can I check information being reported, but don’t file response ?

- What to do along with Compliance Submission?

- Data-Sharing MOUs with various entities

- Final Opportunity

Launch of e-Campaign

The Income Tax Department has started an e-campaign on voluntary compliance of Income Tax for the convenience of taxpayers. The campaign ending on 31st March, 2021 focuses on the assessees/taxpayers who are either:-

1. Non-filers of Income Tax Return or

2. Have discrepancies/deficiency in their returns for the FY 2019-20.

SMS/Email from Income Tax on High Value Transaction under e-Campaign

Taxpayers have started receiving following SMS and Email:-

High Value Transactions e.g. Share Trading/Derivatives

“ Attention (XXXXX1111X), the Income Tax Department has identified high value information which does not appear to be in line with the Income Tax Return filed for Assessment Year 2020-21 (relating to FY 2019-20). Please submit online response under e-Campaign tab on Compliance Portal (CP). Access CP by logging into e-filing portal (My Account) – ITD “

“ We appreciate that you have filed your Income Tax Return and contributed towards the progress of Nation. However, the Income Tax Department has received information on high value transactions relating to (XXXXX1111X) for Financial Year 2019-20. On the basis of data analysis, the Income Tax Department has identified following high value information which does not appear to be in line with the Income Tax Return filed for Assessment Year 2020-21 (relating to FY 2019-20) “

Non Reporting of Savings Bank Interest / FDR Interest in ITR

“ Attention RAM SINGH (XXXXX9999X),The Income Tax Department has identified high value information which does not appear to be in line with the Income Tax Return filed for Assessment Year 2020-21 (relating to FY 2019-20). Please revise ITR / submit online response under e-Campaign tab on Compliance Portal (CP). Access CP by logging into e-filing portal and clicking on ‘Compliance Portal’ link under ‘My Account’ or ‘Compliance’ tab – ITD “

High Value Cash Deposit

“ Dear GXXXXN SXXXH- Income Tax Department has received information about Cash Deposit of 10100000 relating to XXXXX0444X in FY 2019-20. However, as per records available, ITR for AY 2020-21 has not been filed. Please file your ITR by 31.03.2021. You can view transaction details and submit response under e-Campaign tab on Compliance Portal (CP). Access CP by logging into e-filing portal (My Account) – ITD “

What is the source of information for e-Campaign?

Under this e-campaign the Income Tax Department is sending email/sms to identified taxpayers to verify their financial transactions related information received by the I-T department from various sources such as Statement of Financial Transactions (SFT), Tax Deduction at Source (TDS), Tax Collection at Source (TCS), Foreign Remittances (Form 15CC) etc. The department has collected information related to GST, exports, imports and transactions in securities, derivatives, commodities and mutual funds under information triangulation set up.

What is Compliance Portal?

Compliance portal is the dedicated portal operationalized under Project Insight to enable e-verification (i.e. capture of response on specific compliance related issues in a structured manner) for effective compliance monitoring and evaluation. The Compliance portal also enables a seamless, secured two way structured communication to enhance the transparency and functional efficiency of the department.

How to login to Compliance Portal?

Step 1: Login to the e-filing portal by using the URL https://incometaxindiaefiling.gov.in/

Step 2: Click on the ‘Compliance Portal’ link available in “My Account” or “Compliance” tab.

Step 3: The user will be redirected to the compliance Portal.

Facing Issue regarding Email/SMS received but Non Display of Information in e-Campaign (i.e. Blank Data)

You are requested to raise grievance under Communication Category to “E-filing Website Team” on e-Nirvan (attach screenshot of SMS/Email & e-campaign window showing no data).

Response to Few Issued Faced by Taxpayers

1. Why I received SMS/Email even after processing of my ITR & intimation already received u/s.143(1)

> Information regarding High Value Transaction might be reported to Department after Processing of ITR. You are requested to file response to avoid Scrutiny Notice from Department.

2. Why ITR can be revised u/s.139(5) even after Processing of ITR?

> Yes , before the due date of filing of Revised ITR i.e. 31/03/2021 for FY 2019-20

3. Why Few FDRs Interest was not reported in Form 26AS, but reported in e-campaign?

> As TDS is not deducted on FDR Interest upto Rs.50,000, hence not reported in form 26AS. But reported to department through other sources/returns.

