1. Enactment of FATCA and signing of IGA

In 2010, USA enacted a law known as “Foreign Account Tax Compliance Act” (FATCA) with the objective of tackling tax evasion through obtaining information in respect of offshore financial accounts maintained by USA residents and citizens. The provisions of FATCA essentially provide for 30% withholding tax on US source payments made to Foreign Financial Institutions unless they enter into an agreement with the Internal Revenue Service (US IRS) to provide information about accounts held with them by USA persons or entities (firms/companies/trusts) controlled by USA persons. Since domestic laws of sovereign countries (including India) may not permit sharing of client confidential information by FIs directly with USA, USA has entered into Inter-Governmental Agreement (IGA) with various countries. The IGA between India and USA was signed on 9th July, 2015. It provides that the Indian FIs will provide necessary information to the Indian tax authorities, which will then be transmitted to USA periodically. Under the IGA, USA will also provide substantial information about Indians having financial assets in USA. The text of the IGA signed between India and USA is available at Appendix A of Guidance Note on FATCA and CRS as updated on 30th November 2016.

2. New Global Standards on Automatic Exchange of Information

To combat the problem of offshore tax evasion and avoidance and stashing of unaccounted money abroad requiring cooperation amongst tax authorities, the G20 and OECD countries working together developed a Common Reporting Standard (CRS) on Automatic Exchange of Information (AEOI). The CRS on AEOI was presented to G20 Leaders in Brisbane on 16th November, 2014. The Hon’ble Prime Minister of India, speaking on the occasion, supported the new global standard as it would be instrumental in getting information about unaccounted money hoarded abroad and in its eventual repatriation. The CRS on AEOI requires the financial institutions of the “source” jurisdiction to collect and report information to their tax authorities about account holders “resident” in other countries, such information having to be transmitted “automatically’on yearly basis. The information to be exchanged relates not only to individuals but also to shell companies and trusts having beneficial ownership or interest in the “resident”countries. Further, the reporting needs to be done for a wide range of financial products, by a wide variety of financial institutions including banks, depository institutions, collective investment vehicles and insurance companies. The Standard is available at Appendix B of Guidance Note on FATCA and CRS as updated on 30th November 2016.

3. Commitment to Implement CRS on AEOI

In keeping with its leadership role in developing the new global standard, India is one of the early adopters of the CRS and has committed to exchange information automatically by 2017. The Government of India has also, on 3rd June, 2015, joined the Multilateral Competent Authority Agreement (MCAA) for exchanging information as per the above timelines. By December, 2015, 98 jurisdictions have committed to exchange information as per the new global standards, 56 of them from 2017 and the balance 39 from 2018. 75 jurisdictions have also joined the MCAA. Table in Annexure A provides a list of the 98 jurisdictions and the time for exchanging information.

4. Steps taken for Implementation of CRS on AEOI and IGA

4.1 In view of our commitment to implement the CRS on AEOI and also the IGA with USA, and with a view to provide information to other countries, necessary legislative changes have been made through Finance (No. 2) Act, 2014, by amending section 285BA of the Income-tax Act, 1961. Income-tax Rules, 1962 were amended vide Notification No. 62 of 2015 dated 7th August, 2015 by inserting Rules 114F to 114H and Form 61B to provide a legal basis for the Reporting Financial Institutions (RFIs) for maintaining and reporting information about the Reportable Accounts. These Rules have been developed in consultation with Regulators and Financial Institutions in order to address their concerns wherever possible. A copy of the Rules from 114F to 114H the Income-tax Rules, 1962, is at Appendix C of Guidance Note on FATCA and CRS as updated on 30th November 2016.

4.2 The important timelines are summarized below:

| Cut-off date prior to which accounts are treated as pre-existing account under FATCA | 30.06.20 14 |

| Date for considering New Account under FATCA | 01.07.2014 |

| FATCA came into force in India | 3 1.08.2015 |

| First reporting (for calendar year 2014) under FATCA |

10.09.2015 |

| Cut-off date prior to which accounts are treated as Pre-existing account under CRS | 31.12.2015 |

| Date for considering New Account under CRS | 01.01.2016 |

| First reporting (for calendar year 2016) under CRS | 31.05.2017 |

The detailed relevance of the time-lines has been explained later in the guidance note.

5. Overview of the reporting under FATCA and CRS

The compliance related to reporting basically involves the following issues:

a. Who is required to report?

b. What is required to be reported?

c. What is the format and timeline for reporting?

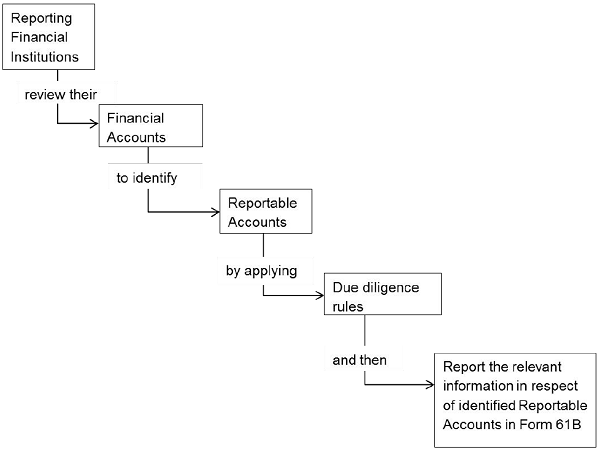

First, an entity needs to find out whether it is a Reporting Financial Institution. Then, Reporting Financial Institution needs to review their financial accounts by applying due diligence procedures to identify whether any of the financial account is a Reportable Account. If any account is identified as a reportable account, then the Reporting Financial Institution shall report the relevant information in Form 61B in respect of the identified reportable account.

The whole process of the reporting can be broken down into small steps and depicted as follows:

Figure: Process of Reporting under FATCA and CRS

Source- Guidance Note on FATCA and CRS as updated on 30th November 2016