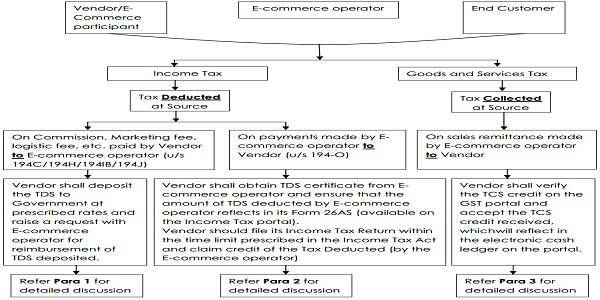

Basic guide to Tax Deduction (TDS) and Tax Collection (TCS) for Vendors selling their products/providing their services through E-commerce operators (ECO)

What does e-commerce means?

E-commerce is a system where a vendor sells its products or provides its services to the end customer through an E-commerce operator (amazon, flipkart, etc.) wherein the E-commerce operator charges commission from Vendor for making such sale.

1. TDS on various fees (commission, logistics fee, listing fee, etc.) charged by E-Commerce Operator (as per Income Tax provisions)

As per the provisions of Section 194H and Section 194C of the Income Tax Act, 1961 (‘the Act’), the vendor is required to deduct TDS at prescribed rates (refer Annexure 1) on commission/logistic charges (and expenses of similar nature) at the time of making such payment. However, in case of E-commerce transactions the Vendor is remitted the amount of sales after netting off the commission, logistic fee, marketing fee, etc. Hence, in such cases it is not possible for the Vendor to deduct TDS at the time of making payment to E-commerce operator. Therefore, in such cases the vendor shall compute the amount of TDS on the basis of statements and invoices received from the E-commerce operator, deposit the computed TDS to government and then claim the refund of the TDS deposited from E-commerce operator.

Key points to remember:

a. If the E-commerce operator has obtained Lower Deduction Certificate (LDC):-Vendor shall deduct TDS at the rate specified in the LDC for the period mentioned in LDC (Validity of LDC can be verified from TRACES portal).

b. Vendor shall make the payment of TDS to government on monthly basis and file the TDS return (Form 26Q) Quarterly.

c. Vendor shall claim the refund from E-commerce operator by submitting the TDS certificate (Form 16A) on E-commerce portal or through E-mail from the registered email ID of the vendor. The E-commerce operator may prefer the TDS certificate to be signed by Digital Signature Certificate (DSC).

d. TDS should be deducted on the amount net of credit notes of fees (due to sales return/other reasons).

e. In case the amount paid is below the specified limit prescribed in Section 194C or Section 194H of the Act, then no TDS is required to be deducted. The limit is Section-wise and not fees-wise.

f. If the Vendor is an Individual/Hindu Undivided Family (HUF) then TDS is required to be

deducted only if their turnover in the preceding Financial Year exceeded Rs. 1 crore.

g. If the E-commerce operator is Non-resident in India then TDS is required to be deducted as per the provisions of Section 195 of the Act.

2. TDS on payments made by E-commerce operator to Vendor (as per Income Tax provisions)

In budget 2020, Government has inserted Section 194-O in the Income Tax Act, 1961 requiring the E-commerce operator to deduct TDS at the rate of 1% of the amount of sale (of goods/services) facilitated through such E-commerce operator. In the given case, the vendor shall obtain TDS certificate (Form 16A) from the E-commerce operator and ensure that the Tax deducted by E-commerce operator reflects in its Form 26AS. The tax deducted by the E-commerce operator can be utilized by the vendor for settlement of tax liability at the time of filing its Income Tax Return (ITR).Further, if the tax liability is less than the overall tax deduction reflected in Form 26AS, the vendor can claim refund of such excess amount.

Key points to remember:

a. No deduction shall be made by E-commerce operator if vendor is an individual or HUF and the gross amount of sale during the previous year does not exceed Rs.5 lakh (through such E-commerce operator)

b. No deduction shall be made if the vendor is a non-resident.

c. TDS should be deducted on the amount excluding GST

d. Vendor can apply for deduction of tax at lower rate by furnishing the Lower Deduction Certificate (LDC)

3. Sales remittance by E-commerce operator to Vendor (as per Goods & Services Tax provisions)

As per the GST law, all e-commerce operators need to collect an amount at the rate of 1% of the net value of taxable supply. TCS collected by the E-commerce operators should be deposited on monthly basis. To claim the TCS deducted by E-commerce operator, the vendor shall login on the portal and match the actual sales with the statement provided by E-commerce operator and accept the TCS, after which the TCS credit is reflected in the electronic cash ledger of the vendor.

Key points to remember:

a. If sellers do not have taxable outward supplies in the month in which supplies are returned, then seller should be eligible for adjusting excess TCS paid earlier, against future outward GST liability or refund of excess balance of TCS available in the electronic cash ledger.

b. A person who sells goods on e-commerce platforms needs to get registered under GST and get a GST Identification Number (GSTIN). The basic exemption limit of Rs 40 lakh (for normal category states) and Rs 20 lakhs (for special category states) does not apply to online seller of goods. However, if a person is selling services through E-commerce operator then such person is required to get registered only if the turnover is more than threshold limit of Rs 20 lakhs (for normal category states) and Rs 10 lakhs (for special category states).

Annexure 1

1Prescribed rates of TDS as per Income Tax Act, 1961-

| Nature of Payment | Section | TDS Rate |

| Shipping Fee | 194C | 2% |

| Courier Fees | 194C | 2% |

| Marketplace Logistics Charges | 194C | 2% |

| Same Day Delivery Fee | 194C | 2% |

| Next Day Delivery Fee | 194C | 2% |

| Pick And Pack Fee | 194C | 2% |

| Easy Ship Weight Handling Fee | 194C | 2% |

| Removal Fee | 194C | 2% |

| Fulfillment Centre Service | 194C | 2% |

| Installation Fee | 194C | 2% |

| Un-Installation Packaging Fee | 194C | 2% |

| Un-Installation Fee | 194C | 2% |

| Fixed Closing Fees | 194H | 5% |

| Listing Fee | 194H | 5% |

| Refund Processing Fee | 194H | 5% |

| Payment Collection Fees | 194H | 5% |

| Closing Fees | 194H | 5% |

| Marketing Fees | 194H | 5% |

| Marketplace Marketing Fees | 194H | 5% |

| Marketplace PG Fees | 194H | 5% |

| Collection Fees | 194H | 5% |

| Commission Fees | 194H | 5% |

| Fixed Fees | 194H | 5% |

| Fee Discount | 194H | 5% |

| Cancellation Fee | 194H | 5% |

| Service Cancellation Fee | 194H | 5% |

| Referral Fee | 194H | 5% |

| Storage Fee | 194IB | 10% |

| Sale of space for advertisement | 194C | 2% |

| Ad Services Fees | 194C | 2% |

| Advertisement Charges/Fees | 194C | 2% |

| Franchise Fee | 194J | 10% |

| Tech Visit Fees | 194J | 10% |

Authored by: CA Chirayu Saraswat

Inputs by: CA Sandeep Manik

Reviewed by: CA Pravin Saraswat

In case you wish to learn more or need assistance, feel free to reach out to us at saraswatandcompany@gmail.com.