4. I have incurred loss in shares transactions, should I show these transactions in ITR?

> Yes, Reporting is mandatory in ITR

5. Can I File ITR (Belated or Revised) after 31/03/2021 in response to e-campaign?

> No, since it would be time barred

6. Why Savings Interest was not reported in form 26AS, but in e-campaign?

> As TDS is not deducted on Saving Account Interest, hence not reported in form 26AS. But reported to department through other sources/returns.

Functionalities under e-Campaign on Compliance Portal?

Under e-Campaign tab of Compliance Portal, information received from various sources related to the taxpayer is displayed for seeking feedback. The taxpayer is required to submit response on each information item to complete the process of submission of response. Following e- Campaign functionalities are available:

What is a Non-filing of return case?

A taxpayer who is having total income above the prescribed limit or fulfils any other condition mentioned in section 139 of the Income Tax Act 1961, is required to file return of income. Non-filers with potential tax liabilities are identified by analysing information received under Annual Information Return (AIR), Statement of Financial Transactions (SFT), Centralised Information Branch (CIB), TDS/TCS Statement, Securities Transaction Tax (STT) etc. and taxpayer profile.

How a Non-filing of return case is identified?

Non-filers with potential tax liabilities are identified by analysing information received under :-

√ Annual Information Return (AIR),

√ Statement of Financial Transactions (SFT),

√ Centralised Information Branch (CIB),

√ TDS/TCS Statement,

√ Securities Transaction Tax (STT) etc

Cases for e-verification are identified on the basis of scenarios and rules approved by the Central Board of Direct Taxes.

What is ‘Taxability of Transaction Relating to Sale of Immovable Property’?

In this response category, the taxpayer is required to give information about the taxability of amount relating to sale of immovable property. The taxpayer can enter relevant information in the following fields to arrive at Income/Gain/Loss with reference to such transaction.

a) Receipts related to above information

b) Stamp value at which property is registered

c) Value taken for computation of capital gains

d) Value relating to other year/PAN

e) Value covered in other information

f) Exemption/Deduction/Expenditure

g) Income/Gain/Loss

What is ‘Source of Funds’?

In this response category, the taxpayer is required to indicate source of deposit/investment/expenditure. If amount is from more than one category, the source of amount may be assigned under various categories in the sequence mentioned below, (Adopting other sequence may result in case being selected for verification based on risk criteria)

a) Out of earlier income or savings

b) Out of receipts exempt from tax

c) Received from identifiable persons (with PAN)

d) Received from identifiable persons (without PAN)

e) Received from un-identifiable persons

f) Others

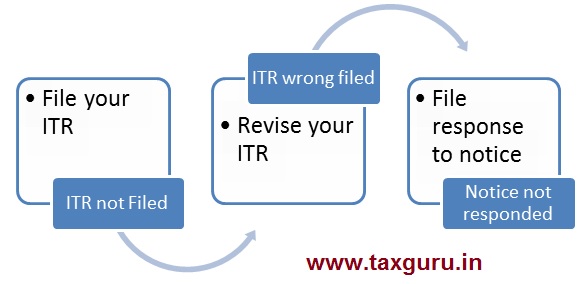

What if I don’t Respond to Compliance Alert ?

Non/Wrong compliance with communication from Income Tax Department, may lead you to face Notice from income Tax Department regarding assessment/Penalty/Prosecution etc.

Response to reported Transaction

Under the e-campaign the taxpayers will be able to access details of their high value transaction related information on the designated portal. They will also be able to submit online response by selecting among any of these options:

(i) Information is correct,

(ii) Information is not fully correct,

(iii) Information related to other person/year,

(iv) Information is duplicate/included in other displayed information, and

(v) Information is denied.

There would be no need to visit any Income Tax office, as the response has to be submitted online.

How can taxpayer view the submitted response on each Information?

Step 1: Visit Compliance Portal at https://compliance.insight.gov.in or Login to the e-filing portal by using the URL https://incometaxindiaefiling.gov.in and Click on ‘Compliance Portal’ link available in “My Account” or “Compliance” tab.

Step 2: After successful login, click on ‘e-Campaign’ Tab available at home page of Compliance Portal to view Information Summary screen.

