Page Contents

How to Authenticate Notice/Order issued by Income Tax Department (ITD) FAQ

Q.1 Why do I need to authenticate notice/order issued to me by Income Tax Authorities?

Ans. Every communication by Income Tax department issued on or after 1st October, 2019 shall bear an unique Document Identification Number(DIN). In order to satisfy yourself that the notice/order or any communication received by you is genuine and issued by Income Tax Authority, you can authenticate any notice/order or any communication using this service.

Q.2 What if the ITD notice/order does not bear a DIN?

Ans. In such case, the notice/order/letter received by you would be treated as invalid and shall be non est in law or deemed to be as if it has never been issued. You do not need to take any action or respond to such communication.

Q.3 Where can I authenticate the order issued to me by ITD?

Ans. You can authenticate the order issued by the Income Tax authorities on the e-Filing portal using “Authenticate Notice/Order Issued by ITD” service.

Q.4 Do I need to log in to authenticate the notice issued to me by ITD?

Ans. No, you do not need to log in to the e-Filing portal to authenticate the notice/order. You can authenticate the notice by clicking on the ‘Authenticate Notice/Order Issued by ITD” link available on the e-Filing portal.

Q.5 Do I need to enter the same mobile number as registered on the e-Filing portal to authenticate my notice?

Ans. No, it is not mandatory to enter the mobile number registered on the e-filing portal to authenticate the notice/letter or any communication issued by Income Tax Department. You may choose to receive OTP on any mobile number which is accessible to you by entering it in the ‘mobile number’ field.

Q.6 What is DIN?

Ans. DIN stands for Documentation Identification Number. It is a computer generated 20 digit unique number which needs to be duly quoted on every communication (letter/notice/order/any other correspondence) issued by any Income Tax Authority to any taxpayer.

How to Authenticate Notice/Order issued by Income Tax Department (ITD) – User Manual

1. Overview

The Authenticate Notice / Order issued by ITD service is available to both registered and unregistered users of the e-Filing portal as a pre-login service to verify the authenticity of a Notice, Order, Summons, Letter or any correspondence issued by Income Tax Authorities.

2. Prerequisites to Avail This Service

Access to the e-Filing portal

3. Step-by-Step Guide

Step 1: Go to the e-Filing portal homepage.

Step 2: Click Authenticate Notice / Order issued by ITD.

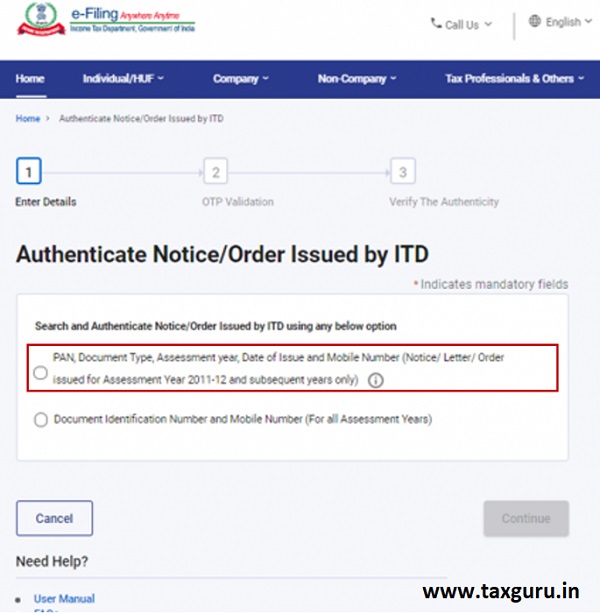

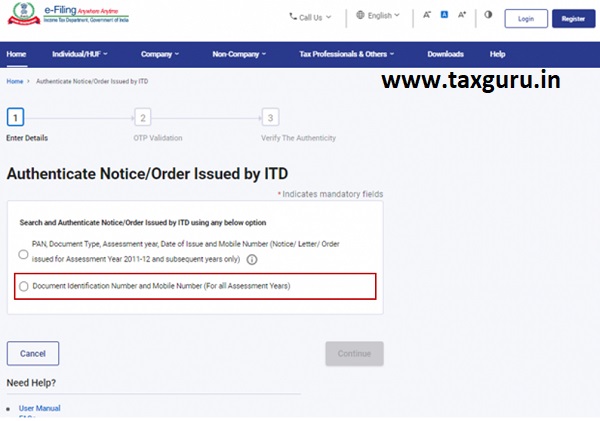

Step 3: Select either of the following options to authenticate the notice / order –

| PAN, Document type, Assessment Year, Date of Issue and Mobile Number | Refer to Section 3.1 |

| Document Identification Number and Mobile Number | Refer to Section 3.2 |

3.1 If you select the option – PAN, Document Type, Date of Issue and Mobile Number

Step 1: Select PAN, Document type, Assessment Year, Date of Issue and Mobile Number.

Step 2: Enter PAN, select Document Type and Assessment Year, enter Mobile Number and Date of Issuance and click Continue.

Step 3: Enter the 6-digit OTP received on the mobile number entered by you in Step 2 and click Continue.

Note:

- OTP will be valid for 15 minutes only.

- You have 3 attempts to enter the correct OTP.

- The OTP expiry countdown timer on screen tells you when the OTP will expire.

- On clicking Resend OTP, a new OTP will be generated and sent.

Once the OTP is validated, the document number of the notice issued along with the date of issue of the notice will be displayed.

Note: In case no notice was issued by ITD, it will display a message – No record found for the given criteria.

3.2: If you select the option – Document Identification Number and Mobile Number

Step 1: Select Document Identification Number and Mobile Number.

Step 2: Enter Document Identification Number and Mobile Number and click Continue.

Step 3: Enter the 6-digit OTP received on the mobile number entered by you in Step 2 and click Continue.

Note:

- OTP will be valid for 15 minutes only.

- You have 3 attempts to enter the correct OTP.

- The OTP expiry countdown timer on screen tells you when the OTP will expire.

- On clicking Resend OTP, a new OTP will be generated and sent.

Once the OTP is validated, a success message will be displayed.

Note: In case no notice was issued by ITD, it will display a message – No record found for the given Document Number.

4. Related Topics

- Response to Outstanding Demand

- Verify your PAN