Step 3: Click on “Financial Year” under Significant Transactions/Non- Filing of Return/High Risk Transactions option (Whichever is applicable).

Step 4: Click on ‘Financial Year’ available under ‘e-Campaign –Information Confirmation’. (Applicable for non-filing of return).

Step 5: Click on “>” button to view information detail.

Step 6: Click on “View Response” button under Information detail.

A Pop-up window will appear displaying the details of response submitted by the taxpayer.

Can I check information being reported, but don’t file response ?

Taxpayer’s every action is being watched & reported in the form of different icons against each information being reported on compliance portal.

What to do along with Compliance Submission?

What to do along with Compliance Submission?

In case you have not filed the ITR, then you may be required to file ITR.

In case you have filed ITR without certain incomes, then you may be required to file Revised ITR.

But both of them can be done, only if it is permissible within statutory due dates e.g. 30/09/2020 is due date for filing ITR of FY 2018-19 (AY 2019-2020).

Data-Sharing MOUs with various entities

After reading above article, you now must be thinking, how database of Income Tax is being built. CBDT is entering into various MOUs with SEBI, CBIC, MoMSME etc for exchange of information. Text of Press Release can be read from following links-

Press Release MoU between CBDT and MoMSME

https://taxguru.in/income-tax/cbdt-signs-mou-momsme-sharing-data.html

Press Release MoU between CBDT and CBIC

https://taxguru.in/income-tax/cbic-cbdt-sign-mou-facilitate-exchange-data.html

Memorandum of Understanding between CBDT and SEBI

https://taxguru.in/sebi/sebi-signs-mou-cbdt-share-data.html

Further , CBDT has launched new Form 26AS to enable taxpayer to view information available with Tax Department, as per following Press Release-

https://taxguru.in/income-tax/form-26as-faceless-hand-holding-taxpayers.html

Final Opportunity

Last date for filing (Belated) as well as revising the ITR for AY 2020-21 is 31st March 2021. The taxpayer must avail the opportunity to participate in the e-campaign for their own ease and benefit.

*****

Disclaimer: The contents of this article are for information purposes only and does not constitute an advice or a legal opinion and are personal views of the author. It is based upon relevant law and/or facts available at that point of time and prepared with due accuracy & reliability. Readers are requested to check and refer relevant provisions of statute, latest judicial pronouncements, circulars, clarifications etc before acting on the basis of the above write up. The possibility of other views on the subject matter cannot be ruled out. By the use of the said information, you agree that Author / TaxGuru is not responsible or liable in any manner for the authenticity, accuracy, completeness, errors or any kind of omissions in this piece of information for any action taken thereof. This is not any kind of advertisement or solicitation of work by a professional.

Article Contributed by: Author can be reached at casagargambhir@gmail.com for any queries, issues & recommendations relating to article.

(Republished with amendments)

As per information available in your case on Compliance Portal of the Income Tax Department, you were supposed to file your ITR for A.Y. 2023-24 but the same has not yet been filed. Please file your ITR or submit online response under ”e-Campaign” tab on ”Compliance Portal”. After login to the e-filing Portal (https://www.incometax.gov.in), go to ”Pending Actions” tab and click on ”Compliance Portal”. On Compliance Portal, navigate to ”e-Campaign tab” and view campaign type ”Non filers” to submit response. Please ignore if ITR has already been filed. – Income Tax Department

i recieved this mssg what I do next

I too got the High Value transaction & it also included all the dividend amounts that I have received for the shares. The high-value transaction is for closing the FDs from joint ownership of about 20L and on the same day I have again created on my wife name. Pl. suggest what option should I select among – A. Information is correct.

B. Information is not fully correct.

C. Information relates to other person/year.

D. Information is duplicate/included in other displayed information.

E. Information is Denied. … All the dividend amounts as they are less than 10L they should be exempted for tax under Section 10(34) and for the FD amount also as I created again – it is my own money so I should not pay is what I am thinking. Pl. help me ASAP. Appreciate your quick response & thanks in advance.

Hi Sir,

Today I got an notification from ITR for FY 2020-2021 to submit ‘High Value Transaction’ as part of e-Campaign, where I didnot include my Future/Option report as it ended up into Net Loss. Is that why I got the notice? What should I do now? Please guide.

I have filed IT return without mentioning share transaction .WHAT SHOULD I DO.

Hi Sagar Sir,

I have done the file return for the assessment year 20-21 and forgot to pay the SB interest tax for the Rs 50,000/-. I got the high-value transaction email and I went into the e-campaign site and submitted the response as all information is correct. I forgot to revise return the file in the given window (May 30th, 2021).

I come in a 30% tax slab. Shall I pay the self assesment tax of Rs 15,000/- for the assessment year 20-21? After paying, do I need to submit any response with paid challan on the income tax site?

Please suggest and need your valuable feedback.

Best, Surendra

Hello Sir, I responded to the compliance but.. Missed to file ITR Revision.. as of end of June… what is alternate procedure for this?. Thanks

Hi Ganesh, I’ve also missed the deadline to file the revised return after receiving eCampaign email. Could you tell me what you did in your case?

Hi Ganesh, could you please tell me how did you manage to file your revised IT return after due date?

Sir, I have deposited ten lakh cash in my saving bank account by mistake, which was received from my father’s side and this entry is showing in e-compaign in Income tax portal, what to do for this

How can I submit a revised return for AY 20-21 as the deadline has passed. Basically, I noticed there was high value transaction response pending in Compliance Portal for not showing SB/FD Interest in original ITR filed. I have accepted the response in full and already made a payment of tax+interest. But need to submit revised return to let them know that I have actioned accordingly.

How can I submit a revised return for AY 20-21 as the due date has passed. I noticed there was a high-value transaction response pending under the ‘e-campaign’ category of Compliance Portal. However,I never received any email/sms for this.

Dear sir,

I had received a sms for SFT/high value transaction. my compliance portal show FDR interest income which are only incured but not received. and not shown in our 26AS also. How to treat this situation.

Hello Sir

I paid income tax(ITR1) for FY 19-20 then due to incorrect detail again filled revised ITR (ITR2).

But then got msg from compliance for not showing interest on FD in return

I submitted the response on compliance portal as information is correct.

I didn’t show 34000 INR interest , I fall in 30 % tax slab .

So as I submitted response on compliance portal do I need to revise my ITR and file it again.

If yes which itr likeITR 1/2/3 ….and for the self assessment tax which option I need to select like challan number and all

Thanks in Advance

I have same problem also, can someone please help

Sagar Sir, I have faced similar problem like many others of this forum. As per my original ITR , I received 18000 rupees as refund. but I need to give back 14000 to IT department as I missed to include my SB interest in the original return. Please suggest if I need to display that 14000 rupees as self-assessment tax in the revised ITR ? In that case the ITR still shows (18000-14000) = 4000 as refund . Kindly suggest.

Yes, 14000 pay as self assessment tax.

Sagar Sir, Thank you so much for your valuable suggestion.

please sir consider this

ORIGINAL ITR REFUND RECIEVED 27000

REVISED ITR TAX PAYBALE 28000.

SHOULD I INCLUDE REFUND IN INCOME OR JUST PAY 28000

Yes, Pay Refund amount as well.

How to pay IT payment against high value transaction

Pay through self assessment tax

Hello Sir

Now CBDT has extended the last date of filing the revised return or belated returns till 31-May-2021.

I am in the process of filing revised return due to high value transaction (SB interest).

I have added the interest amount in “other sources of income..

I have to pay tax which shows Payable Tax column.

My ITR was already processed and I received the refund. Where to enter the refund amount while filling the revised ITR.

or

I should pay the tax payable + refund amount ? Please advise.

Thanks in advance

Hello, I too have exactly the same question. I had received refund amount from income tax dept for original returns filed . Now while filing revised returns for AY2020-2021 should we include the refund amount as additional income earned? The refund amount was recd. in the year 2021.

I have similar question,

I am in the process of filing revised return due to high value transaction (SB interest).

I have added the interest amount in “other sources of income..

I have to pay tax which shows in Payable Tax column.

My ITR was already processed and I received the refund. Where to enter the refund amount while filling the revised ITR, or

Should I pay the tax payable + refund amount ? Please advise.

Thanks in advance

CONSIDER THIS EXAMPLE

Refund amount as per original ITR:- 30K

Tax on additional Income – 15K

Tax paid as self assessment- 15K

so new Revised ITR will also show refund of 30K, but you won’t receive as it has been already received.